The Securities Arbitration Law Firm of Klayman & Toskes Launches Investigation Concerning the Sale of Reverse Merger Entities...

June 16 2011 - 7:01PM

Business Wire

The Securities Arbitration Law Firm of Klayman & Toskes

(“K&T”), www.nasd-law.com, announced today that it is

investigating the sales practices of Financial Industry Regulatory

Authority (“FINRA”) brokerage firms that sold shares of “reverse

merger” entities to its retail and institutional clients. The U.S.

Securities and Exchange Commission (“SEC”) is examining disclosure

and accounting issues regarding Chinese companies that listed on

U.S exchanges through reverse mergers. The SEC issued an investor

bulletin regarding reverse mergers stating “there have been

instances of fraud and other abuses involving reverse merger

companies” and that investors “should be careful” when considering

buying these companies’ stock. A survey issued by the Public

Company Accounting Oversight Board stated that from 2007 through

March 2010, 159 Chinese companies listed in the U.S. through

reverse mergers. As of March 2010, these companies had a total

market cap of $12.8 billion.

The SEC has halted trading in a number of reverse merger

entities, including Heli Electronics (Other OTC: HELI.PK), China

Changjiang Mining & New Energy (Other OTC: CHJI.PK), RINO

International (Other OTC: RINO.PK), Advanced Refractive

Technologies (Other OTC: ARFR.PK), HiEnergy Technologies (Other

OTC: HIET.PK), and Digital Youth Network (Other OTC: DYOUF). The

SEC suspended trading in these companies because either questions

had arisen regarding the accuracy and completeness of information

contained in their public filings, or there was a lack of current

and accurate information about the companies because they had not

filed certain periodic reports with the SEC.

In addition to trading suspensions, the SEC revoked the

securities registration of several reverse merger companies. After

the SEC revokes a company’s securities registration, no broker,

dealer or national securities exchange can execute a trade in the

stock unless the company files to re-register its stock.

K&T is investigating whether brokerage firms who sold stocks

of reverse merger companies performed adequate due diligence into

the companies prior to recommending the companies’ stock. Moreover,

under FINRA Rules, before recommending a security to a customer, a

brokerage firm must perform an analysis to determine whether the

security is “suitable” for the investor. In many instances,

purchases in reverse merger companies were unsuitable for the

investors, which resulted in significant losses.

The attorneys at K&T are dedicated to aggressively pursuing

claims on behalf of investors who have suffered investment losses.

K&T, an experienced, qualified and nationally recognized

securities litigation law firm, practices exclusively in the field

of securities arbitration and litigation. It continues its

representation of investors throughout the world in securities

arbitration and litigation matters against major Wall Street

brokerage firms.

If you have experienced substantial losses as a result of

investing in reverse merger companies and you wish to discuss your

legal options at no obligation, please contact Steven D. Toskes,

Esquire or Jahan K. Manasseh, Esquire of Klayman & Toskes,

P.A., at 888-997-9956, or visit us on the web at http://www.nasd-law.com

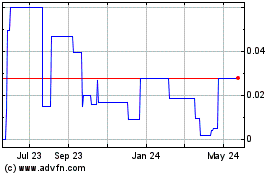

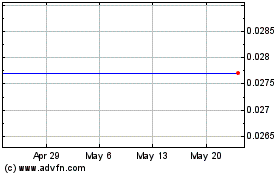

China Changjiang Mining ... (CE) (USOTC:CHJI)

Historical Stock Chart

From Feb 2025 to Mar 2025

China Changjiang Mining ... (CE) (USOTC:CHJI)

Historical Stock Chart

From Mar 2024 to Mar 2025