By Steven Russolillo and Joanne Chiu

Protests are denting Hong Kong's economic growth, business

sentiment and financial markets.

A worsening spiral of violence and demonstrations marks the

former British colony's worst social and political crisis since it

returned to Chinese rule in 1997. The controversial prospect of

extraditions to mainland China, and the resulting unrest, have

clouded Hong Kong's status as a global financial center.

On Tuesday, Hong Kong Chief Executive Carrie Lam said there is

"no room for optimism" on economic growth this year, citing

uncertainties related to the protests and the U.S.-China trade

dispute.

The next day the government estimated that inflation-adjusted

second-quarter gross domestic product was up a modest 0.6% from a

year earlier, as "local economic sentiment deteriorated visibly in

the face of increasing downside risks facing the global economy and

other headwinds."

The pressure has weighed on property and retail stocks, helping

put the benchmark Hang Seng Index on track to be one of the worst

July performers among its global peers.

Finance-industry workers were preparing to participate in a

flash-mob protest on Thursday, making the same key demands as many

other recent protests, including permanent withdrawal of the

extradition bill and an independent investigation into police

conduct. A digital flier for the event circulating on social media

was headlined "freedom snooze, market lose."

Retailers and tour agents have been hit by tensions in normally

bustling commercial and residential districts. Last week, a

lawmaker who represents the city's tourism sector said some tourist

agencies had inquiries about possible cancellations of corporate or

study trips to Hong Kong in August. He said the growth rate for

tourism arrivals had slowed to 8.5% after the demonstrations began

in June, down from 15% in the first five months of the year.

"There is a lot of uncertainty in Hong Kong," said Mariana Kou,

head of Hong Kong consumer research at CLSA, a brokerage. "It's a

tough time for local retailers as we're seeing more widespread and

frequent demonstrations and clashes in the city."

The share price of major retail landlord Wharf Real Estate

Investment Co., owner of the Times Square and Harbour City malls,

has fallen 9.7% this month to its lowest level since January.

Chow Tai Fook Jewellery Group Ltd., the world's second-largest

jeweler after Tiffany & Co., dropped 12% in July after surging

the prior month. It said sales at stores in Hong Kong and Macau

that had been open at least a year fell sharply in the three months

to June. Smaller rival Luk Fook Holdings (International) Ltd.

dropped 3.3% this month.

Mainland Chinese visitors to Hong Kong are among jewelers'

biggest customers.

Shares of MTR Corp., a property company that operates Hong

Kong's train system, has dropped more than 7% over the past two

weeks. The shares hit a record closing high on July 18; later that

day the company released a profit warning. Protesters disrupted

train services on Tuesday, slowing some lines and forcing others to

suspend service.

Smaller companies appear most vulnerable. Ms. Kou said she

expects sales figures for the retail and tourism sectors to

deteriorate further through the summer. She said the disruptions

drove double-digit percentage sales declines for some retailers

during the past weekends, based on CLSA's channel checks, in which

it collects information from third-parties such as distributors and

customers.

A sentiment index of small and midsize companies in Hong Kong

fell to a three-year low, according to a survey by Standard

Chartered PLC.

Foreign companies are also suffering. In a survey published this

week, the American Chamber of Commerce in Hong Kong said it found

more international businesses pessimistic about short-term

prospects for the city. Respondents, spanning sectors including

financial services, logistics and technology, said escalating

violence and political deadlock were fueling perceptions Hong Kong

is becoming a riskier place to do business.

Also this week, Fitch Ratings warned that "unrest and apparent

rising distrust in government" risks damaging business confidence

and eroding the city's governance. It has a stable AA+ rating on

Hong Kong, three notches higher than its rating on mainland China,

but said some of the assumptions that underpin that rating are

being tested, including those about the effectiveness of the

territory's governance and its rule of law.

Even after a rough July, though, the Hang Seng is up roughly 8%

for the year. And much of the decline this month is due to drops in

major mainland stocks, such as China Unicom, Country Garden and

China Construction Bank.

David Webb, an activist investor in Hong Kong, said that the

city's stock market isn't necessarily the best reflection of the

Hong Kong economy, since roughly two-thirds of the Hang Seng Index

are companies that operate mostly in mainland China.

"The bigger issue is obviously whether the situation will get

worse," he said. "With weekly if not daily protests, which have

become increasingly violent as protesters test the will of the

authorities, there isn't any obvious end in sight."

Joyu Wang contributed to this article.

Write to Steven Russolillo at steven.russolillo@wsj.com and

Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

July 31, 2019 07:21 ET (11:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

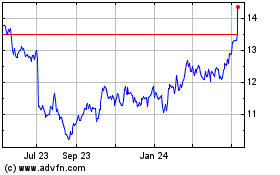

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Jan 2025 to Feb 2025

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Feb 2024 to Feb 2025