Confidence Boost Allows High Grade Bond Deals To Hit Markets Wednesday

November 16 2011 - 12:05PM

Dow Jones News

Market conditions didn't start off great Wednesday but a group

of high-grade issuers see a window of opportunity before the

expected holiday slowdown.

By tapping the U.S. bond markets this week, issuers can also

avoid potential headline risks from deficit talks once the

bipartisan super-committee delivers its plan to Congress on Nov.

23.

"There's no sense in waiting for the holidays and then getting

caught in a market that's volatile," said Richard Testa, co-head of

investment grade capital markets at Mitsubishi UFJ Securities.

The biggest deal entering the market is a $2 billion issue from

BHP Billiton Finance, which is offering a three-part deal comprised

of three-, five-, and 10-year bonds, according to a person familiar

with the deal.

The bonds are guaranteed by its parent, natural resources

company BHP Billiton Ltd. (BHP) According to data provider

Dealogic, BHP was last in the U.S. markets in March 2009 when it

sold $3.25 billion.

The senior unsecured notes are expected to carry ratings of A1

from Moody's Investors Service and A-plus from Standard &

Poor's and Fitch Ratings.

Lead managers are J.P. Morgan and Barclays Capital. The deal is

registered with the Securities and Exchange Commission and proceeds

are for general corporate purposes, the person added.

Statoil ASA (STO) is borrowing $1.5 billion in a three-part

issue of senior unsecured notes maturing in five, 10, and 30 years,

according to a person familiar with the deal. The bonds are

guaranteed by Statoil Petroleum ASA.

The Norwegian energy company last borrowed in the U.S. debt

markets in August 2010, when it issued $2 billion, Dealogic

said.

Lead underwriters are Bank of America Merrill Lynch, Deutsche

Bank, and J.P. Morgan. The proceeds are being used for general

corporate purposes.

The deal is expected to be rated Aa2 by Moody's Investors

Service and AA-minus by Standard & Poor's.

Another major deal: Lowe's Companies Inc (LOW) plans to sell $1

billion of senior unsecured notes in 10-year and 30-year bonds,

which are anticipated to be rated A3 by Moody's Investors Service

and A-minus by Standard & Poor's.

Lowe's, a home improvement retailer, is raising funds for

capital expenditure and to buy back common stock.

Underwriters are Bank of America Merrill Lynch, J.P. Morgan, and

SunTrust Robinson Humphrey.

Jody Lurie, corporate credit analyst at Janney Capital Markets,

said companies are jumping into the market in advance of what

should be a slower period next week, thanks to decent economic data

including Tuesday's retail sales report. She said the data has

boosted investor confidence, despite overseas concerns.

Among smaller deals, Brazilian bank Banco do Brasil SA

(BBAS3.BR) plans to issue $500 million of five-year bonds via the

U.S. debt market, according to a person familiar with the deal.

The issue, expected to be rated Baa1 by Moody's Investors

Service, is to be used for general corporate purposes.

Lead underwriters are Bradesco Securities, Citi, HSBC, and J.P.

Morgan.

The bank last tapped the U.S. market in May 2011 with a $1.5

billion issue, according to Dealogic.

Rockwell Collins Inc. (COL) is also borrowing $250 million in a

10-year deal expected to be rated A1 by Moody's Investors Service

and A by Standard & Poor's and Fitch Ratings, according to a

person familiar with the deal.

The communications and aviation electronics company is using the

proceeds for general corporate purposes including the repurchase of

common stock and repayment of commercial paper. Underwriters are

Bank of America Merrill Lynch, Citi, and Wells Fargo

Securities.

Rockwell was last in the U.S. markets in May 2009, when it

issued $300 million, Dealogic shows.

American Express Credit Corp. is pricing an undetermined amount

of debt, according a person with the deal. The issue is an add-on

its $1.3 billion five-year note sale in September.

It is expected to carry ratings of A2 from Moody's Investors

Service, BBB-plus from Standard & Poor's, and A-plus from Fitch

Ratings. Underwriters are Citi, Goldman Sachs, and UBS.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

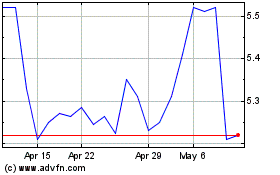

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Oct 2024 to Nov 2024

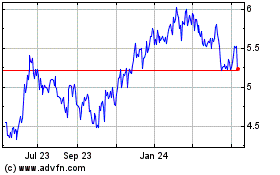

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Nov 2023 to Nov 2024