Crédit Agricole to Refocus on Retail Banking

March 09 2016 - 1:59AM

Dow Jones News

By Noemie Bisserbe

PARIS--French bank Crédit Agricole SA said Wednesday it would

focus on its retail, asset management and insurance businesses to

boost earnings over the next three years following the planned sale

of its 25% stake in the group's regional cooperative banks.

The Paris-based lender, France's second-largest listed bank by

assets, said it expected to achieve a net profit upward of EUR4.2

billion ($4.62 billion) in 2019, compared with EUR3.52 billion in

2015, helped by cross-selling and lower costs.

The bank targets a return on tangible equity--a measure of

profitability--of more than 10% by 2019.

Crédit Agricole, which disclosed its new medium-term strategic

plan on Wednesday, is under pressure to show that it can provide

stable returns to investors, given its new revenue mix, and despite

persistently low interest rates and choppy markets.

Last month, Crédit Agricole announced its plan to sell the stake

it holds in the group's regional lenders back to those banks.

Crédit Agricole is currently 56%-owned by the group's regional

cooperative lenders and in turn controls 25% of those banks.

While the move will help simplify its much-criticized structure

and address investors' concerns on its capital strength, it will

also cut Crédit Agricole's earnings by about EUR470 million.

To make up for the lost income, the bank said it would increase

cross-selling between the group's retail cooperative lenders and

Crédit Agricole's insurance, asset management and consumer credit

businesses, generating additional annual revenue of EUR400 million

by 2019.

Despite the sale, Crédit Agricole expects total revenue to grow

annually by 2.5% between 2016 and 2019.

It targets a 3% annual growth in revenue for its insurance and

asset management division between 2016 and 2019, and a 2.5% annual

revenue increase for its financial services business--including

leasing and consumer credit--during the same period.

LCL, its French retail banking arm, and Cariparma, its Italian

lender, are expected to generate annual revenue growth of 0.5% and

3% respectively between 2016 and 2019.

Crédit Agricole also said it planned to trim its investment bank

to focus on more profitable clients and meet stricter financial

regulation in Europe. The lender said it will cut risk-weighted

assets at its investment bank by EUR10 billion and reduce annual

costs by EUR230 million by 2019. Still, it expects, corporate and

investment banking revenue to grow annually by 2% over the next

three years.

Crédit Agricole is targeting total cost-savings of EUR900

million by 2019 through job cuts, the revamp of its IT system, and

the simplification of its legal structure. At the same time, it

will invest EUR4.4 billion to develop its digital banking services,

meet new banking regulation and rationalize costs.

Its core tier-one ratio, which measures the amount of top

quality capital such as equity and retained earnings against

risk-weighted assets, will stand above 11% in 2019.

From next year on, the bank said it will redistribute 50% of its

profit in cash dividends to its shareholders.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

March 09, 2016 01:44 ET (06:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

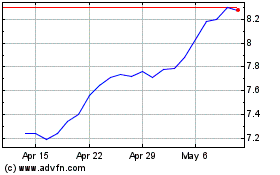

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

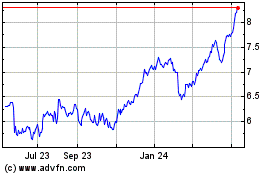

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024