Crédit Agricole Profit Jumps on Stake Sale Proceeds -- 2nd Update

November 08 2016 - 4:07AM

Dow Jones News

By Noemie Bisserbe

PARIS--French bank Crédit Agricole SA said net profit doubled in

the third quarter, bolstered by the sale of its shares in the

group's regional lenders and a rebound in bond trading.

Its shares opened 4.8% higher following the announcement Tuesday

as the bank's improved capital positioned cleared the way for it to

pay a cash dividend to investors this year.

The Paris-based lender, France's second-largest listed bank by

assets, said net profit rose to EUR1.86 billion ($2.05 billion) in

the three months to the end of September, from EUR930 million a

year ago. Revenue was down 5% at EUR3.74 billion.

The profit figure beat analysts' forecasts of EUR1.81 billion,

according to data provider FactSet.

"Another atypical quarter, but normalization is at the end of

the tunnel and visibility on the dividend is assured," said CM-CIC

analyst Pierre Chedeville.

Crédit Agricole booked a EUR1.25 billion gain in the quarter

after selling its 25% holding in the group's regional banks back to

those lenders. The bank, which is 56%-owned by the group's regional

lenders, had disclosed its restructuring plan in February to ease

concerns about its capital strength.

The sale helped lift Crédit Agricole's core tier one ratio,

which compares top-quality capital such as equity and retained

earnings with risk-weighted assets, to 12% in September, up from

11.2% in June, well above the regulatory threshold. Crédit Agricole

said it expected European regulators to set a minimum core tier-one

ratio of 7.25% for the bank next year.

"The issue of capital is now behind us," Chief Executive

Philippe Brassac told reporters.

This should allow the bank to propose a dividend in cash of

EUR0.60 a share this year, and pay out 50% of its profit to

investors from 2017, Crédit Agricole said Tuesday.

Crédit Agricole's move to revise its structure reflects the

pressure on European lenders to fortify their balance sheets and

maintain returns to investors despite sluggish growth and

persistently low interest rates.

This quarter's results highlight the pickup in bond markets that

has boosted the earnings of lenders on both side of the Atlantic,

such as France's BNP Paribas SA or U.S. lender Morgan Stanley.

Crédit Agricole's corporate and investment bank posted a 47%

jump in net profit to EUR458 million, lifted by its fixed income

business.

Net profit for its specialized financial services business rose

10% to EUR157 million, while Crédit Agricole's insurance and asset

management business reported a 37% net profit increase to EUR447

million.

Net profit for its international retail banking business, which

includes Italy, Poland and Egypt, rose 14% to EUR79 million.

In France, however, Crédit Agricole's own domestic retail arm,

LCL, reported a loss of EUR30 million compared with a EUR149

million profit a year ago, hurt by loan renegotiation and low

interest rates.

William Horobin

contributed to this article.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

November 08, 2016 03:52 ET (08:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

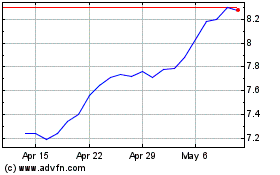

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

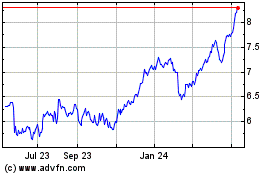

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024