By Carlos Lopez Perea

Spanish banks are getting ready to take advantage of business

that will be generated by the projects driven by EU recovery funds

this year, as the projects will be partly financed through

corporate loans.

The idea of the plan, which includes a 140 billion-euro ($169.27

billion) injection to boost growth in Spain, is to kick off

projects to modernize the economy, with the private sector

investing EUR4 for each EUR1 of public money, said a source from

Spain's Ministry of Economic Affairs and Digital

Transformation.

The Spanish government is finalizing the plan's strategic

design, which will include projects in renewable energy, small and

medium-sized enterprise digitalization and building renovations.

The next step, which will take place starting in the second

quarter, will be to announce public tenders. Once companies have

submitted their proposals, the last stage will be to allocate the

EU funding, to be supplemented by private-sector funds, the source

said.

BANKS PREPARE THE GROUND

Some banks have started to do their homework, including Banco de

Sabadell SA, which is already contacting business associations

across Spain. "We are quite active in this stage of informing

[them]," a person close to the bank said.

Sabadell is focusing on corporate credit. "After all, that is

where the profitability is", the person said, particularly in a

negative interest-rate environment that shows no signs of changing,

and amid uncertainty regarding the economic outlook.

Ibercaja is also getting ready for "the huge amount of money

which will be channeled towards the companies", a spokesman for the

bank said. Ibercaja recently restructured its executive team to

focus more on this line of business, which will be one of the keys

of its strategic plan to be approved by the board in late

March.

"These investments will drive the country for the next five

years," the Ibercaja spokesman said. "In terms of volumes flow,

corporate credit will account for a very large percentage. More

than half of the credit may be linked to these investments," he

said.

He anticipates banks will compete for the loans, particularly as

the industries which will receive the funds will probably draw on

other sectors to complete the project. "This will affect the whole

production chain, which will also require investments," he

added.

"It can be expected that these projects will have some

carry-over effect and allow for the development of further projects

linked to digitalization and energy transition which otherwise

would have happened later or not at all," said Sandra Jodar Rosell,

head of strategic planning at CaixaBank Research.

The competition is expected to be fierce among banks, not just

in terms of prices, but also of service quality, the source close

to Sabadell said. "Businesspeople know it. You cannot be misaligned

with the market in terms of prices, but this won't be the

differential element," the source added.

Generally speaking, Spanish banks believe that they can make an

important contribution at funneling and advancing the funds. "Banks

can play a decisive role in multiplying the effect of the funds and

in ensuring the money arrives in good time and manner, particularly

for those sectors where it usually takes longer, such as for SMEs,

self-employed workers and private individuals," a spokesman for

Banco Bilbao Vizcaya Argentaria SA said.

Banks could even advance the money until the funds arrive from

Brussels, said Ms. Jodar Rosell, the CaixaBank Research

analyst.

"Banks have liquidity and they can advance the funds in order to

avoid project delays," another person from the banking sector

said.

ANALYSTS EXPRESS RESERVATIONS

However, many analysts are skeptical regarding the extent of the

boost banks can hope to enjoy via the EU investment scheme.

"It will be positive for credit, but not a panacea," said Nuria

Alvarez, analyst at Renta 4. She expects that corporate credit will

start to increase in late 2021 or 2022.

"I think the impact on banks should be relatively muted, at

least the direct impact, given that the funds will be predominantly

directed towards public spending on investment," Citi economist

Giada Giani said.

Manuel Romera, director of the financial sector at the

Madrid-based IE Business School, also doesn't believe that the

credit linked to the EU funds will have a prominent role on the

economy. "The bureaucratic form of [Spain's] subsidies law or the

public contracts law lacks the functionality required for that

money to flow; it is only meant for public tenders", he said.

Rather, a potential credit boom could be linked to increases in

Spain's Gross Domestic Product, Mr. Romera said.

Jefferies analyst Benjie Creelan-Sandford also expressed doubts

around this year's economic recovery, depends on the pace of the

vaccination drive and its effect on the summer tourism season. As

for banks, "with short-term rates remaining close to historic lows,

the [banks'] margin/net interest income outlook remains challenging

in our view," he said.

The prospects of credit growth in Spain for 2021 and 2022 are

moderate--"definitely not large enough to materially change banks'

turnover," said S&P Global credit analyst Elena

Iparraguirre.

Write to Carlos Lopez Perea at carlos.perea@dowjones.com

This story was translated in whole or in part from a

Spanish-language version initially published by EFE Dow Jones, a

partner of Dow Jones & Co.

(END) Dow Jones Newswires

March 03, 2021 10:35 ET (15:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

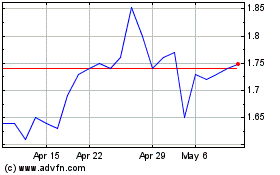

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Nov 2023 to Nov 2024