U. S. SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] |

QUARTERLY REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

May 31, 2015

| [ ] |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________

to __________

Commission File Number:

333-172139

BioPower Operations Corporation

(Exact name of registrant as

specified in its charter)

| Nevada |

|

27-4460232 |

| (State

or other jurisdiction of |

|

(IRS

Employer |

| incorporation

or organization) |

|

Identification

No.) |

1000 Corporate Drive, Suite 200, Fort Lauderdale,

Florida 33334

(Address of principal executive offices)

Issuer’s telephone number, including

area code: (954) 202-6660

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule

12b-2 of the Exchange Act.

| Large

accelerated filer [ ] |

Accelerated

filer [ ] |

| Non-accelerated

filer [ ] (Do not check if a smaller reporting company) |

Smaller

reporting company [X] |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding

of each of the registrant’s classes of common stock, as of the latest practicable date.

As of August 5, 2015, the

registrant had 41,657,680 shares of common stock, par value $0.0001 per share, outstanding.

BIOPOWER OPERATIONS CORPORATION

CONTENTS

CONTENTS

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

BioPower Operations Corporation and Subsidiaries

Consolidated Balance

Sheets

| | |

May

31, 2015 | | |

November

30, 2014 | |

| | |

(Unaudited) | | |

| |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 13,677 | | |

$ | 15,118 | |

| Prepaid expenses | |

| 2,121 | | |

| 818 | |

| Total Current

Assets | |

| 15,798 | | |

| 15,936 | |

| | |

| | | |

| | |

| Equipment - net | |

| 4,881 | | |

| 21,234 | |

| Security deposit | |

| 6,937 | | |

| 11,193 | |

| | |

| 11,818 | | |

| 32,427 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 27,616 | | |

$ | 48,363 | |

| | |

| | | |

| | |

| Liabilities

and Stockholders’ Deficit | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 428,952 | | |

$ | 419,090 | |

| Accounts payable and accrued expenses - related parties | |

| 2,324,517 | | |

| 1,455,540 | |

| Notes payable - related parties | |

| 28,025 | | |

| 51,375 | |

| Notes payable | |

| 240,000 | | |

| 155,000 | |

| Convertible debt, net of discount | |

| 18,083 | | |

| 62,500 | |

| Convertible debt - related parties, net of discount | |

| 18,083 | | |

| - | |

| Total Current

Liabilities | |

| 3,057,660 | | |

| 2,143,505 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 3,057,660 | | |

| 2,143,505 | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Preferred stock, $1 par value; 10,000 shares authorized; 1 share issued and

outstanding | |

| 1 | | |

| 1 | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized; 41,657,680

shares and 41,107,680 shares, respectively, issued and outstanding | |

| 4,167 | | |

| 4,112 | |

| Additional paid-in capital | |

| 3,657,376 | | |

| 3,580,931 | |

| Accumulated deficit | |

| (6,691,588 | ) | |

| (5,680,186 | ) |

| Total Stockholders’

Deficit | |

| (3,030,044 | ) | |

| (2,095,142 | ) |

| | |

| | | |

| | |

| Total Liabilities

and Stockholders’ Deficit | |

$ | 27,616 | | |

$ | 48,363 | |

See accompany notes to consolidated financial

statements

BioPower Operations Corporation and Subsidiaries

Consolidated Statements

of Operations

(Unaudited)

| | |

Three

Months Ended May 31, | | |

Six

Months Ended May 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Revenue, net of costs | |

$ | 7,265 | | |

$ | - | | |

$ | 7,265 | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| General and

administrative expenses | |

| 516,119 | | |

| 278,562 | | |

| 1,004,504 | | |

| 639,015 | |

| Loss from operations | |

| (508,854 | ) | |

| (278,562 | ) | |

| (997,239 | ) | |

| (639,015 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (8,155 | ) | |

| (12,220 | ) | |

| (14,163 | ) | |

| (18,115 | ) |

| Consulting revenue, net of expense | |

| - | | |

| 34,868 | | |

| - | | |

| 111,401 | |

| Total other

income (expense) - net | |

| (8,155 | ) | |

| 22,648 | | |

| (14,163 | ) | |

| 93,286 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (517,009 | ) | |

$ | (255,914 | ) | |

$ | (1,011,402 | ) | |

$ | (545,729 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per

common share - basic and diluted | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.02 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average

number of common shares outstanding during the period - basic and diluted | |

| 41,623,880 | | |

| 30,429,532 | | |

| 41,499,060 | | |

| 30,355,356 | |

See

accompany notes to consolidated financial statements

BioPower Operations Corporation and Subsidiaries

Consolidated Statements

of Cash Flows

(Unaudited)

| | |

Six

Months Ended May 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (1,011,402 | ) | |

$ | (545,729 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 6,170 | | |

| 6,170 | |

| Stock based compensation | |

| 2,500 | | |

| 183,650 | |

| Loss on sale of equipment | |

| 4,183 | | |

| - | |

| Amortization of debt discount | |

| 5,166 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| - | | |

| (25,853 | ) |

| Prepaid expenses and other current assets | |

| 2,953 | | |

| 8,615 | |

| Accounts payable and accrued expenses | |

| 9,862 | | |

| 199,583 | |

| Accounts payable and accrued expenses - related parties | |

| 874,977 | | |

| (46,700 | ) |

| Net

Cash Used In Operating Activities | |

| (105,591 | ) | |

| (220,264 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of equipment | |

| - | | |

| (4,754 | ) |

| Net

Cash Provided By Investing Activities | |

| | | |

| (4,754 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from convertible debt | |

| 22,500 | | |

| 125,000 | |

| Proceeds from notes payable | |

| 22,500 | | |

| - | |

| Repayment notes payable - related party | |

| (850 | ) | |

| - | |

| Proceeds from issuance of common stock | |

| 60,000 | | |

| 100 | |

| Net

Cash Provided By Financing Activities | |

| 104,150 | | |

| 125,100 | |

| | |

| | | |

| | |

| Net Increase (Decrease) in Cash | |

| (1,441 | ) | |

| (99,918 | ) |

| | |

| | | |

| | |

| Cash - Beginning of Period | |

| 15,118 | | |

| 109,172 | |

| | |

| | | |

| | |

| Cash - End of Period | |

$ | 13,677 | | |

$ | 9,254 | |

| | |

| | | |

| | |

| SUPPLEMENTARY CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash Paid During the Period for: | |

| | | |

| | |

| Income Taxes | |

$ | - | | |

$ | - | |

| Interest | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| SUPPLEMENTARY DISCLOSURE OF NON-CASH

INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Related party accounts payable settled by sale of asset to related party | |

$ | 6,000 | | |

$ | - | |

| Reclassification of note payable from convertible to non convertible | |

| 62,500 | | |

| - | |

| Reclassification of note payable from non convertible to convertible | |

| 22,500 | | |

| - | |

| Debt discount recorded on convertible debt | |

| 7,000 | | |

| - | |

| Debt discount recorded on convertible debt - related party | |

| 7,000 | | |

| - | |

See accompany notes to consolidated financial

statements

BioPower Operations Corporation and Subsidiaries

Notes to Consolidated

Financial Statements

May 31, 2015 and 2014

Unaudited

Note 1 Basis of Presentation

The accompanying unaudited interim consolidated

financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America

(“GAAP”) for interim financial information and pursuant to the instructions to Form 10-Q and Article 8 of Regulation

S-X of the United States Securities and Exchange Commission (“SEC”). Certain information or footnote disclosures normally

included in financial statements prepared in accordance with accounting principles generally accepted in the United States of

America have been condensed or omitted, pursuant to the rules and regulations of the SEC for interim financial reporting. Accordingly,

they do not include all the information and footnotes necessary for a comprehensive presentation of financial position, results

of operations, or cash flows. It is our opinion, however, that the accompanying unaudited interim consolidated financial statements

include all adjustments, consisting of a normal recurring nature, which are necessary for a fair presentation of the financial

position, operating results and cash flows for the periods presented.

The accompanying unaudited interim consolidated

financial statements should be read in conjunction with our Annual Report on Form 10-K for the year ended November 30, 2014 as

filed with the SEC, which contains the audited financial statements and notes thereto, together with Management’s Discussion

and Analysis, for the years ended November 30, 2014 and 2013. The financial information as of May 31, 2015 is derived from the

audited financial statements presented in our Annual Report on Form 10-K for the year ended November 30, 2014. The interim results

for the three and six months ended May 31, 2015 are not necessarily indicative of the results to be expected for the year ending

November 30, 2015 or for any future interim periods.

Note 2 Going Concern

As reflected in the accompanying consolidated

financial statements, the Company had a net loss of $1,011,402 and net cash used in operations of $105,591 for the six months

ended May 31, 2015. Additionally, the Company had a working capital deficit of $3,041,862 and a stockholders’ deficit of

$3,030,044 at May 31, 2015. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as

a going concern is dependent on Management’s plans, which include potential asset acquisitions, mergers or business combinations

with other entities, further implementation of its business plan and continuing to raise funds through debt and/or equity financings.

The Company will likely rely upon related party debt and/or equity financing in order to ensure the continuing existence of the

business.

The accompanying consolidated financial statements

have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities

in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded

assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

BioPower Operations Corporation and Subsidiaries

Notes to Consolidated Financial Statements

May 31, 2015 and 2014

Unaudited

Note 3 Equipment

At May 31, 2015 and November 30, 2014, equipment

consists of the following:

| |

|

2015 |

|

|

2014 |

|

|

Estimated

Useful Life |

| Computer

Equipment |

|

$ |

27,760 |

|

|

$ |

27,760 |

|

|

5

years |

| Testing Equipment |

|

|

- |

|

|

|

20,366 |

|

|

3

years |

| Less:

Accumulated depreciation |

|

|

(22,879 |

) |

|

|

(26,892 |

) |

|

|

| Equipment, net |

|

$ |

4,881 |

|

|

$ |

21,234 |

|

|

|

Note 4. Notes Payable and Convertible

Debt

Notes payable consists of the following:

| | |

Balance | | |

Interest

Rate | | |

Maturity |

| Balance – November 30, 2014 | |

$ | 155,000 | | |

| 8 | % | |

Various |

| Reclassification of convertible debt to notes payable | |

| 62,500 | | |

| 8 | % | |

Due on Demand |

| Borrowings | |

| 7,500 | | |

| 8 | % | |

September 1, 2015 |

| Borrowings | |

| 15,000 | | |

| 8 | % | |

July 14, 2015 |

| Balance – May 31, 2015 | |

$ | 240,000 | | |

| | | |

|

In December, 2013, a third party investor

purchased $125,000 of convertible debt, bearing interest, at 8% interest, and due February, 2015. In November, 2014, the Company

converted $62,500 according to the terms of the Convertible Note Purchase Agreement. The remaining balance of $62,500 is not convertible

to common shares of the Company’s stock. The $62,500 note payable bears interest at 8% and is due on demand.

In December, 2014 a third party investor combined

two previous loans dated July 2, 2013 and September 11, 2014 for $18,000 and $5,000, respectively, into a new loan of $23,000,

at 8% interest. The new loan was due on May 5, 2015.

In May, 2015 a third party investor advanced

$7,500, at 8% interest, which is due on September 1, 2015.

On May 13, 2015 a third party investor advanced

$30,000 of which $15,000 was not convertible. The loan was due on or before July 14, 2015, at 8% interest.

Convertible debt consists of the following:

| | |

Balance | | |

Interest

Rate | | |

Maturity | | |

Conversion

Price | |

| | |

| | | |

| | | |

| | | |

| | |

| Balance – November 30, 2014 | |

$ | 62,500 | | |

| 8 | % | |

| | | |

$ | 0.10 | |

| Reclassification to notes payable | |

| (62,500 | ) | |

| | | |

| | | |

| | |

| Borrowings | |

| 7,500 | | |

| 8 | % | |

| December

30, 2016 | | |

$ | 0.12 | |

| Borrowings | |

| 15,000 | | |

| 8 | % | |

| July

14, 2015 | | |

$ | 0.15 | |

| Debt discount | |

| (4,417 | ) | |

| | | |

| | | |

| | |

| Balance – May 31, 2015 | |

$ | 18,083 | | |

| | | |

| | | |

| | |

On December 30, 2014 a third party investor

advanced $7,500 due on or before December 30, 2015. Pursuant to the agreement, the investor is allowed to convert 100% of the

debt at a share price of $0.12. The company accounted for the conversion of loan in accordance with ASC 470, “Debt with

Conversion and Other Options”. The loan was deemed to have a beneficial conversion feature because the fair value of the

stock exceeded the effective conversion price embedded in the loan on the commitment date. Accordingly, the Company recorded the

value of the beneficial conversion feature, which was determined to be $5,000 as a discount to the loan and a corresponding increase

to additional paid in capital.

BioPower Operations Corporation and Subsidiaries

Notes to Consolidated Financial Statements

May 31, 2015 and 2014

Unaudited

On May 13, 2015 a third party investor advanced

$30,000 due on or before July 15, 2015. Pursuant to the agreement, the investor is allowed to convert 50% of the debt at a share

price of $0.15. The company accounted for the conversion of loan in accordance with ASC 470, “Debt with Conversion and Other

Options”. The loan was deemed to have a beneficial conversion feature because the fair value of the stock exceeded the effective

conversion price embedded in the loan on the commitment date. Accordingly, the Company recorded the value of the beneficial conversion

feature, which was determined to be $2,000 as a discount to the loan and a corresponding increase to additional paid in capital.

The loan was due on or before July 14, 2015, at 8% interest.

Accrued interest on notes payable and convertible

debt at May 31, 2015 and November 30, 2014 amounted to $14,039 and $9,009, respectively, which is included as a component of accounts

payable and accrued expenses.

Interest expense on notes payable and convertible

debt with third parties amounted to $5,330 and $14,447 for the three months ended May 31, 2015 and 2014, respectively.

Note 5. Related Party Transactions

Notes payable to related parties at May 31,

2015 and November 30, 2014 is $28,025 and $51,200, respectively. Convertible notes payable to related parties is $22,500 at May

31, 2015, with a corresponding debt discount of $4,417 for a net amount of $18,083.

Accrued interest at May 31, 2015 and November

30, 2014, amounted to $2,437 and $190, respectively and is a component of accounts payable and accrued expenses – related

parties.

On November 5, 2014, the Director of Business

Strategy made a loan of $50,000, bearing interest at 8% which was due on May 5, 2015, however, the note was extended to December

30, 2015 by agreement. The $50,000 non-convertible loan included a provision for matching, future conversion rights with any new

loans made by the company with the exception of a Right of First Refusal. On December 30, 2014, a third party investor loaned

the Company $7,500 with conversion rights at $0.12 per share. Therefore, effective December 30, 2014, $7,500 of the director’s

$50,000 note payable was reclassified to convertible debt with conversion rights of $0.12 per share. The company accounted for

the conversion of loan in accordance with ASC 470, “Debt with Conversion and Other Options”. The loan was deemed to

have a beneficial conversion feature because the fair value of the stock exceeded the effective conversion price embedded in the

loan on the commitment date. Accordingly, the Company recorded the value of the beneficial conversion feature, which was determined

to be $5,000 at December 30, 2014, as a discount to the loan and a corresponding increase to additional paid in capital. On May

13, 2015, another third party investor loaned the Company $30,000 with conversion rights at $0.12 per share. Therefore, effective

May 13, 2015, an additional $15,000 of the directors’ $50,000 note payable was reclassified to convertible debt with conversion

rights of $0.12 per share. The company accounted for the conversion of loan in accordance with ASC 470, “Debt with Conversion

and Other Options”. The loan was deemed to have a beneficial conversion feature because the fair value of the stock exceeded

the effective conversion price embedded in the loan on the commitment date. Accordingly, the Company recorded the value of the

beneficial conversion feature, which was determined to be $2,000 as a discount to the loan and a corresponding increase to additional

paid in capital.

In May, 2015, a director purchased the Company’s

testing equipment for $6,000. The Company solicited bids for the sale of the equipment, which was no longer used in its business,

and the director was the highest bidder. The company recognized a loss on the sale of $4,183 on the sale.

The Company has separated accounts payable

and accrued expenses on the balance sheet to reflect amounts due to related parties primarily consisting of officer compensation,

health insurance, interest on notes and reimbursable expenses to officers for travel, meals and entertainment, vehicle and other

related business expenses.

BioPower Operations Corporation and Subsidiaries

Notes to Consolidated Financial Statements

May 31, 2015 and 2014

Unaudited

Note 6. Stockholders’ Deficit

For the six months ended May 31, 2015:

The Company issued 500,000 shares of stock

to unrelated third parties for cash totaling $60,000, at a price of $0.12 per share.

On May 1, 2015 the Company 50,000 shares of

common stock to a Consultant for services to be provided over a twelve month period, commencing May 1, 2015. In addition, the

Company shall pay to the Consultant a commission to be determined on a case by case basis for the opportunities accepted by the

Company introduced by the Consultant. The shares were valued at $2,500.

There are 41,657,680 and 41,107,680 shares

issued and outstanding at May 31, 2015 and November 30, 2014, respectively.

Note 7. Commitments and Contingencies

Commitments

Employment Agreements – Officers

and Directors

As of November 30, 2014, the Company had employment

agreements with certain officers and directors (two individuals) containing the following provisions:

| |

Term

of contract |

|

4

years, expiring on November 30, 2018 |

| |

Salary |

|

$275,000

commencing December 1, 2014 |

| |

Salary

deferral |

|

All

salaries will be accrued but may be paid from the Company’s available cash flow funds. |

Annual Salaries:

| Name |

|

|

Starting

Dec. 1, 2014 |

|

|

|

2014-15 |

|

|

|

2015-2016 |

|

|

|

2016-2017 |

|

| Robert

Kohn |

|

|

|

|

|

$ |

275,000 |

|

|

$ |

325,000 |

|

|

$ |

375,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bonnie Nelson |

|

|

|

|

|

$ |

275,000 |

|

|

$ |

325,000 |

|

|

$ |

375,000 |

|

The accrued officers and directors payroll

at May 31, 2015 is $1,518,582.

Lease Agreement

On June 3, 2013, the Company entered into

a new lease agreement with its current landlord. The lease is for a 24 month period, expiring on May 31, 2015 , and requires monthly

base rental payments of $ 4,000 for the period from June 1, 2013 through May 31, 2014 and $ 4,080 for the period from June 1,

2014 through May 31, 2015 plus adjustments for Common Area Expenses. On May 29, 2015, the Company Amended the lease agreement

extending it for an additional 12 month period, expiring on May 31, 2016, and requiring monthly base rental payments of $4,583

plus adjustments for Common Area Expenses.

Rent expense was $ 25,425 and $20,549 for

the six month period ended May 31, 2015 and May 31, 2014, respectively.

Contingencies

From time to time, the Company may be involved

in legal matters arising in the ordinary course of business. While the Company believes that such matters are currently not material,

there can be no assurance that matters arising in the ordinary course of business for which the Company is, or could be, involved

in litigation, will not have a material adverse effect on its business, financial condition or results of operations.

Note 8. Subsequent Events

On July 13, 2015, a third party investor exercised

their right and converted 50% of their $30,000 loan into common shares of stock at a price of $0.15.

Only July 24, 2015 a third party investor

combined a note in the amount of $23,000, dated December 1, 2014, along with a note in the amount of $20,000, dated October 14,

2014 and accrued interest of $2,531.28, into one note in the amount of $45,531.28, due December 30, 2015. The loan renewal and

modification allows the debt to be converted into common shares at $0.15 per share.

Only July 24, 2015 a third party investor

combined three previous loans dated July 10, 2014, October 1, 2014, and October 30, 2014 for $30,000, $10,000, and $2,000, respectively,

and accrued interest of $2,447.78, into one note in the amount of $44,447.78, due December 30, 2015. The loan renewal and modification

allows the debt to be converted into common shares at $0.15 per share.

In July, 2015, the Company accepted a common

stock subscription for 100,000 shares of common stock at $0.15 per share or $15,000.

In July, 2015, the Company entered into convertible

debt agreements totaling $120,000 at 8% interest, due on December 30, 2015. The debt is convertible into common shares of stock

at a conversion price of $0.15 per share.

In July, 2015, the Company entered into convertible

debt agreements totaling $50,000 at 8% interest, due on December 30, 2016. The debt is convertible into common shares of stock

at a conversion price of $0.15 per share.

ITEM 2. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD LOOKING STATEMENTS AND ASSOCIATED

RISK

The information contained in this Quarterly

Report on Form 10-Q (this “Quarterly Report”) is intended to update the information contained in our Annual Report

on Form 10-K for the year ended November 30, 2014 (our “2014 Annual Report”) and presumes that readers have access

to, and will have read, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and other information contained in our 2014 Annual Report. The following discussion and analysis also should be read together

with our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this Quarterly

Report.

This discussion summarizes the significant

factors affecting the consolidated operating results, financial condition and liquidity and cash flows of BioPower Operations

Corp. for the three and six months ended May 31, 2015 and 2014. Except for historical information, the matters discussed in this

Management’s Discussion and Analysis of Financial Condition and Results of Operations are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will

likely result” and similar expressions. Forward-looking statements involve risks and uncertainties and are based upon judgments

concerning various factors that are beyond our control. Forward-looking statements are based on current expectations and assumptions

and actual results could differ materially from those projected in the forward-looking statements as a result of, among other

things, those factors set forth in “Risk Factors” contained in Item 1A of our 2014 Annual Report.

Throughout this Quarterly Report, the terms

“we,” “us” and “our” refers to BioPower Operations Corporation and, Unless the context

otherwise requires, The “Company”, “we,” “us,” and “our,” refer to (i) BioPower

Operations Corporation.; (ii) BioPower Corporation (“BC”), Green3Power Holdings Company

and its subsidiaries (“G3P”), Green Oil Plantations Americas Inc. (“Green Oil”), Green Energy

Crops Corporation (“GECC”), Agribopo, Inc., FTZ Exchange LLC and FTZ Energy Corporation. Unless otherwise indicated,

all monetary amounts are reflected in United States Dollars.

Overview

From inception (September 13, 2010) to November

30, 2014, the Company focused on growing biomass crops coupled with the project development of processing and/or conversion facilities

to produce oils, biofuels, electricity and other biomass products. We also intended to utilize licensed patented technology to

convert biomass wastes into products and reduce the amount of waste going to landfills.

Today, BioPower and its subsidiaries intend

to focus on developing waste to energy projects globally by designing, engineering, permitting, procuring equipment, construction

management and operating and maintaining facilities for the conversion of wastes into electricity and synthetic fuels through

licensed gasification technology. The Company intends to also provide waste remediation services.

On August 4, 2015 the St. Lucie County Commissioners

approved the contract and its revisions with G3P to build a $175 Million Renewable Energy Facility on the St. Lucie County, Florida

landfill using the G3P Gasification Technology. The contract was executed on August 7, 2015. The contract provides for a 20 year

waste stream of 1,000 tons per day of municipal solid waste, construction and demolition waste, green waste and tires. The facility

will convert the waste into approximately 80,000 gallons per day of low sulfur synthetic diesel fuel. Vanderweil Engineers and

G3P have completed the Site Plan and are putting together the necessary documentation for permit applications. There can be no

assurance that G3P will successfully fund the $175 Million facility.

Our corporate headquarters are located at

1000 Corporate Drive, Suite 200, Fort Lauderdale, Florida 33334 and our phone number is (954) 202-6660. Our website can be found

at www.biopowercorp.com. The information on our website is not incorporated in this report.

Our Business

Typical Renewable Energy Facility Including

Gasification to Electricity or Synthetic Fuel Production

G3P designs, permits, procures equipment,

manages construction, intends to partially own and operate and maintain Renewable Waste-to-Energy Facilities using our unique

turnkey licensed technology, an upgrade to present gasification technology in use around the world for the last 30 years. These

innovative front-end sorting and drying designs in combination with gasifiers enable the company to enhance the thermal output

which could provide an increase in revenues and bottom lines. We intend to produce energy through the gasification of non-hazardous

municipal solid waste (“MSW”) and other wastes including used tires, tree cuttings, construction and demolition (C&D)

wastes and biomass in our specially designed refuse-derived fuel facilities which process waste prior to combustion and gasification,

in which waste is heated to create gases (“Syngas”) which are then combusted into steam which can be turned into electricity

through traditional steam turbines or create fuel through a Fisher-Tropsch process that has been used for the last ninety years

to create fuels. There can be no assurance we will ever build our first WtE facility.

To our knowledge this is the cleanest and

most cost effective technology for the conversion of wastes to produce electricity or synthetic fuels. Utilizing a Sorting Facility

and an advanced dryer system on the front-end, enables solid wastes, construction & demolition wastes, medical, biological,

and pharmaceutical wastes, and used tires as feedstock to produce synthetic gas known as Syngas. Syngas can then be put through

a gas generator to produce electricity or the Fisher-Tropsch process to produce synthetic fuels. The front-end drying system is

especially helpful in developing countries where there is high organic content and high moisture content waste. G3P also intends

to provide waste remediation services.

On November 13, 2013 we entered into a joint

venture agreement and formed MicrobeSynergy, LLC, a 50-50 joint venture for the exclusive distribution of a cellulosic advanced

biofuels technology. We have to meet certain Milestones to maintain exclusivity otherwise we would have a non-exclusive license.

The Company believes that we met Milestone I but we have received notification from our joint venture partner that we did not

meet Milestone 1. As part of our October 24, 2014 transaction below, we have agreed to sell our interest in this joint venture.

On October 24, 2014, BioPower Operations Corporation

(the “Company” or “BOPO”) executed a Share Exchange Agreement (“SEA”) with Green3Power

Holdings Company (“G3P”) to acquire G3P and its wholly-owned subsidiaries Green3Power

Operations Inc., a Delaware corporation (“G3P OPS”) and Green3Power International Company, a

Nevis Corporation (“G3PI”). Pursuant to the terms thereof, at Closing (as defined in the Share Exchange

Agreement), and following the Closing, G3P, G3P OPS and G3PI will be wholly-owned subsidiaries

of the Company. G3P is a development stage company that is an engineering firm developing waste-to-energy projects

using licensed gasification technology, which can convert wastes to energy including electricity, diesel fuels and advanced biofuels.

G3P designs, procures, constructs, intends to partially own, operate and maintain Gasification Waste-to-Energy power

plants, using their unique thermal licensed gasification technology, an upgrade to present licensed gasification technology in

use around the world for the last 30 years. G3P also provides waste remediation services.

We have not yet generated or realized any

revenues from business operations. Our auditors have issued a going concern opinion. This means there is substantial doubt that

we can continue as an on-going business for the next twelve (12) months unless we obtain additional capital to pay our bills.

This is because we have not generated any revenues and no revenues are anticipated until we begin marketing our products to customers.

Accordingly, we must raise cash from sources other than revenues generated such as from the proceeds of loans, sale of common

shares and advances from related parties.

Licensed Technologies

Green3Power Holdings Company

– Licensed gasification technology for Waste-to-Energy Conversion

G3P has an exclusive global License

for the use of the technologies and processes for building gasification facilities to convert wastes into electricity and synthetic

fuels. Once the royalties paid for the use of these technologies equal $10,000,000, G3P will then own 100% of the technologies

and processes without any further license fees. The initial license fees are paid based upon gross revenues of the facilities

and their waste conversion operations using the gasification technologies and processes.

Enzyme Technology

We have a non-exclusive global License for

a patented one-step enzyme technology which converts wastes from poultry, hogs, humans and sugar to products such as fertilizer,

cellulosic ethanol and other products. The patent expires in June 2029. Under the terms of the agreement, we pay our Licensor

50% of any sub-license fees that we receive. We also pay our Licensor 12% of all royalties on all revenues we earn from utilizing

the technology. This 12% is calculated on the basis of net gross revenues which equal gross revenues less all direct costs associated

with the production of the revenues. As part of our October 24, 2014 transaction above, we have agreed to sell our interest in

this license.

Critical Accounting Policies

In response to financial reporting release

FR-60, Cautionary Advice Regarding Disclosure About Critical Accounting Policies, from the SEC, we have selected our more subjective

accounting estimation processes for purposes of explaining the methodology used in calculating the estimate, in addition to the

inherent uncertainties pertaining to the estimate and the possible effects on the our financial condition. The accounting estimates

involve certain assumptions that, if incorrect, could have a material adverse impact on our results of operations and financial

condition. Our more significant accounting policies can be found in Note 3 of our unaudited interim consolidated financial statements

found elsewhere in this report and in our Annual Report on Form 10-K for the year ended November 30, 2014, as filed with the SEC.

There have been no material changes to our critical accounting policies during the period covered by this report.

Results of Operations

Our financial statements have been prepared

assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability

and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

We expect that we will require additional capital to meet our operating requirements. We expect to raise additional capital through,

among other things, the sale of equity and/or debt securities.

Three and Six Months Ended May 31,

2015 Compared to the Three and Six Months Ended May 31, 2014

The following tables set forth, for the periods

indicated, results of operations information from our unaudited interim consolidated financial statements:

| | |

Three

Months Ended

May 31, | | |

Change | | |

Change | |

| | |

2015 | | |

2014 | | |

(Dollars) | | |

(Percentage) | |

| | |

| | |

| | |

| | |

| |

| Revenue, net of costs | |

$ | 7,265 | | |

$ | - | | |

$ | 7,265 | | |

| 100.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

$ | 516,119 | | |

$ | 278,562 | | |

$ | 237,557 | | |

| 85.3 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (508,854 | ) | |

| (278,562 | ) | |

| (230,292 | ) | |

| 82.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (8,155 | ) | |

| (12,220 | ) | |

| 4,065 | | |

| (33.3 | )% |

| Consulting revenue, net | |

| - | | |

| 34,868 | | |

| (34,868 | ) | |

| (100.0 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other

Income (expense) - net | |

| (8,155 | ) | |

| 22,648 | | |

| (30,803 | ) | |

| (136.01 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (517,009 | ) | |

$ | (255,914 | ) | |

$ | (261,095 | ) | |

| 102.02 | % |

| | |

Six

Months Ended

May 31, | | |

Change | | |

Change | |

| | |

2015 | | |

2014 | | |

(Dollars) | | |

(Percentage) | |

| | |

| | |

| | |

| | |

| |

| Revenue, net of costs | |

$ | 7,265 | | |

$ | - | | |

$ | 7,265 | | |

| 100.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

$ | 1,004,504 | | |

$ | 639,015 | | |

$ | 365,489 | | |

| 57.2 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (997,239 | ) | |

| (639,015 | ) | |

| (358,224 | ) | |

| 56.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (14,163 | ) | |

| (18,115 | ) | |

| 3,952 | | |

| (21.8 | )% |

| Consulting revenue, net | |

| - | | |

| 111,401 | | |

| (111,401 | ) | |

| (100.0 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other

Income - net | |

| (14,163 | ) | |

| 93,286 | | |

| (107,449 | ) | |

| (115.2 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,011,402 | ) | |

$ | (545,729 | ) | |

$ | (465,673 | ) | |

| 85.3 | % |

Revenue. During the three and

six months ended May 31, 2015 and 2014, the Company recognized $7,265 and $0, respectively; in net revenue relating to remediation.

General and Administrative Expenses.

Our general and administrative expenses are mainly comprised of compensation expense, corporate overhead, development

costs, and financial and administrative contracted services for professional services including legal and accounting, SEC filing

fees, and insurance. The increase in our general and administrative expenses is primarily attributable to the increased compensation

expense due to the increased number of employees in the three and six months ended May 31, 2015.

Interest Expense. Interest expense

for the three and six months ended May 31, 2015 and 2014 primarily represents the accretion of debt discount to interest expense

on our outstanding debt, as well as contractual interest expense on our notes payable and convertible debt.

Consulting Revenue. During the

three months ended May 31, 2015 and 2014, the Company recognized $0 and $34,868, respectively; in net consulting revenue related

to the consulting agreement entered into with a third party in February 2013. During the six months ended May 31, 2015 and 2014,

the Company recognized $0 and $111,401, respectively; in net consulting revenue related to this same agreement. The consulting

agreement was terminated during the year ended November 30, 2014.

Liquidity and Financial Condition

| | |

Six

Months Ended May 31, | |

| Category | |

2015 | | |

2014 | |

| | |

| | |

| |

| Net cash used in operating activities | |

$ | (105,591 | ) | |

$ | (220,264 | ) |

| Net cash provided (used) in investing activities | |

| - | | |

| (4,754 | ) |

| Net cash provided by financing activities | |

| 104,150 | | |

| 125,100 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

$ | 1,441 | | |

$ | (99,918 | ) |

Cash Flows from Operating Activities

Net cash used in operating activities was

$105,951 for the six months ended May 31, 2015, compared with $220,264 for the comparable period in 2014. Net cash used in operating

activities for the six months ended May 31, 2015 is mainly attributable to our net loss of $1,011,402, offset by an increase in

accounts payable and accrued expenses. Net cash used in operating activities for the six months ended May 31, 2014 is mainly attributable

to our net loss of $545,729, offset by the loss on impairment of securities, an increase in accounts payable and accrued expenses

due to related parties and an increase in convertible debt and notes payable.

Cash Flows from Financing Activities

We have financed our operations primarily

from either advancements or the issuance of equity and debt instruments. For the six months ended May 31, 2015 cash flows provided

by financing activities was $104,150, compared to $125,100 for the comparable period in 2014. We received $22,500 in proceeds

from convertible debt and notes payable with third parties and related parties during the six months ended May 31, 2015, compared

to $125,000 in proceeds from convertible debt during the six months ended May 31, 2014. Management is seeking, and expects to

continue to seek to raise additional capital through equity and/or debt financings, including through one or more equity or debt

financings to fund its operations, and pay amounts due to its creditors and employees. However, there can be no assurance that

the Company will be able to raise such additional equity or debt financing or obtain such bank borrowings on terms satisfactory

to the Company or at all.

The Company does not currently have sufficient

resources to cover on-going expenses and expansion. As of May 31, 2015, the Company had cash of $13,677 and current liabilities

of $3,057,660. Our current liabilities include accounts payable and accrued expenses to related parties of $2,324,517. We have

historically financed our operations primarily through private placements of common stock, loans from third parties and loans

from our Officer. We plan on raising additional funds from investors to implement our business model. In the event we are unsuccessful,

this will have a negative impact on our operations.

As reflected in the accompanying unaudited

interim consolidated financial statements, the Company has a net loss of $1,011,402 and net cash used in operations of $105,591

for the six months ended May 31, 2015; and a working capital deficit of $3,041,862 at May 31, 2015. These factors raise substantial

doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as

a going concern is dependent on Management’s plans, which include potential asset acquisitions, mergers or business combinations

with other entities, further implementation of its business plan and continuing to raise funds through debt and/or equity financings.

The Company will likely rely upon related party debt and/or equity financing in order to ensure the continuing existence of the

business. The financial statements have been prepared assuming that we will continue as a going concern, which contemplates that

we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Recent Accounting Pronouncements

See Note 3 to our unaudited interim consolidated

financial statements regarding recent accounting pronouncements.

Off-Balance Sheet Arrangements

As of the date of this Quarterly Report, we

do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital

resources that are material to investors.

ITEM 3. QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

This item is not applicable to smaller reporting

companies.

ITEM 4. CONTROLS AND

PROCEDURES.

Evaluation of Disclosure Controls and

Procedures

Our management, under the supervision and

with the participation of our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of the design and

operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”)) as of May 31, 2015, the end of the period covered by this report. Based

on, and as of the date of such evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that our disclosure

controls and procedures were effective as of May 31, 2015 such that the information required to be disclosed in our SEC reports

is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and is accumulated and

communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to

allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial

Reporting

There have not been any significant changes

in our internal control over financial reporting during the fiscal quarter ended May 31, 2015 that have materially affected, or

are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER

INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

From time to time, we are a party to, or otherwise

involved in, legal proceedings arising in the normal and ordinary course of business. As of the date of this report, we are not

aware of any proceeding, threatened or pending, against us which, if determined adversely, would have a material effect on our

business, results of operations, cash flows or financial position.

ITEM 2. UNREGISTERED

SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

None.

ITEM 3. DEFAULTS UPON

SENIOR SECURITIES.

None.

ITEM 4. MINE SAFETY

DISCLOSURES.

Not applicable.

ITEM 5. OTHER INFORMATION.

None.

ITEM 6. EXHIBITS.

The following exhibits are being filed as

part of this Quarterly Report on Form 10-Q.

| Exhibit |

|

|

| Number |

|

Exhibit

Description |

| |

|

|

| 31.1 |

|

Certification

of Chief Executive Officer pursuant to Securities Exchange Act of 1934 Rule 13a-14(a) or 15d- 14(a) |

| |

|

|

| 32.1 |

|

Certification

of Chief Executive Officer pursuant to Securities Exchange Act of 1934 Rule 13a-14(b) or 15d- 14(b) and 18 U.S.C. Section

1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

|

|

| 101.INS |

|

XBRL Instance

Document |

| |

|

|

| 101.SCH |

|

XBRL Taxonomy

Extension Schema Document |

| |

|

|

| 101.CAL |

|

XBRL Taxonomy

Extension Calculation Linkbase Document |

| |

|

|

| 101.DEF |

|

XBRL Taxonomy

Extension Definition Linkbase Document |

| |

|

|

| 101.LAB |

|

XBRL Taxonomy

Extension Label Linkbase Document |

| |

|

|

| 101.PRE |

|

XBRL Taxonomy

Extension Presentation Linkbase Document |

Copies of this report (including the financial

statements) and any of the exhibits referred to above will be furnished at no cost to our shareholders who make a written request

to BioPower Operations Corp., 1000 Corporate Drive, Suite 200, Fort Lauderdale, Florida 33334 Attention: Mr. Robert Kohn.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly

authorized.

| |

|

BioPower Operations Corporation |

| |

|

|

| Dated: August 7, 2015 |

By: |

/s/

Robert D. Kohn |

| |

|

Robert

D. Kohn, Chairman and Chief Executive |

| |

|

Officer

and Chief Financial Officer |

EXHIBIT 31.1

CERTIFICATION OF

PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO SECTION 302(a) OF THE

SARBANES-OXLEY ACT OF 2002

I, Robert D. Kohn, certify that:

1.

I have reviewed this Quarterly Report on Form 10-Q of the Registrant;

2. Based on my knowledge,

this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by

this report;

3. Based on my knowledge,

the financial statements, and other financial information included in this report, fairly present in all material respects the

financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. As the Registrant’s

certifying officer, I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange

Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and

15(d)-15(f)) for the registrant and have:

| |

(a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

(b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

(c) |

Evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

(d) |

Disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

5. As the Registrant’s

certifying officer, I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the Registrant’s

auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

| |

(a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

(b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: August 7,

2015 |

BioPower Operations Corporation |

| |

|

|

| |

By |

/s/

ROBERT D. KOHN |

| |

|

Robert D. Kohn, Chief Executive Officer, Chief Financial Officer, Principal Executive Officer and Director |

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY

ACT OF 2002

In connection with the quarterly report

of BioPower Operations Corporation (the “Company”) on Form 10-Q for the quarter ending May 31, 2015, as filed with

the Securities and Exchange Commission on the date hereof, I, Robert Kohn, Principal Accounting and Financial Officer, Chief executive

Officer, Chief Financial Officer, Secretary and Director of the Company, certify, pursuant to 18 U.S.C. §1350, as adopted

pursuant to §906 of the Sarbanes-Oxley Act of 2002, that to my knowledge:

| |

1. |

The quarterly report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934 and |

| |

|

|

| |

2. |

The information contained in the quarterly report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Dated: August

7, 2015 |

BioPower Operations Corporation |

| |

|

| |

By: |

/s/

Robert D. Kohn |

| |

|

Robert D. Kohn, Chairman and Chief Executive Officer and Chief Financial Officer |

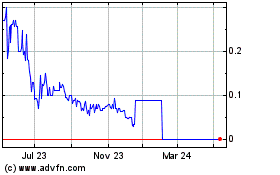

BioPower Operations (CE) (USOTC:BOPO)

Historical Stock Chart

From Dec 2024 to Jan 2025

BioPower Operations (CE) (USOTC:BOPO)

Historical Stock Chart

From Jan 2024 to Jan 2025