UPDATE: Actelion Net Profit Rises, Boosted By Glaxo Payment

April 19 2011 - 3:15AM

Dow Jones News

Swiss biotech company Actelion AG (ATLN.VX) Tuesday reported a

10% rise in first-quarter net profit thanks to the last installment

of a payment linked to a drug development pact with GlaxoSmithKline

PLC (GSK), which offset a hit from higher legal expenses.

The Allschwil, Switzerland, based company is embroiled in a

battle with New York hedge fund Elliott Advisors, which has

criticized the board's lack of strategy, saying its drug

development in particular is lacking focus. Elliott, which owns

close to 6% of the company, wants to replace much of the Swiss

company's current board and demanded the resignation of Chairman

Robert Cawthorn. The fund also wants Actelion's founder and chief

executive Jean-Paul Clozel to step down from the board.

Actelion said Tuesday it has received the support of BB Biotech,

one of its long-term shareholders, and IVOX, a German-based

independent proxy voting service, in advance of the Annual General

Meeting on May 5. To counter Elliott's attack, Actelion has

nominated former GlaxoSmithKline chief executive Jean-Pierre

Garnier and Robert Bertolini, a former chief financial officer for

Schering-Plough to the board.

Actelion derives nearly 90% of its income from one single drug,

a treatment for pulmonary arterial hypertension called Tracleer.

After several drugs failed in clinical trials last year, the Swiss

company doesn't have a certain successor to offset an expected

slump in revenue when Tracleer starts losing patent protection in

2015. Its hopes now rest with macitentan, a possible follow-up drug

to Tracleer, for which key data from clinical testing should be

published by early 2012. If macitentan succeeds in clinical

testing, it may be launched in 2013.

First quarter earnings underlined Actelion's dependence on

Tracleer.

Net profit rose 10% to 146.3 million Swiss francs ($164.4

million) from CHF132.8 million in 2010. Revenue increased 5% to

CHF528.2 million. Product sales were stable at CHF450.1 million

with the bulk of that coming from Tracleer. Sales of Tracleer

declined 0.6% to CHF402.8 million due to the strong Swiss

franc.

"First-quarter sales are in line, but underlying profits are

weak on ongoing legal costs," said Peter Welford, analyst with

Jefferies International in London, who has a hold rating on the

stock.

Actelion received the last payment related to a drug

collaboration with GlaxoSmithKline in the quarter, which helped

boost revenue. Having received this payment, Actelion said it could

now give a revenue estimate for the entire year.

"Unforeseen events excluded, product sales are expected to

increase in the mid-single digit range in local currencies," Chief

Financial Officer Andrew Oakley said.

Actelion, which is defending itself in ongoing litigation with

Japanese drugmaker Asahi Kasei in relation to the Swiss company's

acquisition of U.S. drug company CoTherix Inc., said higher legal

expanses partially offset the increase in contract revenue.

"These legal expenses should scale back in the second half of

the year," Oakley said in a statement.

CoTherix and Asahi Kasei struck a licensing agreement to develop

the Japanese company's experimental drug fasudil, a potential

treatment for pulmonary arterial hypertension, in 2006. Actelion

bought CoTherix in early 2007, and decided not to develop fasudil

and terminate the agreement with the Japanese firm.

Actelion shares closed Monday at CHF50.65. the stock has lost

around 1.1% in value so far this year, giving it a market valuation

of CHF6.55 billion.

-By Anita Greil, Dow Jones Newswires; +41 43 443 8044 ;

anita.greil@dowjones.com

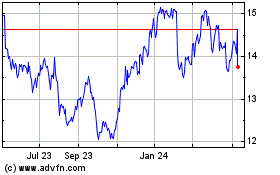

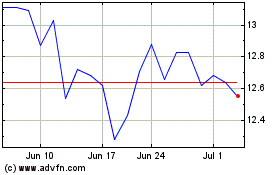

Asahi Kaisai (PK) (USOTC:AHKSY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Asahi Kaisai (PK) (USOTC:AHKSY)

Historical Stock Chart

From Jan 2024 to Jan 2025