2nd UPDATE: HSBC To Sell Chilean Retail Banking Unit To Brazil's Itau

September 29 2011 - 12:30PM

Dow Jones News

HSBC Holdings PLC (HBC) on Thursday said it has agreed to sell

its Chilean retail banking operations to Brazil's largest

private-sector bank in terms of assets, Itau Unibanco Holding SA

(ITUB, ITUB4.BR).

HSBC's operation in Chile focuses on wealthy individuals, with

some 4,000 customers and assets worth $20 million. The U.K. bank

will maintain its investment and commercial banking operations in

Chile.

The sale is subject to regulatory approvals and should be

completed in the fourth quarter of 2011, HSBC said in a

statement.

In a recent interview to the Brazilian financial newspaper Valor

Economico, HSBC Chief Executive Stuart Gulliver said HSBC's

priority areas are China, India, Brazil, Mexico, the U.K. and

France.

For Itau Unibanco, the move continues the expansion of the

Brazilian bank across the region. Itau first started operations in

Chile in 2006, when it bought the assets of BankBoston, and the

unit has $6.7 billion in total assets.

In terms of loans, Itau Chile currently has a 19% share of

Chile's high-income clients and aims to increase that stake to 25%

in coming years, Boris Buvinic, head of the bank's Chile

operations, said at a press conference in Santiago.

Itau Chile has some 100,000 high-end retail clients and seeks to

gain 15,000-17,000 new clients a year, Buvinic said.

Buvinic and HSBC Chile general manager Gustavo Costa both

declined to release the cost for the transaction.

In August, investment bank BTG Pactual said it plans to merge

with Chile's Celfin. BTG has about BRL98 billion in assets under

management, while Celfin is a leading financial and brokerage firm

with operations in Chile, Peru and Colombia with $11 billion in

third-party and private-wealth assets under management.

In the last two years, Latin America's largest bank by assets,

Brazil's government-controlled Banco do Brasil SA (BDORY,

BBAS3.BR), acquired a controlling stake in Argentina's Banco

Patagonia SA (BPAT.BA), bought a small bank called EuroBank and

said that it is looking for other acquisition opportunities,

primarily in South America, to further its strategy.

-By Rogerio Jelmayer, Dow Jones Newswires; 5511-3544-7073;

rogerio.jelmayer@dowjones.com

-Carolina Pica in Santiago contributed to this article.

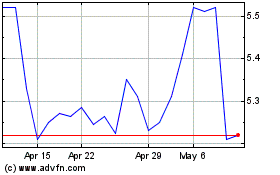

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Sep 2024 to Oct 2024

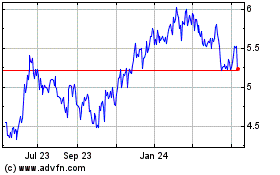

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Oct 2023 to Oct 2024