Affymax, Inc. Announces a Special Cash Distribution and the Appointment of a New Director and Chief Executive Officer

November 26 2014 - 4:15PM

Business Wire

Affymax, Inc. (OTCQB: AFFY) today announced that its Board of

Directors has declared a special cash distribution to shareholders

in the amount of $0.05 per share. The special cash distribution

will be paid to shareholders of record at the close of business on

December 2, 2014, the record date, on or about December 23, 2014.

The Board has also appointed Jonathan M. Couchman as a Class I

director of the Company and as its President and Chief Executive

Officer, and the remaining members of the Board have resigned. The

Company, under the leadership of Mr. Couchman, will continue its

evaluation of strategic alternatives.

“After a review and evaluation of potential alternatives to the

Company’s liquidation and dissolution, the Board of Directors

reached the conclusion that it is in the best interests of the

shareholders to appoint Jonathan M. Couchman as Director, President

and Chief Executive Officer of the Company, and distribute $0.05

per share to the shareholders. Mr. Couchman will endeavor to

identify and cause the company to acquire one or more revenue or

income producing assets,” stated John Orwin, Chairman of the Board

of Directors. “We believe that these arrangements will maximize

value to our shareholders by providing an immediate substantial

cash distribution to shareholders, while preserving and enhancing

the opportunity to derive additional value in the future.”

“I am excited by the challenge to identify and pursue

opportunities to maximize value for Affymax and for its

stockholders and am encouraged by the excellent results the Company

has secured for its shareholders by working hard to resolve a large

number of highly complex matters,” said Mr. Couchman. “I appreciate

the opportunity to continue to pursue strategic opportunities to

further maximize value for shareholders, including the potential to

make new investments and acquisitions among other

alternatives.”

Jonathan M. Couchman serves as Chairman of the Board, Chief

Executive Officer and Chief Financial Officer of Xstelos Holdings,

Inc., and Myrexis, Inc. (OTC Pink Sheets: MYRX) and previously

served as Director of Golf Trust of America, during its evaluation

of strategic alternatives, which culminated in the reverse merger

of privately owned Pernix Therapeutics Holdings, Inc. into Golf

Trust of America, effective March 9, 2010.

Cautionary Statement About Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, statements relating to the

possibility that the Company may be able to acquire one or more

revenue or income generating assets in the future and the potential

for opportunities to further maximize value for shareholders,

including the potential for a private to public reverse merger,

investments and acquisitions among other alternatives. In some

cases, you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “expect,” “plan,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential” or

“continue,” the negative of these terms or other terminology.

Forward-looking statements are based on the opinions and

estimates of management at the time the statements are made and are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those anticipated in the

forward-looking statements. The Company’s actual results may differ

materially from those expressed or implied by these forward-looking

statements based on a number of factors, including the Company’s

failure to acquire one or more revenue or income generating assets

or to identify and execute upon any opportunities to further

maximize value for shareholders, and other risks and uncertainties

described in the Company’s Quarterly Report on Form 10-Q for the

period ended June 30, 2014. Readers are cautioned that these

forward-looking statements and other statements contained in this

press release regarding matters that are not historical facts, are

only estimates or predictions. Readers are cautioned not to place

undue reliance upon these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update any forward-looking statements whether as a

result of new information, future events or other factors, except

as required by law.

AffymaxMark Thompson, 650-812-8700Chief Financial OfficerThe

Brenner Group

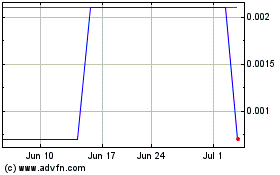

Affymax (CE) (USOTC:AFFY)

Historical Stock Chart

From Jan 2025 to Feb 2025

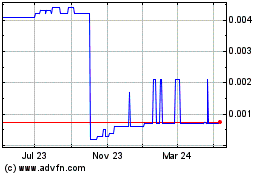

Affymax (CE) (USOTC:AFFY)

Historical Stock Chart

From Feb 2024 to Feb 2025