French Banks' Profits Boosted by Retail Banking

November 05 2015 - 5:30AM

Dow Jones News

PARIS—French banks Socié té Gé né rale SA and Cré dit Agricole

SA on Thursday reported a jump in third-quarter net profit, lifted

by their retail banking business, as France chugs toward economic

recovery.

While Socié té Gé né rale said net profit rose 28% to €1.13

billion ($1.23 billion) in the three months through September, Cré

dit Agricole posted a 15% increase in net profit to €930

million.

Socié té Gé né rale's revenue increased by 8% to €6.36 billion,

and Cré dit Agricole's revenue fell 2% to €3.92 billion.

The French banks' earnings this quarter reflect an uptick in

loan demand in France, as the country's economy progressively

recovers from back-to-back crises.

Socié té Gé né rale's retail bank in France posted a net profit

of €410 million, up 29% from a year ago, while Cré dit Agricole's

retail banking net profit rose 2% to €250 million.

A €447 million gain because of an accounting rule that permits

banks to post paper profit when the value of their own credit

declines also helped push Socié té Gé né rale's higher, while Cré

dit Agricole's stake in investment firm Eurazeo boosted the French

bank's earnings this quarter.

However, market volatility, fueled by fears over slower growth

in China, dented the two lender's corporate and investment banking

business.

Socié té Gé né rale's global banking and investor solution

business posted a 30% drop in net profit to €320 million in the

third-quarter, while Cré dit Agricole's corporate and investment

bank reported a 3% decline in net profit to €256 million.

A strong third-quarter allowed the French banks to continue to

increase their capital buffers to meet stricter regulation.

Socié té Gé né rale's core tier-one ratio, which compares top

quality capital such as equity and retained earnings with

risk-weighted assets, stood at 10.5%, up from 10.4% at the end of

June. Cré dit Agricole's core tier-one ratio rose to 10.3%, up from

10.2% in June.

Socié té Gé né rale's leverage ratio, which measures capital

held by the bank against its total assets, rose to 3.9%, while that

of Cré dit Agricole increased to 4.4%.

Cré dit Agricole, however, made no progress this quarter with

its plans to simplify its complex corporate structure, which has

for a long time dragged on its valuation. The French bank has been

working on a restructuring plan for over a year—Cré dit Agricole is

56%-owned by the group's regional retail banks, and in turn it

controls 25% of these lenders—but it has yet to agree terms with

European regulators..

When asked for an update, Cré dit Agricole deputy chief

executive Xavier Musca told reporters the situation hadn't changed,

sending shares sharply lower.

The bank appointed Wednesday long-serving executive Dominique

Lefè bvre in a new group chairmanship role—he will chair the listed

entity and the regional retail banks.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 05:15 ET (10:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

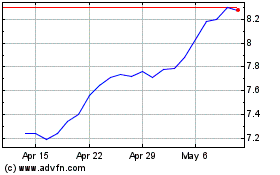

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

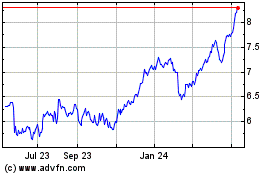

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024