0001162896

false

--12-31

0001162896

2023-10-12

2023-10-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 12, 2023

Prairie

Operating Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-33383 |

|

98-0357690 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

602

Sawyer Street, Suite 710

Houston,

TX |

|

77007 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (713) 424-4247

N/A

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.03 | Material Modification to Rights of Security Holders. |

On

October 12, 2023, Prairie Operating Co. (the “Company”) filed a Certificate of Amendment to its Certificate of Incorporation

(the “Certificate of Amendment”) with the Delaware Secretary of State to effect a reverse stock split of outstanding shares

of the Company’s common stock, par value $0.01 per share (“Common Stock”), at an exchange ratio of 1:28.5714286 (the

“Reverse Stock Split”). The Company will also change its name from Creek Road Miners, Inc. to Prairie Operating Co. (the “Corporate

Name Change”) and change its symbol from “CRKR” to “PROP” (the “Symbol Change”). The Reverse

Stock Split and the Corporate Name Change would become effective on the OTCQB marketplace of OTC Markets on October 16, 2023 (the “Effective

Date”). In connection with the Reverse Stock Split, Corporate Name Change and Symbol Change, the CUSIP number for the Company’s

Common Stock will change to 739650109. The Company’s Common Stock will continue to trade on the OTCQB marketplace under the symbol

“CRKRD” for a period of 20 trading days following the Effective Date, and after such time will be announced on the OTC Markets

under the “PROP” symbol and, one trading day thereafter, the symbol will begin trading under the “PROP” symbol,

thereby completing the Symbol Change.

The

Certificate of Amendment filed by the Company with the Delaware Secretary of State on October 12, 2023 will take effect October 16, 2023

and will, among other things, (i) effect the Reverse Stock Split; and (ii) change the total number of shares of all classes of stock which

the Company shall have authority to issue 155,000,000 shares, consisting of (a) 150,000,000 shares of Common Stock and (b) 5,000,000 shares

of preferred stock, par value $0.01 per share (“Preferred Stock”). Immediately after the filing of the Certificate of Amendment

on October 12, 2023, the Company filed the Second Amended and Restated Certificate of Incorporation (the “Amended and Restated Charter”)

with the Delaware Secretary of State, with the Amended and Restated Charter taking effect October 16, 2023, to, among other things, (i)

eliminate certain provisions related to the Preferred Stock as a result of the elimination of certain classes of Preferred Stock; (ii)

remove provisions providing for action by written consent of stockholders; (iii) include a waiver of the corporate opportunity doctrine;

(iv) certain modifications to the election and removal of directors of the Company; (v) adopt Delaware as the exclusive forum for certain

shareholder litigation; and (vi) increase the total number of shares of all classes of stock which the Company shall have authority to

issue 550,000,000 shares, consisting of (a) 500,000,000 shares of Common Stock and (b) 50,000,000 shares of Preferred Stock. The foregoing

actions were approved by the Company’s shareholders on October 25, 2022. The foregoing descriptions of the Certificate of Amendment

and the Amended and Restated Charter do not purport to be complete and are qualified in their entirety by reference to the full texts

of the Certificate of Amendment and Amended and Restated Charter, which are attached hereto as Exhibit 3.1 and Exhibit 3.2, respectively,

and are incorporated herein by reference into this Item 3.03.

As

a result of the Reverse Stock Split, there are approximately 7,074,668 shares of Common Stock outstanding (subject to adjustment due to

the effect of rounding fractional shares into whole shares). The Reverse Stock Split will not have any effect on the stated par value

of the Common Stock. Each shareholder’s percentage ownership interest in the Company and proportional voting power remains

virtually unchanged as a result of the Reverse Stock Split, except for minor changes and adjustments that will result from rounding fractional

shares into whole shares. All options, warrants and convertible Preferred Stock of the Company outstanding immediately prior to the Reverse

Stock Split will, to the extent they do not provide otherwise, be adjusted according to their terms as a result of the Reverse Stock Split.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws. |

The information

required by this Item 5.03 is set forth in Item 3.03 above, which information is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to Item 7.01 and the press release attached hereto

as Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PRAIRIE

OPERATING CO. |

| Date:

October 13, 2023 |

|

|

| |

By: |

/s/

Edward Kovalik |

| |

|

Edward

Kovalik |

| |

|

Chief

Executive Officer |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT

TO

THE

AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION

OF

PRAIRIE

OPERATING CO.

Prairie

Operating Co. (the “Corporation”), organized and existing under and by virtue of the General Corporation Law of the

State of Delaware (“DGCL”), does hereby certify:

FIRST:

The Amended and Restated Certificate of Incorporation is hereby amended by deleting the text of the first paragraph of Article Fourth

thereof and substituting the following two paragraphs therefor.

“Effective as of October

16, 2023, at 12:00 a.m. Eastern Time (the “Effective Date”), the shares of Common Stock, par value $0.01 per share,

of the Corporation issued and outstanding immediately prior to the Effective Date (the “Old Shares”) shall, automatically

and without any action on the part of the respective holders thereof, be combined and converted into shares of Common Stock (as defined

below) at an exchange ratio of 1-to-28.5714286, inclusive, as approved by the Board (the “Reverse Stock Split”). No

fractional shares shall be issued as a result of the Reverse Stock Split and, in lieu thereof, the Corporation shall pay to the holder

of any such fractional share an amount in cash equal to such fraction multiplied by the closing sale price of the Corporation’s

common stock on the OTCQB on the trading day immediately before the Effective Date. Each stock certificate representing the Old Shares

immediately prior to the Effective Date shall thereafter represent that number of whole shares of Common Stock outstanding after the Effective

Date into which the Old Shares represented by such certificate shall have been combined. Each holder of record of a stock certificate

or certificates representing the Old Shares shall receive, upon surrender of such certificate or certificates, a new certificate or certificates

representing the number of whole shares of Common Stock to which such holder is entitled pursuant to the Reverse Stock Split or, at the

discretion of the Corporation and unless otherwise instructed by such holder, book-entry shares in lieu of a new certificate or certificates

representing the number of whole shares of Common Stock to which such holder is entitled pursuant to the Reverse Stock Split. The shares

of Common Stock issued in connection with the Reverse Stock Split shall have the same rights, preferences and privileges as the Old Shares.

Immediately after the effectiveness of the Reverse Stock Split,

the total number of shares of all classes of stock which the Corporation shall have authority to issue is 155,000,000 shares, consisting

of (i) 150,000,000 shares of common stock, par value $0.01 per share (“Common Stock”), and (ii) 5,000,000 shares of

preferred stock, par value $0.01 per share (“Preferred Stock”). The Board of Directors is vested with the authority

to prescribe the classes, series and the number of each class or series of stock and the voting powers, designations, preferences, limitations,

restrictions and relative rights of each class or series of stock. If more than one class or series of stock is authorized by the Board

of Directors, the resolution of the Board of Directors must prescribe distinguishing designations of each class or series.”

SECOND: This Certificate

of Amendment was duly adopted in accordance with Section 242 of the DGCL. The Board of Directors duly adopted resolutions setting forth

and declaring advisable this Certificate of Amendment and directed that the proposed Amendment be considered by the stockholders of the

Corporation. A majority written consent of the shareholders was entered into and duly noticed to all shareholders not signing the written

consent in accordance with Section 228 of the General Corporation Law of the State of Delaware, wherein the necessary number of shares

as required by statute were represented in favor of the amendment.

THIRD:

The remaining provisions of the Amended and Restated Certificate of Incorporation, including without limitation the remaining provisions

of Article Fourth, are not affected by the aforementioned amendment and remain in full force and are not affected by this Certificate

of Amendment.

[Signature

page follows]

IN

WITNESS WHEREOF, said corporation has caused this certificate to be signed this 12th day of October, 2023.

| |

PRAIRIE

OPERATING CO. |

| |

a

Delaware corporation |

| |

|

| |

By: |

/s/

Edward Kovalik |

| |

Name: |

Edward

Kovalik |

| |

Title: |

Chief

Executive Officer |

Signature Page to Certificate of Amendment to

the Amended and Restated Certificate of Incorporation

of

Prairie Operating Co.

Exhibit 3.2

SECOND

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

PRAIRIE OPERATING CO.

Prairie

Operating Co. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State

of Delaware as set forth in Title 8 of the Delaware Code (the “DGCL”), hereby certifies as follows:

1. The

original Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on May 2, 2001,

and the Amended and Restated Certificate of Incorporation of the Corporation (as amended, the “Amended and Restated Certificate

of Incorporation”) was filed with the Secretary of State of the State of Delaware on June 5, 2020.

2. This

Second Amended and Restated Certificate of Incorporation (this “Certificate of Incorporation”), which restates and

amends the Amended and Restated Certificate of Incorporation, has been declared advisable by the board of directors of the Corporation

(the “Board”), duly adopted by the stockholders of the Corporation and duly executed and acknowledged by the officers

of the Corporation in accordance with Sections 103, 228, 242 and 245 of the DGCL.

3. Effective

as of October 16, 2023, at 12:01 a.m. Eastern Time, the Amended and Restated Certificate of Incorporation is hereby amended and restated

in its entirety to read as follows:

First:

The name of the Corporation is Prairie Operating Co.

Second:

The address of its registered office in the State of

Delaware is The Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware 19801 in New Castle County, Delaware. The name of

its registered agent at such address is The Corporation Trust Company.

Third:

The nature of the business or purposes to be conducted

or promoted by the Corporation is to engage in any and all lawful acts or activities for which corporations may be organized under the

DGCL as it currently exists or may hereafter be amended, and the Corporation shall have the power to perform all lawful acts and activities.

Fourth:

The total number of shares of stock that the Corporation

shall have authority to issue is 550,000,000 shares of stock, classified as (i) 50,000,000 shares of preferred stock, par value $0.01

per share (“Preferred Stock”), and (ii) 500,000,000 shares of common stock, par value $0.01 per share (“Common

Stock”).

The

designations and the powers, preferences, rights, qualifications, limitations and restrictions of Preferred Stock and Common Stock are

as follows:

1. Provisions

Relating to Preferred Stock.

(a) Preferred

Stock may be issued from time to time in one or more classes or series, the shares of each class or series to have such designations

and powers, preferences and rights, and qualifications, limitations and restrictions thereof, as are stated and expressed herein and

in the resolution or resolutions providing for the issue of such class or series adopted by the Board as hereafter prescribed (a “Preferred

Stock Designation”).

(b) Authority

is hereby expressly granted to and vested in the Board to authorize the issuance of Preferred Stock from time to time in one or more

classes or series, and with respect to each series of Preferred Stock, to fix and state by the resolution or resolutions from time to

time adopted by the Board providing for the issuance thereof the designation and the powers, preferences, rights, qualifications, limitations

and restrictions relating to each class or series of Preferred Stock, including, but not limited to, the following:

(i) whether

or not the class or series is to have voting rights, full, special or limited, or is to be without voting rights, and whether or not

such class or series is to be entitled to vote as a separate class either alone or together with the holders of one or more other classes

or series of stock;

(ii) the

number of shares to constitute the class or series and the designations thereof;

(iii) the

preferences, and relative, participating, optional or other special rights, if any, and the qualifications, limitations or restrictions

thereof, if any, with respect to any class or series;

(iv) whether

or not the shares of any class or series shall be redeemable at the option of the Corporation or the holders thereof or upon the happening

of any specified event, and, if redeemable, the redemption price or prices (which may be payable in the form of cash, notes, securities

or other property), and the time or times at which, and the terms and conditions upon which, such shares shall be redeemable and the

manner of redemption;

(v) whether

or not the shares of a class or series shall be subject to the operation of retirement or sinking funds to be applied to the purchase

or redemption of such shares for retirement, and, if such retirement or sinking fund or funds are to be established, the annual amount

thereof, and the terms and provisions relative to the operation thereof;

(vi) the

dividend rate, whether dividends are payable in cash, stock of the Corporation or other property, the conditions upon which and the times

when such dividends are payable, the preference to or the relation to the payment of dividends payable on any other class or classes

or series of stock, whether or not such dividends shall be cumulative or noncumulative, and if cumulative, the date or dates from which

such dividends shall accumulate;

(vii) the

preferences, if any, and the amounts thereof which the holders of any class or series thereof shall be entitled to receive upon the voluntary

or involuntary liquidation, dissolution or winding up of, or upon any distribution of the assets of, the Corporation;

(viii) whether

or not the shares of any class or series, at the option of the Corporation or the holder thereof or upon the happening of any specified

event, shall be convertible into or exchangeable for, the shares of any other class or classes or of any other series of the same or

any other class or classes of stock, securities or other property of the Corporation and the conversion price or prices or ratio or ratios

or the rate or rates at which such conversion or exchange may be made, with such adjustments, if any, as shall be stated and expressed

or provided for in such resolution or resolutions; and

(ix) such

other powers, preferences, rights, qualifications, limitations and restrictions with respect to any series as may to the Board seem advisable.

(c) The

shares of each class or series of Preferred Stock may vary from the shares of any other class or series thereof in any or all of the

foregoing respects. The Board may increase the number of shares of the Preferred Stock designated for any existing class or series by

a resolution adding to such class or series authorized and unissued shares of the Preferred Stock not designated for any class or other

series. Unless otherwise provided in the Preferred Stock Designation, the Board may decrease the number of shares of the Preferred Stock

designated for any existing class or series by a resolution subtracting from such class or series authorized and unissued shares of the

Preferred Stock designated for such existing class or series, and the shares so subtracted shall become authorized, unissued and undesignated

shares of the Preferred Stock.

2. Provisions

Relating to Common Stock.

(a) Each

share of Common Stock shall have identical rights and privileges in every respect. Common Stock shall be subject to the express terms

of Preferred Stock and any class or series thereof. Except as may otherwise be provided in this Certificate of Incorporation, in a Preferred

Stock Designation or by applicable law, each stockholder shall be entitled to one vote for each share of Common Stock held by that stockholder.

Except as may otherwise be provided in this Certificate of Incorporation (including any Preferred Stock Designation), the holders of

shares of Common Stock shall have the exclusive right to vote for the election of directors and on all other matters upon which stockholders

are entitled to vote, and the holders of Preferred Stock shall not be entitled to vote at or receive notice of any meeting of stockholders.

Each holder of Common Stock shall be entitled to notice of any stockholders’ meeting in accordance with the bylaws of the Corporation

(as they may be amended or restated from time to time, the “Bylaws”) as in effect at the time in question and applicable

law on all actions to be taken by the stockholders of the Corporation.

(b) Notwithstanding

the foregoing, except as otherwise required by applicable law, holders of Common Stock, as such, shall not be entitled to vote on any

amendment to this Certificate of Incorporation (including any Preferred Stock Designation) that relates solely to the terms of one or

more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together with the

holders of one or more other such class or series, to vote thereon pursuant to this Certificate of Incorporation (including any Preferred

Stock Designation) or pursuant to the DGCL.

(c) Subject

to the prior rights and preferences, if any, applicable to shares of Preferred Stock or any class or series thereof, and subject to the

right of participation, if any, of the holders of Preferred Stock in any dividends, the holders of shares of Common Stock shall be entitled

to receive ratably in proportion to the number of shares of Common Stock held by them such dividends and distributions (payable in cash,

stock or otherwise), if any, as may be declared thereon by the Board at any time and from time to time out of any funds of the Corporation

legally available therefor.

(d) In

the event of any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, after distribution in full of the

preferential amounts, if any, to be distributed to the holders of shares of Preferred Stock or any class or series thereof, and subject

to the right of participation, if any, of the holders of Preferred Stock in any dividends, the holders of shares of Common Stock shall

be entitled to receive all of the remaining assets of the Corporation available for distribution to its stockholders, ratably in proportion

to the number of shares of Common Stock held by them. A liquidation, dissolution or winding-up of the Corporation, as such terms are

used in this paragraph (d), shall not be deemed to be occasioned by or to include any consolidation or merger of the Corporation with

or into any other corporation or corporations or other entity or a sale, lease, exchange or conveyance of all or a part of the assets

of the Corporation.

(e) The

number of authorized shares of Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares thereof

then outstanding plus the number reserved for issuance upon the exercise, conversion or exchange of outstanding securities) by the affirmative

vote of the majority of the voting power of the outstanding shares of stock of the Corporation entitled to vote generally on the election

of directors, voting as a single class, irrespective of the provisions of Section 242(b)(2) of the DGCL (or any successor provision thereto),

and no vote of the holders of either Common Stock or Preferred Stock voting separately as a class or series shall be required therefor.

3. General.

(a) Subject

to the foregoing provisions of this Certificate of Incorporation, the Corporation may issue shares of Preferred Stock and Common Stock

from time to time for such consideration (not less than the par value thereof) as may be fixed by the Board, which is expressly authorized

to fix the same in its absolute discretion subject to the foregoing conditions. Shares so issued for which the consideration shall have

been paid or delivered to the Corporation shall be deemed fully paid stock and shall not be liable to any further call or assessment

thereon, and the holders of such shares shall not be liable for any further payments in respect of such shares.

(b) The

Corporation shall have authority to create and issue rights and options entitling their holders to purchase shares of the Corporation’s

capital stock of any class or series or other securities of the Corporation, and such rights and options shall be evidenced by instrument(s)

approved by the Board. The Board shall be empowered to set the exercise price, duration, times for exercise and other terms of such rights

or options; provided, however, that the consideration to be received for any share of capital stock subject thereto shall not be

less than the par value thereof.

Fifth:

The business and affairs of the Corporation shall be

managed by or under the direction of the Board. Subject to applicable law, the rights of the holders of any class or series of Preferred

Stock and the then-applicable terms of the Stockholders’ Agreement, dated as of the date hereof (as may be amended, restated, supplemented,

modified or replaced), among the Corporation and certain of its stockholders (the “Stockholders’ Agreement”), any newly

created directorship that results from an increase in the number of directors or any vacancy on the Board that results from the death,

disability, resignation, disqualification or removal of any director or from any other cause shall be filled solely by the affirmative

vote of a majority of the total number of directors then in office, even if less than a quorum, or by a sole remaining director and shall

not be filled by the stockholders. No decrease in the number of authorized directors constituting the Board shall shorten the term of

any incumbent director.

Subject

to the rights of the holders of shares of any class or series of Preferred Stock, if any, to elect or remove additional directors pursuant

to this Certificate of Incorporation (including any Preferred Stock Designation thereunder) and the then-applicable terms of the Stockholders’

Agreement, any director or the entire Board may be removed with or without cause by the affirmative vote of the holders of a majority

of the shares then entitled to vote at an election of directors.

Subject

to the rights of the holders of any class or series of Preferred Stock to elect directors under specified circumstances, if any, and

the then-applicable terms of the Stockholders’ Agreement, the number of directors shall be fixed from time to time exclusively

pursuant to a resolution adopted by a majority of the members of the Board serving at that time. Unless and except to the extent that

the Bylaws so provide, the election of directors need not be by written ballot.

Cumulative

voting for the election of directors shall be prohibited.

The

Board may designate and appoint from among its members one or more committees, which may have one or more members, and may designate

one or more of its members as alternate members, who may, subject to any limitations imposed by the Board, replace absent or disqualified

members at any meeting of such committee. The stockholders of the Corporation shall have no power to appoint or remove directors as members

of committees of the Board, nor to abrogate the power of the Board to establish any such committees or the power of any such committee

to exercise the powers and authority of the Board.

Sixth:

Subject to the rights of the holders of any class or

series of Preferred Stock with respect to such class or series of Preferred Stock, any action required or permitted to be taken by the

stockholders of the Corporation must be taken at a duly held annual or special meeting of stockholders and may not be taken by any consent

in writing of such stockholders.

Seventh:

Except as otherwise required by applicable law and the

rights of the holders of any class or series of Preferred Stock, special meetings of stockholders of the Corporation, and any proposals

to be considered at such meetings, may be called and proposed only by the Chairman (or any Co-Chairman) of the Board or the Board pursuant

to a resolution adopted by a majority of the total number of directors then in office. Subject to the rights of the holders of any class

or series of Preferred Stock, the stockholders of the Corporation do not have the power to call a special meeting of stockholders of

the Corporation.

Eighth:

In furtherance of, and not in limitation of, the powers

conferred by the laws of the State of Delaware, the Board is expressly authorized to adopt, amend or repeal the Bylaws without any action

on the part of the stockholders of the Corporation. Any adoption, amendment or repeal of the Bylaws by the Board shall require the approval

of a majority of the members of the Board serving at the time of that vote. The stockholders of the Corporation shall have the power

to adopt, alter, amend and repeal the Bylaws with the vote of holders of not less than 66⅔% in voting power of the then-outstanding

shares of stock entitled to vote generally on the election of directors, voting together as a single class. No bylaws hereafter made

or adopted, nor any repeal of or amendment thereto, shall invalidate any prior act of the Board that was valid at the time it was taken,

nor contain any provision inconsistent with this Certificate of Incorporation.

Ninth:

No director or officer of the Corporation shall be liable

to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, as applicable, except

to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as it now exists. In addition to the

circumstances in which a director or officer of the Corporation is not personally liable as set forth in the preceding sentence, a director

or officer of the Corporation shall not be liable to the fullest extent permitted by any amendment to the DGCL hereafter enacted that

further limits the liability of a director or officer.

Any

amendment, repeal or modification of this Article Ninth shall be prospective only and shall not affect any limitation on liability of

a director or officer for acts or omissions occurring prior to the date of such amendment, repeal or modification.

Tenth:

The (a) directors of the Corporation and (b) officers

of the Corporation (each such person, a “Specified Party,” and collectively, the “Specified Parties”)

have participated (directly or indirectly) in and may, but shall have no duty to, continue to (1) participate (directly or indirectly)

in venture capital and other direct investments in corporations, joint ventures, limited liability companies and other entities conducting

business of any kind, nature or description (“Other Investments”) and (2) have interests in, participate with, aid

and maintain seats on the boards of directors or similar governing bodies of Other Investments, in each case that may, are or will be

competitive with the business of the Corporation and its subsidiaries or in the same or similar lines of business as the Corporation

and its subsidiaries, or that could be suitable for the Corporation or its subsidiaries; provided, however, that an individual who is

an employee of the Corporation or one of its subsidiaries shall only be a Specified Party for purposes of this Article Tenth to the extent

that, prior to participating in the Other Investment or business opportunity for such Other Investment in question (including any overriding

royalty interest participation program) pursuant to clauses (1) or (2) above, (a) such Specified Party receives prior written approval

from the Audit Committee of the Board authorizing such participation and (b) the Corporation publicly discloses such participation. To

the fullest extent permitted by applicable law, the Corporation, on behalf of itself and its subsidiaries, renounces any interest or

expectancy of the Corporation and its subsidiaries in, or in being offered an opportunity to participate in, any such Other Investment

or any business opportunities for such Other Investments that are from time to time presented to any Specified Party or are business

opportunities in which a Specified Party participates or desires to participate, even if the Other Investment or business opportunity

is one that the Corporation or its subsidiaries might reasonably be deemed to have pursued or had the ability or desire to pursue if

granted the opportunity to do so, and, subject to the requirements included in this Article Tenth, each such Specified Party shall have

no duty to communicate or offer any such Other Investment or business opportunity to the Corporation and, to the fullest extent permitted

by applicable law, shall not be liable to the Corporation or any of its subsidiaries or any stockholder, including for breach of any

fiduciary or other duty, as a director or officer or controlling stockholder or otherwise, and the Corporation shall indemnify each Specified

Party against any claim that such Specified Party is liable to the Corporation or its stockholders for breach of any fiduciary duty,

by reason of the fact that such Specified Party (i) participates in any such Other Investment or pursues or acquires any such business

opportunity, (ii) directs any such business opportunity to another person or (iii) fails to present any such Other Investment or business

opportunity, or information regarding any such Other Investment or business opportunity, to the Corporation or its subsidiaries, unless,

in the case of a Specified Party who is a director or officer of the Corporation, such business opportunity is expressly offered to such

Specified Party in writing solely in his or her capacity as a director or officer of the Corporation.

Neither

the amendment nor repeal of this Article Tenth, nor the adoption of any provision of this Certificate of Incorporation or the Bylaws,

nor, to the fullest extent permitted by Delaware law, any modification of law, shall eliminate, reduce or otherwise adversely affect

any right or protection of any person granted pursuant hereto existing at, or arising out of or related to any event, act or omission

that occurred prior to, the time of such amendment, repeal, adoption or modification (regardless of when any proceeding (or part thereof)

relating to such event, act or omission arises or is first threatened, commenced or completed).

If

any provision or provisions of this Article Tenth shall be held to be invalid, illegal or unenforceable as applied to any circumstance

for any reason whatsoever, (a) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining

provisions of this Article Tenth (including, without limitation, each portion of any paragraph of this Article Tenth containing any such

provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in

any way be affected or impaired thereby and (b) to the fullest extent possible, the provisions of this Article Tenth (including, without

limitation, each such portion of any paragraph of this Article Tenth containing any such provision held to be invalid, illegal or unenforceable)

shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in

respect of their good faith service to or for the benefit of the Corporation to the fullest extent permitted by applicable law.

This

Article Tenth shall not limit any protections or defenses available to, or indemnification or advancement rights of, any director or

officer of the Corporation under this Certificate of Incorporation, the Bylaws, applicable law or as may be set forth in individual indemnification

agreements with such director or officer. Any person or entity purchasing or otherwise acquiring any interest in any securities of the

Corporation shall be deemed to have notice of and to have consented to the provisions of this Article Tenth.

Eleventh:

The Corporation shall have the right, subject to any

express provisions or restrictions contained in this Certificate of Incorporation or Bylaws, from time to time, to amend this Certificate

of Incorporation or any provision hereof in any manner now or hereafter provided by applicable law, and all rights and powers of any

kind conferred upon a director, officer, or stockholder of the Corporation by this Certificate of Incorporation or any amendment hereof

are subject to such right of the Corporation.

Twelfth:

Notwithstanding any other provision of this Certificate

of Incorporation or the Bylaws (and in addition to any other vote that may be required by applicable law, this Certificate of Incorporation

or the Bylaws), the affirmative vote of at least 66⅔% of the voting power of the outstanding shares of stock of the Corporation

entitled to vote in an election of directors, voting together as a single class, shall be required to amend, alter or repeal any provision

of this Certificate of Incorporation.

Thirteenth:

Unless the Corporation consents in writing to the selection

of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery of the State of Delaware does not

have jurisdiction, the Superior Court of the State of Delaware, or, if the Superior Court of the State of Delaware does not have jurisdiction,

the United States District Court for the District of Delaware, in each case, subject to that court having personal jurisdiction over

the indispensable parties named defendants therein) shall, to the fullest extent permitted by law, be the sole and exclusive forum for

(i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim for a breach of a fiduciary

duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders,

(iii) any action asserting a claim arising pursuant to any provision of the DGCL or as to which the DGCL confers jurisdiction on the

Court of Chancery of the State of Delaware, or (iv) any action asserting a claim governed by the internal affairs doctrine including,

without limitation, any action to interpret, apply, enforce or determine the validity of this Second Amended and Restated Certificate

or the Bylaws of the Corporation (as they shall be amended from time to time), or any provision thereof. Unless the Corporation consents

in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the sole and

exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933. Any person

or entity purchasing or otherwise acquiring any interest in any securities of the Corporation shall be deemed to have notice of and to

have consented to the provisions of this Article Thirteenth.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Incorporation this 12th day of October, 2023.

| |

PRAIRIE

OPERATING CO. |

| |

|

|

| |

By: |

/s/

Edward Kovalik |

| |

Name: |

Edward

Kovalik |

| |

Title: |

Chief

Executive Officer |

[Signature

Page to Second Amended and Restated Certificate of Incorporation]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

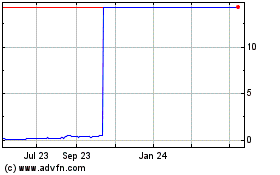

Creek Road Miners (QB) (USOTC:CRKR)

Historical Stock Chart

From Apr 2024 to May 2024

Creek Road Miners (QB) (USOTC:CRKR)

Historical Stock Chart

From May 2023 to May 2024