UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

SCHEDULE 14A

___________________________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. 1)

|

Filed by the Registrant

|

|

☒

|

|

Filed by a Party other than the Registrant

|

|

☐

|

Check the appropriate box:

|

☒

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

Breeze Holdings Acquisition Corp.

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

BREEZE HOLDINGS ACQUISITION CORP.

955 W. John Carpenter Freeway, Suite 100-929

Irving, TX 75039

To the Stockholders of Breeze Holdings Acquisition Corp.:

You are cordially invited to attend a special meeting of stockholders of Breeze Holdings Acquisition Corp. on December 23, 2024, at 10:00 a.m. Eastern Time. The special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the special meeting online, vote and submit your questions during the special meeting by visiting www.virtualshareholdermeeting.com/BRZH2024SM. If you plan to attend the virtual online special meeting, you will need the control number found on your proxy card, voting instruction form or notice.

Information regarding each of the matters to be voted on at the special meeting is contained in the attached Proxy Statement and Notice of Special Meeting of Stockholders. We urge you to read the proxy statement carefully. The proxy statement and proxy card are being mailed on or about November 29, 2024 to all stockholders of record as of November 20, 2024.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to attend the virtual Special Meeting, please vote as promptly as possible to ensure your representation and the presence of a quorum at the Special Meeting. Only stockholders who held shares at the close of business on the record date, November 20, 2024, may vote at the special meeting. As an alternative to voting online during the special meeting, you may vote in advance of the special meeting, via the Internet, by telephone, or by signing, dating and returning the proxy card. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the special meeting.

We look forward to seeing you virtually on December 23, 2024.

Very truly yours,

Breeze Holdings Acquisition Corp.

|

By:

|

|

/s/ J. Douglas Ramsey, Ph.D.

|

|

|

| |

|

J. Douglas Ramsey, Ph.D.

|

|

|

| |

|

Chairman of the Board and

|

|

|

| |

|

Chief Executive Officer

|

|

|

Important Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Stockholders to be Held on December 23, 2024:

Electronic Copies of this notice of meeting and the Proxy Statement are available at

www.virtualshareholdermeeting.com/BRZH2024SM

BREEZE HOLDINGS ACQUISITION CORP.

955 W. John Carpenter Freeway, Suite 100-929

Irving, TX 75039

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held December 23, 2024

TO THE STOCKHOLDERS OF BREEZE HOLDINGS ACQUISITION CORP.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of Breeze Holdings Acquisition Corp. (the “Company”) will be held on December 23, 2024, at 10:00 a.m. Eastern Time. The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Special Meeting online, vote and submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/BRZH2024SM. If you plan to attend the virtual online Special Meeting, you will need the control number found on your proxy card, voting instruction form or notice.

The Special Meeting will be held for the sole purpose of considering and voting upon the following proposals:

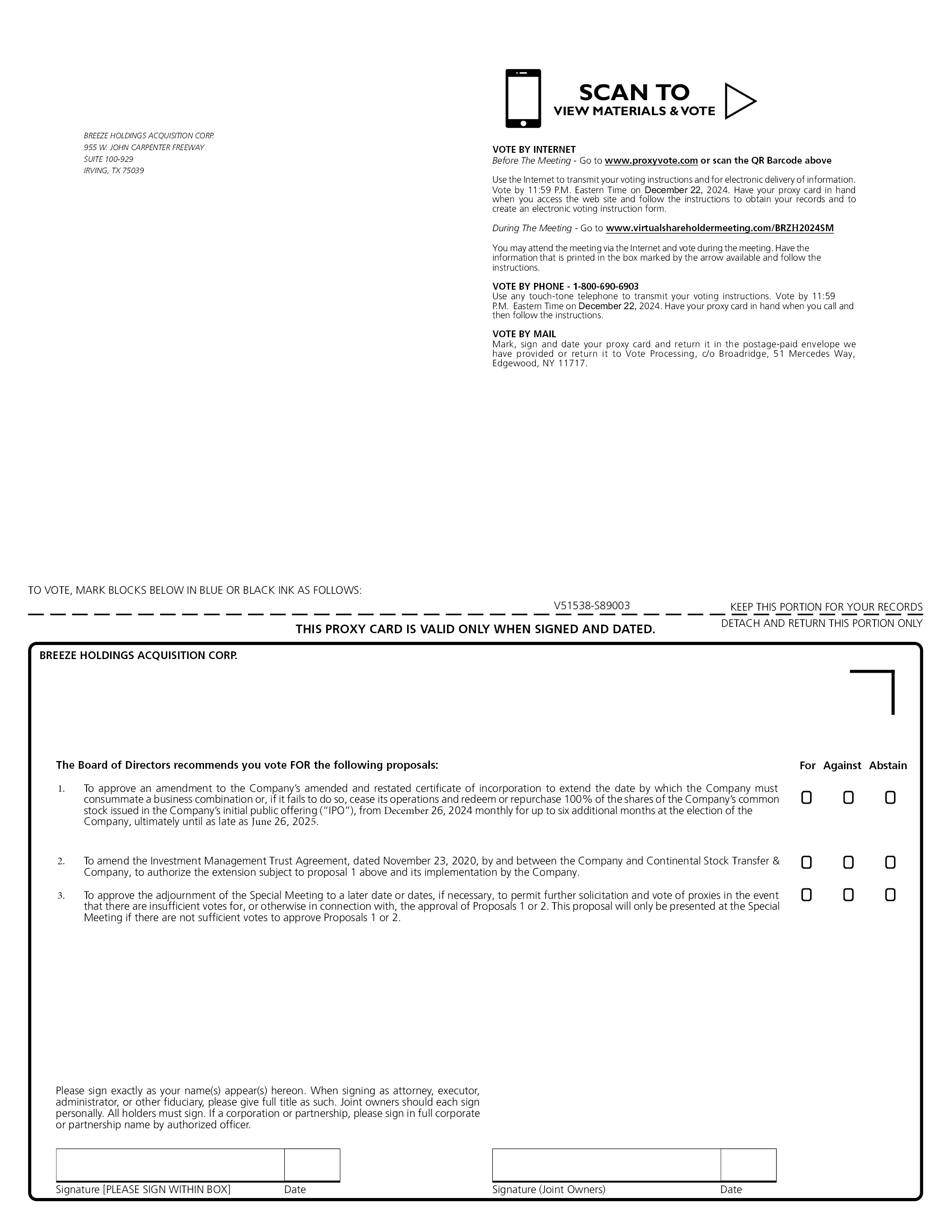

1. To approve an amendment to the Company’s amended and restated certificate of incorporation to extend the date by which the Company must consummate a business combination or, if it fails to do so, cease its operations and redeem or repurchase 100% of the shares of the Company’s common stock issued in the Company’s initial public offering (“IPO”), from December 26, 2024 monthly for up to six additional months at the election of the Company, ultimately until as late as June 26, 2025.

2. To amend the Investment Management Trust Agreement, dated November 23, 2020, by and between the Company and Continental Stock Transfer & Company, to authorize the extension subject to proposal 1 above and its implementation by the Company.

3. To approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposals 1 or 2. This proposal will only be presented at the Special Meeting if there are not sufficient votes to approve Proposals 1 or 2.

Only stockholders of record of the Company at the close of business on November 20, 2024 are entitled to notice of and to vote at the Special Meeting or any adjournment or postponement thereof. A complete list of these stockholders will be open for the examination of any stockholder of record at the Company’s principal executive offices located at 955 W. John Carpenter Freeway, Suite 100-929, Irving, TX 75039 for a period of ten days prior to the Special Meeting. The list will also be available for the examination of any stockholder of record present at the Special Meeting.

The Special Meeting may be adjourned or postponed from time to time without notice other than by announcement at the meeting. This Notice of Special Meeting of Stockholders and proxy statement, along with a proxy card, was first mailed on or about November 29, 2024 to our stockholders of record as of the Record Date. These materials are also available electronically at www.virtualshareholdermeeting.com/BRZH2024SM.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE PROVIDED.

|

|

|

By Order of the Board of Directors,

|

| |

|

Breeze Holdings Acquisition Corp.

|

| |

|

/s/ J. Douglas Ramsey, Ph.D.

|

|

Irving, Texas

|

|

J. Douglas Ramsey, Ph.D.

|

|

November [ ], 2024

|

|

Chairman of the Board and

|

| |

|

Chief Executive Officer

|

BREEZE HOLDINGS ACQUISITION CORP.

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

To Be Held December 23, 2024

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Breeze Holdings Acquisition Corp. was formed for the purpose of identifying, acquiring and operating a target company through a business combination and not with the purpose of being an investment company. In an effort to mitigate the risk that the Company might be deemed to be an investment company the Company has moved all of its assets in the Trust from government securities to a bank demand deposit account which had an interest yield of 5.20% for the month of March 2024, and intends to maintain its assets in this account until it consummates its initial business combination or winds up its existence and liquidates. There can be no assurance that this action will foreclose a judicial or regulatory finding or an allegation, that the Company is an investment company. See “Proposal 1: To Approve The Extension Proposal.”

WHY DID YOU SEND ME THIS PROXY STATEMENT?

This proxy statement and the enclosed proxy card are furnished in connection with the solicitation of proxies by the Board of Directors of Breeze Holdings Acquisition Corp., a Delaware corporation, for use at the Special Meeting of Breeze Holdings Acquisition Corp.’s stockholders to be held on December 23, 2024, at 10:00 a.m. Eastern Time, and at any adjournments or postponements of the Special Meeting. The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Special Meeting online, vote and submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/BRZH2024SM. If you plan to attend the virtual online Special Meeting, you will need the control number found on your proxy card, voting instruction form or notice.

This proxy statement summarizes the information you need to make an informed vote on the proposals to be considered at the Special Meeting. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card using the envelope provided. The terms “Breeze,” “Company,” “we,” or “our” refer to Breeze Holdings Acquisition Corp.

WHAT PROPOSALS WILL BE ADDRESSED AT THE SPECIAL MEETING?

The Special Meeting will be held for the sole purpose of considering and voting upon the following proposals:

1. To approve an amendment to the Company’s amended and restated certificate of incorporation to extend the date by which the Company must consummate a business combination or, if it fails to do so, cease its operations and redeem or repurchase 100% of the shares of the Company’s common stock issued in the Company’s IPO, from December 26, 2024 monthly for up to six additional months at the election of the Company, ultimately until as late as June 26, 2025 (the “Extension”, and such applicable extension date the “Extended Date”). A copy of the proposed amendment, which we refer to as the “Extension Amendment”, is set forth in Annex A to the accompanying Proxy Statement.

2. To amend the Investment Management Trust Agreement, dated November 23, 2020, (the “Trust Agreement”), by and between the Company and Continental Stock Transfer & Company (the “Trustee”), pursuant to an amendment to the Trust Agreement in the form set forth in Annex B of the accompanying proxy statement, to authorize the Extension and its implementation by the Company.

3. To approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposals 1 or 2. This proposal will only be presented at the Special Meeting if there are not sufficient votes to approve Proposals 1 or 2.

1

WHO MAY VOTE ON THESE PROPOSALS?

We will send this proxy statement, the attached Notice of Special Meeting and the enclosed proxy card on or about November 29, 2024, to all stockholders as of November 20, 2024 (the “Record Date”). Stockholders who owned shares of our common stock at the close of business on the Record Date are entitled to vote at the Special Meeting on all matters properly brought before the Special Meeting.

On the Record Date, we had 4,320,484 shares of issued and outstanding common stock entitled to vote at the Special Meeting.

HOW MANY VOTES DO I HAVE?

Each share of common stock is entitled to one vote on each matter presented at the Special Meeting. Cumulative voting is not permitted.

HOW DO I VOTE BY PROXY?

Whether you plan to attend the Special Meeting or not, we urge you to complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Special Meeting and vote at the meeting.

If you properly fill in your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors (the “Board”) as follows:

1. FOR approval of an amendment to the Company’s amended and restated certificate of incorporation to extend the date by which the Company must consummate a business combination or, if it fails to do so, cease its operations and redeem or repurchase 100% of the shares of the Company’s common stock issued in the Company’s IPO, from December 26, 2024 monthly for up to six additional months at the election of the Company, ultimately until as late as June 26, 2025 (the “Extension”, and such applicable extension date the “Extended Date”).

2. FOR approval to amend the Investment Management Trust Agreement, dated November 23, 2020, (the “Trust Agreement”), by and between the Company and Continental Stock Transfer & Company (the “Trustee”), to authorize the Extension and its implementation by the Company.

3. FOR approval for the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposals 1 or 2. This proposal will only be presented at the Special Meeting if there are not sufficient votes to approve Proposal 1 or 2.

The purpose of the above proposals are to allow us additional time to complete our initial business combination. As previously announced on September 25, 2024, the Company entered into the merger agreement and plan of reorganization (the “Merger Agreement”) by and among (i) the Company, (ii) a Cayman Islands exempted company and wholly-owned subsidiary of Parent expected to be named “YD Bio Limited,” which is in the process of being formed, and once formed will enter into a joinder to the Merger Agreement (“YD Bio Limited”), (iii) Breeze Merger Sub, Inc., a Delaware corporation and which will be a direct, wholly-owned subsidiary of YD Bio Limited (“Parent Merger Sub”), (iv) a Cayman Islands exempted company which will be a wholly-owned subsidiary of YD Bio Limited, expected to be named “BH Biopharma Merger Sub Limited,” and once formed, will enter into a joinder to the Merger Agreement (“Company Merger Sub,” with Company Merger Sub and Parent Merger Sub together referred to herein as the “Merger Subs”), and (v) YD Biopharma Limited, a Cayman Islands exempted clinical-stage biopharmaceutical company based in Taipei City, Taiwan (“YD Biopharma”). Upon closing of the transaction, YD Bio Limited and its common stock is expected to trade on the Nasdaq Capital Market. In connection with the proposed transaction, we intend to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 that will include a proxy statement of the Company and that also will constitute a prospectus of YD Bio Limited with respect to the shares of YD Bio Limited common stock to be issued in the proposed transaction (the “Proxy Statement/Prospectus”). This document is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus (if and when available) will be delivered to our and YD Biopharma’s stockholders. We may also file other relevant documents regarding the proposed transaction with the SEC. The Company expects the transaction to close in the first quarter of 2025, subject to the satisfaction of customary closing conditions, including certain regulatory and shareholder approvals.

2

MAY I REVOKE MY PROXY?

If you give a proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in three ways:

1. You may send in another proxy with a later date.

2. You may notify us in writing (or if the stockholder is a corporation, under its corporate seal, by an officer or attorney of the corporation) at our principal executive offices before the Special Meeting that you are revoking your proxy.

3. You may vote at the Special Meeting.

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

Proposal 1: To Approve The Extension Proposal.

The approval of Proposal 1 requires the affirmative vote of 65% of the outstanding shares of the Company. Broker non-votes and abstentions will be counted as votes against the proposal.

Proposal 2: To Approve The Trust Amendment Proposal.

The approval of Proposal 2 requires the affirmative vote of 65% of the outstanding shares of the Company. Broker non-votes and abstentions will be counted as votes against the proposal.

Proposal 3: Adjournment Proposal.

The approval of Proposal 3 requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter. Broker non-votes will not be taken into account in determining the outcome of the proposal, and abstentions will be counted as votes against the proposal.

ARE THERE ANY RIGHTS OF APPRAISAL?

The Board of Directors is not proposing any action for which the laws of the State of Delaware, our certificate of incorporation or our bylaws provide a right of a stockholder to obtain appraisal of or payment for such stockholder’s shares.

WHO BEARS THE COST OF SOLICITING PROXIES?

We will bear the cost of soliciting proxies in the accompanying form and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution.

We have engaged D.F. King & Co. (“D.F. King”) to assist in the solicitation of proxies for the Special Meeting. We have agreed to pay D.F. King a fee of $5,000 plus a discretionary success fee. We will also reimburse D.F. King for reasonable out-of-pocket expenses and will indemnify D.F. King and its affiliates against certain claims, liabilities, losses, damages and expenses. In addition to these mailed proxy materials, our directors and officers may also solicit proxies in person, by telephone or by other means of communication. These parties will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. While the payment of these expenses will reduce the cash available to us to consummate an initial business combination, we do not expect such payments to have a material effect on our ability to consummate an initial business combination.

WHERE ARE THE COMPANY’S PRINCIPAL EXECUTIVE OFFICES?

The principal executive offices of the Company are located at 955 W. John Carpenter Freeway, Suite 100-929, Irving, TX 75039 and our telephone number is (619) 500-7747.

HOW CAN I OBTAIN ADDITIONAL INFORMATION ABOUT THE COMPANY?

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, which requires that we file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding companies, including Breeze, that file electronically with the SEC. The SEC’s website address is www.sec.gov. In addition, our filings may be inspected and copied at the public reference facilities of the SEC located at 100 F Street, N.E. Washington, DC 20549.

3

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Company’s common stock as of the record date based on information obtained from the persons named below, with respect to the beneficial ownership of shares of the Company’s common stock, by:

• each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock;

• each of our executive officers and directors that beneficially owns shares of common stock; and

• all our officers and directors as a group.

As of the record date, there were 4,033,712 shares of common stock issued and outstanding. Unless otherwise indicated, all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them.

|

|

|

Common Stock

|

|

Name and Address of Beneficial Owner(1)

|

|

Number of

Shares

Beneficially

Owned

|

|

Approximate

Percentage of

Outstanding

Common Stock

|

|

Breeze Sponsor, LLC

|

|

2,475,000

|

|

61.4

|

%

|

|

J. Douglas Ramsey, Ph.D.(2)

|

|

2,475,000

|

|

61.4

|

%

|

|

Russell D. Griffin(3)

|

|

0

|

|

*

|

|

|

Charles C. Ross(3)

|

|

0

|

|

*

|

|

|

Albert McLelland

|

|

25,000

|

|

*

|

|

|

Robert Lee Thomas

|

|

25,000

|

|

*

|

|

|

Bill Stark

|

|

25,000

|

|

*

|

|

|

James L. Williams

|

|

0

|

|

*

|

|

|

All directors and executive officers as a group (7 individuals)

|

|

2,550,000

|

|

63.2

|

%

|

|

Harraden Circle Investors, LP(4)

|

|

534,698

|

|

13.3

|

%

|

|

Feis Equities LLC(5)

|

|

533,108

|

|

13.2

|

%

|

|

I-Bankers Securities, Inc.

|

|

512,500

|

|

12.7

|

%

|

|

Cowen Financial Products LLC(6)

|

|

250,000

|

|

6.2

|

%

|

4

PROPOSAL 1:

THE EXTENSION PROPOSAL

The Company is proposing to amend its charter to extend the date by which the Company has to consummate a business combination monthly for up to six additional months at the election of the Company, ultimately until as late as December 26, 2024 (the “Extended Date”), to allow the Company more time to complete its initial business combination (the “Extension Proposal”).

The purpose of this proposal is to allow the Company additional time to complete an initial business combination. As previously announced on November 1, 2022, the Company entered into a merger agreement and plan of reorganization (the “TV Ammo Merger Agreement”) with TV Ammo, Inc., an advanced technology and composite manufacturing company based in Garland, Texas (“TV Ammo”), pursuant to which a newly-formed wholly-owned subsidiary of the Company would merge with and into TV Ammo, with TV Ammo surviving as a wholly-owned subsidiary of the Company. The TV Ammo Merger Agreement was terminated on August 5, 2024. As previously announced on September 25, 2024, the Company entered into the Merger Agreement by and among (i) the Company, (ii) a Cayman Islands exempted company and wholly-owned subsidiary of Parent expected to be named “YD Bio Limited,” which is in the process of being formed, and once formed will enter into a joinder to the Merger Agreement (“YD Bio Limited”), (iii) Breeze Merger Sub, Inc., a Delaware corporation and which will be a direct, wholly-owned subsidiary of YD Bio Limited (“Parent Merger Sub”), (iv) a Cayman Islands exempted company which will be a wholly-owned subsidiary of YD Bio Limited, expected to be named “BH Biopharma Merger Sub Limited,” and once formed, will enter into a joinder to the Merger Agreement (“Company Merger Sub,” with Company Merger Sub and Parent Merger Sub together referred to herein as the “Merger Subs”), and (v) YD Biopharma Limited, a Cayman Islands exempted clinical-stage biopharmaceutical company based in Taipei City, Taiwan (“YD Biopharma”). Upon closing of the transaction, YD Bio Limited and its common stock is expected to trade on the Nasdaq Capital Market. In connection with the proposed transaction, we filed with the SEC a registration statement on Form F-4 that, when declared effective, will include a proxy statement of the Company and that will also constitute a prospectus of YD Bio Limited with respect to the shares of YD Bio Limited common stock to be issued in the proposed transaction (the “Proxy Statement/Prospectus”). This document is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus (if and when available) will be delivered to our and YD Biopharma’s stockholders. We may also file other relevant documents regarding the proposed transaction with the SEC. The Company expects the transaction to close in the first quarter of 2025, subject to the satisfaction of customary closing conditions, including certain regulatory and shareholder approvals. The Board believes that, given the Company’s expenditure of time, effort and money on finding a business combination, circumstances warrant providing public stockholders an opportunity to consider a business combination.

If the Extension Proposal is approved, commencing December 26, 2024, our Sponsor, or its designees, in their sole discretion, may provide us with loans each month to extend monthly for up to six additional months in the amount equal to $0.035 for each redeemable public share that is not redeemed in connection with this Special Meeting for each of the six subsequent calendar months commencing on June 26, 2025, that is needed by us to complete an initial business combination. Assuming the Extension Proposal is approved, each monthly contribution will be deposited in the Trust Account on or before the 26th day of such calendar month.

The contributions are conditioned upon the implementation of the Extension Proposal. The contributions will not occur if the Extension Proposal is not approved or the Extension is not completed. The amount of the contributions will not bear interest and will be repayable by the Company to our Sponsor or its designees upon consummation of an initial business combination. Concurrently with the execution of the Merger Agreement, the Company, YD Biopharma, our Sponsor and our independent directors (current and former) executed a sponsor support agreement, pursuant to which, among other things, our Sponsor and our independent directors (current and former) agreed, among other things: (a) to vote all of their shares of the Company’s common stock in favor of the Extension Proposal; (b) to take, or cause to be taken, all actions and to do, or cause to be done, all things reasonably necessary under applicable laws to consummate the transactions contemplated by the Merger Agreement, including the Extension, on the terms and subject to the conditions set forth in the Merger Agreement prior to any valid termination of the Merger Agreement; and (c) to waive their rights to redeem any of their shares of the Company’s common stock in connection with the approval of the Extension Proposal. A copy of the proposed amendment to the charter of the Company is attached to this Proxy Statement as Annex A.

5

Whether or not the Extension Proposal is approved, the Company’s public stockholders will have an opportunity to have their public shares redeemed in accordance with the Company’s charter either upon enactment of the Extension Amendment, upon consummation of the initial business combination or in connection with the winding up of the Company. See “Redemption Rights” below.

Reasons for the Extension Proposal

The Company’s charter provides that the Company has until December 26, 2024 to complete the purposes of the Company including effecting a business combination under its terms. The purpose of the Extension Amendment is to allow the Company more time to complete its initial business combination.

The Board currently believes that there will not be sufficient time before December 26, 2024 to complete an initial business combination. Accordingly, the Board believes that, in order to be able to consummate an initial business combination, we will need to obtain the Extension and that, without the Extension, we would be forced to liquidate even if our stockholders are otherwise in favor of consummating an initial business combination.

The Company’s charter provides that the affirmative vote of the holders of at least 65% of all outstanding shares of common stock, including the 2,875,000 shares of common stock that were issued prior to our IPO that are held by our Sponsor, our independent directors (current and former) and I-Bankers Securities, Inc. (“I-Bankers”) collectively, which shares we refer to as “Founder Shares,” is required to amend the charter to extend our corporate existence, except in connection with, and effective upon, consummation of a business combination. Because we continue to believe that a business combination would be in the best interests of our stockholders, and because we do not expect to be able to conclude a business combination before December 26, 2024, the Board has determined to seek stockholder approval to extend the date by which we have to complete a business combination until the Extended Date. We intend to hold another stockholder meeting prior to the Extended Date in order to seek stockholder approval of an initial business combination.

We believe that the foregoing charter provision was included to protect Company stockholders from having to sustain their investments for an unreasonably long period if the Company failed to find a suitable business combination in the timeframe contemplated by the charter. We also believe that, given the Company’s expenditure of time, effort and money on finding a business combination, circumstances warrant providing public stockholders an opportunity to consider an initial business combination pursuant to the Merger Agreement with YD Biopharma, as described above.

If the Extension Proposal is Not Approved

If the Extension Proposal is not approved, we will not amend our charter to extend the deadline for effecting a business combination. If that deadline is not extended, we will not consummate an initial business combination by December 26, 2024. If we have not consummated an initial business combination by December 26, 2024, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter subject to lawfully available funds therefor, redeem 100% of the public shares of common stock in consideration of a per-share price, payable in cash, equal to the quotient obtained by dividing (A) the aggregate amount then on deposit in the Trust Account, including interest (net of taxes payable, less up to $100,000 of such net interest to pay dissolution expenses), by (B) the total number of then outstanding public shares of common stock, which redemption will completely extinguish rights of public stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of the remaining stockholders and the Board in accordance with applicable law, dissolve and liquidate, subject in each case to the Company’s obligations under the DGCL to provide for claims of creditors and other requirements of applicable law.

There will be no distribution from the Trust Account with respect to the Company’s warrants or rights which will expire worthless in the event we wind up. In the event of a liquidation, our Sponsor, officers and directors will not receive any monies held in the Trust Account as a result of their ownership of the Founder Shares and warrants.

If the Extension Proposal Is Approved

If the Extension Proposal is approved, the Company will file an amendment to the charter with the Secretary of State of the State of Delaware in the form set forth in Annex A hereto to extend the time it has to complete a business combination until the Extended Date. The Company will remain a reporting company under the Exchange Act and its common stock, public warrants and rights will remain publicly traded. The Company will then continue to work to consummate an initial business combination by the Extended Date.

6

Notwithstanding stockholder approval of the Extension Proposal, our Board will retain the right to abandon and not implement the Extension at any time without any further action by our stockholders.

If the Extension Proposal is approved, and the Extension Amendment is implemented, each public stockholder may seek to redeem its public shares as described under “Redemption Rights,” below, we cannot predict the amount that will remain in the Trust Account following any redemptions, and the amount remaining in the Trust Account may be only a small fraction of the approximately $10.6 million that was in the Trust Account as of the record date. We will not proceed with the Extension Amendment if redemptions or repurchases of our public shares cause us to have less than $5,000,001 of net tangible assets following approval of the Extension Proposal.

You are not being asked to vote on a business combination at this time. If the Extension Amendment is implemented and you do not elect to redeem your public shares, provided that you are a stockholder on the record date for a meeting to consider a business combination, you will retain the right to vote on a business combination when it is submitted to stockholders, and you will have the right to redeem your public shares for cash in the event that a business combination is approved and completed or we have not consummated a business combination by the Extended Date.

Required Vote

The affirmative vote by holders of at least 65% of the Company’s outstanding shares of common stock, including the Founder Shares, is required to approve the Extension Proposal. If you do not vote, you abstain from voting or you fail to instruct your broker or other nominee as to the voting of shares you beneficially own (“broker non-votes”), your action will have the same effect as an “AGAINST” vote on the Extension Proposal.

If you do not want the Extension Proposal approved, you must abstain, not vote, or vote “AGAINST” the Extension Amendment. You will be entitled to redeem your public shares for cash in connection with the Extension Amendment whether or not you vote on the Extension Proposal, and regardless of how you vote, so long as you exercise your redemption rights as described above under “Redemption Rights.” The Company anticipates that a public stockholder who tenders shares for redemption in connection with the vote to approve the Extension Proposal would receive payment of the redemption price for such shares soon after the implementation of the Extension.

Our Sponsor, I-Bankers and our independent directors (current and former) are obligated to vote any common stock owned by them in favor of the Extension Proposal pursuant to the Sponsor Support Agreement they entered into concurrently with the execution of the Merger Agreement. On the record date, our Sponsor, I-Bankers and our independent directors (current and former) beneficially owned and were entitled to vote an aggregate of 3,087,500 shares, including 2,875,000 Founder Shares, representing approximately 76.5% of the Company’s issued and outstanding shares of common stock. Our Sponsor and our directors, executive officers and their affiliates do not intend to purchase shares of common stock in the open market or in privately negotiated transactions in connection with the stockholder vote on the Extension Amendment.

Recommendation of the Board

After careful consideration of all relevant factors, our Board has determined that the Extension Amendment is in the best interests of the Company and its stockholders. Our Board has approved and declared advisable adoption of the Extension Proposal.

Our Board unanimously recommends that our stockholders vote “FOR” the approval of the Extension Proposal.

Interests of our Sponsor, Directors and Officers

When you consider the recommendation of our Board, you should keep in mind that our Sponsor, executive officers and members of our Board have interests that may be different from, or in addition to, your interests as a stockholder. These interests include, among other things:

• our Sponsor, which is affiliated with our executive officers and certain directors, owns 2,475,000 Founder Shares and 4,325,000 warrants, and our independent directors (current and former) own an aggregate of 100,000 Founder Shares; none of these securities (which represent an aggregate investment of $4,347,391) are subject to redemption, and all will expire worthless if a business combination is not consummated by September 26, 2023, unless the Extension Amendment is implemented;

• in connection with previous extensions of the date by which we have to complete an initial business combination, our Sponsor deposited in the Trust Account an aggregate of approximately $2,902,838, which it lent to us pursuant to interest-free loans and which will not be repaid if a business combination is not consummated by December 26, 2024, unless the Extension Amendment is implemented;

• the fact that, if the Trust Account is liquidated, including in the event we are unable to complete an initial business combination within the required time period, the Sponsor has agreed to indemnify us to ensure that the proceeds in the Trust Account are not reduced below $11.085 per public share, or such lesser per public share amount as is in the Trust Account on the liquidation date, by the claims of prospective target businesses with which we have entered into an acquisition agreement or claims of any third party for services rendered or products sold to us, but only if such a third party or target business has not executed a waiver of any and all rights to seek access to the Trust Account; and

• the fact that none of our officers or directors has received any cash compensation for services rendered to the Company, and all of the current members of our Board are expected to continue to serve as directors at least through the date of the special meeting to vote on a proposed business combination and may even continue to serve following any potential business combination and receive compensation thereafter.

Risk Factors

You should consider carefully all of the risks described in our Annual Report on Form 10-K filed with the SEC on April 1, 2024 and amended on April 25, 2024 and in the other reports we file with the SEC before making a decision to invest in our securities. Furthermore, if any of the following events occur, our business, financial condition and operating results may be materially adversely affected or we could face liquidation. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. The risks and uncertainties described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business, financial condition and operating results or result in our liquidation.

There are no assurances that the Extension will enable us to complete a business combination.

Approving the Extension involves a number of risks. Even if the Extension is approved, the Company can provide no assurances that a business combination will be consummated prior to the Deadline Date. Our ability to consummate any business combination is dependent on a variety of factors, many of which are beyond our control. If the Extension is approved, the Company expects to seek stockholder approval of a business combination. We are required to offer stockholders the opportunity to redeem shares in connection with the Extension Amendment and Trust Amendment, and we will be required to offer stockholders redemption rights again in connection with any stockholder vote to approve a business combination. Even if the Extension or a business combination are approved by our stockholders, it is possible that redemptions will leave us with insufficient cash to consummate a business combination on commercially acceptable terms, or at all. The fact that we will have separate redemption periods in connection with the Extension and a business combination vote could exacerbate these risks. Other than in connection with a redemption offer or liquidation, our stockholders may be unable to recover their investment except through sales of our shares on the open market. The price of our shares may be volatile, and there can be no assurance that stockholders will be able to dispose of our shares at favorable prices, or at all.

If we were deemed to be an investment company for purposes of the Investment Company Act, we may be forced to abandon our efforts to consummate an initial business combination and instead be required to liquidate the Company.

In Release Nos. 33-11048; 34-94546 (March 30, 2022) at pages 136 and 137, the SEC stated that “[d]epending on the facts and circumstances, SPACs could meet the definition of “investment company” in Section 3(a)(1)(A) [of the Investment Company Act of 1940 (the “Investment Company Act”)]. To assess a SPAC’s status as an investment company under that definition, we generally look to the SPAC’s assets, the sources of its income, its historical development, its public representations of policy, and the activities of its officers and directors (known as the “Tonopah factors”). SPACs are generally formed to identify, acquire and operate a target company through a business combination and not with a stated purpose of being an investment company. We understand that SPACs typically view their public

8

representations, historical development and efforts of officers and directors as consistent with those of issuers that are not investment companies. At the same time, most SPACs ordinarily invest substantially all their assets in securities, often for a period of a year or more, meaning that investors hold interests for an extended period in a pool of securities. Moreover, whatever income a SPAC generates during this period is generally attributable to its securities holdings. The asset composition and sources of income for most SPACs may therefore raise questions about their status as investment companies under Section 3(a)(1)(A) of the Investment Company Act and, in assessing this status, these factors would need to be weighed together with the other Tonopah factors. The Company was formed for the purpose of identifying, acquiring and operating a target company through a business combination and not with the purpose of being an investment company. In an effort to mitigate the risk that the Company might be deemed to be an investment company, the Company has moved all of its assets held in the Trust from government securities to a bank demand deposit account which had an interest yield of 5.20% for the month of March 2024 in order to preclude the generation of any future yield on the assets in the Trust by means of investment in a pool of securities, and the Company intends to maintain its assets in this account until it consummates its initial business combination, or winds up its existence and liquidates. There can be no assurance that this action will foreclose a judicial or regulatory finding, or an allegation, that the Company is an investment company.

We Were Delisted from the Nasdaq, and There is a Limited Trading Volume for our Common Stock on the OTCQX.

In July 2024, our common stock was delisted from The Nasdaq Stock Market LLC (the “Nasdaq”). Our common stock currently trades on the OTCQX tier of the OTC Markets Group Inc. (the “OTCQX”) under the symbol BRZH, and there is a limited trading volume for our common stock. As a result, relatively small trades of our common stock may have a significant impact on the price of our common stock and, therefore, may contribute to the price volatility of our common stock. Because of limited trading volume in our common stock and the price volatility of our common stock, you may be unable to sell your shares of common stock when you desire or at the price you desire. The inability to sell your shares in a declining market because of such illiquidity or at a price you desire may substantially increase your risk of loss.

The delisting of our common stock from the Nasdaq may have an adverse effect on institutional investor interest in holding or acquiring our common stock and otherwise reduce the number of investors willing to hold or acquire our common stock. This could negatively affect our ability to raise capital necessary to maintain operations and service our debt or effect any contemplated strategic alternatives to restructure our outstanding indebtedness. In addition, the delisting of our common stock from the Nasdaq may cause a loss of confidence among our employees and customers and otherwise negatively affect our financial condition, results of operations and cash flows.

We do not currently meet the listing standards of the Nasdaq or any other national securities exchange. We presently anticipate that our common stock will continue to be quoted on the OTCQX. As a result of the limited trading volume for our common stock, investors may be unable to sell shares of common stock at the times or in the quantities desired and, therefore, may be required to hold some or all of their shares for an indefinite period of time.

The delisting may make us less attractive as a merger partner for potential target companies, as many targets seek to merge with entities that offer immediate access to a major national securities exchange. This could materially impair our ability to complete a business combination within the required timeframe, potentially subjecting us to dissolution and the return of funds held in trust to our public shareholders.

We may not be able to complete an initial business combination with a U.S. target company if such initial business combination is subject to U.S. foreign investment regulations and review by a U.S. government entity such as the Committee on Foreign Investment in the United States (CFIUS), or is ultimately prohibited.

None of the members of the Company’s sponsor group is, is controlled by, or has substantial ties with a foreign person and therefore, we believe, will not be subject to U.S. foreign investment regulations and review by a U.S. government entity such as the Committee on Foreign Investment in the United States (CFIUS). However, our initial business combination with a U.S. business may be subject to CFIUS review, the scope of which was expanded by the Foreign Investment Risk Review Modernization Act of 2018 (“FIRRMA”), to include certain non-passive, non-controlling investments in sensitive U.S. businesses and certain acquisitions of real estate even with no underlying U.S. business. FIRRMA, and subsequent implementing regulations that are now in force, also subjects certain categories of investments to mandatory filings. If our potential initial business combination with a U.S. business falls within CFIUS’s jurisdiction, we may determine that we are required to make a mandatory filing or that we will submit a voluntary notice to CFIUS,

9

or to proceed with the initial business combination without notifying CFIUS and risk CFIUS intervention, before or after closing the initial business combination. CFIUS may decide to block or delay our initial business combination, impose conditions to mitigate national security concerns with respect to such initial business combination or order us to divest all or a portion of a U.S. business of the combined company without first obtaining CFIUS clearance, which may limit the attractiveness of or prevent us from pursuing certain initial business combination opportunities that we believe would otherwise be beneficial to us and our shareholders. As a result, the pool of potential targets with which we could complete an initial business combination may be limited and we may be adversely affected in terms of competing with other special purpose acquisition companies which do not have similar foreign ownership issues.

Moreover, the process of government review, whether by the CFIUS or otherwise, could be lengthy and we have limited time to complete our initial business combination. If we cannot complete our initial business combination by December 26, 2024, or such later date that may be approved by our shareholders, such as the Extended Date, because the review process extends beyond such timeframe or because our initial business combination is ultimately prohibited by CFIUS or another U.S. government entity, we may be required to liquidate. If we liquidate, our public shareholders may only receive $11.085 per share, without taking into account any interest earned on IPO proceeds held in the Trust Account, and our warrants will expire worthless. This will also cause you to lose the investment opportunity in a target company, and the chance of realizing future gains on your investment through any price appreciation in the combined company.

A new 1% U.S. federal excise tax could be imposed on the Company in connection with redemptions by Company of its shares in connection with a business combination or other stockholder vote pursuant to which stockholders would have a right to submit their shares for redemption (a “Redemption Event”).

On August 16, 2022, the Inflation Reduction Act of 2022 (“IR Act”) was signed into federal law. The IR Act provides for, among other things, a new U.S. federal 1% excise tax on certain repurchases (including redemptions) of stock by publicly traded domestic (i.e., U.S.) corporations and certain domestic subsidiaries of publicly traded foreign corporations.

The excise tax is imposed on the repurchasing corporation itself, not its stockholders from which shares are repurchased. The amount of the excise tax is generally 1% of the fair market value of the shares repurchased at the time of the repurchase. However, for purposes of calculating the excise tax, repurchasing corporations are permitted to net the fair market value of certain new stock issuances against the fair market value of stock repurchases during the same taxable year. In addition, certain exceptions apply to the excise tax. The Treasury has been given authority to provide regulations and other guidance to carry out, and prevent the abuse or avoidance of the excise tax. In this regard, on December 27, 2022, the Treasury and the Internal Revenue Service issued a notice announcing their intent to issue proposed regulations addressing the application of the excise tax, and describing certain rules on which taxpayers may rely prior to the issuance of such proposed regulations (the “Notice”).

Any redemption or other repurchase that occurs after December 31, 2022 in connection with a Redemption Event may be subject to the excise tax. Pursuant to the rules set forth in the Notice, however, redemptions in connection with a liquidation of the Company are generally not subject to the excise tax. Whether and to what extent the Company would be subject to the excise tax in connection with a Redemption Event would depend on a number of factors, including (i) the fair market value of the redemptions and repurchases in connection with the Redemption Event, (ii) the structure of the business combination, (iii) the nature and amount of any “PIPE” or other equity issuances in connection with the business combination (or otherwise issued not in connection with the Redemption Event but issued within the same taxable year of the business combination) and (iv) the content of regulations and other future guidance from the Treasury. In addition, because the excise tax would be payable by the Company, and not by the redeeming holder, the mechanics of any required payment of the excise tax have not been determined; however, the Company will not use the funds held in the Trust Account or any additional amounts deposited into the Trust Account, as well as any interest earned thereon, to pay the excise tax (if any). The foregoing could cause a reduction in the cash available on hand to complete a business combination and in the Company’s ability to complete a business combination.

Redemption Rights

If the Extension Proposal is approved and the Extension Amendment is implemented, each public stockholder may seek to redeem its public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (which interest shall be net of taxes payable), divided by the number of then

10

outstanding public shares. An aggregate of 3,140,000 shares are not subject to redemption pursuant to the Extension Proposal which amount includes the Founder Shares as well as 212,500 representative shares held by I-Bankers, 37,500 representative shares held by Northland Capital Markets and 15,000 consultant shares. A public stockholder will have this redemption right regardless of how it voted, or whether it voted, with respect to the Extension Proposal. Holders of public shares who do not elect to redeem their public shares in connection with the Extension will retain the right to redeem their public shares in connection with any stockholder vote to approve a proposed business combination, or if the Company has not consummated a business combination by the Extended Date.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST SUBMIT A REQUEST IN WRITING THAT WE REDEEM YOUR PUBLIC SHARES FOR CASH TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY AT THE ADDRESS BELOW, AND, AT THE SAME TIME, COMPLY, OR ENSURE YOUR BANK OR BROKER COMPLIES, WITH THE REQUIREMENTS IDENTIFIED ELSEWHERE HEREIN, INCLUDING DELIVERING YOUR SHARES TO THE TRANSFER AGENT PRIOR TO 5:00 P.M. EASTERN TIME ON DECEMBER 19, 2024. The redemption rights include the requirement that a stockholder must identify itself in writing as a beneficial holder and provide its legal name, phone number, and address in order to validly redeem its public shares.

In connection with tendering your shares for redemption, prior to 5:00 p.m. Eastern time on December 19, 2024 (two business days before the Special Meeting), you must elect either to physically tender your stock certificates to Continental Stock Transfer & Trust Company, 1 State Street Plaza, 30th Floor, New York, New York 10004, Attn: Mark Zimkind, mzimkind@continentalstock.com, or to deliver your shares to the transfer agent electronically using the Depository Trust Company’s (“DTC”) DWAC system, which election would likely be determined based on the manner in which you hold your shares. The requirement for physical or electronic delivery prior to 5:00 p.m. Eastern time on December 19, 2024 (two business days before the Special Meeting) ensures that a redeeming holder’s election is irrevocable once the Extension Proposal is approved. In furtherance of such irrevocable election, stockholders making the election will not be able to tender their shares after the vote at the Special Meeting.

Through the DWAC system, this electronic delivery process can be accomplished by the stockholder, whether or not it is a record holder or its shares are held in “street name,” by contacting the transfer agent or its broker and requesting delivery of its shares through the DWAC system. Delivering shares physically may take significantly longer. In order to obtain a physical stock certificate, a stockholder’s broker and/or clearing broker, DTC, and the Company’s transfer agent will need to act together to facilitate this request. There is a nominal cost associated with the above-referenced tendering process and the act of certificating the shares or delivering them through the DWAC system. The transfer agent will typically charge the tendering broker $45 and the broker would determine whether or not to pass this cost on to the redeeming holder. It is the Company’s understanding that stockholders should generally allot at least two weeks to obtain physical certificates from the transfer agent. The Company does not have any control over this process or over the brokers or DTC, and it may take longer than two weeks to obtain a physical stock certificate. Such stockholders will have less time to make their investment decision than those stockholders that deliver their shares through the DWAC system. Stockholders who request physical stock certificates and wish to redeem may be unable to meet the deadline for tendering their shares before exercising their redemption rights and thus will be unable to redeem their shares.

Certificates that have not been tendered in accordance with these procedures prior to 5:00 p.m. Eastern time on December 19, 2024 (two business days before the Special Meeting) will not be redeemed for cash held in the Trust Account on the redemption date. In the event that a public stockholder tenders its shares and decides prior to the vote at the Special Meeting that it does not want to redeem its shares, the stockholder may withdraw the tender. If you delivered your shares for redemption to our transfer agent and decide prior to the vote at the Special Meeting not to redeem your public shares, you may request that our transfer agent return the shares (physically or electronically). You may make such request by contacting our transfer agent at the address listed above. In the event that a public stockholder tenders shares and the Extension Proposal is not approved or the Extension is otherwise not implemented, these shares will not be redeemed and the physical certificates representing these shares will be returned to the stockholder promptly following the determination that the Extension Proposal will not be approved. The Company anticipates that a public stockholder who tenders shares for redemption in connection with the vote to approve the Extension Proposal would receive payment of the redemption price for such shares soon after implementation of the Extension. The transfer agent will hold the certificates of public stockholders that make the election until such shares are redeemed for cash or returned to such stockholders.

11

If properly demanded, the Company will redeem each public share for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (which interest shall be net of taxes payable), divided by the number of then outstanding public shares. Based upon the amount in the Trust Account as of the record date, the Company anticipates that the per-share price at which public shares will be redeemed from cash held in the Trust Account will be approximately $11.085 at the time of the Special Meeting. The closing price of the Company’s common stock on August 18, 2023 was $11.085.

If you exercise your redemption rights, you will be exchanging your shares of the Company’s common stock for cash and will no longer own the shares. You will be entitled to receive cash for these shares only if you properly demand redemption and tender your stock certificate(s) to the Company’s transfer agent prior to 5:00 p.m. Eastern time on December 19, 2024 (two business days before the Special Meeting).

12

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a summary of certain United States federal income tax considerations for holders of our common stock with respect to the exercise of redemption rights in connection with the approval of the Extension Proposal. This summary is based upon the Internal Revenue Code of 1986, as amended, which we refer to as the “Code”, the regulations promulgated by the U.S. Treasury Department, current administrative interpretations and practices of the Internal Revenue Service, which we refer to as the “IRS”, and judicial decisions, all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain a position contrary to any of the tax considerations described below. This summary does not discuss all aspects of United States federal income taxation that may be important to particular investors in light of their individual circumstances, such as investors subject to special tax rules (e.g., financial institutions, insurance companies, mutual funds, pension plans, S corporations, broker-dealers, traders in securities that elect mark-to-market treatment, regulated investment companies, real estate investment trusts, trusts and estates, partnerships and their partners, and tax-exempt organizations (including private foundations)) and investors that hold common stock as part of a “straddle,” “hedge,” “conversion,” “synthetic security,” “constructive ownership transaction,” “constructive sale,” or other integrated transaction for United States federal income tax purposes, investors subject to the alternative minimum tax provisions of the Code, U.S. Holders (as defined below) that have a functional currency other than the United States dollar, U.S. expatriates, investors that actually or constructively own five percent or more of the common stock of the Company, and Non-U.S. Holders (as defined below, and except as otherwise discussed below), all of whom may be subject to tax rules that differ materially from those summarized below. In addition, this summary does not discuss any state, local, or non-United States tax considerations, any non-income tax (such as gift or estate tax) considerations, alternative minimum tax or the Medicare tax. In addition, this summary is limited to investors that hold our common stock as “capital assets” (generally, property held for investment) under the Code.

If a partnership (including an entity or arrangement treated as a partnership for United States federal income tax purposes) holds our common stock, the tax treatment of a partner in such partnership will generally depend upon the status of the partner, the activities of the partnership and certain determinations made at the partner level. If you are a partner of a partnership holding our common stock, you are urged to consult your tax advisor regarding the tax consequences of a redemption.

WE URGE HOLDERS OF OUR COMMON STOCK CONTEMPLATING EXERCISE OF THEIR REDEMPTION RIGHTS TO CONSULT THEIR OWN TAX ADVISORS CONCERNING THE UNITED STATES FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES THEREOF.

U.S. Federal Income Tax Considerations to U.S. Holders

This section is addressed to U.S. Holders of our common stock that elect to have their common stock redeemed for cash. For purposes of this discussion, a “U.S. Holder” is a beneficial owner that so redeems its common stock of the Company and is:

• an individual who is a United States citizen or resident of the United States;

• a corporation (including an entity treated as a corporation for United States federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

• an estate the income of which is includible in gross income for United States federal income tax purposes regardless of its source; or

• a trust (A) the administration of which is subject to the primary supervision of a United States court and which has one or more United States persons (within the meaning of the Code) who have the authority to control all substantial decisions of the trust or (B) that has in effect a valid election under applicable Treasury regulations to be treated as a United States person.

13

Redemption of Common Stock

In the event that a U.S. Holder’s common stock of the Company is redeemed, the treatment of the transaction for U.S. federal income tax purposes will depend on whether the redemption qualifies as a sale of the common stock under Section 302 of the Code. Whether the redemption qualifies for sale treatment will depend largely on the total number of shares of our stock treated as held by the U.S. Holder (including any stock constructively owned by the U.S. Holder as a result of owning warrants or rights) relative to all of our shares both before and after the redemption. The redemption of common stock generally will be treated as a sale of the common stock (rather than as a distribution) if the redemption (i) is “substantially disproportionate” with respect to the U.S. Holder, (ii) results in a “complete termination” of the U.S. Holder’s interest in us or (iii) is “not essentially equivalent to a dividend” with respect to the U.S. Holder. These tests are explained more fully below.

In determining whether any of the foregoing tests are satisfied, a U.S. Holder takes into account not only stock actually owned by the U.S. Holder, but also shares of our stock that are constructively owned by it. A U.S. Holder may constructively own, in addition to stock owned directly, stock owned by certain related individuals and entities in which the U.S. Holder has an interest or that have an interest in such U.S. Holder, as well as any stock the U.S. Holder has a right to acquire by exercise of an option, which would generally include common stock which could be acquired pursuant to the exercise of the warrants and possibly the rights. In order to meet the substantially disproportionate test, the percentage of our outstanding voting stock actually and constructively owned by the U.S. Holder immediately following the redemption of common stock must, among other requirements, be less than 80% of our outstanding voting stock actually and constructively owned by the U.S. Holder immediately before the redemption. There will be a complete termination of a U.S. Holder’s interest if either (i) all of the shares of our stock actually and constructively owned by the U.S. Holder are redeemed or (ii) all of the shares of our stock actually owned by the U.S. Holder are redeemed and the U.S. Holder is eligible to waive, and effectively waives in accordance with specific rules, the attribution of stock owned by certain family members and the U.S. Holder does not constructively own any other stock. The redemption of the common stock will not be essentially equivalent to a dividend if a U.S. Holder’s conversion results in a “meaningful reduction” of the U.S. Holder’s proportionate interest in us. Whether the redemption will result in a meaningful reduction in a U.S. Holder’s proportionate interest in us will depend on the particular facts and circumstances. However, the IRS has indicated in a published ruling that even a small reduction in the proportionate interest of a small minority stockholder in a publicly held corporation who exercises no control over corporate affairs may constitute such a “meaningful reduction.”

If none of the foregoing tests are satisfied, then the redemption will be treated as a distribution and the tax effects will be as described below under “U.S. Federal Income Tax Considerations to U.S. Holders — Taxation of Distributions.”

U.S. Holders of our common stock considering exercising their redemption rights should consult their own tax advisors as to whether the redemption of their common stock of the Company will be treated as a sale or as a distribution under the Code.

Gain or Loss on a Redemption of Common Stock Treated as a Sale

If the redemption qualifies as a sale of common stock, a U.S. Holder must treat any gain or loss recognized as capital gain or loss. Any such capital gain or loss will be long-term capital gain or loss if the U.S. Holder’s holding period for the common stock so disposed of exceeds one year. Generally, a U.S. Holder will recognize gain or loss in an amount equal to the difference between (i) the amount of cash received in such redemption and (ii) the U.S. Holder’s adjusted tax basis in its common stock so redeemed. A U.S. Holder’s adjusted tax basis in its common stock generally will equal the U.S. Holder’s acquisition cost (that is, the portion of the purchase price of a unit allocated to a share of common stock or the purchase price of a share of common stock purchased in the open market) less any prior distributions treated as a return of capital. Long-term capital gain realized by a non-corporate U.S. Holder generally will be taxable at a reduced rate. The deduction of capital losses is subject to limitations.

Taxation of Distributions

If the redemption does not qualify as a sale of common stock, the U.S. Holder will be treated as receiving a distribution. In general, any distributions to U.S. Holders generally will constitute dividends for United States federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under United States federal income tax principles. Distributions in excess of current and accumulated earnings and profits will constitute a return of capital that will be applied against and reduce (but not below zero) the U.S. Holder’s adjusted tax basis in our

14

common stock. Any remaining excess will be treated as gain realized on the sale or other disposition of the common stock and will be treated as described under “U.S. Federal Income Tax Considerations to U.S. Holders — Gain or Loss on a Redemption of Common Stock Treated as a Sale”. Dividends we pay to a U.S. Holder that is a taxable corporation generally will qualify for the dividends received deduction if the requisite holding period is satisfied. With certain exceptions, and provided certain holding period requirements are met, dividends we pay to a non-corporate U.S. Holder generally will constitute “qualified dividends” that will be taxable at a reduced rate.

U.S. Federal Income Tax Considerations to Non-U.S. Holders

This section is addressed to Non-U.S. Holders of our common stock that elect to have their common stock redeemed for cash. For purposes of this discussion, a “Non-U.S. Holder” is a beneficial owner (other than a partnership) that so redeems its common stock of the Company and is not a U.S. Holder.

Redemption of Common Stock

The characterization for United States federal income tax purposes of the redemption of a Non-U.S. Holder’s common stock generally will correspond to the United States federal income tax characterization of such a redemption of a U.S. Holder’s common stock, as described under “U.S. Federal Income Tax Considerations to U.S. Holders”.

Non-U.S. Holders of our common stock considering exercising their redemption rights should consult their own tax advisors as to whether the redemption of their common stock of the Company will be treated as a sale or as a distribution under the Code.

Gain or Loss on a Redemption of Common Stock Treated as a Sale

If the redemption qualifies as a sale of common stock, a Non-U.S. Holder generally will not be subject to United States federal income or withholding tax in respect of gain recognized on a sale of its common stock of the Company, unless:

• the gain is effectively connected with the conduct of a trade or business by the Non-U.S. Holder within the United States (and, under certain income tax treaties, is attributable to a United States permanent establishment or fixed base maintained by the Non-U.S. Holder), in which case the Non-U.S. Holder will generally be subject to the same treatment as a U.S. Holder with respect to the redemption, and a corporate Non-U.S. Holder may be subject to the branch profits tax at a 30% rate (or lower rate as may be specified by an applicable income tax treaty);

• the Non-U.S. Holder is an individual who is present in the United States for 183 days or more in the taxable year in which the redemption takes place and certain other conditions are met, in which case the Non-U.S. Holder will be subject to a 30% tax on the individual’s net capital gain for the year; or

• we are or have been a “U.S. real property holding corporation” for United States federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition or the period that the Non-U.S. Holder held our common stock, and, in the case where shares of our common stock are regularly traded on an established securities market, the Non-U.S. Holder has owned, directly or constructively, more than 5% of our common stock at any time within the shorter of the five-year period preceding the disposition or such Non-U.S. Holder’s holding period for the shares of our common stock. We do not believe we are or have been a U.S. real property holding corporation.

Taxation of Distributions

If the redemption does not qualify as a sale of common stock, the Non-U.S. Holder will be treated as receiving a distribution. In general, any distributions we make to a Non-U.S. Holder of shares of our common stock, to the extent paid out of our current or accumulated earnings and profits (as determined under United States federal income tax principles), will constitute dividends for U.S. federal income tax purposes and, provided such dividends are not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States, we will be required to withhold tax from the gross amount of the dividend at a rate of 30%, unless such Non-U.S. Holder is eligible for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification of its eligibility for such reduced rate. Any distribution not constituting a dividend will be treated first as reducing (but not below zero) the Non-U.S. Holder’s adjusted tax basis in its shares of our common stock and, to the extent such distribution

15

exceeds the Non-U.S. Holder’s adjusted tax basis, as gain realized from the sale or other disposition of the common stock, which will be treated as described under “U.S. Federal Income Tax Considerations to Non-U.S. Holders — Gain on Sale, Taxable Exchange or Other Taxable Disposition of Common Stock”. Dividends we pay to a Non-U.S. Holder that are effectively connected with such Non-U.S. Holder’s conduct of a trade or business within the United States generally will not be subject to United States withholding tax, provided such Non-U.S. Holder complies with certain certification and disclosure requirements. Instead, such dividends generally will be subject to United States federal income tax, net of certain deductions, at the same graduated individual or corporate rates applicable to U.S. Holders (subject to an exemption or reduction in such tax as may be provided by an applicable income tax treaty). If the Non-U.S. Holder is a corporation, dividends that are effectively connected income may also be subject to a “branch profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty).

As previously noted above, the foregoing discussion of certain material U.S. federal income tax consequences is included for general information purposes only and is not intended to be, and should not be construed as, legal or tax advice to any stockholder. We once again urge you to consult with your own tax adviser to determine the particular tax consequences to you (including the application and effect of any U.S. federal, state, local or foreign income or other tax laws) of the receipt of cash in exchange for shares redeemed in connection with the Extension Proposal.

16

PROPOSAL 2:

THE TRUST AMENDMENT PROPOSAL

Overview

The Company entered into that certain Investment Management Trust Agreement, dated November 23, 2020 (as amended, the “Trust Agreement”), by and between the Company and Continental Stock Transfer & Company (the “Trustee”) in connection with the Company’s IPO and a potential business combination.

The proposed amendment to the Trust Agreement, in the form set forth in Annex B hereof (the “Trust Amendment”), would amend the Trust Agreement to authorize the Extension as contemplated by the Extension Proposal.

Reasons for the Proposal

The purpose of the Trust Amendment Proposal is to authorize the Extension under the Trust Agreement, as the Extension is not contemplated under the Trust Agreement’s current terms.

We believe that given the Company’s expenditure of time, effort and money on pursuing an initial business combination, circumstances warrant providing public stockholders an opportunity to consider a business combination. For the Company to implement the Extension, the Trust Agreement must be amended to authorize the Extension.

Vote Required for Approval

The affirmative vote of holders of 65% of the Company’s outstanding shares of common stock, including the Founder Shares, is required to approve the Trust Amendment Proposal. If you do not vote, you abstain from voting or you fail to instruct your broker or other nominee as to the voting of shares you beneficially own, your action will have the same effect as a vote “AGAINST” the Trust Amendment Proposal. If you do not want the Trust Amendment Proposal approved, you must abstain, not vote, or vote “AGAINST” the Trust Amendment.