Crédit Agricole to Pay $787 Million in U.S. Sanctions Case

October 20 2015 - 1:16PM

Dow Jones News

By Christopher M. Matthews and Noemie Bisserbe

French bank Crédit Agricole SA has agreed to pay $787 million to

U.S. and New York authorities to resolve allegations it violated

U.S. sanctions by handling transactions involving Iran, Sudan,

Myanmar and Cuba.

Federal prosecutors accused the bank of conspiring to defraud

the U.S. government by violating economic sanctions, according to a

complaint filed in federal court in Washington, D.C., Tuesday. As

part of the deal to resolve the allegations, the bank admitted

wrongdoing and the criminal charge is expected to be dropped after

three years if it abides by the settlement terms. The bank also

settled with a handful of other federal and state authorities.

A Crédit Agricole spokeswoman declined to comment.

The settlement is the latest to stem from a crackdown by U.S.

authorities on European banks that allegedly did deals with

companies or people in countries under U.S. sanctions. In recent

years, U.S. authorities and New York state regulators have

aggressively pursued and fined banks active in Iran, Sudan, and

other sanctioned countries.

Commerzbank AG, Credit Suisse Group AG, HSBC Holdings, Barclays

PLC, and Standard Chartered, among others, have agreed to pay

billions of dollars in fines to settle allegations of sanctions

violations.

New York City prosecutors filed separate charges Tuesday that

Crédit Agricole violated New York state law by falsifying business

records, a charge that will be dropped under the terms of a

separate settlement reached with the New York State Department of

Financial Services, Treasury Department's Office of Foreign Assets

Control, and the Board of Governors of the Federal Reserve System.

The Washington, D.C., U.S. attorney's office filed the federal

criminal charge.

The agreement should come as a relief to investors after U.S.

authorities last year ordered French peer BNP Paribas SA to pay a

record $9 billion fine in connection with sanctions violations,

raising fears Crédit Agricole could face a similar fate.

Crédit Agricole set aside EUR1.6 billion to cover total

potential litigation costs.

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

October 20, 2015 13:01 ET (17:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

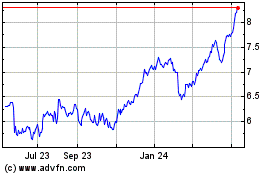

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

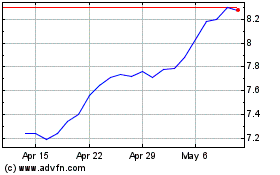

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024