Current Report Filing (8-k)

February 09 2021 - 4:29PM

Edgar (US Regulatory)

0000737207

false

0000737207

2021-02-09

2021-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date

of Report (Date of Earliest Event Reported):

|

February

9, 2021

|

Adhera

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-13789

|

|

11-2658569

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

|

8000

Innovation Parkway Drive

Baton

Rouge, Louisiana

|

|

70820

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code:

|

919-518-3748

|

N/A

Former

name or former address, if changed since last report

Securities

registered pursuant to Section 12(b) of the Act: None

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

—

|

|

—

|

|

—

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

January 31, 2021, Adhera Therapeutics, Inc. (the “Company”) issued to an existing investor in and lender to the Company

a 10% original issue discounted Senior Secured Convertible Promissory Note for a purchase price of $52,778 (the “Note”).

Additionally, the Company issued to the investor 753,968 warrants to purchase the Company’s common stock at an exercise

price of $0.08 per share (the “Warrant”).

Pursuant

to the Note, the Company promises to pay the principal sum of the Note to the noteholder on the date that is the six- month anniversary

of the original issue date, or such earlier date as the Note is required or permitted to be repaid as provided thereunder, and

to pay interest to the noteholder on the aggregate unconverted and then outstanding principal amount of the Note in accordance

with the provisions thereof. Interest shall accrue on the aggregate unconverted and then outstanding principal amount of the Note

at the rate of 10% per annum, calculated based on a 360-day year and shall accrue daily commencing on the original issue date

until payment in full of the outstanding principal (or conversion to the extent applicable), together with all accrued and unpaid

interest, liquidated damages and other amounts which may become due thereunder, has been made.

The

Note is convertible, in whole or in part, at any time, and from time to time, into shares of the common stock of the Company at

the option of the noteholder at a conversion price of $0.07 (as adjusted for stock splits, stock combinations and similar events);

provided, that if an event of default has occurred under the Note, then the conversion price shall be 70% of the then conversion

price. The conversion price shall also be adjusted upon subsequent equity sales by the Company. The obligations of the Company

under the Note are secured by a senior lien and security interest in all assets of the Company.

The

foregoing summaries of the material terms of the form of Note and the form of Warrant are not complete and are qualified in their

entirety by reference to the full text thereof, copies of which are filed herewith as Exhibits 4.1 and 4.2, respectively, and

incorporated by reference herein.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

disclosures set forth under Item 1.01 relating to the issuance of the Note, and the execution and delivery of the Security Agreement,

are hereby incorporated by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosures set forth under Item 1.01 relating to the issuance of the Note and the Warrant are hereby incorporated by reference.

The issuance of the Note and the Warrant was made in reliance upon the exemption from the registration requirements of the Securities

Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(b)

of Regulation D promulgated thereunder.

Item

8.01 Other Events.

On

January 2, 2021, Les Laboratoires Servier (“Servier”) terminated all rights, titles and interest granted to the Company

under the Amended and Restated Licensing Agreement, dated January 11, 2012, including the termination of all activities related

to the sale and commercialization of Prestalia, a product for the treatment of hypertension. As previously disclosed in a Current

Report on Form 8-K that the Company filed with the Securities and Exchange Commission on December 17, 2019, the Company terminated

its commercial operations relating to the sale of Prestalia in December 2019, and the Company has not engaged in any commercialization

efforts with respect to Prestalia since that time.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

February

9, 2021

|

By:

|

/s/

Andrew Kucharchuk

|

|

|

Name:

|

Andrew

Kucharchuk

|

|

|

Title:

|

CEO

|

EXHIBIT

INDEX

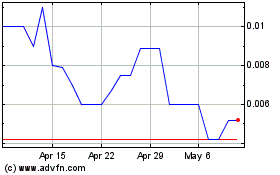

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

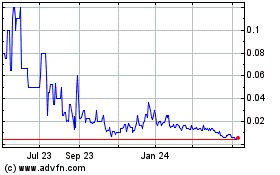

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Dec 2023 to Dec 2024