Dollar at One-Month High Against Yen -- Update

October 05 2016 - 5:34PM

Dow Jones News

By Chelsey Dulaney

The dollar rose to a one-month high against the Japanese yen

Wednesday, after strong U.S. service-sector data.

The dollar recently was up 0.6% to Yen103.54, on track for its

seventh consecutive session of gains. The WSJ Dollar Index, which

measures the U.S. currency against 16 others, essentially was flat

as the dollar slipped against the British pound and many

emerging-market currencies.

The Institute for Supply Management's nonmanufacturing index

rose to 57.1 in September from 51.4 in August, beating economists'

expectations. The gauge of the U.S. service sector was at its

highest level in nearly a year in September, a sign of steady

growth for a key segment of the economy.

"Markets are regaining some confidence in the U.S. economy,"

said Vassili Serebriakov, an FX strategist at Crédit Agricole.

The dollar has been particularly strong against the Japanese yen

recently, likely because investors have been forced to unwind big

bets that the dollar will fall against the yen, Mr. Serebriakov

said.

"The caution around the U.S. economy, the disappointing data we

got a month ago was built into positioning on dollar/yen," said Mr.

Serebriakov. "They got caught wrong-footed by some of that U.S.

data."

Separately, a report from Automatic Data Processing Inc. on

Wednesday showed that private U.S. employers added 154,000 workers

in September, below the 173,000 additions that economists had

expected.

The data comes before Friday's U.S. nonfarm payrolls report,

viewed by many as the best read on the health of the labor market.

Investors are watching this week's data and commentary from Fed

officials for clues on the path of U.S. interest-rate

increases.

The Fed held rates steady at its meeting in September but said

the case for raising rates this year has strengthened.

Fed-funds futures, used to bet on central-bank policy, on

Wednesday showed that investors assigned a 60% likelihood to a rate

increase in December, compared with 63% the previous day, according

to CME data.

Higher rates tend to boost the dollar by making it more

attractive to investors seeking yield.

The dollar was lower against many commodity-linked currencies as

oil prices rose. The dollar fell 0.5% against the Russian ruble and

0.1% against the Canadian dollar.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

October 05, 2016 17:19 ET (21:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

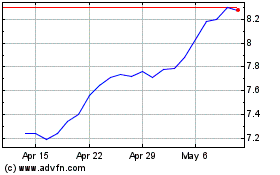

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

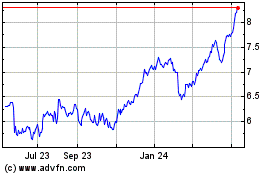

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024