As

filed with the Securities and Exchange Commission on May 11, 2020

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

CORO

GLOBAL INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

7372

|

|

85-0368333

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

78

SW 7th Street

Miami,

FL 33130

888-879-8896

(Address,

including zip code and telephone number, including

area

code, of registrant’s principal executive offices)

J.

Mark Goode

78

SW 7th Street

Miami,

FL 33130

888-879-8896

(Name,

address, including zip code and telephone number, including area code, of agent for service)

Copies

to:

|

Thomas

A. Rose, Esq.

Jeff

Cahlon, Esq.

Sichenzia

Ross Ference LLP

1185

Avenue of the Americas, 37th Floor

New

York, New York 10036

(212)

930-9700

|

|

Andrew

M. Tucker, Esq.

Nelson

Mullins Riley & Scarborough LLP

101

Constitution Avenue, NW

Suite 900

Washington, D.C. 20001

(202)

689-2800

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of the registration statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

|

Non-accelerated

filer ☒

|

Smaller

reporting company ☒

|

|

|

|

Emerging

growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed

Maximum

Aggregate

Offering Price(1)

|

|

|

Amount of

Registration Fee(2)

|

|

|

Common Stock, par value $0.0001

|

|

$

|

11,500,000

|

|

|

$

|

1,492.70

|

|

|

Underwriter’s Warrants(3) (4)

|

|

|

--

|

|

|

|

--

|

|

|

Shares of Common Stock underlying Underwriter’s Warrants(4)

|

|

|

1,000,000

|

|

|

|

129.80

|

|

|

Total

|

|

|

12,500,000

|

|

|

|

1,622.50

|

|

|

(1)

|

Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of

1933, as amended. Includes shares to be sold upon exercise of the underwriters’ option to purchase additional shares.

|

|

|

|

|

(2)

|

Pursuant

to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be

issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(3)

|

No

fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended.

|

|

(4)

|

The

Underwriter’s Warrants will represent the right to purchase 8% of the aggregate number of shares of common stock

sold in this offering excluding the overallotment option at an exercise price equal to 125% of the offering price per

share.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement

shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it

is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED MAY 11, 2020

|

Shares

of Common Stock

Coro

Global Inc.

We are offering an aggregate of shares

of our common stock, $0.0001 par value per share. We assume a public offering price of $ per

share of our common stock which was the last reported sale price of our common stock on the OTC Pink on ______, 2020.

Our common stock is presently quoted on the

OTC Pink under the symbol “CGLO”. We have applied to have our common stock listed on the Nasdaq Capital Market under

the symbol “CORO”. No assurance can be given that our application will be approved. If our application is not approved,

we will not complete this offering. On May 8, 2020, the last reported sale price for our common stock on the OTC Pink was $5.50

per share.

The

final public offering price per share will be determined through negotiation between us and the underwriter in this offering and

will take into account the recent market price of our common stock, the general condition of the securities market at the time

of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations

and our prospects for future revenues. The recent market price used throughout this prospectus may not be indicative of the public

offering price per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 3 of this prospectus for a

discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

Does

not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering payable to the underwriters.

See “Underwriting” for a description of compensation payable to the underwriters.

|

We

have granted a 45-day option to the representative of the underwriters to purchase up to additional shares

of our common stock, solely to cover over-allotments, if any.

The underwriters expect to deliver our shares

to purchasers in the offering on or about ______, 2020.

Aegis

Capital Corp.

The

date of this prospectus is , 2020

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus, as supplemented and amended. We have not authorized anyone to

provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The

information in this prospectus may only be accurate on the date of this prospectus. We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. Neither we nor any of the underwriters

is making an offer to sell or seeking offers to buy these securities in any jurisdiction where, or to any person to whom, the

offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the front cover

of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business,

financial condition, results of operations and future growth prospects may have changed since those dates.

For

investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or

possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the

United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and

observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United

States.

We

urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the common

stock being offered.

As

used in this prospectus and unless otherwise indicated, the terms “we,” “us,” “our,” “Coro

Global,” or the “Company” refer to Coro Global Inc. and its subsidiary.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a

summary, it does not contain all of the information that you should consider before investing in shares of our securities and

it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere

in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including

“Risk Factors” beginning on page 3, and the financial statements and related notes included in this prospectus.

Overview

We

are developing financial technology products and solutions that use distributed ledger technologies for improved security, speed,

and reliability.

We

have not yet commenced sales of any current products. We are developing the following planned products:

1.

Coro is a global money transmitter that will allow customers to send, receive, and exchange currencies faster, cheaper and more

securely. We believe Coro will be the world’s first global payment application that includes gold, the oldest and most trusted

currency. Following licensure and launch in the United States, we will pursue money transmission licenses in foreign countries

such as Mexico and Canada. Coro’s technology facilitates money transmission and exchange with faster speeds, better security,

and lower costs than existing options in the marketplace. At launch, Coro will provide the ability to send, receive and exchange

U.S. dollars and gold. The exchange rate between U.S. dollars and gold is transparent and set by the London Bullion Market Association

(LBMA) and the global banks that are market makers in foreign currency exchange. The initial development of our money transmission

technology and mobile application functionality is now complete. Coro is now undergoing an intensive phase of integrations and

testing. We anticipate commercial launch of Coro by the end of the second quarter of 2020.

2.

Financial Crime Risk Management (FCRM) platform – We believe there are currently two problems with anti-money laundering/know

your customer (or AML/KYC) solutions. The first problem is that the laws and compliance regulations have increased faster than

compliance officers have been able to respond. The result is a bottle-neck, slowing global financial transactions. Onboarding

new clients of financial institutions is both complex and difficult. Once onboarded the ongoing monitoring of transactions for

suspicious activity has become an even greater challenge. The technology industry has been rushing to provide solutions to meet

compliance requirements. Unfortunately, most of the compliance solutions offered are fragmented and inefficient. Even the best

solutions only excel at one element of the AML/KYC process. With this need in mind we are developing our FCRM platform, an integrated

AML/KYC onboarding and transaction monitoring solution that provides an affordable and fully integrated compliance solution for

compliance departments that meet the rigorous demands of government regulators, while supporting customers. A form of the FCRM

technology will be built into Coro, but FCRM will require additional development as a stand-alone product. We anticipate launching

FCRM as a stand-alone product during late 2020.

Corporate

Information

Our

principal executive offices are located at 78 SW 7th Street, Miami, FL 33130, and our telephone number is 888-879-8896.

Our website address is https://coro.global. Information on our website is not part of this prospectus.

THE

OFFERING

|

Securities

offered by us:

|

|

An

aggregate of shares of our common stock at an assumed

public offering price of $ per share based on the last

quoted price of our common stock on , 2020.

|

|

|

|

|

|

Common

stock outstanding before the offering(1)

|

|

24,392,246

shares of common stock.

|

|

|

|

|

|

Common

stock to be outstanding after the offering(2)

|

|

shares

of common stock. If the underwriter’s over-allotment option is exercised in full, the total number of shares of common

stock outstanding immediately after this offering would be .

|

|

|

|

|

|

Option

to purchase additional shares

|

|

We

have granted the underwriters a 45-day option to purchase up to additional

shares of our common stock to cover allotments, if any.

|

|

|

|

|

|

Use

of proceeds

|

|

We

intend to use the net proceeds of this offering for general corporate purposes, including completing the testing of, launching

and marketing of our Coro product, and working capital. See “Use of Proceeds.”

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set

forth in the “Risk Factors” section beginning on page 3 before deciding to invest in our securities.

|

|

|

|

|

|

Trading

symbol

|

|

Our

common stock is currently quoted on the OTC Pink under the trading symbol “CGLO”. We have applied to the

Nasdaq Capital Market to list our common stock under the symbol “CORO”. No assurance can be given that our

application will be approved. If our application is not approved, we will not complete this offering.

|

|

|

|

|

|

Lock-ups

|

|

We

and our directors and executive officers have agreed with the underwriters not to offer for sale, issue, sell, contract to

sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180

days after the date of this prospectus, in the case of our executive officers and directors, and 90 days with respect to us.

See “Underwriting.”

|

|

(1)

|

Based

on shares of common stock outstanding on May 5, 2020. Includes 750,000 shares that are

subject to forfeiture under certain conditions (see “Executive Compensation--Employment

Agreements”).

|

|

|

|

|

(2)

|

Based

on assumed public offering price of $ .

|

Unless

otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional

shares of common stock to cover over-allotments, if any.

RISK

FACTORS

Investing

in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider

carefully the specific factors discussed below, together with all of the other information contained in this prospectus. Our business,

financial condition, results of operations and prospects could be materially and adversely affected by these risks.

Risks

Related to Our Business

We

have a limited operating history under our current business focus, and we may not succeed.

We

have a limited operating history, in particular under our current business focus, and we may not succeed. We are subject to all

risks inherent in a developing business enterprise. You should consider, among other factors, our prospects for success in light

of the risks and uncertainties encountered by companies that, like us, are in their early stages. For example, unanticipated expenses,

problems, and technical difficulties may occur and they may result in material challenges to our business. We may not be able

to successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so,

such failure could have a material adverse effect on our business, financial conditions and results of operation. We may never

generate significant revenues or achieve profitability.

We

may not succeed in developing or generating sales of our products.

We

have not yet generated revenues from any current products. The development of our products is a costly, complex, and time-consuming

process, and investments in product development often involve a long period of time until completed and a return, if any, can

be achieved on such an investment. We may face difficulties or delays in the development and commercialization of our products,

which could result in our inability to timely offer products or services that satisfy the market. We have been making and anticipate

making significant investments in developing our products, but such an investment is inherently speculative and requires substantial

capital expenditures. Any unforeseen technical obstacles and challenges that we encounter in the development process could result

in delays in, or the abandonment of, the development and launch of, or ability to generate revenue. Further, once we complete

development of a product, there is no assurance we will succeed in generating sales from such product. We may not succeed in launching

or generating sales of our products.

We

may encounter significant competition and may not be able to successfully compete.

There

are many financial technology companies developing money transmission products, and more competitors are likely to arrive. Some

of our competitors have considerably more financial resources than us, and the backing of traditional large financial institutions.

As a result, we may not be able to successfully compete in our market, which could result in our failure to launch Coro, or otherwise

fail to successfully compete. There can be no assurances that we will be able to compete successfully in this environment.

The

distributive ledger technology on which our products may rely may be the target of malicious cyberattacks or may contain exploitable

flaws in its underlying code, which could result in security breaches and the loss or theft of funds. If such attacks occur

or security is compromised, this could expose us to liability and reputational harm and could seriously curtail the utilization

of Coro, resulting in customers reducing their use of Coro, or stopping their use of Coro altogether.

The

structural foundation, the software applications and other interfaces or applications upon which Coro may rely or that they will

be built upon are unproven, and there can be no assurances that such planned products and the creating, transfer or storage of

data and funds will be uninterrupted or fully secure, which could result in impermissible transfers, and a complete loss of a

customer’s data and funds. Coro may be subject to a cyberattack, software error, or other intentional or negligent act or

omission that results in the theft of funds, funds being lost, destroyed or otherwise compromised. Further, Coro (and any technology

on which we rely) may also be the target of malicious attacks from hackers or malware distributors seeking to identify and exploit

weaknesses in the software, which could result in the loss or theft of data and funds. If such attacks occur or security

is compromised, this could expose us to liability and reputational harm and could seriously curtail the utilization of Coro, resulting

in customers reducing their use of Coro or stopping their use altogether, which could have a material adverse effect on our business,

financial condition and results of operations.

We

may not be able to raise capital as needed to develop our products or maintain our operations.

We

expect that we will need to raise additional funds to execute our business plan and expand our operations. Additional financing

may not be available to us on favorable terms, or at all. If we cannot raise needed funds on acceptable terms, the Company’s

business and prospects may be materially adversely affected.

We

may face risks of Internet disruptions, which could have an adverse effect on the use of our products.

A

disruption of the Internet may affect the use of our products. Generally, our products are dependent upon the Internet. A significant

disruption in Internet connectivity could disrupt network operations until the disruption is resolved.

Exchange

rates are continuously changing and can be volatile. Coro customers will be exposed to this risk.

The

price of gold is continuously changing and has exhibited periods of volatility throughout history. Customers that choose to maintain

gold balances (which would be in XAU, the International Organization of Standardization’s currency code for gold.) but have

personal liabilities in U.S. dollars (USD) will be exposed to this potential volatility and could incur significant gains or losses

when converting from XAU back to USD. This may make Coro less appealing to prospective customers.

Coro

will not be a market maker and thus will not guarantee a fixed bid/ask spread or guarantee that a bid or an ask will be available

to customers. Coro will be reliant on the financial institutions with whom it interacts to facilitate its services.

Coro

will be dependent upon the bid/ask spread as provided by large gold dealers and LBMA members. In times of market turbulence, it

is possible that the bid/ask spread could widen significantly thus increasing the cost of transacting between XAU and USD. This

may make Coro less appealing to prospective customers.

Changes

in general economic and business conditions, internationally, nationally and in the markets in which we operate, could have an

adverse effect on our business, financial condition, or results of operations.

Our

operating results may be subject to factors which are outside of our control, including changes in general economic and business

conditions, internationally, nationally and in the markets in which we operate. Such factors could have a material adverse effect

on our business, financial condition, or results of operations.

In

addition, disruptions in the credit and financial markets, declines in consumer confidence, increases in unemployment, declines

in economic growth and uncertainty about earnings could have a significant negative impact on the U.S. and global financial and

credit markets and the overall economy. Such events could have an adverse impact on financial institutions resulting in limited

access to capital and credit for many companies. Furthermore, economic uncertainties make it very difficult to accurately forecast

and plan future business activities. Changes in economic conditions, changes in financial markets, deterioration in the capital

markets or other factors could have an adverse effect on our financial position, revenues, results of operations and cash flows

and could materially adversely affect our business, financial condition and results of operations.

Our

operations will significantly rely on our team of managers, advisors, and technical personnel.

The

successful operation and development of our business will be dependent primarily upon the operating and management skills of our

managers, advisors, and technical personnel. The loss of the services of any one of our key personnel, in particular our chief

executive officer, J. Mark Goode, could have a material adverse impact on our ability to realize our objectives, including our

ability to complete development of, launch and commercialize our planned products, which could have a material adverse effect

on our business, financial condition and results of operations.

If

we fail to protect our intellectual property and proprietary rights, we could lose our ability to compete.

Our

intellectual property and proprietary rights are essential to our ability to remain competitive and successful in the development

of our products and our business. We expect to rely on a combination of patent, trademark, copyright, and trade secret laws as

well as confidentiality agreements and procedures, non-competition agreements, and other contractual provisions to protect our

intellectual property, other proprietary rights, and our brand. Our intellectual property rights may be challenged, invalidated

or circumvented by third parties. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge

or other trade secrets by employees or competitors. If we do not adequately protect our intellectual property or proprietary rights,

our competitors could use it to enhance their products, compete against us, and take our market share. Our inability to adequately

protect our intellectual property could adversely affect the Company’s business, financial condition and results of operations.

Other

companies may claim that we infringe their intellectual property.

We

do not believe that our technologies infringe, or will infringe, on the proprietary rights of any third party, but claims of infringement

are becoming increasingly common and third parties may assert infringement claims against us in the future. It may be difficult

or impossible to identify, prior to receipt of notice from a third party, the trade secrets, patent position or other intellectual

property rights of a third party. If any of our products or services, such as Coro, if developed and launched, were found to infringe

on other parties’ proprietary rights and we are unable to come to terms regarding a license with such parties, we may be

forced to modify our products to make them non-infringing or to cease to offer such products altogether, which could adversely

affect our business, financial condition and results of operations.

We

have an evolving business model.

As

financial technologies become more widely available, we expect the services and products associated with them to evolve. In order

to stay current with the industry, our business model may need to evolve as well. From time to time, we may modify aspects of

our business model relating to our product mix and service offerings. Any such modifications we may make may not be successful

and may result in harm to our business. We may not be able to manage growth effectively, which could damage our reputation, limit

our growth and negatively affect our operating results.

An

occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations.

The

occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. The COVID-19 pandemic

has resulted in social distancing, travel bans and quarantine, and this has limited and may continue to limit access to our facilities

by our, management, support staff and professional advisors. These factors, in turn, may not only impact our operations, financial

condition and development of our products but our overall ability to react timely to mitigate the impact of this event. Also,

it may hamper our efforts to comply with our filing obligations with the Securities and Exchange Commission, and our ability to

raise capital on favorable terms, or at all.

Risks

Related to this Offering and our Common Stock

There

is not an active, liquid market for our common stock, and investors may find it difficult to buy and sell our shares.

Our common stock is not listed on any national

securities exchange. Accordingly, investors may find it more difficult to buy and sell our shares than if our common stock was

traded on an exchange. Although our common stock is quoted on the OTC Pink, it is an unorganized, inter-dealer, over-the-counter

market which provides significantly less liquidity than the Nasdaq Capital Market or other national securities exchange. Further,

there is minimal reported trading in our common stock. These factors may have an adverse impact on the trading and price of our

common stock.

Further, we have applied to have our common

stock listed on the Nasdaq Capital Market. If our application is not approved, we will not complete this offering. In the event

this offering is completed and our common stock is listed on the Nasdaq Capital Market, there is no assurance an active trading

market for our common stock will develop or be sustained or that we will remain eligible for continued listing on the Nasdaq Capital

Market.

The

market price of our common stock is likely to be highly volatile and subject to wide fluctuations.

In

the event a more active market for common stock develops, we anticipate that the market price of our common stock will be highly

volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

|

|

●

|

variations

in our quarterly operating results;

|

|

|

●

|

announcements

that our revenue or income are below analysts’ expectations;

|

|

|

●

|

general

economic slowdowns;

|

|

|

●

|

sales

of large blocks of our common stock; and

|

|

|

●

|

announcements

by us or our competitors of significant contracts, acquisitions, strategic partnerships,

joint ventures or capital commitments.

|

Our

common stock has in the past been, and may in the future be considered a “penny stock” and thus be subject to additional

sale and trading regulations that may make it more difficult to buy or sell.

Our common stock, which is traded on the OTC

Pink has in the past been, and may (if it is not then listed on a national securities exchange such as the Nasdaq Capital Market)

in the future be considered a “penny stock.” Securities broker-dealers participating in sales of “penny stock”

are subject to the “penny stock” regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Generally, brokers may be less willing to execute transactions

in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common

stock and cause a decline in the market value of our stock.

We

do not intend to pay dividends on our common stock for the foreseeable future.

We

have paid no dividends on our common stock to date and we do not anticipate paying any dividends to holders of our common stock

in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business,

we currently anticipate that we will retain any earnings to finance our future expansion and for the implementation of our business

plan. Investors should take note of the fact that a lack of a dividend can further affect the market value of our common stock,

and could significantly affect the value of any investment in the Company.

Our

articles of incorporation allow for our board to create new series of preferred stock without further approval by our stockholders,

which could adversely affect the rights of the holders of our common stock.

Our

board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of

directors has the authority to issue up to 10,000,000 shares of our preferred stock without further stockholder approval. As a

result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders of preferred

stock the right to our assets upon liquidation, or the right to receive dividend payments before dividends are distributed to

the holders of common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that

has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative

voting power of our common stock or result in dilution to our existing stockholders. Although we have no present intention to

issue any shares of preferred stock or to create any series of preferred stock, we may create such series and issue such shares

in the future.

Additional

stock offerings in the future may dilute then-existing shareholders’ percentage ownership of the Company.

Given

our plans and expectations that we will need additional capital and personnel, we anticipate that we will need to issue additional

shares of common stock or securities convertible or exercisable for shares of common stock, including convertible preferred stock,

convertible notes, stock options or warrants. The issuance of additional securities in the future will dilute the percentage ownership

of then current stockholders.

Ownership

of our common stock is highly concentrated.

Our executive officers, directors, and principal

stockholders will beneficially own an aggregate of approximately % of our outstanding common stock (see “Security Ownership

of Certain Beneficial Owners and Management”) after giving effect to the sale of the shares offered hereby. As a result,

such principal stockholders will be able to exert significant control over the election of the members of our board of directors,

our management, and our affairs, and other corporate transactions (such as mergers, consolidations, or the sale of all or substantially

all of our assets) that are submitted to shareholders for approval, and their interests may differ from the interests of other

stockholders.

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the

future.

You

will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of shares offered

in this offering at an assumed public offering price of $ per share, and after deducting underwriting discounts and commissions

and estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of approximately $ per share. See “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase our

common stock in the offering.

Management

will have broad discretion as to the use of the proceeds from this offering, and may not use the proceeds effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in

ways that may not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds

effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. Forward-looking statements give current expectations

or forecasts of future events or our future financial or operating performance. We may, in some cases, use words such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,”

“plan,” “potential,” “predict,” “project,” “should,” “will,”

“would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes

to identify these forward-looking statements.

These

forward-looking statements reflect our management’s beliefs and views with respect to future events, are based on estimates

and assumptions as of the date of this prospectus and are subject to risks and uncertainties, many of which are beyond our control,

that could cause our actual results to differ materially from those in these forward-looking statements. We discuss many of these

risks in greater detail in this prospectus under “Risk Factors.” Moreover, new risks emerge from time to time. It

is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments

or otherwise, except as may be required by applicable laws or regulations.

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of the securities we are offering will be approximately $ million (or approximately

$ million if the underwriters exercise in full their over-allotment option), after deducting the estimated underwriting discounts

and commissions and estimated offering costs payable by us.

We intend to use the net proceeds from this

offering for general corporate purposes, including completing the testing of, launching and marketing of our Coro product, the

launch of our FCRM product and working capital.

This

expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions.

Pending our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation

investments, including short-term, investment grade, interest bearing instruments and U.S. government securities.

MARKET

FOR COMMON STOCK

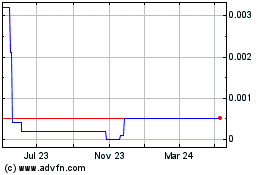

Our common stock is quoted on the OTC Pink under

the symbol “CGLO.” We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “CORO”.

No assurance can be given that our application will be approved. If our application is not approved, we will not complete this

offering.

As of May 5, 2020, there were approximately

1,129 holders of record of our common stock.

Equity

Compensation Plan Information

In

January 2019, the Company adopted the Company’s 2019 Equity Incentive Plan. 2,400,000 shares are available for awards under

the plan. The plan was approved by the Company’s stockholders in February 2019.

The

following table provides equity compensation plan information as of December 31, 2019:

|

Plan category

|

|

Number of securities to be

issued upon exercise of

outstanding options

(a)

|

|

|

Weighted-

average

exercise

price of

outstanding options

(b)

|

|

|

Securities

remaining

available

for future

issuance

under equity

compensation

plans

(excluding

securities

reflected in column

(a)) (c)

|

|

|

Equity compensation plans approved by security holders

|

|

|

—

|

|

|

$

|

—

|

|

|

|

2,400,000

|

|

|

Equity compensation plans not approved by security holders

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

|

—

|

|

|

$

|

—

|

|

|

|

2,400,000

|

|

DIVIDEND

POLICY

We

have paid no dividends on our common stock to date and we do not anticipate paying any dividends to holders of our common stock

in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business,

we currently anticipate that we will retain any earnings to finance our future expansion and for the implementation of our business

plan.

DILUTION

If

you purchase shares of common stock in this offering, your interest will be diluted to the extent of the difference between the

public offering price per share and the net tangible book value per share of our common stock after this offering. Our net tangible

book value as of December 31, 2019 was $151,307, or $0.006 per share of common stock. “Net tangible book value” is

total assets minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible

book value divided by the total number of shares of common stock outstanding.

After giving effect to the sale by us in this

offering of shares at an assumed public offering price of $ per share

(the closing price of our common stock on , 2020) and after deducting the estimated underwriting discounts and commissions and

estimated offering expenses that we will pay, our net tangible book value as of December 31, 2019 would have been approximately

$ , or $ per

share of common stock. This amount represents an immediate increase in net tangible book value of $ per

share to existing stockholders and an immediate dilution of $ per share

to purchasers in this offering.

The

following table illustrates the dilution:

|

Assumed

public offering price per share

|

$

|

|

|

Net

tangible book value per share as of December 31, 2019

|

$

|

|

|

Increase

in net tangible book value per share attributable to this offering

|

$

|

|

|

Pro

forma net tangible book value per share after this offering

|

$

|

|

|

Dilution

per share to new investors

|

$

|

|

The

above table is based on 23,372,746 shares of common stock outstanding as of December 31, 2019.

If

the underwriters exercise in full their over-allotment option, our net tangible book value per share after giving effect to this

offering would be approximately $ million, or $ per share, which amount represents an immediate increase in net tangible book

value of $ per share to existing stockholders and a dilution to new investors of $ per share.

CAPITALIZATION

The

following table sets forth our cash and our capitalization as of December 31, 2019 on:

|

|

●

|

on

a pro forma basis to give effect to the sale by us in this offering of shares,

at the assumed public offering price of $ per share,

after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

You

should read this table in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results

of Operations,” and our audited financial statements for the years ended December 31, 2019 and 2018, and the related notes

thereto, included in this prospectus.

|

|

|

As of December 31, 2019

|

|

|

|

|

Actual

|

|

|

Pro Forma

|

|

|

Cash

|

|

$

|

407,800

|

|

|

$

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value: 10,000,000 authorized, 0 shares issued and outstanding, 0 shares outstanding, respectively

|

|

|

0

|

|

|

|

0

|

|

|

Common Stock, $.0001 par value: 700,000,000 shares authorized; 23,372,746 shares outstanding as of December 31, 2019 actual; shares outstanding pro forma

|

|

|

2,337

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

39,276,760

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

(39,125,811

|

)

|

|

|

(

|

)

|

|

Total stockholders’ equity

|

|

|

153,286

|

|

|

|

|

|

The

number of shares to be outstanding immediately after giving effect to this offering as shown above is based on 23,372,746 shares

outstanding as of December 31, 2019.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion highlights the principal factors that have affected our financial condition and results of operations as

well as our liquidity and capital resources for the periods described. This discussion should be read in conjunction with our

Consolidated Financial Statements and the related notes included in this prospectus. This discussion contains forward-looking

statements. Please see “Cautionary Note Regarding Forward-Looking Statements” for a discussion of the uncertainties,

risks and assumptions associated with these forward-looking statements.

Results

of Operations for the years ended December 31, 2019 and 2018

Revenues

Revenues

for the year ended December 31, 2019 totaled $0 compared to revenues of $6,485 during the year ended December 31, 2018. The

decrease of $6,485 is related to the Company’s shift in business. We previously generated revenues from professional service

specializing in HIPAA compliant retrieval, reproduction and release of information.

Selling,

General and Administrative Expenses

Selling, general and administrative expenses

for the year ended December 31, 2019 totaled $3,835,548, an increase of $1,379,744 or approximately 56% compared to selling, general

and administrative expenses of $2,455,774 for the year ended December 31, 2018. During the year ended December 31, 2019 consulting

fees increased by $464,487 in connection with the expansion of our operations, which was partially offset by decreased marketing

fees of $105,894. During the year ended December 31, 2019 we incurred stock compensation expense and settlement of derivative liability

of $2,617,291 and $0, respectively, compared to $1,550,995 and $6,088, respectively for the year ended December 31, 2018 which

was included in selling, general and administrative expenses.

Development

Expense

Development

expenses for the year ended December 31, 2019 totaled $997,620 compared to $962,063 for the year ended December 31, 2018. We began

to incur significant development expenses, including fees paid to vendors, for our planned Coro product in the third quarter of

2018, which continued during the year ended December 31, 2019.

Interest

Expense

Interest

expense on debentures for the year ended December 31, 2019 and 2018, was $17,211 and $606,527, respectively. Interest expense

during the year ended December 31, 2018 included the amortization of $586,921 of beneficial conversion of convertible loans.

Other

Expense

Loss

on change in fair value of derivative liabilities for the year ended December 31, 2019 and 2018 was $0 and $6,088 respectively.

Net

Loss

For

the reasons stated above, our net loss for the year ended December 31, 2019 was ($4,850,379) or ($0.21) per share, an increase

of $(826,412) or 21%, compared to net loss of ($4,023,967), or ($0.26) per share, during the year ended December 31, 2018.

Liquidity

and Capital Resources

As

of December 31, 2019, we had cash of $470,800, which compared to cash of $223,576 as of December 31, 2018. Net cash used in operating

activities for the year ended December 31, 2019 was $2,194,996. Our current liabilities as of December 31, 2019 of $333,933 consisted

of: $153,551 for accounts payable and accrued liabilities, and note payable – related party of $180,382.

During

the year ended December 31, 2019 we entered into and closed subscription agreements with accredited investors pursuant to which

the Company sold to the investors an aggregate of 482,000 shares of common stock, for a purchase price of $5.00 per share, and

aggregate gross proceeds of $2,410,000. A related party advanced us $3,000 and was repaid $3,000. In February 2019, the Company

issued a promissory note to a then-related party in the principal amount of $110,000 with an original issue discount of $10,000.

The note has a 0% interest rate and had an original maturity date of March 31, 2019, which has been extended to June 30, 2020.

Following the maturity date, the note bears a 9% annual interest rate until paid in full. In April 2019, we repaid $50,000 of

a convertible loan to a related party and exchanged the remaining $50,000 into 10,000 shares of common stock valued at $50,000.

Net

cash used in operating activities for the year ended December 31, 2018 was $1,653,420. Our current liabilities as of December

31, 2018 of $709,891 consisted of: $223,067 for accounts payable and accrued liabilities, net convertible debenture – related

party of $85,829, deferred compensation of $300,395, note payable – related party of $100,000, and derivative liability

of $0.

From

June 2018 to July 2018 we entered into and closed subscription agreements with accredited investors pursuant to which the Company

sold to the investors an aggregate of 3,030,303 shares of common stock, for a purchase price of $0.33 per share, and aggregate

gross proceeds of $1,000,000. From August 2018 to September 2018, we entered into and closed subscription agreements with accredited

investors pursuant to which the Company sold to the investors an aggregate of 866,666 shares of common stock for a purchase price

of $1.00 per share, and aggregate gross proceeds of $866,666. The investors included JMG Horseshoe, LLC, which purchased 333,333

shares of common stock for a purchase price of $333,333. The managing member of JMG Horseshoe, LLC is J. Mark Goode, who is the

Company’s chief executive officer. A related party converted $484,651 of convertible notes, accrued interest and preferred

stock into common stock. The Company repaid two related parties a total of $101,935.

We

anticipate that we will need to raise additional capital to execute our business plan, which may not be available on acceptable

terms, or at all. If we raise funds through the sale of common stock or securities convertible into common stock, it may result

in substantial dilution to our then-existing stockholders.

Off

Balance Sheet Arrangements

We

currently have no off-balance sheet arrangements that have or are reasonably likely to have a current or future material effect

on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures

or capital resources.

Critical

Accounting Policies and Estimates

Revenue

Recognition

Effective

January 1, 2018, we recognize revenue in accordance with Accounting Standards Codification 2014-09, Revenue from Contracts with

Customers (Topic 606), which supersedes the revenue recognition requirements in Topic 605, Revenue Recognition, and most industry-specific

revenue recognition guidance throughout the Industry Topics of the Accounting Standards Codification. The updated guidance states

that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects

the consideration to which the entity expects to be entitled in exchange for those goods or services. The guidance also provides

for additional disclosures with respect to revenues and cash flows arising from contracts with customers. The standard will be

effective for the first interim period within annual reporting periods beginning after December 15, 2017, and we adopted the standard

using the modified retrospective approach effective January 1, 2018. The adoption of this guidance did not have a material impact

on our financial statements.

Stock-Based

Compensation

We

account for all compensation related to stock, options or warrants using a fair value-based method whereby compensation cost is

measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting

period. We use the Black-Scholes pricing model to calculate the fair value of options and warrants issued to both employees and

non-employees. Stock issued for compensation is valued using the market price of the stock on the date of the related agreement.

Impairment

of long-lived assets

We

review long-lived assets for impairment whenever events or changes in circumstances indicate that the asset’s carrying amount

may not be recoverable. We conduct our long-lived asset impairment analyses in accordance with ASC 360-10-15, “Impairment

or Disposal of Long-Lived Assets.” ASC 360-10-15 requires the Company to group assets and liabilities at the lowest level

for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities and evaluate the asset

group against the sum of the undiscounted future cash flows. If the undiscounted cash flows do not indicate the carrying amount

of the asset is recoverable, an impairment charge is measured as the amount by which the carrying amount of the asset group exceeds

its fair value based on discounted cash flow analysis or appraisals.

Recently

Issued Accounting Pronouncements

There

were various updates recently issued, most of which represented technical corrections to the accounting literature or application

to specific industries and are not expected to have a material impact on our financial position, results of operations or cash

flows.

In

February 2016, the FASB issued ASU 2016-02, Leases, which amended current lease accounting to require lessees to recognize (i)

a lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted

basis, and (ii) a right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of,

a specified asset for the lease term. ASU 2016-02 does not significantly change lease accounting requirements applicable to lessors;

however, certain changes were made to align, where necessary, lessor accounting with the lessee accounting model. This standard

was effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The adoption

of this ASU did not have a material impact on our balance sheet.

Management

does not believe that any other recently issued but not yet effective accounting pronouncements, if adopted, would have a material

effect on the accompanying financial statements.

BUSINESS

Coro

Global Inc. is a Nevada corporation that was originally formed on November 1, 2005 when Bio-Solutions International, Inc. (“Bio-Solutions”)

entered into an Agreement and Plan of Merger with OmniMed Acquisition Corp., a Nevada corporation and a wholly-owned subsidiary

of Bio-Solutions, OmniMed International, Inc. (“OmniMed”) and the shareholders of OmniMed. On January 17, 2006, OmniMed

changed its name to MedeFile International, Inc. The Company’s business following the closing of this agreement was the

sale of an Internet-enabled Personal Health Record (iPHR) system for gathering, digitizing, maintaining, accessing and sharing

an individual’s medical records, and in connection therewith, providing a professional service specializing in HIPAA compliant

retrieval, reproduction and release of information. Under this service, Company personnel went onsite to physicians’ offices

weekly to reproduce the records requested by third parties.

In

October 2017, the name of the Company was changed to Tech Town Holdings, Inc. to reflect a new business strategy centered on identifying

and fostering new or early stage business opportunities being fueled by digital innovation.

Following

close scrutiny of emerging business opportunities, coupled with evaluation of market trends, the Company determined that a more

prudent strategy was to narrow its focus to financial technology, also known as Fintech. Effective March 2, 2018, the Company

changed its name to Hash Labs Inc. and effective January 9, 2020, the Company changed its name to Coro Global Inc.

Products

and Services

We

are developing financial technology products and solutions that use distributed ledger technologies for improved security, speed,

and reliability. We have not yet commenced sales of any current products. We have developed or are developing the following planned

products:

1.

Coro – Coro is a global money transmitter that will allow customers to send, receive, and exchange currencies faster, cheaper

and more securely. We believe Coro will be the world’s first global payment application that includes gold, the oldest and

most trusted currency. We will offer Coro through Coro Corp., a subsidiary of Coro Global Inc., which will operate pursuant

to both Federal and State money transmission regulations. Coro Corp. has already registered as a money services business (MSB)

with the Financial Crimes Enforcement Network (FinCEN) at the U.S. Treasury Department. Coro has already received its Money Services

Business License approval from Florida Office of Financial Regulation. Coro is in the application process for multiple state money

transmission licenses throughout the US. Coro Corp. intends to complete its MSB licensure in all U.S. States by the end of 2020.

Following commercial launch in the US, we will pursue money transmission licenses in foreign countries such as Mexico and Canada.

Coro’s technology facilitates money transmission and exchange with faster speeds, better security, and lower costs than

existing options in the marketplace. At launch, Coro will provide the ability to send, receive and exchange U.S. dollars and gold.

The exchange rate between U.S. dollars and gold is transparent and set by the London Bullion Market Association and the global

banks that are market makers in foreign currency exchange. Coro Corp. will operate as a money transmitter under 31 CFR §

1010.100(ff)(5)(i)(A) and will not market or sell investments in gold. The initial development of Coro’s money transmission

technology and mobile application functionality is now complete. Coro is now undergoing an intensive phase of integrations and

testing. We anticipate commercial launch of the Coro payment application by the end of the second quarter of 2020.

2.

Financial Crime Risk Management (FCRM) platform – We believe there are currently two problems with AML/KYC solutions. The

first problem is that the laws and compliance regulations have increased faster than compliance officers have been able to respond.

The result is a bottle-neck, slowing global financial transactions. Onboarding new clients of financial institutions is both complex

and difficult. Once onboarded the ongoing monitoring of transactions for suspicious activity has become an even greater challenge.

The technology industry has been rushing to provide solutions to meet compliance requirements. Unfortunately, most of the compliance

solutions offered are fragmented and inefficient. Even the best solutions only excel at one element of the AML/KYC process. With

this need in mind we are developing our FCRM platform, an integrated AML/KYC onboarding and transaction monitoring solution that

provides an affordable and fully integrated compliance solution for compliance departments that meet the rigorous demands of government

regulators, while supporting customers. A form of the FCRM technology will be built into Coro, but FCRM will require additional

development as a stand-alone product. We anticipate launching FCRM as a stand-alone product during late 2020.

Coro

Money Transmitter Business

Coro

is a mobile application that will allow customers to send and receive USD or XAU. Coro will operate on a private permissioned

network which insures the highest level of security and compliance.

In

order to use Coro, customers will be required to pass an identity verification and stringent anti-money laundering/know-your customer

check, to prevent bad actors from joining and assist in ensuring regulatory compliance. Our FCRM platform will manage onboarding,

screening and monitoring of Coro’s customers.

Coro

will provide its customers with the benefits of speed, security, transparency, and ease of use, as well as the opportunity to

transact in dollars or gold on the fastest distributed ledger technology (DLT) on the market.

We

believe Coro will solve the following two important problems:

|

|

●

|

The

ability to send and receive currency faster, cheaper, more securely and across borders with ease. Current fees for sending

payments from one country to another are in the double digits. Coro aims to lower the price of sending and receiving money,

dramatically opening up financial services to a wider audience.

|

|

|

●

|

The

ability to use gold as money has not existed in decades. Much like physical cash is disappearing because it became inconvenient

to use in modern transactions, physical gold is also not convenient for everyday transactions. We believe Coro will solve

this by allowing customers to send and receive gold as money. As a registered money service business and licensed money transmitter,

Coro Corp. will be required to maintain custody accounts for U.S. dollars (USD) and gold (XAU) on behalf of its customers.

|

Coro

will maintain two custody accounts to facilitate the flow of funds. One custody account will be maintained by the independent

vaulting custodian for storage of users’ physical gold. The Coro users’ gold will be fully insured at all times. The

balance of the users’ custody account will be represented in XAU, the International Organization of Standardization’s

currency code for gold. The second custody account will be a U.S. dollar account held at a FDIC insured U.S. Bank. The balance

of the U.S. dollar account will be represented in USD, the International Organization of Standardization’s currency code

for U.S. dollars.

Customers

who download the Coro app and pass the verification process will be able to:

|

|

●

|

Deposit

USD into their Coro account. Under this process, customers fund their Coro USD account by entering their bank information

in the mobile app and authorizing the transfer of the desired amount to our U.S. banking custodian by ACH.

|

|

|

●

|

Exchange

USD for XAU. Under this process, customers are able to exchange USD into XAU at the current XAU to USD global exchange rate

minus Coro’s transaction fees. Coro processes the exchange through its gold dealer and the independent gold vaulting

custodian.

|

|

|

●

|

Exchange

XAU into USD. Under this process customers are able to exchange XAU into USD at the current global XAU to USD exchange rate

minus Coro’s transaction fees. Coro processes the exchange through its gold dealer and the independent gold custodian.

USD received from the exchange are deposited back in Coro’s U.S. bank custody account held on behalf of the customer.

|

|

|

●

|

XAU

withdrawal. From time to time customers may wish to withdraw their gold from their Coro accounts. Coro’s customers will

be able to select the amount for withdrawal, subject to a minimum of 1 XAU which equals 1 troy ounce of gold, and Coro will

process the withdrawal through its gold dealer, who will ship the physical gold directly to Coro’s customers.

|

|

|

●

|

USD

withdrawal. From time to time customers may wish to withdraw their U.S. dollars from their Coro account. Customers are required

to connect a U.S. bank account at the time that they open their Coro account. Customers are able to transfer any or all of

their U.S. dollar funds in their Coro account back to their U.S. bank account at any time. This transfer is done by ACH and

is transmitted by Coro’s U.S. bank custodian.

|

Coro

operates as a licensed money transmitter company by allowing users of its mobile app to send and receive monetary value in two

formats: USD and XAU.

Coro

Process

The

Coro platform will operate as follows:

|

|

●

|

Coro’s

distributed ledger tracks and records the movements of gold and USD between the users and assures the integrity of the system.

The Coro users’ gold ownership is recorded on the ledger, guaranteeing that the users’ account information is

protected and always available to them and the gold vaulting custodian. Both sender and receiver must enroll and complete

an AML/KYC process to become users of the Coro app. A sender must first fund their USD account by transferring funds from

their personal bank account to Coro’s custodial bank account via ACH.

|

|

|

●

|

To

send USD, a user transmits from within the app to any other users of the Coro app.

|

|

|

●

|

To

send gold, a user first exchanges USD held in its Coro account into XAU. The user can then send XAU via the mobile app to

other Coro users. Coro has engaged a gold dealer to provide gold to Coro users. When users exchange USD into gold, the gold

dealer delivers the purchased amount of gold to an insured gold vaulting custodian. The corresponding USD is transmitted from

the Coro custodial bank account to the gold dealer. When funds are received by the gold dealer, Coro users acquire title to

the asset.

|

|

|

●

|

Coro

has arranged physical custody of the gold with an insured gold vault custodian. Coro manages administration and record keeping

for transactions performed through the Coro app. Coro users and the gold vaulting custodian also have identical sets of the

records so that in the event Coro were to cease operations for any reason there is clear title documentation for Coro users

to arrange delivery of their gold from the gold vaulting custodian.

|

|

|

●

|

Coro

acts as agent for the user in the purchase, sale and custody of the gold.

|

|

|

●

|

Physical

gold purchased from the gold dealer and held by the gold vaulting custodian is a custodial asset for the user’s benefit

in a “bailor / bailee” relationship. The Coro user (bailor) has ownership of the gold and the gold vaulting custodian

(bailee) has authorized physical possession of the gold on the bailor’s behalf.

|

|

|

●

|

If

a user decides to withdraw gold, the user sends an order to the gold dealer through the Coro app and gold is shipped to the

user’s residence.

|

|

|

●

|

If

a user decides to exchange XAU into USD, the user sends an order to the gold dealer through the Coro app and the gold vaulting

custodian moves the physical gold from the allocated gold custodial account to the gold dealer. At the same time, the gold

dealer generates a USD transfer to the user via Coro’s USD custodial bank account.

|

Legal

rights

Coro

users will have direct ownership of their allocated gold as follows. Such gold ownership will be effected contractually through

bailment with the vault custodian. Bailment is the act of placing property in the custody and control of another, by an agreement

in which the holder (bailee) is responsible for the safekeeping and return of the property. In bailment law, ownership and possession

of the gold are split and they merge at the moment of delivery. Coro users have a bailor/bailee relationship with the custodian

for the storage of their physical gold. Coro users (bailors) have ownership of the gold and the gold vault custodian (bailee)

has authorized possession of the gold.

Coro

users will only buy allocated gold with direct ownership. Gold bars are allocated and identifiable for Coro users inside independent

custody vault. The gold belongs to the users and is their absolute property. This is evidenced by:

|

|

●

|

Customer

gold is neither an asset nor liability on Coro’s balance sheet;

|

|

|

●

|

The

gold vaulting custody agreement is under bailment;

|

|

|

●

|

Payment

of a custody fee (which has previously been decisive in proving the bailor/bailee relationship in law);

|

|

|

●

|

User’s

gold in custody is fully insured for theft or loss (Lloyds of London);

|

|

|

●

|

Full

allocation of Coro users’ property is documented each day by daily reconciliation and verified by the monthly custodial

audit and quarterly independent 3rd-party audit;

|

|

|

●

|

All

transactions and users’ balances are recorded on a distributed ledger which improves accuracy, transparency and security;

and

|

|

|

●

|

Coro

users can monitor the total weight of gold they own on the Coro mobile app in real time.

|

Coro

Gold Ownership

When

a Coro customer purchases gold through the Coro mobile payment application, the Coro user becomes the legal owner of the gold.

Coro instantly routes gold purchase transactions through a gold dealer. Within the Coro app, customers’ dollars are exchanged

for an equivalent amount of gold at the prevailing spot rate. Coro’s spot rate is derived from the CME and the LBMA, plus

Coro’s fee. Gold purchased by the customer is identified and evidenced by a serial number, or otherwise identified and evidenced

with a specific identifier in accordance with the methods used by the auditors of the independent gold vaulting custodian, such

as with SKUs/bar codes, and then allocated within Coro’s custody account with the independent gold vaulting custodian. The

independent vaulting custodian maintains a bailment arrangement with Coro’s customers, so that the customers have direct

ownership of their gold at all times. Our Coro customers’ gold is fully insured by the vaulting custodian. The vaulting

custodian will have a daily record of each customer’s gold holdings. Allocated gold is, by definition, unencumbered. In

the event of Coro’s dissolution or failure, Coro’s customers would not risk becoming creditors of the company since

their ownership of their gold is direct. Coro and the independent vaulting custodian maintain an inventory list of the allocated

customer gold which is updated in real time and reconciled daily. The Coro user’s gold inventory will be physically counted

weekly and audited by an independent auditor on a quarterly basis. The customer’s gold ownership is also recorded, confirmed

and evidenced on Coro’s accounting ledger and shared with the independent vaulting custodian. Coro Corp. and the gold vaulting

custodian have the right of substitution within the allocated gold. Right of substitution means that when a customer withdraws

their gold, Coro Corp. and the gold vaulting custodian may choose which gold to provide the customer, thus the serial number at

purchase may be different than the serial number at withdrawal. Right of substitution makes the logistics of gold storage, deposit

and withdrawal more pragmatic and is the primary method used for the independent safe custody of all commodities.

Government

Regulation

In

the United States, money transmission activities are strictly regulated both at the federal level by FinCEN and at the state level

by financial institution regulators. Registration with FinCEN is mandatory for all money transmitters and state regulators impose

strict requirements to obtain and maintain a license to operate in their jurisdiction. In addition, state regulations covering

money transmission provide enhanced protections for the consumers in case of fraud or bankruptcy and require regular examination

and review of licensees’ activities.

Coro

Corp. is registered with and regulated by FinCEN, a bureau of the U.S. Department of the Treasury. FinCEN regulates Coro Corp.

as both a MSB and a Dealer in Precious Metal. As a regulated financial institution, Coro Corp. must assess the money laundering