UPDATE:Emerging-Market Debt Issuers Jump In To Catch Tepid Wave

January 10 2012 - 6:00PM

Dow Jones News

Debt issuance from emerging-market sovereigns and corporations

is picking up pace with more than $7.34 billion already on tap this

week, as issuers take advantage of calmer markets.

Sovereign and quasi-sovereign issuers have raised nearly $10

billion so far this month, more than double their tally of $4.1

billion last January, according to Dealogic. But worries about

Europe still weigh on investors, making them biased toward

high-grade issuers that can offer a concession. There also is a

marked preference for sovereigns rather than corporate issuers,

with high-grade corporate issuers having sold $4.138 billion in

global bonds this month, sharply down from the $26 billion in

January 2011, according to Dealogic.

Despite the relatively tepid markets, issuers are eager to get a

head start on their funding needs for 2012, particularly before any

negative developments in the euro-zone debt crisis triggers a

return to rollercoaster markets.

"Sovereign and corporate [emerging-market] debt issuance is off

to a reasonably good start," said Russ Rowley, portfolio manager at

Principal Global Investors. "But it's muted due to Europe, and we

didn't get to an aggressive start of the year."

On Tuesday alone, Poland, Colombia, BBVA Banco Continental SA of

Peru and the Asian Development Bank all entered the market. That

adds to bond deals from Mexico, Brazil, the Philippines and South

Africa seen in the first nine days of 2012. Also, Indonesia on

Monday sold the largest-ever long-dated sovereign bond out of Asia,

at $1.75 billion. Among companies, Brazilian bank Banco Bradesco SA

(BBD, BBDC4.BR) and Brazilian mining company Vale SA (VALE,

VALE5.BR) tapped markets for a combined $1.75 billion last

week.

Investors are "looking for diversification out of the western

world," said Steven Aloupis, managing director and regional head of

capital markets Americas for Standard Chartered.

While investor demand is strong, buyers remain picky and are

sticking to high-grade issuers and demanding concessions on some

offerings. That's largely because of the threats to markets

emanating from the euro-zone crisis. Investors fear that risk

premiums may gap out dramatically, as they did several times last

year, if market fears escalate and risk aversion takes hold. So,

they are demanding sizeable concessions to cushion against such a

fallout.

For example, South Africa's $1.5 billion bond gave investors 20

basis points more yield than that paid on comparable sovereigns,

while Bradesco's $750 million, five-year issue priced at a

concession of 50 basis points, according to investors.

Despite the higher cost, part of the motivation for some of

these issuers, besides frontloading their funding needs for this

year as many already did at the end of 2011, is to better manage

their existing debt.

Colombia's government said Tuesday that it had reopened its 2041

dollar-denominated sovereign bond with a 6.125% coupon. The funds

raised will be used to buy back a swath of foreign bonds with

maturity dates from 2013 to 2027, the government said in a

statement.

The current market calm and investors' relentless demand for

such debt means more deals are in the pipeline in coming months,

market participants say. Also, the higher returns, forecast to be

7% to 8% on sovereign bonds and 6% to 7% on emerging-market

corporate bonds, make them attractive to investors.

If the euro crisis subsides further, along with market

volatility, "we could see that translate into strong issuance from

the emerging markets," said Standard Chartered's Aloupis.

Brazilian government-run Banco do Brasil SA (BDORY, BBAS3.BR),

Latin America's biggest bank by assets, is expected to tap the

international debt market this week with an issue of perpetual

bonds.

J.P. Morgan analysts expect $60 billion in sovereign

emerging-market bond issuance and $185 billion in corporate debt in

2012, though both gross supply figures are lower than in previous

years.

-By Erin McCarthy and Prabha Natarajan, Dow Jones Newswires;

212-416-2712; erin.mccarthy@dowjones.com @djfxtrader

--Darcy Crowe and Rogerio Jelmayer contributed to this

article.

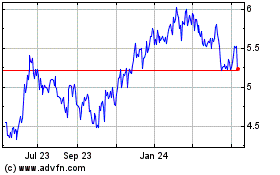

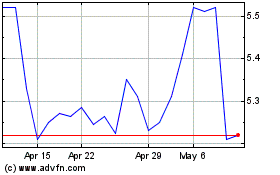

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jul 2023 to Jul 2024