Credit Agricole to Acquire Three Italian Savings Banks for EUR130 Million

September 29 2017 - 1:04PM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA (ACA.FR) said Friday that it would pay 130

million euros ($153 million) to buy three Italian savings banks in

an agreement with the Italian Interbank Deposit Protection

Fund.

The French bank is buying more than 95% of the capital in the

Cesena, Rimini and San Miniato saving banks following negotiations

over the summer.

As part of the agreement, the Italian fund's voluntary scheme,

an instrument used to resolve banking crises, will bolster the

capital of the three banks to strengthen their CET1 ratio, a

measure of capital strength.

The banks' portfolios of bad loans, which total around EUR3

billion, will be securitized with the help of Italian banking fund

Fund Atlante II or sold to private investors, Credit Agricole

said.

Credit Agricole expects the transaction to be completed by the

end of 2017.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

September 29, 2017 12:49 ET (16:49 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

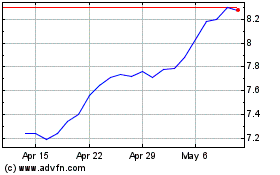

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jun 2024 to Jul 2024

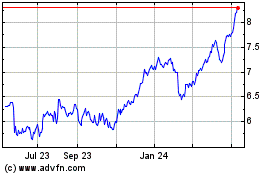

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024