- Current report filing (8-K)

May 24 2010 - 3:58PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): May 19, 2010

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-52490

|

|

98-0512515

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

750

Coronado Center Drive

Suite

120

Henderson,

Nevada 89052

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item

1.01 Entry

into a Material Definitive Agreement

Share

Exchange Agreement

On May

19, 2010 Beyond Commerce, Inc. (the “Company”) entered into a Share

Exchange Agreement (the “Agreement”) with all of the shareholders of Adjuice,

Inc. (“Adjuice”), an online media and marketing company. Under the Agreement,

the Company agreed to issue and exchange 5,100,000 shares of its common stock

for all of the issued and outstanding stock of Adjuice. In addition,

the Company also agreed to issue 900,000 shares of its common stock to two

secured lenders of Adjuice to re-pay in full, and terminate two Adjuice secured

loans. The Agreement further contains an earn-out provision that provides for

the issuance of an additional 4,450,000 shares from the Company’s common stock

on the first anniversary of the transaction upon the achievement of certain

gross revenue targets by Adjuice, now a subsidiary of the Company. During the

previous year, Adjuice had generated over $500,000 in sales and earned

approximately $100,000 in income. The Company is realizing approximately

$200,000 in working capital from the transaction.

Adjuice,

Inc. is an online advertising network and lead generation company with over 22

million registered users, 700 affiliates and 350 retail clients in six major

industries. Adjuice currently offer sales leads for debt companies, auto

warranty companies, auto dealers, banks and insurance companies. The unique

Adjuice platform provides a premium service that consistently commands some of

the highest rates for leads sold in their respective industries. Its

process of generating online consumer requests for services, and then qualifying

them using its proprietary technology and dedicated call center, is supported by

more than $7 million invested in developing Adjuice

’

s proprietary

technology. Adjuice is based in Santa Monica,

California.

Concurrently

with the execution of the Agreement, the Company also entered into a three-year

employment agreement with Matt Hill, the Chief Executive Officer of

Adjuice. Under the employment agreement, Mr. Hill will become the

President of Adjuice. Mr. Hill’s initial base salary shall be

$140,000, which amount will increase to $170,000 if Adjuice, Inc. achieves

profitability. The Company also agreed to grant options to Mr. Hill

for the purchase of 1,500,000 shares of the Company’s common stock at an

exercise price of $0.10 per share. The options vest over a 24-month

period. Mr. Hill also will be entitled to certain other option and

cash compensation based on the future profitability of Adjuice,

Inc.

Item

2.01 Completion

of Acquisition or Disposition of Assets

Effective

May 19, 2010, the Company closed the acquisition of Adjuice, Inc. as

contemplated by the Agreement. For additional information regarding

Adjuice, Inc. and the terms of the acquisition, see Item 1.01

above.

Item

3.02 Unregistered

Sales of Equity Securities

Effective

May 19, 2010, the Company issued a total of 5,100,000 to the five shareholders

of Adjuice, Inc. and a total of 900,000 shares to the two lenders of Adjuice,

Inc. (the two lenders also are shareholders of Adjuice,

Inc.) For additional information regarding the terms of the stock

issuances, see Item 1.01 above. The foregoing shares to the five

persons/entities were issued in reliance upon an exemption from the registration

requirements pursuant to Section 4(2) of the Securities Act of 1933, as

amended.

Item

9.01

Financial Statements and

Exhibits

|

Exhibit Number

|

|

Description

|

|

10.01

|

|

Share

Exchange Agreement

|

|

10.02

|

|

Hill

Employment

Agreement

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Beyond

Commerce, Inc.

|

|

Date:

May 24, 2010

|

|

|

|

|

By:

|

/s/

Mark V. Noffke

|

|

|

|

Mark

V. Noffke

|

|

|

|

Chief

Financial Officer

|

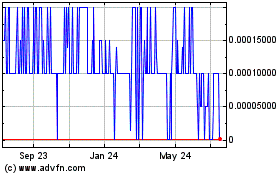

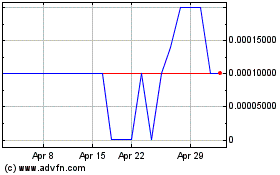

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024