- Current report filing (8-K)

July 06 2009 - 2:45PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): June 19, 2009

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-52490

|

|

98-0512515

|

|

(State

or other jurisdiction of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

9029

South Pecos

Suite

2800

Henderson,

Nevada 89074

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Copies

to:

David B.

Manno, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32

nd

Floor

New York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation

under an Off-Balance Sheet Arrangement

On June 19, 2009, the average trading

volume of the common stock of Beyond Commerce, Inc. (the “Company”) was under

$80,000 for the ten prior consecutive trading days, which constituted an “Event

of Default” under the Company’s Series 2009 Secured Convertible Original Issue

Discount Note Due June 15, 2010, dated June 4, 2009 (the “Note”), made by the

Company, in favor of St. George Investments, LLC (the “Holder”). As a result of

the Event of Default, the principal amount of the Note, equal to $714,286, plus

a penalty of $71,428.60 (equal to 10% of the principal amount), became

immediately due and payable. Such unpaid principal and penalty amounts due bear

interest at the rate of 1.5% per month. In addition, as a result of the Event of

Default, the Note became convertible into shares of the Company’s common stock

at the lower of the closing bid price of the stock or the average of the volume

weighted average price of the stock, provided, however, the Holder cannot

convert the Note into shares of the Company’s common stock to the extent such

conversion would cause the Holder’s beneficial ownership of the Company’s common

stock to exceed 9.99% of the Company’s issued and outstanding common stock

immediately following such conversion.

The Note

was secured by an aggregate of 4,020,000 shares of the Company’s common stock

pledged by affiliates of the Company, pursuant to stock pledge agreements

entered into by the affiliates in favor of the Holder, including 2,020,000

shares pledged by Mark Noffke, the Company’s chief financial officer. Pursuant

to the pledge agreement entered into by Mr. Noffke, shares pledged by Mr. Noffke

may be transferred to the Holder and sold in full satisfaction of the Company’s

obligations under the Note.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Beyond

Commerce, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Robert J. McNulty

|

|

|

|

Robert

J. McNulty

|

|

|

|

Chief

Executive Officer

|

Date:

July 6, 2009

3

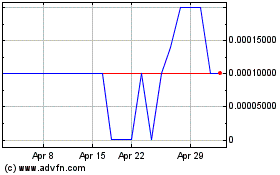

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

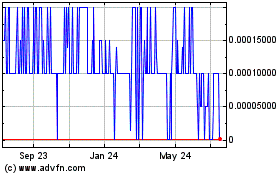

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024