HONG KONG—Chinese insurer Anbang Insurance Group Co., which just

upped the ante in a bidding war for Starwood Hotels & Resorts

Worldwide Inc., made three unsuccessful offers last year to

purchase the same U.S. luxury hotel chain.

Each time, Anbang and its chairman, Wu Xiaohui, were pressed by

Starwood and its bankers for details on how they would pay for the

deal, according to public filings by Starwood. On the third attempt

on Nov. 3, Anbang withdrew its offer in the middle of a meeting

with Starwood executives, the filings say, after Starwood told the

Chinese insurer it wouldn't be able to proceed without financing

details.

Anbang has exploded onto the international scene in recent years

by spending billions to acquire insurers and hotels throughout the

world. In February 2015, it laid out nearly $2 billion to buy New

York's Waldorf Astoria, the highest price ever paid for a single

U.S. hotel. It is also a big player at home, with stakes in listed

Chinese developers and banks, while also investing in a traditional

Chinese medicine maker and a wind-turbine manufacturer.

On Monday, Starwood said Anbang had made a new, $14 billion

all-cash offer for Starwood, continuing a bidding war with Marriott

International Inc. that started earlier this month. Starwood said

the revised, nonbinding offer from the Anbang-led consortium, which

includes private-equity firms J.C. Flowers & Co. and Primavera

Capital Ltd., was "reasonably likely" to top Marriott's.

Marriott said Monday it remains committed to its latest offer of

cash and shares, worth $13.6 billion when announced last week,

which it believes offers "greater long-term value" to Starwood

shareholders. Starwood and Marriott shareholders are slated to vote

on their deal on April 8.

Complicated ownership

For all its ambition, Anbang remains opaque to many both inside

and outside of China. Its ownership, as of its most recent public

filings, is a mash of corporate shareholders, with multiple layers

of holding companies registered all around the country.

Asked for comment, Anbang said it is owned by 31 corporate

investors that don't participate in the daily operation of the

company. It added that its strategic and investment committee

selected the investors in 2014 out of over 300 interested

parties.

The Beijing-based company has gotten financial backing from

state lender China Construction Bank Corp. for its Starwood bid,

people familiar with the matter said earlier, and it owns big

stakes in other Chinese banks. Yet insurance-industry analysts in

China have warned that Anbang's aggressive acquisitions could be

straining its books. Standard & Poor's in November said it

suspended its ratings on Vivat, the Dutch insurer Anbang bought

last year, because it was "unable to secure sufficient information

to accurately assess" Anbang's creditworthiness.

Anbang said in a statement that S&P would rate Vivat after

it rates its parent company, Anbang's life insurance arm. Vivat has

received positive ratings from other agencies, Anbang said.

Several Wall Street banks haven't gotten internal clearance to

pursue work with Anbang in the past, partly because it is unclear

who effectively owns the company, people familiar with the matter

said. None of those people said the banks had ruled out working

with Anbang in the future.

Anbang didn't dispute accounts of individual banks that have

declined to do business with it. In a written statement, it said:

"Anbang has engaged in and has fully complied with all corporate

governance and internal compliance procedures, including 'Know Your

Customer' regulations, with top-tier financial advisers, such as

Bank of America Merrill Lynch, Credit Suisse, Deutsche Bank,

Evercore Partners, Goldman Sachs, Nomura and PJT Partners." It

added that regulatory authorities in Asia, Europe, and the U.S. had

approved Anbang acquisitions in the past.

Anbang acquisitions have been cleared by a number of government

oversight bodies, including Dutch and South Korean insurance

regulators and the Committee on Foreign Investment in the U.S., or

CFIUS. CFIUS review includes an examination of the ultimate

beneficial ownership of foreign companies, lawyers said.

"We've worked with Anbang senior leadership for many years now

and have always found them to be astute businesspeople," said Chris

Flowers, chief executive of J.C. Flowers, in a statement. "We have

seen them successfully execute deals in multiple jurisdictions and

we have had several successful interactions with them."

Anbang was founded to sell car insurance in 2004 in the city of

Ningbo, just south of Shanghai, with a cast of powerful backers.

Early investors include Shanghai Automotive Industry Corp., now

SAIC Corp., China's biggest car company, and state-owned energy

giant China Petroleum & Chemical Corp., also known as Sinopec.

Chen Xiaolu, the youngest son of revolutionary Communist general

Chen Yi, is a director, online Chinese corporate registry records

show.

By 2010 Anbang had won coveted licenses from China's insurance

regulator to sell property, life and health insurance as well.

Today, Anbang says it has $254 billion (1.65 trillion yuan) in

assets and that its goal is to become one of the "top 10

comprehensive financial groups in the world." In 2014, Anbang had

nearly $4.2 billion in net profit and a net return on equity of

37%, according to a video of a presentation Mr. Wu made last year

at the Global Insurance Forum in New York, which was held at

Anbang's newly purchased Waldorf Astoria.

"The shareholders want to build Anbang into a global financial

empire, rather than a pure insurance firm," said Eva Liu, an

analyst at Z-Ben Advisors, a Shanghai-based consulting firm.

Anbang has been spending billions to build that empire at home

and abroad. Mr. Wu has set his sights on battered European

financial firms such as Vivat and Belgium's Delta Lloyd Bank that

are inexpensive and could prove a source of funding for further

investments. He is also snatching up high-quality hotel properties

with strong cash flow.

In a transcript of remarks Anbang says were given at a Harvard

University recruitment event last year, Mr. Wu gives a folksy

description of the company's investment strategy, saying Anbang is

targeting high-returning assets in five areas, corresponding to

five fingers, from the Internet and real estate to life

sciences.

In overseas acquisitions, it is important for Anbang to "win the

first battle and every battle thereafter as we are representing

Chinese enterprises going global," he said.

China's slowing growth could be hastening Anbang's push abroad.

In a January 2015 interview in Caixin, a Chinese business magazine,

Anbang director Chen Xiaolu says he advised Mr. Wu to invest in

U.S. dollar assets because China's domestic economic growth was

slowing while the U.S. was recovering.

Anbang's investors include a collection of 39 Chinese companies

in sectors from cars to real estate, according to online corporate

registry filings viewed by The Wall Street Journal. Local media

have said some of those firms may have ties to the family of former

Chinese leader Deng Xiaoping, whose granddaughter married Mr.

Wu.

Mr. Wu and members of the Deng family couldn't be reached for

comment. Anbang didn't make executives at the company available for

interviews.

A due-diligence report on Anbang compiled for a global

investment bank and viewed by The Wall Street Journal noted

Anbang's reported connections with the Deng family as well as

recruitment of former senior Chinese officials.

The report noted questions about Anbang's funding, particularly

the source of nearly 50 billion yuan worth of capital put into

Anbang in 2014 by 31 new shareholders with names including Ningbo

World Automobile City Co. Ltd. and Dream Future Investment Co.

Ltd.

A person answering the phone at Ningbo World Automobile City

said she didn't know about the company's relationship with Anbang

and declined to make anyone else available to answer questions. The

mobile phone for Dream Future listed in the Beijing corporate

registry was powered off.

Anbang's approach to international investments represents a

change in tone among Chinese acquirers, who in the past timidly

stepped into foreign markets. So far this year, Chinese buyers have

launched bids for over $100 billion in overseas deals. In the

latest acquisition wave, Chinese buyers have shown themselves

willing to make aggressive bids for foreign targets, sometimes

breaking up already-agreed deals or seeking control of sensitive

targets. Many of the Chinese buyers are helmed by charismatic

leaders with strong political connections and backing from state

lenders.

'Ordinary' person

Little verified information exists in the public domain about

Mr. Wu, who is 49 years old. He describes himself as an "ordinary"

person whom employees can "email directly" in remarks on Anbang's

website, which the company said Mr. Wu gave at the 2015 Harvard

event. Anbang said he has a public administration degree from the

National University of Singapore.

In 2014, Anbang's growth went into overdrive. It more than

quintupled its registered capital, or shareholder equity, from 12

billion to 61.9 billion yuan, online corporate registry records

show, making it the largest Chinese insurer by that measure, though

not by policies or sales.

Before 2014, shareholding in Anbang was concentrated among a

small group of investment firms as well as Sinopec and SAIC. With

the capital raise, Anbang brought on 31 new shareholders, including

little-known investment, real-estate and automotive companies

spread around China. As of the end of 2014, the last date for which

online corporate registry records are available, no single entity

had contributed more than 4% of Anbang's registered capital.

Some of the companies that invested in Anbang in 2014 appear to

be related. According to online corporate registry records, some

share current or former shareholders and legal representatives, or

people appointed to act on behalf of the companies.

(MORE TO FOLLOW) Dow Jones Newswires

March 28, 2016 18:55 ET (22:55 GMT)

Nine of Anbang's new investors were registered in Sichuan

province roughly within a month of each other, in December 2012 and

January 2013. Several of the Beijing companies which invested in

Anbang in 2014 at one point listed the same contact email address,

the online corporate registry records show. Emails to that address

went unanswered, and mobile phones for the three companies listed

in the Beijing corporate registry were turned off.

Sichuan province-registered Shuangliu Guoyi Investment Co. Ltd.,

which contributed roughly 3.6% of Anbang's registered capital in

September 2014, is in turn owned by a Jiangsu Province-registered

car dealership, according to Chinese corporate registries. The

dealership's majority shareholder is a Beijing-registered

technology company owned by two individuals for whom contact

information wasn't listed and who couldn't otherwise be

reached.

Prior to December 2014, the Jiangsu car dealership was owned by

a Shenzhen-registered car dealership, which itself contributed 3.7%

of Anbang's registered capital. Before May 2014, Shuangliu Guoyi

was owned by a Zhejiang investment company.

A person answering the number listed in the corporate registry

for Shuangliu Guoyi hung up when asked a question about Anbang. The

Shenzhen car dealership and Zhejiang investment company couldn't be

reached for comment, and a person answering the number listed for

the Beijing technology company said it was the wrong number. The

company couldn't otherwise be reached. A person answering the phone

at the Jiangsu car dealership said she didn't know about the

company's relationship with Anbang and declined to make anyone else

available to answer questions.

Anbang's growth has required Chinese government approval every

step of the way, from getting licenses from China's insurance

regulator to navigating the thicket of agencies which approve

outbound foreign investment.

"The fact that the company has been allowed to flourish both

domestically and outside of China indicates pretty consistent and

strong support from the Chinese government at a very high level,"

said Victor Shih, a political-science professor at the University

of California-San Diego.

In 2014, Anbang also accelerated its overseas buying spree. It

agreed to purchase the Waldorf Astoria from Hilton Worldwide

Holdings Inc. in October of that year. Mr. Wu pledged to renovate

and furnish the landmark property with a Chinese restaurant

designed to "showcase the true depth of the country's cuisine,"

according to the hotel's website, in time for last year's United

Nations General Assembly. Chinese President Xi Jinping stayed there

during the U.N. meetings, while President Obama decamped to the New

York Palace Hotel.

Mr. Wu now hobnobs with one of the world's richest

private-equity investors, Stephen Schwarzman of Blackstone Group

LP, which agreed to sell luxury hotel group Strategic Hotels &

Resorts Inc. to Anbang earlier this month for around $6.5 billion

including debt.

At the Harvard recruitment event, Mr. Wu said he hadn't let his

achievements go to his head. "When you've been through as many

things and as many business negotiations, you will most likely be

polished into a smooth character," Mr. Wu said, according to the

transcript on Anbang's website. "But I do not seem that wise or

worldly. I'm even a bit simple, as a child."

Write to Rick Carew at rick.carew@wsj.com and Ned Levin at

ned.levin@wsj.com

(END) Dow Jones Newswires

March 28, 2016 18:55 ET (22:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

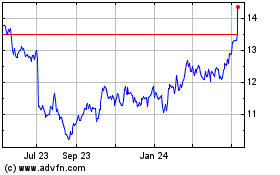

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Apr 2024 to May 2024

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From May 2023 to May 2024