Crédit Agricole to Sell Back its Regional Bank Stakes

February 17 2016 - 1:29AM

Dow Jones News

By Noemie Bisserbe

PARIS--Crédit Agricole SA said it will sell back the 25%

holdings it has in the group's regional lenders in a move aimed at

easing concerns about its capital strength but which could also

dent its earnings prospects.

Crédit Agricole said its regional lenders will pay around EUR18

billion ($20 billion) to buy back their stakes.

The Paris-based lender, France's second-largest listed bank by

assets, announced the restructuring plan Wednesday as it reported a

28% jump in fourth-quarter net profit to EUR882 million in the

three months to the end of December. Revenue was up 11% at EUR4.29

billion, lifted by a pickup in loan demand.

The move to revise its structure highlights the pressure on

European banks to fortify their balance sheets and improve

transparency to woo investors, amid volatile markets and continuing

pressure from regulators.

"The current environment is such that we can no longer afford to

have investors believe, rightly or wrongly, that the group is weak

on capital, " said Chief Executive Philippe Brassac. "This allows

us to address the issue on capital once and for all," he said.

The French bank had been working for months on a plan to revise

its corporate structure, which has for a long time weighed on its

valuation, and ease tensions within the bank. Crédit Agricole is

56%-owned by the group's regional retail banks. In turn it controls

25% of these lenders--a structure analysts say is too complex.

The transaction will have a positive impact on the bank's

capital buffers. Crédit Agricole's core tier-one ratio, which

compares top-quality capital such as equity and retained earnings

with risk-weighted assets, would reach over 11%, well above the

9.5% threshold set by regulators, up from 10.7% in December.

The deal will be financed in part by a 10-year loan of EUR11

billion at a 2.15% interest rate by Crédit Agricole to its regional

lenders and should be completed this summer, the bank said.

The proposed transaction could, however, impact the bank's

earnings growth going forward.

Crédit Agricole's domestic retail lenders contributed EUR236

million to net profit in the fourth quarter, up 14% from a year

ago, while the group's corporate and investment bank posted a 78%

drop in net profit to EUR50 million.

Mr. Brassac said that the corporate and investment bank's

earnings this quarter were in part dented by a one-off loss on a

real estate portfolio in Italy, and its risk profile remained low.

He said the group had no plans to trim its investment bank

further.

Crédit Agricole's large insurance and savings management

business, which posted a 17% increase in net profit to EUR462

million this quarter, should also help support growth.

The bank will propose a dividend of EUR0.60 a share on 2015

earnings, compared with EUR0.30 last year.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

February 17, 2016 01:14 ET (06:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

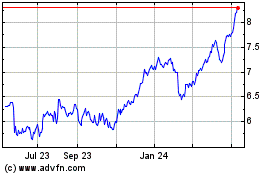

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

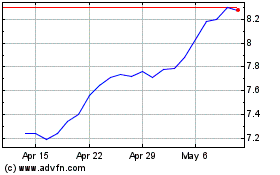

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024