- Current report filing (8-K)

July 22 2009 - 4:34PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): July 21, 2009

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-52490

|

|

98-0512515

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

9029

South Pecos

Suite

2800

Henderson,

Nevada 89074

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Copies

to:

Gregory

Sichenzia, Esq.

Darrin M.

Ocasio, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32

nd

Floor

New York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant

|

Sale of

Debenture

On July

21, 2009, pursuant to the Amended and Restated Securities Purchase Agreement

dated July 10, 2009 between Beyond Commerce, Inc. (the “Company”) and

OmniReliant Holdings, Inc. (the “Investor”), the Company issued to the Investor

a secured original issue discount convertible debenture (the “Debenture”) and a

warrant to purchase 7,500,042 shares of the Company’s common stock for an

aggregate purchase price of one million five hundred thousand dollars

($1,500,000). The Debenture has a face value of $1,750,010 and will

become due and payable on July 21, 2010. The Debenture may be

converted at any time at the option of the Investor and has a conversion price

of $0.70 per share. The conversion price is subject to reset to $0.35

if the Company does not repay the Debenture within six months of the date of

issuance or upon an “Event of Default”, as that term is defined in the

Debenture. The Warrant may be exercised at any time for a period of five years

from the date of issuance and has an exercise price of $0.70. The

Warrant may be exercised on a cashless basis if there is no effective

registration statement registering the shares underlying the

Warrant.

As of

July 21, 2009, the Company has sold Investor an aggregate of $3,500,000 of

Debentures and has received gross proceeds of $3,000,000.

In

connection with the sale of the Debenture, Midtown Partners & Co, LLC

received a warrant to purchase 600,003 shares of the Company’s Common Stock (the

“Midtown Warrant”) pursuant to the terms of its placement agent agreement with

the Company. The Midtown Warrant may be exercised at any time for a

period of five years from the date of issuance and has an exercise price of

$0.70. The Warrant may be exercised on a cashless basis if there is

no effective registration statement registering the shares underlying the

Warrant.

In

connection with the sale of the Debenture and issuance of the Midtown Warrant,

the Company relied upon the exemption from securities registration afforded by

Rule 506 of Regulation D as promulgated by the SEC under the Securities Act of

1933, as amended (the “Securities Act”) and/or Section 4(2) of the Securities

Act. No advertising or general solicitation was employed in offering the

securities.

|

Item

3.02

|

Unregistered

Sales of Equity Securities

|

See Item

2.03 above.

|

Item

9.01

|

Financial

Statements and Exhibits

|

|

(a)

|

Financial

statements.

|

Not

applicable.

|

(b)

|

Pro

forma financial information.

|

Not

applicable.

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Amended

and Restated Securities Purchase Agreement dated July 10, 2009 by and

between the Company and OmniReliant Holdings, Inc. (Incorporated by

reference to the Current Report on Form 8-K filed with the SEC on July 16,

2009)

|

|

10.2

|

|

Form

of Debenture

|

|

10.3

|

|

Form

of Warrant

|

|

|

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Beyond

Commerce, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Mark

Noffke

|

|

|

|

Mark

Noffke

|

|

|

|

Chief

Financial Officer

|

Date:

July 22, 2009

Exhibit

Index

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Amended

and Restated Securities Purchase Agreement dated July 10, 2009 by and

between the Company and OmniReliant Holdings, Inc. (Incorporated by

reference to the Current Report on Form 8-K filed with the SEC on July 16,

2009)

|

|

10.2

|

|

Form

of Debenture

|

|

10.3

|

|

Form

of Warrant

|

|

|

|

|

3

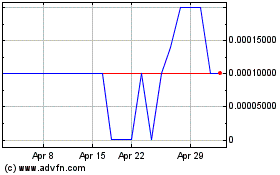

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

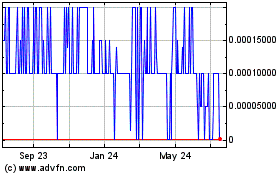

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024