Deutsche Bank Discusses Big Asset Cleanup -- WSJ

April 24 2019 - 3:02AM

Dow Jones News

By Jenny Strasburg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 24, 2019).

Deutsche Bank AG executives have discussed creating a new unit

to house unwanted assets and businesses that could be earmarked for

closure, part of contingency planning under way should a possible

merger with German rival Commerzbank AG fall through, according to

people familiar with the matter.

Deutsche Bank for years has been retooling its strategy and

management, promising to reinvigorate profits, repair compliance

weaknesses and cut rising costs. Executives insisted publicly up

until late 2018 that the bank should only consider deals after it

heals itself. Now, deep into merger talks, it is looking at a

potentially bigger cleanup effort than it previously signaled.

Planning for a possible no-deal outcome has taken on greater

urgency at Deutsche Bank as merger talks have proven more

complicated than proponents originally expected, the people

said.

Staunch union resistance to massive job cuts needed for a deal

to work financially have proved an especially difficult impediment

since the two banks revealed in mid-March that they are exploring a

potential tie-up. Deutsche Bank at that time described the merger

talks as part of a strategic review aimed at boosting its

profitability.

A new unit for disposing of assets and discontinued operations

-- a so-called bad bank -- could be used flexibly, whether Deutsche

Bank strikes a deal or not, some of the people said. A merger would

likely require Deutsche Bank to make sizable cuts to parts of its

investment bank, narrowing the scope of businesses to focus

resources on more-profitable areas as part of a strategy overhaul,

some of the people said.

Businesses the bank has eyed for possible downsizing include

equities, equity derivatives and portions of rates trading.

Deutsche Bank executives have signaled a strong commitment to areas

like credit trading, debt underwriting and foreign exchange and

cash management to serve corporate clients.

The discussions have been aimed at allowing the bank to map out

potential capital needs, profit and cost forecasts while keeping

its options open, some people close to the bank say.

Deutsche Bank has heard demands from investors to assess

alternatives to a merger, by analyzing other options and how they

would affect the bank's capital demands and balance of

businesses.

The planning inside the bank includes discussions about

shrinking portions of the global trading operations, which include

chronically underperforming businesses with burdensome costs, some

of the people said.

Deutsche Bank has explored options to reshape various pieces of

the bank. Officials with its asset-management arm, DWS, have

discussed a potential deal to combine with Swiss rival UBS AG's

asset management business, among other options, according to people

familiar with the matter. Such a deal would likely see Deutsche

Bank remain DWS's biggest shareholder with a goal of growing the

merged entity, with UBS owning a stake. DWS already is publicly

traded, providing shares for currency in such a deal.

The talks aren't exclusive or guaranteed to result in a deal,

and timing of any potential agreement is uncertain, according to a

person close to the matter. Bloomberg earlier reported on the

talks.

The bank is scheduled to report first-quarter earnings on

Friday, raising pressure on executives to decide whether to pursue

a deal with Commerzbank.

Paul Achleitner, chairman of the supervisory board, has said

publicly that the bank would update investors on the merger talks

by Friday. Executives on Tuesday still hoped to meet that deadline

this week, people familiar with the matter said.

Deutsche Bank's struggling investment bank was a central focus

of Commerzbank merger talks from the start. Investors have

increasingly pressured executives to shed businesses that

chronically lose money or barely break even. At least one prominent

investor has urged Deutsche Bank executives to close its

money-losing U.S. equities business and cut the equities operations

elsewhere.

A new bad-bank unit would allow Deutsche Bank to wall off

business lines it intends to close or de-emphasize as well as

positions that take time to sell or run down. Deutsche Bank

previously had a similar unit called noncore operations that it

used to dispose of unwanted assets, many of them dating to the

financial crisis. That loss-making unit reported revenues and other

financial details distinct from the bank's core businesses.

Deutsche Bank closed the noncore unit in late 2016. In March

2017, the bank launched a share sale to raise EUR8 billion in

capital. In the process, it designated a new pile of around EUR20

billion in risk-weighted assets as "nonstrategic." They were

earmarked to be run down within the investment bank rather than as

a new separate unit.

The return of discussions about a noncore unit highlight

Deutsche Bank's continued difficulties in streamlining and cutting

costs to focus on businesses where it has a competitive edge.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

April 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

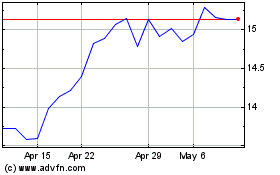

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jun 2024 to Jul 2024

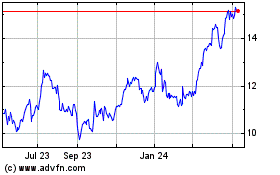

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jul 2023 to Jul 2024