UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under Rule 14a-12

|

CLS HOLDINGS USA, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

CLS Holdings USA, Inc.

516 S. 4th Street

Las Vegas, NV 89101

(888) 359-4666

October 19, 2023

Dear Stockholder:

On behalf of the Board of Directors and management of CLS Holdings USA, Inc., you are cordially invited to join us at the 2023 Annual Stockholders Meeting (the “2023 Annual Meeting”) to be held at 12:00 p.m. local time on November 28, 2023. The 2023 Annual Meeting will be held in a virtual format only. To attend, vote, and submit questions during the 2023 Annual Meeting visit www.proxyvote.com and enter the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card. Attendance at the 2023 Annual Meeting is subject to capacity limits set by the virtual meeting platform provider.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting, and our annual report on Form 10-K for the fiscal year ended May 31, 2023. We also will report on matters of current interest to our stockholders.

At this year’s meeting, you will be asked to:

|

|

(1)

|

elect one director nominee to serve for a three-year term as a Class III director;

|

|

|

(2)

|

ratify the appointment of our independent registered public accounting firm for our fiscal year ending May 31, 2024; and

|

|

|

(3)

|

Approve an increase in the number of authorized shares to 350,000,000 from the current authorized of 187,500,000;

|

|

|

(4)

|

transact such other business as may properly come before the 2023 Annual Meeting, or any adjournments or postponements thereof.

|

The Board of Directors recommends the election of the nominee for director and approval of the other proposal.

Your vote is important. Whether you own a few shares or many, and whether or not you plan to attend the 2023 Annual Meeting, it is important that your shares be represented and voted at the meeting. You may vote your shares by proxy on the Internet, by telephone, or by completing, signing and promptly returning a proxy card, or you may vote in real time online at the 2023 Annual Meeting.

Thank you for your continuing support of CLS Holdings USA, Inc. and its vision.

Sincerely,

Andrew Glashow

Chief Executive Officer and Chairman of the Board

CLS HOLDINGS USA, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 28, 2023

To the Stockholders of CLS Holdings USA, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “2023 Annual Meeting”) of CLS Holdings USA, Inc., a Nevada corporation (the “Company”), will be held virtually at 12:00 p.m. local time on Tuesday, November 28, 2023. To attend, vote, and submit questions during the 2023 Annual Meeting visit www.proxyvote.com and enter the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card. The 2023 Annual Meeting will be held for the following purposes:

|

|

(1)

|

elect one director nominee to serve for a three-year term as a Class III director;

|

|

|

(2)

|

ratify the appointment of our independent registered public accounting firm for our fiscal year ending May 31, 2024; and

|

|

|

(3)

|

Approve an increase in the number of authorized shares to 350,000,000 from the current authorized of 187,500,000;

|

|

|

(4)

|

transact such other business as may properly come before the 2023 Annual Meeting, or any adjournments or postponements thereof.

|

The Board of Directors has fixed the close of business on October 2, 2023, as the record date for determining those stockholders entitled to notice of, and to vote at, the 2023 Annual Meeting and any adjournments or postponements thereof.

Whether or not you expect to attend virtually, please vote using our secure online voting website or by signing, dating and returning your enclosed proxy card in the postage-paid envelope provided for that purpose as promptly as possible.

By Order of the Board of Directors,

Andrew Glashow, Chief Executive Officer and Chairman of the Board

Las Vegas, Nevada

October 19, 2023

ALL STOCKHOLDERS ARE INVITED TO VIRTUALLY ATTEND THE 2023 ANNUAL MEETING BY VISITING WWW.PROXYVOTE.COM AND ENTERING THEIR CONTROL NUMBER INCLUDED IN THEIR NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS. THOSE STOCKHOLDERS WHO ARE UNABLE TO ATTEND ARE RESPECTFULLY URGED TO EXECUTE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE. STOCKHOLDERS WHO EXECUTE A PROXY MAY NEVERTHELESS VIEW AND PARTICIPATE IN THE VIRTUAL 2023 ANNUAL MEETING, REVOKE THEIR PROXY AND VOTE THEIR SHARES AT THE MEETING.

The Company’s notice of annual meeting, proxy statement and annual report on Form 10-K, as amended, for the fiscal year ended May 31, 2023 are available on the Internet at www.proxyvote.com.

TABLE OF CONTENTS

CLS HOLDINGS USA, INC.

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 28, 2023

PROXY STATEMENT

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of CLS Holdings USA, Inc. of proxies to be voted at our 2023 Annual Meeting of Stockholders to be held on November 28, 2023 at 12:00 p.m. local time, and at any postponements or adjournments thereof. In this proxy statement, CLS Holdings USA, Inc. is referred to as the “Company,” “we,” “our” or “us.”

The approximate date that this proxy statement and the enclosed form of proxy are first being made available or mailed to our stockholders is October 19, 2023. You should review the information provided in this proxy statement with our annual report on Form 10-K, as amended, for the fiscal year ended May 31, 2023, which is being made available or delivered to stockholders simultaneously with this proxy statement. Stockholders may access our proxy materials at www.proxyvote.com or on our website at www.clsholdingsinc.com.

GENERAL INFORMATION

Who is entitled to vote at the 2023 Annual Meeting?

Our Board has set the close of business on October 2, 2023 as the record date for determining those stockholders entitled to notice of, and to vote on, all matters that may properly come before the 2023 Annual Meeting. As of the record date, the Company had 72,543,141 outstanding shares of common stock entitled to notice of, and to vote at, the 2023 Annual Meeting. No other securities are entitled to vote at the 2023 Annual Meeting. Only stockholders of record on such date are entitled to notice of, and to vote at, the 2023 Annual Meeting.

What are the voting rights of stockholders?

Each stockholder of record is entitled to one vote for each share of our common stock that is owned as of the close of business on the record date on all matters to come before the 2023 Annual Meeting. Under our Amended and Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), stockholders do not have cumulative voting rights in the election of directors.

How many votes must be present to hold the 2023 Annual Meeting?

To conduct business at the 2023 Annual Meeting, a quorum must be present. The attendance, virtually or by proxy, of holders of a majority of the outstanding shares of our common stock entitled to vote on the matters being considered at the 2023 Annual Meeting is necessary to constitute a quorum. For purposes of determining whether a quorum exists, we count proxies marked “abstain” as to a particular proposal as being present at the meeting. Shares represented by a proxy as to which there is a “broker non-vote” (that is, where a broker holding your shares in “street” or “nominee” name indicates to us on a proxy that you have not given the broker the authority to vote your shares on non-routine matters), will also be considered present at the meeting for purposes of determining whether a quorum exists.

How do I vote my shares?

We use the “Notice and Access” method of providing proxy materials to our stockholders via the Internet. We believe that this process provides you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about October 19, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access our proxy statement and Form 10-K and vote electronically via the Internet. The Notice will also contain instructions on how to receive a paper copy of your proxy materials.

To vote by mail, please sign, date and return as soon as possible the proxy card, enclosed with your proxy materials or delivered to you if you request proxy materials in paper form. An envelope with postage paid, if mailed in the United States, is or will be provided for this purpose. Properly executed proxies that are received in time and not subsequently revoked will be voted as instructed on the proxies. If you vote by Internet as described above, you do not need to mail a proxy.

You may vote by ballot at the 2023 Annual Meeting by visiting www.proxyvote.com and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card. If you want to vote by ballot, and you hold your shares in street name (that is, through a bank or broker), you must obtain a legal proxy from that organization and use the control number listed on that proxy to vote at the 2023 Annual Meeting. Even if you plan to attend the 2023 Annual Meeting, you are encouraged to submit a proxy card or vote by Internet to ensure that your vote is received and counted. If you vote at the virtual 2023 Annual Meeting, your prior proxy will be revoked.

In addition, if you are a stockholder of record, you may revoke your proxy by giving written notice of revocation to the Corporate Secretary of the Company bearing a later date than your proxy, or by executing and delivering to the Corporate Secretary a proxy card dated after the date of your proxy. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: CLS Holdings USA, Inc., 516 S. 4th Street, Las Vegas, NV 89101, Attention: Corporate Secretary. If your shares are held in street name, you may change your vote by following your nominee’s procedures for revoking your proxy or changing your vote.

Will my shares be voted if I do not provide instructions to my broker or nominee?

Brokers, banks or other nominees who hold shares of our common stock for a beneficial owner in “street name” have the discretion to vote on “routine” proposals when they have not received voting instructions from the beneficial owner prior to the 2023 Annual Meeting. A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Under the rules that govern brokers that are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. Proposal 2 regarding the ratification of the Audit Committee’s appointment of M&K CPAs, PLLC, as our independent registered public accounting firm for the fiscal year ending May 31, 2024 is considered a routine proposal. Proposal 1, election of a Class III director, is considered non-routine. Proposal 3, the vote to authorize the issuance of new shares is considered non-routine. Therefore, your broker has the discretion to vote your shares on Proposal 2 but does not have discretion to vote your shares on Proposals 1 and 3.

We encourage you to provide instructions to your bank or brokerage firm by voting your proxy. This action ensures your shares will be voted at the 2023 Annual Meeting in accordance with your wishes. If you do not provide instructions to your bank or brokerage firm, your shares will not be voted, except on Proposal 2.

What vote is required and how will abstentions and broker discretionary voting effect the proposals?

The election of the Board’s nominee to the Board of Directors at the 2023 Annual Meeting is expected to be an uncontested election. Our Amended and Restated Bylaws (the “Bylaws”) require that directors be elected by a plurality of the votes cast at any meeting of stockholders. A plurality means that the candidate with the most votes for his or her election, even if less than a majority of those cast, is elected to the Board. Stockholders are not permitted to vote against a candidate. For purposes of determining whether a quorum is present, votes cast include votes to “withhold” and exclude abstentions with respect to that director’s election. Abstentions and broker non-votes will have no impact on Proposal 1.

Proposal 2 will be ratified if votes representing a majority of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Therefore, abstentions and broker non-votes will have the effect of a vote “AGAINST” Proposal 2.

Proposal 3 will be ratified if votes representing 66 2/3 % of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Therefore, abstentions and broker non-votes will have the effect of a vote “AGAINST” Proposal 3.

How does the Board of Directors recommend that I vote?

Our Board unanimously recommends that you vote as follows:

|

|

Proposal

|

|

Board Recommendation

|

|

For More

Information,

See Page

|

|

|

|

|

|

|

|

|

(1)

|

Election of one director

|

|

FOR THE NOMINEE

|

|

5

|

|

|

|

|

|

|

|

|

(2)

|

Ratification of the appointment of M&K CPAs, PLLC as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2024.

|

|

FOR

|

|

6

|

|

(3)

|

Approve an increase in the number of authorized shares to 350,000,000 from the current authorized amount of 187,500,000.

|

|

FOR

|

|

7

|

We will also consider other business, if any, that is properly presented at the 2023 Annual Meeting. At the time of availability of this proxy statement, however, we are not aware of any matters to be presented at the 2023 Annual Meeting other than those described in this proxy statement.

How will my shares be voted if I mark “Abstain” on my proxy card?

We will count a properly executed proxy card marked “Abstain” as present for purposes of determining whether a quorum is present, but abstentions will not be counted as votes cast for or against any given matter.

What does it mean if I receive more than one proxy card or voting instruction form?

If you hold your shares in more than one account, you will receive a proxy card or voting instruction form for each account. To ensure that all of your shares are voted, please vote using each proxy card or voting instruction form you receive or, if you vote by Internet, you will need to enter each of your Control Numbers. Remember, you may vote by Internet or telephone at the 2023 Annual Meeting, or by signing, dating and returning the proxy card in the postage-paid envelope provided.

Who will solicit proxies on behalf of the Board?

Proxies may be solicited on behalf of the Board of Directors by our directors, officers and regular employees, who will not receive any additional compensation for solicitation activities. The solicitation of proxies by mail may be supplemented by telephone, facsimile, electronic mail, and personal solicitation by our directors, officers or other regular employees. You may also be solicited by press releases issued by us, additional mailings and postings on our corporate website. Unless expressly indicated otherwise, information contained on our corporate website is not part of this proxy statement.

Who will bear the cost of the solicitation of proxies?

The entire cost of soliciting proxies, including the costs of preparing, assembling, printing and mailing this proxy statement, the proxy card and any additional soliciting materials furnished to stockholders, will be borne by us. The solicitation materials will be made available or furnished to banks, brokerage houses, dealers, banks, voting trustees, their respective nominees and other agents holding shares in their names that are beneficially owned by others, so that they may provide access to or forward such solicitation materials to beneficial owners. In addition, we will reimburse these persons for their reasonable expenses in providing access to or forwarding these materials to the beneficial owners upon request.

May I attend the 2023 Annual Meeting?

The 2023 Annual Meeting will be held in a virtual format only. Only holders of our shares as of the record date are entitled to virtually attend the 2023 Annual Meeting. If you are a stockholder of record attending online, please be prepared to provide your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card to access the 2023 Annual Meeting online. Beneficial owners of shares held in “street name” who wish to attend the meeting must request a proxy, executed in their favor, from the stockholder of record (the bank, brokerage firm, or other nominee) providing this control number and giving them the right to vote the shares at the 2023 Annual Meeting. Attendance at the 2023 Annual Meeting is subject to capacity limits set by the virtual meeting platform provider.

May I record the 2023 Annual Meeting?

No recording of the 2023 Annual Meeting is allowed, including audio and video recording.

Can the 2023 Annual Meeting date be changed?

The 2023 Annual Meeting may not be adjourned, unless approved by the holders of a majority of the shares represented and entitled to vote at the 2023 Annual Meeting. If adjourned, adjournment would be announced at the 2023 Annual Meeting. If we postpone the 2023 Annual Meeting, we will announce the new date, time and location of the 2023 Annual Meeting by press release prior to the rescheduled 2023 Annual Meeting date.

Where and when will I be able to find the voting results?

You can find the official results of voting at the 2023 Annual Meeting in our Current Report on Form 8-K that we will file with the SEC following the 2023 Annual Meeting.

What information is available on the Internet?

A copy of this proxy statement and our annual report on Form 10-K, as amended, for the fiscal year ended May 31, 2023, are available for download free of charge at www.proxyvote.com.

Our website address is www.clsholdingsinc.com. We use our website as a channel of distribution for important Company information. Important information, including press releases, analyst presentations and financial information regarding us is routinely posted and accessible on the Investors subpage of our website, which is accessible by clicking on the tab labeled “Investors” on our website home page. Visitors to our website can also register to receive automatic e-mail and other notifications alerting them when new information is made available on the Investors subpage of our website.

In addition, we make available on the Investors subpage of our website (under the link “SEC Filings”) free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, ownership reports on Forms 3 and 4 and any amendments to those reports, as soon as practicable after we electronically file such reports with the SEC. Further, copies of our Articles of Incorporation and Bylaws and the charter for the Audit Committee of our Board of Directors are also available on the Investors subpage of our website (under the link “Governance”).

Who can answer my questions?

Your vote at the 2023 Annual Meeting is important, no matter how many or how few shares you own. Please sign and date your enclosed proxy card and return it in the enclosed postage-paid envelope promptly or vote by Internet or telephone. If you have questions or require assistance in the voting of your shares, please call our Corporate Secretary at (888) 260-7775.

How can I obtain additional copies of these materials or copies of other documents?

Complete copies of our proxy statement and our annual report on Form 10-K, as amended, for the fiscal year ended May 31, 2023 are available on our website at www.clsholdingsinc.com and also may be obtained by contacting our Corporate Secretary by phone at (888) 260-7775 or by mail sent to the Corporate Secretary, 516 S. 4th Street, Las Vegas, NV 89101.

PROPOSAL 1:

ELECTION OF CLASS III DIRECTOR

The Board currently consists of three members and is divided into three classes with each class of directors serving a staggered three-year term. Andrew Glashow’s term as a director expires in 2025, Ross Silver’s term as a director expires in 2024, and David Zelinger’s term as a director expires in 2023.

Nominee for Election to the Board

Our Board of Directors has nominated David Zelinger for election at the 2023 Annual Meeting as a Class III director, to serve until the 2026 annual meeting of stockholders and until his successor has been duly elected and qualified or his earlier resignation, removal, retirement, disqualification or death.

Unless authority to vote for the election of the nominee is withheld by marking the proxy card to that effect, the persons named as proxies on the enclosed proxy card will, upon receipt of a properly executed proxy card, vote to elect the nominee for the term described above. The Board of Directors knows of no reason why the nominee should be unable or unwilling to serve, but if that should be the case, proxies will be voted for the election of such substitute as the Board of Directors may designate.

Background Information on Nominee

David Zelinger Director

Mr. Zelinger was appointed to serve as a member of our Board of Directors commencing August 16, 2022 to fill a vacancy on the Board of Directors. After spending eight years in investment banking, with executive positions at Archeus Capital and Deutsche Bank, as well as holding various roles in both startups and multi-national fintech firms, Mr. Zelinger entered the cannabis industry in 2021. He joined LeafLink to help build their funding and technology solutions business in the Nevada market, gaining insight on the infrastructure of the cannabis market. Though he recently left this position to rejoin the fintech industry as the Chief Operating Officer for RTX Fintech & Research, an FTC regulated swap execution facility, in 2022, he still remains closely engaged with the cannabis industry. As his home state of New York expands into adult-use, he advises new license holders on how to go to market, capital management, and strategic planning.

As a result of Mr. Zelinger’s background in finance and extensive track record as an advisor, analyst, and leader, and experience in the cannabis industry, we believe Mr. Zelinger is an excellent fit for our team as we look toward future growth. Mr. Zelinger is considered an independent director.

Vote Required and Recommendation

The nominee for election to the Board of Directors is elected by a plurality of the votes cast at the 2023 Annual Meeting. A plurality means that the candidate with the most votes for his or her election, even if less than a majority of those cast, is elected to the Board of Directors. Stockholders are not permitted to vote against a candidate. Votes to “withhold” authority and abstentions with respect to that director’s election do not impact the plurality vote. Therefore, since the current nominee is uncontested, there is no set number of votes that must be obtained to elect the nominee and a single vote for the candidate will result in his election. Stockholders do not have the right to cumulate their votes for directors. A broker non-vote with respect to the election of a nominee to the Board of Directors will not be voted with respect to such nominee, although it will be counted for purposes of determining whether a quorum is present.

The Board of Directors unanimously recommends you vote FOR the nominee for director set forth above.

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF M&K CPAs, PLLC AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING MAY 31, 2024

The Audit Committee, which is responsible for the appointment, compensation and oversight of our independent auditors, has engaged M&K CPAs, PLLC (“M&K”) as our independent auditors to audit our consolidated financial statements for the year ending May 31, 2024. M&K have served as the Company’s and its predecessors in interest’s independent auditors since the fiscal year ended May 31, 2013.

As a matter of good corporate governance, we are requesting that stockholders ratify the Audit Committee’s appointment of M&K as independent auditors. If stockholders do not ratify the appointment of M&K, the Audit Committee will reevaluate the appointment, but may retain such independent auditor. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

We have been informed that a representative of M&K will attend the 2023 Annual Meeting virtually, and will be available to respond to appropriate questions by stockholders.

Audit and Non-Audit Fees

The following table shows fees what we paid (or accrued) for professional services rendered by M&K for our fiscal years ended May 31, 2023 and 2022.

| |

|

Year Ended May 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Audit Fees (1)

|

|

$ |

76,000 |

|

|

$ |

78,350 |

|

|

Audit-Related Fees (2)

|

|

|

2,870 |

|

|

|

7,750 |

|

|

Tax fees (3)

|

|

|

- |

|

|

|

- |

|

|

All other fees

|

|

|

- |

|

|

|

- |

|

|

Total

|

|

$ |

78,870 |

|

|

$ |

86,100 |

|

|

|

1

|

Audit fees consist of audit work performed in the preparation of financial statements, as well as work generally only the independent auditor can reasonably be expected to provide, such as statutory audits.

|

|

|

2

|

Audit-related fees consist of fees billed for consents and registration statement reviews, as well as assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.”

|

|

|

3

|

Tax fees consist of fees billed for professional services rendered for tax compliance, tax advice, and tax planning. These services include assistance regarding federal, state, and international tax compliance, acquisitions and international tax planning.

|

Our Audit Committee requires that management obtain the prior approval of the Audit Committee for all audit and permissible non-audit services to be provided by the Company’s auditors. The Audit Committee considers and approves at each meeting, as needed, anticipated audit and permissible non-audit services to be provided by the auditors during the year and estimated fees.

Our independent auditor for the fiscal year ended May 31, 2023, M&K, has advised us that neither it, nor any of its members, has any direct financial interest in the Company as a promoter, underwriter, voting trustee, director, officer or employee. All professional services rendered by M&K during the fiscal year ended May 31, 2023 were furnished at customary rates and were performed by full-time, permanent employees.

Vote Required and Recommendation

The selection of M&K CPAs, PLLC, as our independent certified public accountants for the fiscal year ending May 31, 2024 will be ratified if votes representing a majority of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Abstentions and broker non-votes will have the same effect as a vote “AGAINST” Proposal 2.

The Board of Directors unanimously recommends that you vote FOR Proposal 2, to ratify the appointment of M&K CPAs, PLLC, as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2024.

PROPOSAL 3: APPROVE AN INCREASE IN THE NUMBER OF AUTHORIZED SHARES TO 350,000,000 FROM THE CURRENT AUTHORIZED AMOUNT OF 187,500,000

Introduction

On October 2, 2023, the Board acted unanimously to adopt the proposal to amend our Amended and Restated Articles of Incorporation (the “Certificate of Incorporation”), to increase the authorized common stock, par value $0.0001 per share, from 187,500,000 shares to 350,000,000 shares (the “Increased Capitalization Charter Amendment”). The Board is now asking you to approve the Increased Capitalization Charter Amendment.

On October 2, 2023, there were 72,543,141 shares of our common stock outstanding. In addition, an aggregate of 96,590,021 shares of common stock were reserved for issuance upon conversion or exercise of various debt and equity instruments that we have issued and upon issuance of previously granted but unissued restricted stock grants.

Form of the Amendment

If shareholders approve this proposal, the Company’s Amended and Restated Articles of Incorporation will be further amended to increase the number of shares of common stock the Company is authorized to issue from 187,500,000 to 350,000,000. The par value of the common stock will remain at $0.0001 per share. The number of shares of preferred stock the Company is authorized to issue would not change, and the par value of the preferred stock will remain at $0.001 per share. The amendment would amend the introductory paragraph of Article IV of our Amended and Restated Articles of Incorporation, to read in its entirety as follows:

|

“The aggregate number of shares of all classes of capital stock which the Corporation shall have the authority to issue is Three Hundred Fifty Million (350,000,000), consisting of (i) Three Hundred Forty-Five Million (345,000,000) shares of common stock, par value $0.0001 per share (the “Common Stock”) and (ii) Five Million (5,000,000) shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). The designations and the preferences, limitations and relative rights of the Preferred Stock and the Common Stock of the Corporation are as follows:

[REMAINDER OF ARTICLE IV IS NOT AFFECTED]

|

Purpose of the Amendment

The Board believes that it is advisable to have a greater number of authorized shares of common stock available for issuance in connection with various general corporate programs and purposes.

The Board believes that having the authority to issue additional shares of common stock will enhance the business and financial flexibility of the Company and avoid the possible delays and significant expense of calling and holding an additional special meeting of shareholders to increase the authorized common shares at a later date.

The shares may be issued by the Board in its discretion, subject to any further shareholder action required in the case of any particular issuance by applicable law, regulatory agency, or under the rules of any securities exchange.

The newly authorized shares of common stock would be issuable for any proper corporate purpose, including future acquisitions, renegotiation of outstanding convertible debentures and warrants, investment opportunities, capital raising transactions of equity or convertible debt securities, stock splits, stock dividends, issuance under future equity compensation plans, employee stock or incentive and savings plans or for other corporate purposes. There are no immediate plans, arrangements, commitments or understandings with respect to issuance of any of the additional shares of common stock that would be authorized by the proposed amendment, although the Company hopes to begin negotiations with certain of its convertible debtholders to convert some of the outstanding principal balance to shares of common stock and renegotiate the exercise price of certain warrants.

Our Board of Directors believes that the proposed increase in authorized shares will provide sufficient additional flexibility to allow us to pursue our strategic objectives. Historically, flexibility has been critical in enabling us to pursue acquisitions to support our growth and to retire outstanding indebtness, and we anticipate that having additional flexibility would allow us to pursue similar opportunities in the future, in addition to allowing us to provide equity incentives to help attract and retain key employees.

Rights of Additional Authorized Shares

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. The Company’s shareholders do not have preemptive rights with respect to its common stock. Accordingly, should the Board elect to issue additional shares of common stock, existing shareholders would not have any preferential rights to purchase the shares.

Potential Adverse Effects of the Amendment

Future issuances of capital stock or securities convertible into capital stock could have a dilutive effect on the earnings per share, book value per share, voting power and percentage interest of holdings of current shareholders. In addition, the availability of additional shares of capital stock for issuance could, under certain circumstances, discourage or make more difficult efforts to obtain control of the Company. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt, but nothing would prevent the Board from taking any appropriate actions not inconsistent with its fiduciary duties.

Effectiveness of the Amendment and Vote Required

If the proposed amendment is adopted, it will become effective upon the filing of a certificate of amendment to our Amended and Restated Articles of Incorporation with the Secretary of State of the State of Nevada. The adoption of this amendment requires the approval of the holders of 66-2/3% of our issued and outstanding shares of common stock.

The Board Unanimously recommends that you vote FOR Proposal 3, to increase the number of authorized shares to 350,000,000 from the current authorized amount of 187,500,000.

STOCKHOLDERS MATTERS

Stockholder Communications with the Board

Any stockholder may communicate by mail with the Board or individual directors by contacting our Corporate Secretary at CLS Holdings USA, Inc., 516 S. 4th Street, Las Vegas, NV 89101 or via our website at www.clsholdingsinc.com. The Board has instructed the Corporate Secretary to review this correspondence and determine, in his or her discretion, whether matters submitted are appropriate for Board consideration. The Corporate Secretary may also forward certain communications to others at the Company for review and possible response. Communications such as customer or commercial inquiries or complaints, job inquiries, surveys and business solicitations or advertisements or patently offensive or otherwise inappropriate material will not be forwarded to the Board.

Stockholder Proposals for Inclusion in 2024 Proxy Statement

Pursuant to Rule 14a-8 of the SEC’s proxy rules, a stockholder intending to present a proposal to be included in the proxy statement for our 2024 Annual Meeting of Stockholders must have delivered a proposal in writing to our principal executive offices no later than August 1, 2024 (or if we change the date of the 2024 Annual Meeting by more than 30 days from the date of this year’s 2023 Annual Meeting, a reasonable time before we begin to print and mail the proxy materials for the 2024 Annual Meeting). Proposals should be addressed to: Corporate Secretary, CLS Holdings USA, Inc., 516 S. 4th Street, Las Vegas, NV 89101. Proposals from stockholders must also comply with the SEC’s rules regarding the inclusion of stockholder proposals in proxy materials, and we may omit any proposal from our proxy materials that does not comply with the SEC’s rules.

Other Stockholder Proposals for Presentation at 2024 Annual Meeting

Stockholder proposals intended to be presented at, but not included in the proxy materials for, our 2024 Annual Meeting of Stockholders, including director nominations for election to our Board, must be timely received by us in writing at our principal executive offices, addressed to the Corporate Secretary of the Company as indicated above. Under our Bylaws, to be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not less than 60 days, nor more than 90 days, prior to the meeting. If we give less than 70 days’ notice of the meeting date, however, notice by a stockholder will be deemed timely given if received by us not later than the close of business on the tenth day following either the date we publicly announce the date of our annual meeting or the date of mailing of the notice of the meeting, whichever occurs first. A stockholder’s notice to the Corporate Secretary must set forth the following information as to each matter the stockholder proposes to bring before the annual meeting:

|

|

•

|

A brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting;

|

|

|

|

|

|

|

•

|

The name and record address of the stockholder proposing such business;

|

|

|

|

|

|

|

•

|

The class and number of shares beneficially owned by the stockholder; and

|

|

|

|

|

|

|

•

|

Any material interest of the stockholder in such business.

|

The SEC’s rules permit our management to vote proxies on a proposal presented by a stockholder as described above, in the discretion of the persons named as proxy, if:

|

|

•

|

We receive timely notice of the proposal and advise our stockholders in that year’s proxy materials of the nature of the matter and how management intends to vote on the matter; or

|

|

|

|

|

|

|

•

|

We do not receive timely notice of the proposal in compliance with our Bylaws.

|

Interests of officers and directors in matters to be acted upon.

Except in the election of David Zelinger as a Class III director under Proposal 1, none of the Company’s officers or directors has any interest in any of the matters to be acted upon at the 2023 Annual Meeting.

OTHER BUSINESS

The Board knows of no other business to be brought before the 2023 Annual Meeting. If, however, any other business should properly come before the 2023 Annual Meeting, the persons named in the accompanying proxy will, to the extent permitted by applicable law, vote proxies in their discretion as they may deem appropriate, unless they are directed by a proxy to do otherwise.

HOUSEHOLDING OF ANNUAL DISCLOSURE DOCUMENTS

We are sending only one Notice or one proxy statement to stockholders residing at the same address unless one of the stockholders has notified us of his or her desire to receive multiple copies. This practice, known as “householding,” reduces duplicate mailings, enabling us to save paper and reduce printing costs.

Stockholders residing at the same address who currently receive only one copy of the Notice or proxy statement and who would like to receive an additional copy of the proxy statement for this 2023 Annual Meeting or for future meetings may contact our Corporate Secretary by phone at (888) 359-4666 or by mail addressed to our Corporate Secretary at 516 S. 4th Street, Las Vegas, NV 89101.

By Order of the Board of Directors,

Andrew Glashow

Chief Executive Officer and Chairman of the Board

Las Vegas, Nevada

October 19, 2023

|

CLS HOLDINGS USA, INC.

516 S. 4th Street

LAS VEGAS, NV 89101

|

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m. Eastern Time on November 27, 2023. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on November 27, 2023. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

|

|

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

|

D60851-P61537

|

KEEP THIS PORTION FOR YOUR RECORDS

|

|

|

DETACH AND RETURN THIS PORTION ONLY

|

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

|

CLS HOLDINGS USA, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Board of Directors recommends a vote FOR the nominee listed in Proposal 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Election of Class III Director: To elect one member to the Board of Directors to serve for a three-year term as the Class III director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee:

|

For

|

Withhold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David Zelinger

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Board of Directors recommends a vote FOR Proposal 2.

|

For

|

Against

|

Abstain

|

|

|

|

|

|

|

|

|

|

|

|

2. Ratification of the appointment of M&K CPAs, PLLC, as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2024.

|

☐

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

| |

The Board of Directors recommends a vote FOR Proposal 3.

|

|

|

|

For

|

Against

|

Abstain

|

|

|

|

|

|

|

|

|

|

| |

3. Approve an increase in the number of authorized shares to 350,000,000 from the current authorized amount of 187,500,000.

|

☐

|

☐

|

☐

|

| |

|

|

|

|

| |

|

|

|

|

|

|

NOTE: The Company may transact such other business as may properly come before the 2023 Annual Meeting, or any adjournments or postponements thereof.

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Yes

|

No

|

|

|

|

|

|

|

Please indicate if you wish to view meeting materials electronically via the Internet rather than receiving a hard copy. Please note that you will continue to receive a proxy card for voting purposes only.

|

☐

|

☐

|

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature [PLEASE SIGN WITHIN BOX]

|

Date

|

|

|

|

Signature (Joint Owners)

|

Date

|

|

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting:

The Notice and Proxy Statement and Form 10-K are available at www.proxyvote.com.

|

CLS HOLDINGS USA, INC.

Annual Meeting of Stockholders

November 28, 2023 3:00 PM, EST

This proxy is solicited by the Board of Directors

The undersigned stockholder hereby appoints Charlene Soco and Andrew Glashow, or either of them, as proxies, each with the power to appoint his or her substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this proxy, all of the shares of common stock of CLS HOLDINGS USA, INC. that the undersigned stockholder is entitled to vote at the 2023 Annual Meeting of Stockholders of the Company to be held at 3:00 PM, EST on November 28, 2023 in a virtual format only, and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations.

Continued and to be signed on reverse side

|

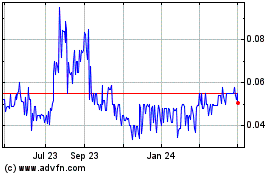

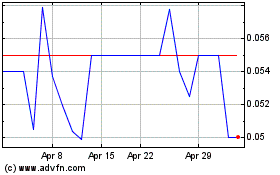

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Jul 2023 to Jul 2024