- Amended Annual Report (10-K/A)

April 23 2010 - 6:06AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 10-K/A

Amendment No.

1

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

For

the fiscal year ended December 31, 2009

|

|

|

|

or

|

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

For

the transition period from ______ to ______

|

|

Commission

file number:

000-52490

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

98-0512515

|

|

(State

of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

9029

South Pecos

Suite

2800

Henderson,

Nevada 89074

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Securities

Registered Pursuant To Section 12 (b) Of The Act

Title

of each class

NONE

Securities

Registered Pursuant To Section 12 (g) Of The Act:

Common

Stock $0.001 Par Value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

¨

Yes

x

No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act.

¨

Yes

x

No

Indicate

by check mark whether the registrant: (1) has filed all reports required to

be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes

x

No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

¨

|

Accelerated

filer

¨

|

|

Non-accelerated

filer

¨

(Do not check

if a smaller reporting company)

|

Smaller

reporting company

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).Yes

¨

No

x

As of

June 30, 2009, the aggregate market value of the registrant's common stock

held by non-affiliates (assuming for the sole purpose of this calculation, that

all directors and officers of the registrant are "affiliates") was $9,970,857

(based on the closing sale price of the registrant's common stock as reported on

the OTCBB). The number of shares of common stock outstanding at that date was

45,186,179 shares.

As of

April 19, 2010 there were outstanding 59,493,311 of the registrant’s common

stock.

EXPLANATORY

NOTE

We are

filing this amendment (this “Amendment No. 1”) to our Annual Report on Form 10-K

for the year ended December 31, 2009 (our “2009 Annual Report”) for the sole

purpose of filing Exhibit 23, the Consent Of Independent Registered Public

Accounting Firm, which was inadvertently omitted from the 2009 Annual

Report that was filed on April 21, 2010.

This

Amendment No. 1 does not update or amend the disclosures contained in the Annual

Report.

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT

SCHEDULES

|

THE

FINANCIAL STATEMENTS OF BEYOND COMMERCE, INC. ARE LISTED ON THE INDEX TO

FINANCIAL STATEMENTS AS SET FORTH ON PAGE F-2

OF THE ANNUAL REPORT ON FORM

10-K

.

The

following list describes the exhibits filed as part of this Annual Report Form

10-K/A.

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Articles

of Incorporation (1)

|

|

3.2

|

|

Amendment

to Articles of Incorporation (name

change)(2)

|

|

3.3

|

|

Bylaws

(1)

|

|

4.1

|

|

Form

of Series A Common Stock Purchase Warrant(4)

|

|

5.1

|

|

Opinion

of Sichenzia Ross Friedman Ference LLP

|

|

10.1

|

|

Agreement

and Plan of Reorganization (3)

|

|

10.2

|

|

Employment

Agreement Wendy Borow-Johnson (13)

|

|

10.3

|

|

Property

Lease - Santa Ana, California (3)

|

|

10.4

|

|

Property

Lease - Henderson, Nevada (3)

|

|

10.5

|

|

2008

Equity Incentive Plan (12)

|

|

10.6

|

|

Form

of Incentive Stock Option Agreement (12)

|

|

10.7

|

|

Form

of Non-Qualified Stock Option Agreement (12)

|

|

10.8

|

|

Form

of Subscription Agreement by and among the Company and the Subscribers

named therein. (4)

|

|

10.9

|

|

Form

of Secured Convertible Note. (4)

|

|

10.10

|

|

Form

of Guaranty, dated July 7, 2008, by BoomJ.com, Inc. (4)

|

|

10.11

|

|

Collateral

Agent Agreement, dated as of July 7, 2008, by and among BoomJ.com, Inc.,

the Subscribers and the Company. (4)

|

|

10.12

|

|

Form

of Security Agreement, dated July 7, 2008, between the Company and the

Subscribers(4)

|

|

10.13

|

|

Secured

Original Issue Discount Promissory Note, due November 16, 2009

(5)

|

|

10.14

|

|

Common

Stock Purchase Warrant, dated May 20, 2009 (5)

|

|

10.15

|

|

Security

Interest and Pledge Agreement, dated May 20, 2009, between Linlithgow

Holdings LLC and the Company (5)

|

|

10.16

|

|

Purchase

Agreement, dated June 17, 2009, between the Company and OmniReliant

Holdings, Inc. (6)

|

|

10.17

|

|

Secured

Original Issue Discount Promissory Note due June 17, 2009

(6)

|

|

10.18

|

|

Common

Stock Purchase Warrant, dated June 17, 2009 (6)

|

|

10.19

|

|

Security

Interest and Pledge Agreement, dated June 17, 2009, among OmniReliant

Holdings, Inc., the Company, and Linlithgow Holdings LLC

(6)

|

|

10.20

|

|

Amended

and Restated Securities Purchase Agreement, dated July 2, 2009, between

the Company and OmniReliant Holdings, Inc. (7)

|

|

10.21

|

|

Original

Issue Discount Secured Convertible Debenture, due July 2, 2010

(7)

|

|

10.22

|

|

Common

Stock Purchase Warrant, dated July 2, 2009 (7)

|

|

10.23

|

|

Amended

and Restated Pledge and Security Agreement, dated July 2, 2009, among the

Company and the Pledgors named therein in favor of OmniReliant Holdings,

Inc. (7)

|

|

10.24

|

|

Security

Agreement, dated July 2, 2009, among the Company, the Company’s

subsidiaries, and the Secured Parties named therein (7)

|

|

10.25

|

|

Subsidiary

Guarantee, dated July 2, 2009, by the Guarantors named therein in favor of

OmniReliant Holdings, Inc. (7)

|

|

10.26

|

|

Amended

and Restated Securities Purchase Agreement, dated July 10, 2009, between

the Company and OmniReliant Holdings, Inc. (8)

|

|

10.27

|

|

Original

Issue Discount Secured Convertible Debenture, due July 10, 2010

(8)

|

|

10.28

|

|

Common

Stock Purchase Warrant, dated July 10, 2009 (8)

|

|

10.29

|

|

Original

Issue Discount Secured Convertible Debenture, due July 21, 2010

(9)

|

|

10.30

|

|

Common

Stock Purchase Warrant, dated July 21, 2009 (9)

|

|

10.31

|

|

Securities

Purchase Agreement, dated July 30, 2009, between the Company and

OmniReliant Holdings, Inc. (10)

|

|

10.32

|

|

Original

Issue Discount Secured Convertible Debenture, due July 30, 2010

(10)

|

|

10.33

|

|

Common

Stock Purchase Warrant, dated July 30, 2009 (10)

|

|

10.34

|

|

Security

Interest and Pledge Agreement, dated July 30, 2009, between OmniReliant

Holdings, Inc. and the Company (10)

|

|

10.35

|

|

Agreement,

dated July 30, 2009, between the Company and St. George Investments, LLC

(11)

|

|

10.36

|

|

Asset

Purchase Agreement, dated October 9, 2009, between the Company, Local Ad

Link, Inc. and OmniReliant Holdings, Inc. (14)

|

|

10.37

|

|

Securities

Purchase Agreement, dated October 9, 2009, between the Company and Zurvita

Holdings, Inc. (14)

|

|

23

|

|

Consent

of

L J

Soldinger Associates, LLC

|

|

31.1

|

|

Certification

of Chief Executive Officer

|

|

31.2

|

|

Certification

of Chief Financial Officer (Principal Accounting

Officer)

|

|

32.1

|

|

Certification

of Chief Executive Officer and Chief Financial Officer (Principal

Accounting Officer) pursuant to Section 906 of the Sarbanes-Oxley Act of

2002, 18 U.S.C. Section 1350

|

|

32.2

|

|

Certification

of Chief Executive

Officer

|

(1) Previously

filed as an exhibit to the Company’s Registration Statement filed on January 22,

2007, which exhibit is hereby incorporated herein by

reference.

(2) Previously

filed as an exhibit to the Company’s Annual Report Form 10-KSB filed , February

7, 2008), which exhibit is hereby incorporated herein by

reference.

(3) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on January 4,

2008, which exhibit is hereby incorporated herein by

reference.

(4) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on July 11,

2008, which exhibit is hereby incorporated herein by

reference.

(5) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on May 21, 2009,

which exhibit is hereby incorporated herein by reference.

(6) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on June 23,

2009, which exhibit is hereby incorporated herein by

reference.

(7) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on July 6, 2009,

which exhibit is hereby incorporated herein by reference.

(8) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on July 16,

2009, which exhibit is hereby incorporated herein by

reference.

(9) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on July 22,

2009, which exhibit is hereby incorporated herein by

reference.

(10) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on August 4,

2009, which exhibit is hereby incorporated herein by

reference.

(11) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on August 5,

2009, which exhibit is hereby incorporated herein by

reference.

(12) Previously

filed as an exhibit to the Company’s Annual Report on Form 10-K for the year

ended December 31, 2008, filed with the SEC on April 3, 2009, which exhibit is

hereby incorporated herein by reference.

(13)

Previously filed as an exhibit to the Company’s Annual Report on Form 10-KSB for

the year ended December 31, 2007, filed with the SEC on April 4, 2008, which

exhibit is hereby incorporated herein by reference.

(14) Previously

filed as an exhibit to the Company’s Current Report on Form 8-K on October

16, 2009, which exhibit is hereby incorporated herein by

reference.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

BEYOND

COMMERCE, INC.

|

|

|

|

|

|

Date: April

22, 2010

|

By:

|

/s/ MARK NOFFKE

|

|

|

|

Mark

Noffke

|

|

|

|

Chief Financial

Officer

|

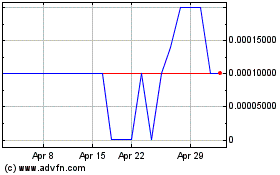

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

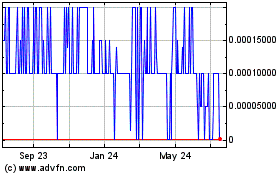

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024