Amended Tender Offer Statement by Issuer (sc To-i/a)

July 02 2019 - 4:23PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 2)

(Rule

14d-100)

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

of

the Securities Exchange Act of 1934

ADHERA

THERAPEUTICS, INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer))

Warrants

exercisable for Common Stock at an exercise price of $0.55 per share

Warrants

exercisable for Common Stock at an exercise price of $0.50 per share

(Title

of Class of Securities)

00687E

109

(CUSIP

Number of Common Stock Underlying Warrants)

Nancy

R. Phelan

Chief

Executive Officer

Adhera

Therapeutics, Inc.

4721

Emperor Blvd., Suite 350

Durham,

NC 27703

(919)

578-5901

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Lawrence

Remmel, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, NY 10036

Tel:

(212) 421-4100

CALCULATION

OF FILING FEE

|

Transaction

valuation*

|

|

Amount

of filing fee

|

|

$6,387,612

|

|

$774.18(#)

|

|

*

|

Estimated

for purposes of calculating the amount of the filing fee only. Adhera Therapeutics, Inc. (the “

Company

”)

is offering holders of the Company’s outstanding warrants that were issued in connection with the Company’s private

placements of its Series E Convertible Preferred Stock and Series F Convertible Preferred Stock during the 2018 calendar year

(the “

Warrants

”) the opportunity to exchange such Warrants for shares of the Company’s common

stock, par value $0.006 per share (the “

Shares

”), by tendering one Warrant in exchange for two (2)

Shares. The amount of the filing fee assumes that all of the outstanding Warrants will be exchanged and is calculated pursuant

to Rule 0-11(b) of the Securities Exchange Act of 1934, as amended. The transaction value was determined by using the average

of the high and low prices of the Company’s common stock as reported by the OTCQB on May 22, 2019, which was $0.22.

|

|

|

|

|

#

|

Previously

paid.

|

|

|

|

|

[ ]

|

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

Amount

Previously Paid: N/A

|

|

Filing

Party: N/A

|

|

Form

or Registration No.: N/A

|

|

Date

Filed: N/A

|

|

[ ]

|

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check

the appropriate boxes below to designate any transactions to which the statement relates:

|

|

[ ]

|

third-party

tender offer subject to Rule 14d-1.

|

|

|

[X]

|

issuer

tender offer subject to Rule 13e-4.

|

|

|

[ ]

|

going-private

transaction subject to Rule 13e-3.

|

|

|

[ ]

|

amendment

to Schedule 13D under Rule 13d-2.

|

Check

the following box if the filing is a final amendment reporting the results of the tender offer: [ ]

SCHEDULE

TO

This

Amendment No. 1 (this “

Amendment

”) amends and supplements the Tender Offer Statement on Schedule TO

originally filed with the Securities and Exchange Commission on May 28, 2019 (together with any subsequent amendments and supplements

thereto, the “

Schedule TO

”) by Adhera Therapeutics, Inc., a Delaware corporation (the “

Company

”),

relating to the offer by the Company to all holders of the Company’s outstanding warrants that were issued to investors

in connection with the Company’s private placement of its Series E Convertible Preferred Stock and Series F Convertible

Preferred Stock during 2018 (the “

Private Placements

”), which warrants are exercisable for shares of

the Company’s common stock, par value $0.006 per share (the “

Shares

”), which have an exercise

price of $0.50 per share (subject to adjustment) with respect to the warrants that were issued in connection with the Company’s

private placement of its Series E Convertible Preferred Stock (the “

Series E Warrants

”) and $0.55 per

share (subject to adjustment) with respect to the warrants that were issued in connection with the Company’s private placement

of its Series F Convertible Preferred Stock (the “

Series F Warrants

”, and together with the Series E

Warrants, the “

Warrants

”), to receive two (2) Shares in exchange for every Warrant tendered by the holders

thereof.

The

offer is subject to the terms and conditions set forth in the Offer to Exchange, dated May 28, 2019 (as it may be amended, restated

or supplemented from time to time, including by that certain Amended and Restated Offer to Exchange dated June 6, 2019, the “

Offer

Letter

”), and in the related Letter of Transmittal (as it may be amended, restated or supplemented from time to

time, including by that certain Amended and Restated Letter of Transmittal dated June 6, 2019, the “

Letter of Transmittal

”),

a copy of which of the foregoing are filed herewith as Exhibits (a)(1)(A) – (a)(1)(D) (which documents collectively constitute

the “

Offer

”).

This

Amendment is being filed to announce the termination of the Offer and to amend and supplement Items 1 through Item 11 of

the Schedule TO as provided below.

Items

1 through Item 11.

The

disclosure in the Offer Letter and Items 1 through 11 of the Schedule TO is hereby amended and supplemented by adding the following

new paragraphs thereto:

“On

July 2, 2019, the Company announced the termination of the Offer. As a result of the termination of the Offer, no Warrants

were accepted for exchange or exchanged pursuant to the Offer. The Company has instructed the Depositary to promptly return all

Warrants tendered and not withdrawn to the tendering warrantholders.

The

full text of the press release issued by the Company announcing the termination of the Offer is attached as Exhibit (a)(1)(E)

to this Schedule TO and is incorporated by reference herein.”

Item

12. Exhibits.

Item

12 of the Schedule TO is hereby amended and supplemented by adding the following exhibit:

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Nancy R. Phelan

|

|

|

Name:

|

Nancy

R. Phelan

|

|

|

Title:

|

Chief

Executive Officer

|

|

Date:

July 2, 2019

EXHIBIT

INDEX

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Exchange Letter dated May 28, 2019. (#)

|

|

|

|

|

|

(a)(1)(B)

|

|

Letter of Transmittal. (#)

|

|

|

|

|

|

(a)(1)(C)

|

|

Amended and Restated Offer to Exchange Letter dated June 6, 2019. (#)

|

|

|

|

|

|

(a)(1)(D)

|

|

Amended and Restated Letter of Transmittal. (#)

|

|

|

|

|

|

(a)(1)(E)

|

|

Press

release of Adhera Therapeutics, Inc. regarding termination of the Offer on July 2, 2019.

|

|

|

|

|

|

(a)(5)(A)

|

|

The Company’s Annual Report on Form 10-K for the year ended December 31, 2018 (incorporated herein by reference to the Company’s filing with the SEC on April 16, 2019).

|

|

|

|

|

|

(a)(5)(B)

|

|

The Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 (incorporated herein by reference to the Company’s filing with the SEC on May 15, 2019).

|

|

|

|

|

|

(b)

|

|

Not

applicable.

|

|

|

|

|

|

(d)(1)

|

|

Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K dated July 20, 2005).

|

|

|

|

|

|

(d)(2)

|

|

Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.7 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011).

|

|

|

|

|

|

(d)(3)

|

|

Form of Common Stock Purchase Warrant issued by the Company to the purchasers of its Series E Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K dated April 16, 2018).

|

|

|

|

|

|

(d)(4)

|

|

Form of Common Stock Purchase Warrant issued by the Company to the purchasers of its Series F Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K dated July 11, 2018).

|

|

|

|

|

|

(g)

|

|

Not

applicable.

|

|

|

|

|

|

(h)

|

|

Not

applicable.

|

#

Previously filed.

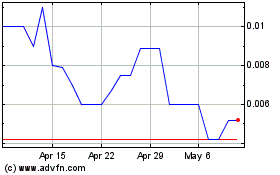

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

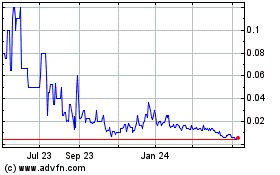

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Mar 2024 to Mar 2025