UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 10-Q

_______________

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November 30,

2014

OR

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to

______.

Commission File Number: 333-192759

___________________________________________________

CANNABICS PHARMACEUTICALS INC.

(Exact name of registrant

as specified in its charter)

___________________________________________________

| Nevada |

|

|

46-5644005 |

|

(State or other jurisdiction of

incorporation or organization) |

|

|

(IRS Employer Identification No.) |

| |

|

|

|

|

#3 Bethesda Metro Center, Suite

700

Bethesda, MD |

|

|

20814 |

| (Address of principal executive offices) |

|

|

(Zip Code) |

(877) 424-2429

(Registrant’s

telephone number, including area code)

_____________________________________________________

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for

such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x

No o

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes x

No o

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions

of “large accelerated filer”, “accelerated filer” and “smaller reporting company" in Rule 12b-2

of the Exchange Act:

| Large accelerated filer o |

Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company

as defined in Rule 12b-2 of the Exchange Act. Yes o

No x

As of January 12th, 2015, the registrant

had 100,633,333 shares of its Common Stock, $0.0001 par value, outstanding.

CANNABICS PHARMACEUTICALS INC.

FORM 10-Q

NOVEMBER 30, 2014

INDEX

| PART I -- FINANCIAL INFORMATION |

Page |

| |

|

|

| Item 1. |

Consolidated Financial Statements |

3 |

| |

Consolidated Balance Sheets as of November 30, 2014 (unaudited) and August 31, 2014 |

3 |

| |

Consolidated Statements of Operations for the Three Months Ended November 30, 2014 and 2013 (unaudited) |

4 |

| |

Consolidated Statements of Cash Flows for the Three Months Ended November 30, 2014 and 2013 (unaudited) |

5 |

| |

Notes to Consolidated Financial Statements (unaudited) |

6 |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

10 |

| Item 3 |

Quantitative and Qualitative Disclosures About Market Risk |

13 |

| Item 4. |

Controls and Procedures |

13 |

| |

|

|

| PART II -- OTHER INFORMATION |

|

| |

|

|

| Item 1. |

Legal Proceedings |

13 |

| Item 1.A. |

Risk Factors |

13 |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

13 |

| Item 3. |

Defaults Upon Senior Securities |

14 |

| Item 4. |

Mine Safety Disclosures |

14 |

| Item 5. |

Other Information |

14 |

| Item 6. |

Exhibits |

14 |

| |

|

14 |

| SIGNATURE |

|

15 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

CANNABICS PHARMACEUTICALS

INC.

Consolidated

Balance Sheets

| | |

| | |

| |

| | |

November 30, | | |

August 31, | |

| | |

2014 | | |

2014 | |

| | |

(unaudited) | | |

| |

| | |

| | |

| |

| ASSETS |

| | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 65,618 | | |

$ | 98,768 | |

| Prepaid expenses | |

| 18,211 | | |

| 13,989 | |

| Total current assets | |

| 83,829 | | |

| 112,757 | |

| | |

| | | |

| | |

| Equipment, net | |

| 4,807 | | |

| 1,465 | |

| | |

| | | |

| | |

| Intangible assets | |

| 4,409,899 | | |

| 4,409,899 | |

| | |

| | | |

| | |

| Total assets | |

$ | 4,498,535 | | |

$ | 4,524,121 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 23,038 | | |

$ | 25,340 | |

| Due to a related party | |

| 55,483 | | |

| 48,800 | |

| Total current liabilities | |

| 78,521 | | |

| 74,140 | |

| | |

| | | |

| | |

| Other liabilities | |

| – | | |

| – | |

| | |

| | | |

| | |

| Total liabilities | |

| 78,521 | | |

| 74,140 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity (deficit): | |

| | | |

| | |

| Common stock, $.0001 par value, 900,000,000 shares authorized,100,633,333 and 100,250,000

shares issued and outstanding at November 30, 2014 and August 31, 2014, respectively |

|

|

10,063 |

|

|

|

10,025 |

|

| Additional paid-in capital | |

| 5,273,502 | | |

| 5,177,707 | |

| Accumulated other comprehensive income | |

| 1,858 | | |

| – | |

| Accumulated deficit | |

| (865,409 | ) | |

| (737,751 | ) |

| Total stockholders' equity (deficit) | |

| 4,420,014 | | |

| 4,449,981 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity (deficit) | |

$ | 4,498,535 | | |

$ | 4,524,121 | |

See accompanying notes to consolidated financial statements.

CANNABICS PHARMACEUTICALS INC.

Consolidated Statements of Operations

(unaudited)

| |

For the Three Months Ended | |

| |

November 30, | | |

November 30, | |

| | |

2014 | | |

2013 | |

| Operating expenses: | |

| | | |

| | |

| General and administrative expenses | |

| 24,621 | | |

| 782 | |

| Management salaries | |

| 32,184 | | |

| – | |

| Consulting fees | |

| 17,500 | | |

| 6,000 | |

| Professional fees | |

| 137 | | |

| 7,441 | |

| Legal fees | |

| 19,945 | | |

| – | |

| Sales and marketing expenses | |

| 31,000 | | |

| – | |

| Research and development expense | |

| 299 | | |

| – | |

| Depreciation | |

| 368 | | |

| – | |

| Total operating expenses | |

| 126,054 | | |

| 14,223 | |

| | |

| | | |

| | |

| Loss from operations | |

| (126,054 | ) | |

| (14,223 | ) |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| Foreign exchange gain/(loss) | |

| (1,604 | ) | |

| 883 | |

| Total other income (expense) | |

| (1,604 | ) | |

| 883 | |

| | |

| | | |

| | |

| Loss before income taxes | |

| (127,658 | ) | |

| (13,340 | ) |

| Provision for income taxes | |

| – | | |

| – | |

| Net loss | |

$ | (127,658 | ) | |

$ | (13,340 | ) |

| | |

| | | |

| | |

| Net loss per share - basic and diluted: | |

| | | |

| | |

| Net loss | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding - Basic and Diluted |

|

|

100,555,678 |

|

|

|

6,195,571 |

|

| | |

| | | |

| | |

| Net loss | |

| (127,658 | ) | |

| (13,340 | ) |

| Foreign currency translation gain | |

| 1,858 | | |

| – | |

| Total comprehensive loss | |

$ | (125,800 | ) | |

$ | (13,340 | ) |

See accompanying notes to consolidated financial statements.

CANNABICS PHARMACEUTICALS INC.

Consolidated Statements of Cash Flows

(unaudited)

| |

For the Three Months Ended | |

| |

November 30, | | |

November 30, | |

| | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (127,658 | ) | |

$ | (13,340 | ) |

| Adjustments to reconcile net loss to net cash used in operations: | |

| | | |

| | |

| Depreciation | |

| 368 | | |

| – | |

| Stock issued for services | |

| 17,500 | | |

| – | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses | |

| (4,222 | ) | |

| – | |

| Accounts payable and accrued liabilities | |

| (2,302 | ) | |

| (23,668 | ) |

| Due to related party | |

| 6,683 | | |

| (4,394 | ) |

| Net cash used in operating activities | |

| (109,631 | ) | |

| (41,402 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of equipment | |

| (3,710 | ) | |

| – | |

| Net cash used in investing activities | |

| (3,710 | ) | |

| – | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from loans from shareholder | |

| – | | |

| – | |

| Proceeds received from exclusivity and collaboration agreement | |

| – | | |

| – | |

| Proceeds from sale of common stock | |

| 78,333 | | |

| – | |

| Net cash provided by financing activities | |

| 78,333 | | |

| – | |

| | |

| | | |

| | |

| Effects of exchange rates on cash | |

| 1,858 | | |

| – | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (33,150 | ) | |

| (41,402 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of year | |

| 98,768 | | |

| 72,755 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of year | |

$ | 65,618 | | |

$ | 31,353 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Cash paid for taxes | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash financing activities: | |

| | | |

| | |

| 40,000,000 shares of common stock issued in conversion of loan from

shareholder |

|

|

|

|

|

|

|

|

| Due to a related party | |

$ | – | | |

$ | (100,000 | ) |

| Common stock | |

$ | – | | |

$ | 4,000 | |

| Additional paid in capital | |

$ | – | | |

$ | (96,000 | ) |

See accompanying

notes to consolidated financial statements.

CANNABICS PHARMACEUTICALS INC.

Notes to Consolidated Financial Statements

November 30, 2014

(unaudited)

Note 1 – Nature of Business, Presentation and Going

Concern

Organization

Cannabics Pharmaceuticals Inc. (the "Company"),

was incorporated in the State of Nevada, on September 15, 2004, under the name of Thrust Energy Corp. The Company was originally

engaged in the exploration, exploitation, development and production of oil and gas projects within North America, but was unable

to operate profitably.

In May 2011, the Company changed its name to

American Mining Corporation, suspending its oil and gas operations and changing its business to toll milling and refining, mineral

exploration and mine development.

On April 25, 2014, the Company experienced

a change in control. Cannabics, Inc. (“Cannabics”) acquired a majority of the issued and outstanding common

stock of the Company in accordance with stock purchase agreements by and between Cannabics and Thomas Mills (“Mills”). On

the closing date, April 25, 2014, pursuant to the terms of the Stock Purchase Agreement, Cannabics purchased from Mills 20,500,000

shares of the Company’s outstanding restricted common stock for $198,000, representing 51%.

On May 21, 2014, the Company changed its name,

via merger in the state of Nevada, to Cannabics Pharmaceuticals Inc. As of May 21, 2014, the Company has changed its course of

business to laboratory research and development.

On August 25, 2014, the Company organized G.R.I.N.

Ultra Ltd. (“GRIN”), an Israeli corporation, as a wholly-owned subsidiary. GRIN provides research and development activities

for the Company’s products in Israel.

Stock Split

On June 3, 2014, the Company's Board of Directors

declared a two-to-one forward stock split of all outstanding shares of common stock. The stock split was approved by FINRA on June

25, 2014. The effect of the stock split increased the number of shares of common stock outstanding from 40,880,203 to 81,760,406.

All common share and per common share data in these financial statements and related notes hereto have been retroactively adjusted

to account for the effect of the stock split for all periods presented prior to June 3, 2014. The total number of authorized common

shares and the par value thereof was not changed by the split.

Basis of Presentation

The accompanying unaudited financial statements

have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for

interim financial statement presentation and in accordance with Form 10-Q. Accordingly, they do not include all of the information

and footnotes required in annual financial statements. In the opinion of management, the unaudited financial statements contain

all adjustments (consisting only of normal recurring accruals) necessary to present fairly the financial position and results of

operations and cash flows. The results of operations presented are not necessarily indicative of the results to be expected for

any other interim period or for the entire year.

These unaudited financial statements should

be read in conjunction with our 2014 annual financial statements included in our Form 10-K/A, filed with the U.S. Securities and

Exchange Commission (“SEC”) on December 15, 2014.

Principles of Consolidation

The consolidated financial statements include

the accounts of Cannabics Pharmaceuticals Inc. and its wholly-owned subsidiary, G.R.I.N. Ultra Ltd. All significant inter-company

balances and transactions have been eliminated in consolidation.

Going Concern

The accompanying unaudited financial statements

have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in

the normal course of business. The Company has incurred a net loss of $127,658 for the three months ended November 30, 2014 and

has incurred cumulative losses since inception of $865,409. These conditions raise substantial doubt about the ability of the Company

to continue as a going concern.

The ability of the Company to continue as a

going concern is dependent upon its abilities to generate revenues, to continue to raise investment capital, and develop and implement

its business plan. No assurance can be given that the Company will be successful in these efforts.

CANNABICS PHARMACEUTICALS INC.

Notes to Consolidated Financial Statements

November 30, 2014

(unaudited)

Note 1 – Nature of Business, Presentation and Going

Concern (Continued)

Going Concern (Continued)

The unaudited financial statements do not include

any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of

liabilities that might be necessary should the Company be unable to continue as a going concern. Management believes that actions

presently being taken to obtain additional funding and implement its strategic plans provide the opportunity for the Company to

continue as a going concern. No assurance can be given that the Company will be successful in these efforts.

Reclassifications

Certain amounts in the prior period financial

statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported

losses, total assets, or stockholders’ equity as previously reported.

Note 2 – Intangible Assets

On July 24, 2014, the Company executed a Collaboration

& Exclusivity Agreement with Cannabics, Inc. (“Cannabics”), a Delaware corporation and largest shareholder of the

Company. Per the terms of the Agreement, the Company has issued 18,239,594 shares of its common stock to acquire the entire institutional

knowledge of Cannabics, Inc., which primarily consists of the human Brain Trust in its team of experts, the cumulative result of

their years of scientific knowledge in the fields of Molecular Biology, Cancer and Pharmacology research.

Cannabics has executed an Exclusivity clause

whereby from that day forth they shall carry on their research and development as part of, and for the exclusive benefit of the

Company. Additionally Cannabics tendered $150,000 to the Company specifically earmarked as working funds towards prospective short-term

projects of the Company.

The shares were valued at $0.25 per share based

on an August 2014 Private Placement Memorandum (“PPM”) issued by the Company for 1,000,000 shares of common stock at

$0.25 per share. The total value of the shares of $4,559,899 is reduced by the cash received from Cannabics of $150,000, for a

net value of the intangible assets of $4,409,899.

Management has determined that the intangible

assets have indefinite lives, and as such, are not amortized on a period basis. The value of the intangible assets will be tested

for impairment of their value on an as needed basis, no less than annually. There was no impairment recorded for the three months

ended November 30, 2014 and the year ended August 31, 2014.

Note 3 – Related Party Transactions

On June 24, 2013, the Company accepted a subscription

for 40,000,000 shares of its common stock at a purchase price of $0.0025 per share for total cash consideration of $100,000 from

Ophion Management Ltd. (“Ophion”), a Canadian corporation controlled by Thomas Mills, who was at the time the controlling

shareholder of the Company. On June 28, 2013, the subscription was rescinded by mutual consent and a promissory note for the principal

amount of $100,000 (the “Promissory Note”) was issued by the Company to Ophion. The Promissory Note was due on demand

and accrued simple interest at the rate of 20% per year from June 20, 2013. The Promissory Note was assigned to Mr. Mills on October

7, 2013.

On October 24, 2013, the Company entered into

a debt restructuring agreement with Mr. Mills, whereby he agreed to surrender the Promissory Note for cancellation. In exchange

for the Promissory Note, the Company agreed to issue a convertible promissory note with a fixed maturity date of December 31, 2013

(the “Convertible Note”). The Convertible Note, accrued simple interest at the rate of 20% per annum from June 20,

2013, and was convertible at any time by the holder of the Convertible Note into shares of the Company’s common stock at

the rate of one share for each $0.0025 of indebtedness secured by the Convertible Note. On October 28, 2013, the Promissory Note

was cancelled and the Convertible Note was issued.

On November 20, 2013, the Convertible Note

was rescinded by agreement and a subscription by Mr. Mills for 40,000,000 shares of the Company’s common stock at $0.0025

per share was accepted by the Company.

As of August 31, 2013, Mr. Mills had advanced

$30,798 to the Company. During the year ended August 31, 2014, Mr. Mills advanced an additional $9,202 and was repaid $40,000,

resulting in a balance of $-0- at August 31, 2014 and November 30, 2014.

CANNABICS PHARMACEUTICALS INC.

Notes to Consolidated Financial Statements

November 30, 2014

(unaudited)

Note 3 – Related Party Transactions

(Continued)

During the year ended August 31, 2014, Cannabics

advanced $48,800 to the Company for working capital purposes resulting in a balance outstanding at August 31, 2014 of $48,800.

During the three months ended November 30, 2014, Cannabics advanced an additional $6,683, resulting in a balance of $55,483 at

November 30, 2014. The advance is due on demand and bears no interest.

Note 4 – Stockholders’ Equity

(Deficit)

Authorized Shares

The Company is authorized to issue up to 900,000,000

shares of common stock, par value $0.0001 per share. Each outstanding share of common stock entitles the holder to one vote per

share on all matters submitted to a stockholder vote. All shares of common stock are non-assessable and non-cumulative, with no

pre-emptive rights.

Common Stock

On June 3, 2014, the Company's Board of Directors

declared a two-to-one forward stock split of all outstanding shares of common stock. The stock split was approved by FINRA on June

25, 2014. The effect of the stock split increased the number of shares of common stock outstanding from 40,880,203 to 81,760,406.

All common share and per common share data in these financial statements and related notes hereto have been retroactively adjusted

to account for the effect of the stock split for all periods presented prior to June 3, 2014. The total number of authorized common

shares and the par value thereof was not changed by the split.

During the year ended August 31, 2014, the

Company issued 18,239,594 shares of its common stock to Cannabics in connection with the July 24, 2014 Collaboration & Exclusivity

Agreement (the “Agreement”) between the Company and Cannabics. The shares were valued at $0.25 per share, or a total

of $4,559,899, based on an August 2014 Private Placement Memorandum (“PPM”) issued by the Company for 1,000,000 shares

of common stock at $0.25 per share. Pursuant to the Agreement, the Company received also $150,000 cash from Cannabics.

During the year ended August 31, 2014, the

Company issued 40,000,000 shares of its common stock to 10 investors for $101,980 cash, or an average of $0.0025 per share.

During the year ended August 31, 2014, the

Company issued 250,000 shares of its common stock to 5 consultants for services rendered at a fair value of $62,500, or an average

of $0.25 per share.

During the year ended August 31, 2014, the

Company issued 40,000,000 shares of its common stock in conversion of a loan from Thomas Mills of $100,000 (See Note 3 –

Related Party Transactions).

During the three month period ended November

30, 2014, the Company issued a total of 313,333 shares of its common stock to non-affiliated investor for $78,333 cash, or $0.25

per share and 70,000 common shares were issued to two consultants for services rendered at a fair value of $17,500, or $0.25 per

share.

CANNABICS PHARMACEUTICALS INC.

Notes to Consolidated Financial Statements

November 30, 2014

(unaudited)

Note 5 – Commitments and Contingencies

Effective December 1, 2014, the Company leases office space for

its research and development activities in Caesarea, Israel under a multiple year non-cancelable operating lease that expires November

30, 2016. The lease agreement has certain escalation clauses and renewal options.

At November 30, 2014, future minimum lease payments under these

leases are as follows:

| Year ending August 31, | |

| |

| 2015 | |

$ | 23,877 | |

| 2016 | |

| 31,836 | |

| 2017 | |

| 7,959 | |

| 2018 | |

| – | |

| 2019 | |

| – | |

| 2020 and thereafter | |

| – | |

| | |

| | |

| Total minimum future lease payments | |

$ | 63,672 | |

Rent expense for the three months ended November 30, 2014 and 2013

was $-0- and $-0-.

As required by the lease, the Company has provided an unconditional

bank guarantee in the amount of $5,100 to ensure the Company’s obligations are met under the lease.

Note 6 – Subsequent Events

On December 18th, 2014, Cannabics

Pharmaceuticals Inc. executed a letter of engagement with Mountain High Products in Colorado, for the manufacturing and distribution

of Cannabics SR medical cannabis products in the Colorado market. Cannabics SR medical cannabis products will be produced by Mountain

High Products in strict compliance with Colorado laws and regulations of "Cannabis Infused Edible Products" and distributed

to certified dispensaries through Mountain High's existing distribution channels.

On December 31st, 2014, Cannabics

Pharmaceuticals Inc. executed an IP Licensing and Collaboration Agreement with Barak Security Ltd (Israel) for the production and

distribution of the Company’s CANNABICS SR line of medical cannabis products. The IP Licensing Agreement allows for the Company’s

advanced cannabinoid administration technology to be manufactured and distributed in Israel and the Czech Republic, exclusively

through Barak Security’s affiliates and subsidiaries in strict compliance with all local laws and regulations.

The Company has evaluated subsequent events

through the date the financial statements were issued and filed with the Securities and Exchange Commission. The Company has determined

that there are no other such events that warrant disclosure or recognition in the financial statements.

Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of Operations.

SPECIAL NOTE CONCERNING FORWARD-LOOKING STATEMENTS

We believe that it is important to

communicate our future expectations to our security holders and to the public. This report, therefore, contains statements

about future events and expectations which are “forward-looking statements” within the meaning of Sections 27A of

the Securities Act of 1933 and 21E of the Securities Exchange Act of 1934, including the statements about our plans,

objectives, expectations and prospects under the heading “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” You can expect to identify these statements by forward-looking words such as

“may,” “might,” “could,” “would,” ”will,”

“anticipate,” “believe,” “plan,” “estimate,” “project,”

“expect,” “intend,” “seek” and other similar expressions. Any statement contained in this

report that is not a statement of historical fact may be deemed to be a forward-looking statement. Although we

believe that the plans, objectives, expectations and prospects reflected in or suggested by our forward-looking statements

are reasonable, those statements involve risks, uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or

implied by these forward-looking statements, and we can give no assurance that our plans, objectives, expectations and

prospects will be achieved.

Important factors that might cause our actual

results to differ materially from the results contemplated by the forward-looking statements are contained in the “Risk Factors”

section of and elsewhere in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014 and in our subsequent filings

with the Securities and Exchange Commission. The following discussion of our results of operations should be read together

with our financial statements and related notes included elsewhere in this report.

Company Overview

Cannabics Pharmaceuticals Inc. (the "Company",

“CNBX”, “we”, “us” or “our”) was incorporated in Nevada on September 15, 2004,

under the name of Thrust Energy Corp. The Company was originally engaged in the exploration, exploitation, development and production

of oil and gas projects within North America, but was unable to operate profitably.

In May 2011, the Company changed its name to

American Mining Corporation, suspending its oil and gas operations and changing its business to toll milling and refining, mineral

exploration and mine development.

On April 25, 2014, the Company experienced

a change in control. Cannabics, Inc. (“Cannabics”) acquired a majority of the issued and outstanding common

stock of the Company in accordance with stock purchase agreements by and between Cannabics and Thomas Mills (“Mills”). On

the closing date, April 25, 2014, pursuant to the terms of the Stock Purchase Agreement, Cannabics purchased from Mills 20,500,000

shares of the Company’s outstanding restricted common stock for $198,000, representing 51%. The purchase price for the Mills

Shares was held in escrow subject to a condition subsequent as to certain representations and warranties by Mr. Mills which were

not satisfied by Mr. Mills until June 20, 2014, at which time Escrow was released.

Cannabics is a US based company founded in

2012 by a group of researchers from the fields of molecular biology, cancer research and pharmacology.

On May 21, 2014, the Company changed its name,

via merger in the state of Nevada, to Cannabics Pharmaceuticals Inc. The Company’s principle offices are in Bethesda, Maryland.

As of May 21, 2014, the Company has changed its course of business to laboratory research and development.

On June 3rd, 2014, the Company's Board of Directors

declared a two-to-one forward stock split of all outstanding shares of common stock. The stock split was approved by FINRA on June

19th, 2014. The effect of the stock split increased the number of shares of common stock outstanding from 40,880,203

to 81,760,406. All common share and per common share data in these financial statements and related notes hereto have been retroactively

adjusted to account for the effect of the stock split for all periods presented prior to June 3rd, 2014. The total number

of authorized common shares and the par value thereof was not changed by the split.

On June 19th, 2014, FINRA granted

final approval of Change of Name & Ticker Symbol of the Corporation from American Mining Corporation to CANNABICS PHARMACEUTICALS

INC., with the new Ticker Symbol of “CNBX”. Said approval was predicated upon Cannabics Pharmaceuticals Inc.’s

filing of Articles of Merger with American Mining Corporation with the Nevada Secretary of State on May 21st, 2014.

Under the laws of the State of Nevada, Cannabics Pharmaceuticals Inc. was merged with and into the Registrant, with the Registrant

being the surviving entity. The Merger was completed under Section 92A.180 of the Nevada Revised Statutes, Chapter 92A, as amended,

and as such, does not require the approval of the stockholders of either the Registrant or Cannabics Pharmaceuticals Inc.

On July 24th, 2014, Cannabics Pharmaceuticals

Inc. executed a Collaboration & Exclusivity Agreement with Cannabics, Inc., a Delaware Corporation and largest shareholder

of the Company. Per the terms of the Agreement, the Company issued 18,239,594 Shares to acquire the entire institutional knowledge

of Cannabics, Inc., which primarily consists of the human Brain Trust in its team of experts, the cumulative result of their years

of scientific knowledge in the fields of Molecular Biology, Cancer and Pharmacology research. Cannabics Inc., executed an Exclusivity

clause whereby from that day forward they carry on their research and development as part of, and to the exclusive benefit of

the Company. Additionally Cannabics Inc. tendered $150,000.00 to the Company specifically earmarked as working funds towards prospective

short-term projects of the Company.

On July 31st, 2014, Cannabics Pharmaceuticals

Inc. filed its exclusive Patent Application with the US Patent & Trademark Office (USPTO), which covers the proprietary technology

developed by its team of experts in the field of cannabinoid long acting lipid based formulations. This technology is the basis

for the company’s “CANNABICS SR” line of products, which consists of standardized and long acting medical cannabis

capsules, designed for patients suffering from diverse indications. Simultaneously this Patent was filed with the PCT division

of the Israeli Patent Office (ILPO) in order to provide International IP protection.

On August 25th, 2014, Cannabics

Pharmaceuticals Inc. incorporated a wholly owned subsidiary in Israel, named “G.R.I.N Ultra Ltd”, dedicated to the

advanced research and development in the company’s research laboratory in Caesarea, Israel.

On October 20th, 2014, Cannabics

Pharmaceuticals Inc. received Government Certification from the Ministry of Health in Israel for the establishment of an advanced

R&D laboratory dedicated to medical research and development of cannabinoid-based therapies. R&D is conducted to date in

Israel and has resulted in an IP portfolio that includes proprietary formulation methods of cannabinoid extracts that enable a

sustained release PK profile of the active ingredients upon oral administration. Their first product is “Cannabics SR”

- a standardized, high bioavailability, sustained release medical cannabis capsule that is based on cannabinoid extracts from selected

strains of medical cannabis. The Cannabics SR proprietary formulation was shown to provide a steady state level of beneficial

therapeutic effects within the therapeutic window for 10-12 hours. In Israel, numerous patients (most of them oncology patients)

have already been treated with Cannabics SR capsules; with both patients and doctors reporting high levels of satisfaction from

the uniformity and long lasting therapeutic effects of this unique medical product.

On November 4th, 2014, Cannabics

Pharmaceuticals Inc. executed an IP Licensing and Collaboration Agreement with Kalapa Holdings (Spain) for the production and distribution

of the Company’s CANNABICS SR medical capsules. The IP Licensing Agreement allows for the Company’s advanced cannabinoid

administration technology to be manufactured and distributed in Spain, exclusively through Kalapa Holdings and its subsidiaries

in strict compliance with Spanish law and regulations to certified patients.

On December 18th, 2014, Cannabics

Pharmaceuticals Inc. executed a letter of engagement with Mountain High Products in Colorado, for the manufacturing and distribution

of Cannabics SR medical cannabis products in the Colorado market. Cannabics SR medical cannabis products will be produced by Mountain

High Products in strict compliance with Colorado laws and regulations of "Cannabis Infused Edible Products" and distributed

to certified dispensaries through Mountain High's existing distribution channels.

On December 31st, 2014, Cannabics

Pharmaceuticals Inc. executed an IP Licensing and Collaboration Agreement with Barak Security Ltd (Israel) for the production and

distribution of the Company’s CANNABICS SR line of medical cannabis products. The IP Licensing Agreement allows for the Company’s

advanced cannabinoid administration technology to be manufactured and distributed in Israel and the Czech Republic, exclusively

through Barak Security’s affiliates and subsidiaries in strict compliance with all local laws and regulations.

Plan of Operation

We are dedicated to the development of advanced

and sophisticated cannabinoid-based treatments and therapies. Our main focus is development and marketing of various new and innovative

therapies and biotechnological tools aimed at providing relief from diverse ailments that respond to active ingredients sourced

from the cannabis plant. These advanced tools include innovative delivery systems for cannabinoids, personalized medicine therapies

and procedures based on cannabis originated compounds and bioinformatics tools.

Results of Operations

For the Three Months Ended November 30, 2014 and 2013

Revenues

We had no revenue for the three months ended

November 30, 2014 and 2013.

Operating Expenses

For the three months ended November 30, 2014

our total operating expenses were $126,054 compared to $14,223 for the three months ended November 30, 2013 resulting in an increase

of $111,831. The increase is attributable to increases in general and administrative expenses of $23,839; management salaries of

$32,184; consulting fees of $11,500; legal fees of $19,945; sales and marketing expenses of $31,000; research and development expenses

of $299; and depreciation of $368; offset by a decrease in professional fees of $7,304.

We incurred foreign exchange losses of $1,604

for the three months ended November 30, 2014 compared to foreign exchange gains of $883 for the three months ended November 30,

2013. As a result, net loss was $127,658 for the three months ended November 30, 2014 compared to $13,340 for the three months

ended November 30, 2013.

Liquidity and Capital Resources

Overview

As of November 30, 2014, the Company had $65,618

in cash and working capital of $5,308. We do not have sufficient resources to effectuate our business. We expect to incur a minimum

of $1,000,000 in expenses during the next twelve months of operations. We estimate that these expenses will be comprised primarily

of general expenses including overhead, legal and accounting fees, research and development expenses, and fees payable to outside

medical centers for clinical studies.

Liquidity and Capital Resources during

the Three Months Ended November 30, 2014 compared to the Three Months ended November 30, 2013

We used cash in operations of $109,631

for the three months ended November 30, 2014 compared to cash used in operations of $41,402 for the three months ended

November 30, 2013. The negative cash flow from operating activities for the three months ended November 30, 2014 is primarily

attributable to the Company's net loss from operations of $127,658, offset by depreciation of $368, stock issued for services

of $17,500, and by changes in operating assets and liabilities of $159. Cash used in operations for the three months ended

November 30, 2013 is primarily attributable to the Company's net loss from operations of $13,340, and by the net changes in

operating assets and liabilities of $28,062.

Cash used in investing activities for the three

months ended November 30, 2014 was $3,710, consisting of the acquisition of equipment. We did not use any cash in investing activities

during the three months ended November 30, 2013.

Cash generated in our financing activities

was $78,333 consisting of the sale of common stock for the three months ended November 30, 2014, compared to no cash generated

during the comparable period in 2013.

We will have to raise funds to pay for our

expenses. We may have to borrow money from shareholders or issue debt or equity or enter into a strategic arrangement with a third

party. There can be no assurance that additional capital will be available to us. We currently have no arrangements or understandings

with any person to obtain funds through bank loans, lines of credit or any other sources. Since we have no such arrangements or

plans currently in effect, our inability to raise funds for our operations will have a severe negative impact on our ability to

remain a viable company.

Going Concern

Due to the uncertainty of our ability to meet

our current operating and capital expenses, our independent auditors included an explanatory paragraph in their report on the audited

financial statements for the year ended August 31, 2014 regarding concerns about our ability to continue as a going concern. Our

financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent

auditors.

Our unaudited financial statements have been

prepared on a going concern basis, which assumes the realization of assets and settlement of liabilities in the normal course of

business. Our ability to continue as a going concern is dependent upon our ability to generate profitable operations in the future

and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations

when they become due. The outcome of these matters cannot be predicted with any certainty at this time and raise substantial doubt

that we will be able to continue as a going concern. Our unaudited financial statements do not include any adjustments to the amount

and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

There is no assurance that our operations will

be profitable. Our continued existence and plans for future growth depend on our ability to obtain the additional capital necessary

to operate either through the generation of revenue or the issuance of additional debt or equity.

Off-Balance Sheet Arrangements

We currently have no off-balance sheet arrangements

that have or are reasonably likely to have a current or future material effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

The preparation of financial statements in

conformity with accounting principles generally accepted in the United States of America requires us to make a number of estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements. Such estimates and assumptions affect the reported amounts of revenues and expenses during

the reporting period. We base our estimates on historical experiences and on various other assumptions that we believe to be reasonable

under the circumstances. Actual results may differ materially from these estimates under different assumptions and conditions.

We continue to monitor significant estimates made during the preparation of our financial statements. On an ongoing basis, we evaluate

estimates and assumptions based upon historical experience and various other factors and circumstances. We believe our estimates

and assumptions are reasonable in the circumstances; however, actual results may differ from these estimates under different future

conditions.

See Item 7, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and Note 2, “Summary of Significant Accounting Policies”

in our audited consolidated financial statements for the year ended August 31, 2014, included in our Annual Report on Form 10-K

as filed on December 15, 2014, for a discussion of our critical accounting policies and estimates.

Item 3. Quantitative and

Qualitative Disclosures About Market Risk.

The disclosure required under this item is

not required to be reported by smaller reporting companies; as such term is defined by Item 503(e) of

Regulation S-K.

Item 4. Controls and Procedures.

| (a) | Evaluation of Disclosure Controls and Procedures |

In connection with the preparation of this

Quarterly Report on Form 10-Q, an evaluation was carried out by the Company's management, with the participation of the principal

executive officer and the principal financial officer, of the effectiveness of the Company's disclosure controls and procedures

(as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 ("Exchange Act")) as of November

30, 2014. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed

or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Securities

and Exchange Commission's rules and forms, and that such information is accumulated and communicated to management, including the

chief executive officer and the chief financial officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company's management

concluded, as of the end of the period covered by this report, that the Company's disclosure controls and procedures were not effective

in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in

the Commission's rules and forms, and that such information was accumulated and communicated to management, including the principal

executive officer and the principal financial officer, to allow timely decisions regarding required disclosures.

| (b) | Changes in Internal Control over Financial Reporting |

There were no changes in our internal control

over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably

likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

We are currently not involved in any litigation

that we believe could have a material adverse effect on our financial condition or results of operations. There is no

action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization

or body pending or, to the knowledge of the executive officers of our company, threatened against or affecting our company or our

common stock in which an adverse decision could have a material adverse effect.

Item 1A. Risk Factors

The disclosure required under this item is

not required to be reported by smaller reporting companies; as such term is defined by Item 503(e) of Regulation S-K.

Item 2. Unregistered Sales

of Equity Securities and Use of Proceeds.

On September 15, 2014, the Company issued 300,000

shares of its common stock to an investor for $75,000 pursuant to an August 2014 Private Placement Memorandum.

On September 15, 2014, the Company issued 50,000

shares of its common stock to a consultant for services rendered at a fair value of $12,500.

On November 5, 2014, the Company issued 13,333

shares of its common stock to an investor for $3,333 pursuant to an August 2014 Private Placement Memorandum.

On November 5, 2014, the Company issued 20,000

shares of its common stock to a consultant for services rendered at a fair value of $5,000.

Item 3. Defaults Upon Senior

Securities.

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information.

None.

Item 6. Exhibits

| Exhibit 31.1 |

Certification by the Principal Executive Officer of Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 13a-14(a) or Rule 15d-14(a)). * |

| |

|

| Exhibit 31.2 |

Certification by the Principal Financial Officer of Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 13a-14(a) or Rule 15d-14(a)). * |

| |

|

| Exhibit 32.1 |

Certification by the Principal Executive Officer pursuant to 18 U.S.C. 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. * |

| |

|

| Exhibit 32.2 |

Certification by the Principal Financial Officer pursuant to 18 U.S.C. 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. * |

| |

|

| 101.INS |

XBRL Instance Document ** |

| |

|

| 101.SCH |

XBRL Taxonomy Extension Schema Document ** |

| |

|

| 101.CAL |

XBRL Taxonomy Extension Calculation Linkbase Document ** |

| |

|

| 101.DEF |

XBRL Taxonomy Extension Definition Linkbase Document ** |

| |

|

| 101.LAB |

XBRL Taxonomy Extension Label Linkbase Document ** |

| |

|

| 101.PRE |

XBRL Taxonomy Extension Presentation Linkbase Document ** |

| * |

Filed herewith. |

| |

|

| ** |

XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of

the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: January 20, 2015 |

By: |

/s/ Zohar Koren |

| |

|

Zohar Koren |

| |

|

Chief Executive Officer

Chief Financial Officer

(Principal Executive and Financial

Officer)

|

Exhibit 31.1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 302 OF

THE SARBANES-OXLEY ACT OF 2002

I, Zohar Koren, certify that:

| 1. |

I have reviewed this Form 10-Q of CANNABICS PHARMACEUTICALS INC.; |

| |

|

|

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

|

|

| 3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods present in this report; |

| |

|

|

| 4. |

I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13-a-15(f) and 15d-15(f)) for the registrant and have: |

| |

|

|

| |

a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| |

|

|

| 5. |

I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| |

|

|

| |

a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

Any fraud, whether or not material, that involved management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: January 20, 2015 |

By: |

/s/ Zohar Koren |

|

| |

|

Zohar Koren |

|

| |

|

Chief Executive Officer

(Principal Executive Officer)

CANNABICS PHARMACEUTICALS INC. |

|

Exhibit 31.2

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 302 OF

THE SARBANES-OXLEY ACT OF 2002

I, Zohar Koren, certify that:

| 1. |

I have reviewed this Form 10-Q of CANNABICS PHARMACEUTICALS INC.; |

| |

|

|

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

|

|

| 3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods present in this report; |

| |

|

|

| 4. |

I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13-a-15(f) and 15d-15(f)) for the registrant and have: |

| |

|

|

| |

a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| |

|

|

| 5. |

I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| |

|

|

| |

a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

Any fraud, whether or not material, that involved management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: January 20, 2015 |

By: |

/s/ Zohar Koren |

|

| |

|

Zohar Koren |

|

| |

|

Chief Financial Officer

(Principal Financial Officer)

CANNABICS PHARMACEUTICALS INC. |

|

Exhibit 32.1

CERTIFICATION OF

PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with this Quarterly Report of

CANNABICS PHARMACEUTICALS INC. (the “Company”) on Form 10-Q for the quarter ending November 30, 2014, as

filed with the U.S. Securities and Exchange Commission on the date hereof (the “Report”), I, Zohar Koren, Chief Executive

Officer (Principal Executive Officer) of the Company, certify to the best of my knowledge, pursuant to 18 U.S.C. Sec. 1350, as

adopted pursuant to Sec. 906 of the Sarbanes-Oxley Act of 2002, that:

| 1. |

Such Quarterly Report on Form 10-Q for the quarter ending November 30, 2014 , fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| 2. |

The information contained in such Quarterly Report on Form 10-Q for the quarter ending November 30, 2014 , fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| |

|

|

|

| Date: January 20, 2015 |

By: |

/s/ Zohar Koren |

|

| |

|

Zohar Koren |

|

| |

|

Chief Executive Officer

(Principal Executive Officer)

CANNABICS PHARMACEUTICALS INC. |

|

| |

|

|

|

Exhibit 32.2

CERTIFICATION OF

PRINCIPAL FINANCIAL OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with this Quarterly Report of

CANNABICS PHARMACEUTICALS INC. (the “Company”) on Form 10-Q for the quarter ending November 30, 2014, as

filed with the U.S. Securities and Exchange Commission on the date hereof (the “Report”), I, Zohar Koren, Chief Financial

Officer (Principal Financial Officer) of the Company, certify to the best of my knowledge, pursuant to 18 U.S.C. Sec. 1350, as

adopted pursuant to Sec. 906 of the Sarbanes-Oxley Act of 2002, that:

| 1. |

Such Quarterly Report on Form 10-Q for the quarter ending November 30, 2014 , fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| 2. |

The information contained in such Quarterly Report on Form 10-Q for the quarter ending November 30, 2014 , fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| |

|

|

|

| Date: January 20, 2015 |

By: |

/s/ Zohar Koren |

|

| |

|

Zohar Koren |

|

| |

|

Chief Financial Officer

(Principal Financial Officer)

CANNABICS PHARMACEUTICALS INC. |

|

| |

|

|

|

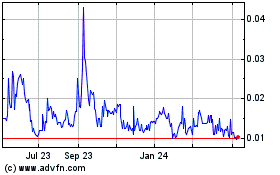

CNBX Pharmaceuticals (PK) (USOTC:CNBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

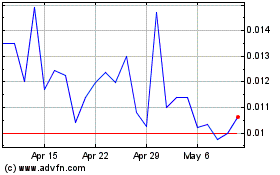

CNBX Pharmaceuticals (PK) (USOTC:CNBX)

Historical Stock Chart

From Nov 2023 to Nov 2024