Cré dit Agricole Lifted by Loan Demand

November 05 2015 - 2:00AM

Dow Jones News

PARIS—Cré dit Agricole SA posted Thursday a 15% increase in

third-quarter net profit, boosted by its retail bank and its asset

management and insurance business.

The Paris-based lender, France's second-largest listed bank by

assets, said net profit rose to €930 million ($1.01 billion) in the

three months to the end of September. Revenue was down 2% at €3.92

billion.

Cré dit Agricole's earnings this quarter highlight a pickup in

loan demand in France, as the country's economy gradually

recovers.

At Cré dit Agricole's domestic retail bank, net profit rose 2%

to €250 million in the third-quarter, while its insurance and

banking business posted a 9% increase to €438 million.

Its international retail banking business, which includes Italy,

Poland and Egypt, posted a 39% jump in net profit to €69

million.

However, Cré dit Agricole's corporate and investment bank posted

a 3% drop in net profit to €256 million, hurt by lower client

demand and market volatility.

Last month, Cré dit Agricole agreed to pay $787 million to

settle U.S. allegations that it handled illegal transactions

involving Sudan, Iran and Cuba.

The bank, however, said that the fine had no impact on its

earnings or its capital buffers this quarter.

Cré dit Agricole's core tier-one ratio, which compares

top-quality capital such as equity and retained earnings with

risk-weighted assets, stood at 10.3%, up from 10.2% in June.

The bank's leverage ratio, which measures capital held by the

bank against its total assets, stood at 4.4% compared with 4.3% at

the end of June.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 01:45 ET (06:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

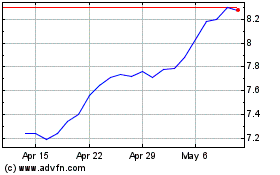

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

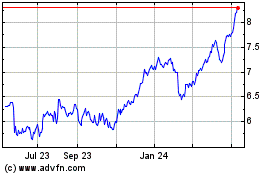

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024