UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 1)

(Rule

14d-100)

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

of

the Securities Exchange Act of 1934

ADHERA

THERAPEUTICS, INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer))

Warrants

exercisable for Common Stock at an exercise price of $0.55 per share

Warrants

exercisable for Common Stock at an exercise price of $0.50 per share

(Title

of Class of Securities)

00687E

109

(CUSIP

Number of Common Stock Underlying Warrants)

Nancy

R. Phelan

Chief

Executive Officer

Adhera

Therapeutics, Inc.

4721

Emperor Blvd., Suite 350

Durham,

NC 27703

(919)

578-5901

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Lawrence

Remmel, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, NY 10036

Tel:

(212) 421-4100

CALCULATION

OF FILING FEE

|

Transaction

valuation*

|

|

Amount

of filing fee

|

|

$6,387,612

|

|

$774.18(#)

|

|

*

|

Estimated

for purposes of calculating the amount of the filing fee only. Adhera Therapeutics, Inc. (the “

Company

”)

is offering holders of the Company’s outstanding warrants that were issued in connection with the Company’s private

placements of its Series E Convertible Preferred Stock and Series F Convertible Preferred Stock during the 2018 calendar year

(the “

Warrants

”) the opportunity to exchange such Warrants for shares of the Company’s common

stock, par value $0.006 per share (the “

Shares

”), by tendering one Warrant in exchange for two (2)

Shares. The amount of the filing fee assumes that all of the outstanding Warrants will be exchanged and is calculated pursuant

to Rule 0-11(b) of the Securities Exchange Act of 1934, as amended. The transaction value was determined by using the average

of the high and low prices of the Company’s common stock as reported by the OTCQB on May 22, 2019, which was

$0.22.

|

|

|

|

|

#

|

Previously paid.

|

|

|

|

|

[ ]

|

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

Amount

Previously Paid: N/A

|

|

Filing

Party: N/A

|

|

Form

or Registration No.: N/A

|

|

Date

Filed: N/A

|

|

[ ]

|

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check

the appropriate boxes below to designate any transactions to which the statement relates:

|

|

[ ]

|

third-party

tender offer subject to Rule 14d-1.

|

|

|

[X]

|

issuer

tender offer subject to Rule 13e-4.

|

|

|

[ ]

|

going-private

transaction subject to Rule 13e-3.

|

|

|

[ ]

|

amendment

to Schedule 13D under Rule 13d-2.

|

Check

the following box if the filing is a final amendment reporting the results of the tender offer: [ ]

SCHEDULE

TO

This

Amendment No. 1 (this “

Amendment

”) amends and supplements the Tender Offer Statement on Schedule

TO originally filed with the Securities and Exchange Commission on May 28, 2019 (the “

Schedule TO

”)

by Adhera Therapeutics, Inc., a Delaware corporation (the “

Company

”), relating to the offer by

the Company to all holders of the Company’s outstanding warrants that were issued to investors in connection with the Company’s

private placement of its Series E Convertible Preferred Stock and Series F Convertible Preferred Stock during 2018 (the “

Private

Placements

”), which warrants are exercisable for shares of the Company’s common stock, par value $0.006 per

share (the “

Shares

”), which have an exercise price of $0.50 per share (subject to adjustment) with respect

to the warrants that were issued in connection with the Company’s private placement of its Series E Convertible Preferred

Stock (the “

Series E Warrants

”) and $0.55 per share (subject to adjustment) with respect to the warrants

that were issued in connection with the Company’s private placement of its Series F Convertible Preferred Stock (the “

Series

F Warrants

”, and together with the Series E Warrants, the “

Warrants

”), to receive two

(2) Shares in exchange for every Warrant tendered by the holders thereof. The offer is subject to the terms and conditions set

forth in the Amended and Restated Offer to Exchange, dated June 6, 2019 (the “

Offer Letter

”),

a copy of which is filed herewith as Exhibit (a)(1)(C), and in the related Amended and Restated Letter of Transmittal

(the “

Letter of Transmittal

”), a copy of which is filed herewith as Exhibit (a)(1)(D)

(which, together with any amendments or supplements thereto, collectively constitute the “

Offer

”).

The

purpose of this Amendment (and the documents filed herewith) is to amend and supplement the Schedule TO and the Offer. Only those

items amended are reported in this Amendment. Except as specifically provided in this Amendment, the information contained in

the Schedule TO remains unchanged. This Amendment should be read with the Schedule TO and the Offer Letter and the Letter of

Transmittal filed herewith. For the avoidance of doubt, the Offer Letter filed herewith as Exhibit (a)(1)(C) amends and restates

in its entirety the Offer to Exchange dated May 28, 2019 that was filed as Exhibit (a)(1)(A) to the Schedule TO, and the Letter

of Transmittal filed herewith as Exhibit (a)(1)(D) amends and restates in its entirety the Letter of Transmittal that was filed

as Exhibit (a)(1)(B) to the Schedule TO.

The

Schedule TO is intended to satisfy the reporting requirements

of Rule 13e-4 under the Securities Exchange Act of 1934, as amended. The information in the Offer Letter and the Letter of Transmittal

is incorporated herein by reference as set forth below. All share and per share information included in this Amendment shall be

appropriately adjusted to give effect to any split or combination of the Shares that may become effective prior to the completion

of the Offer, including the one-for-three (or greater) reverse split of the Shares that the Company intends to effect prior

to, and as a condition of, the closing of the Offer.

Item

1. Summary Term Sheet.

The

information set forth in the section of the Offer Letter titled “Summary” is incorporated herein by reference.

Item

2. Subject Company Information.

(a)

Name and Address.

The name of the subject company and the filing person is Adhera Therapeutics, Inc., a Delaware corporation.

The address of the Company’s principal executive offices is 4721 Emperor Boulevard, Suite 350, Durham, North Carolina 27703.

The Company’s telephone number is (919) 578-5901.

(b)

Securities.

The subject class of securities consists of the Company’s outstanding Warrants. As of May 24,

2019, there were 26,177,078 Series E Warrants outstanding and 2,857,500 Series F Warrants outstanding, each of which is exercisable

for one share of the Company’s common stock, at an exercise price of $0.50 per share with respect to the Series E Warrants

and $0.55 per share with respect to the Series F Warrants. The actual number of Shares that will be issued will depend on the

number of Warrants tendered and accepted for exchange and subsequently cancelled. If all of the outstanding Warrants are

tendered and accepted for exchange, an aggregate of approximately 58,069,156 Shares will be issued in connection with the Offer.

Warrants that are validly tendered and accepted for exchange will be cancelled.

The

Offer relates to the Warrants that were issued by the Company to investors in connection with the Private Placements. The Warrants

were issued in private transactions, and do not trade on any exchange or trading platform. The Offer does not relate to any of

the other outstanding warrants that have been issued from time to time by the Company. Any and all outstanding Warrants are eligible

to be tendered pursuant to, and in accordance with the conditions applicable to, the Offer.

(c)

Trading Market and Price.

The information set forth in the Offer Letter under “The Offer, Section 6. Price Range

of Shares” is incorporated herein by reference.

Item

3. Identity and Background of Filing Person.

(a)

Name and Address.

The Company is the subject company and the filing person. The business address and telephone number

of the Company are set forth under Item 2(a) above.

The

names of the executive officers and directors of the Company who are persons specified in Instruction C to Schedule TO are set

forth below. The business address for each such person is c/o Adhera therapeutics, Inc., 4721 Emperor Boulevard, Suite 350, Durham,

North Carolina 27703 and the telephone number for each such person is (919) 578-5901.

|

Name

|

|

Position

|

|

Nancy

R. Phelan

|

|

Chief

Executive Officer, Secretary and a Director

|

|

Uli

Hacksell, Ph.D.

|

|

Chairman

of the Board

|

|

Isaac

Blech

|

|

Director

|

|

Tim

Boris

|

|

Director

|

|

Erik

Emerson

|

|

Director

|

|

Donald

A. Williams

|

|

Director

|

Item

4. Terms of the Transaction.

The

information set forth in the Offer Letter under “The Offer, Sections 1 through 15” is incorporated herein by reference.

The

information set forth in the Offer Letter under “The Offer, Section 5.D., Background and Purpose of the Offer—Interests

of Directors and Executive Officers” is incorporated herein by reference.

Item

5. Past Contracts, Transactions, Negotiations and Arrangements.

(a)

Agreements Involving the Subject Company’s Securities.

The information set forth in the Offer Letter under “The

Offer, Section 8. Transactions and Agreements Concerning the Company’s Securities” is incorporated herein by reference.

Item

6. Purposes of the Transaction and Plans or Proposals.

(a)

Purposes.

The information set forth in the Offer Letter under “The Offer, Section 5.C., Background and Purpose of

the Offer—Purpose of the Offer” is incorporated herein by reference.

(b)

Use of Securities Acquired.

The Warrants validly tendered and accepted for exchange pursuant to the Offer will be retired

and cancelled.

(c)

Plans.

No plans or proposals described in this Schedule TO or in any materials sent to the holders of the Warrants in

connection with the Offer relate to or would result in the conditions or transactions described in Regulation M-A, Items 1006(a)

through (c). The exchange of each Warrant pursuant to the Offer will result in the acquisition by the exchanging holder of two

(2) Shares.

Item

7. Source and Amount of Funds or Other Consideration.

(a)

Sources of Funds.

No funds will be used by the Company in connection with the Offer, other than funds used to pay the

expenses of the Offer.

(b)

Conditions.

Not applicable.

(d)

Borrowed funds.

Not applicable.

Item

8. Interest in Securities of the Subject Company.

(a)

Securities ownership.

The information regarding ownership of Warrants set forth in the Offer Letter under “The Offer,

Section 5.D., Background and Purpose of the Offer—Interests of Directors and Executive Officers” is incorporated herein

by reference.

(b)

Securities transactions.

The information set forth in the Offer Letter under “The Offer, Section 5.D., Background

and Purpose of the Offer—Interests of Directors and Executive Officers” is incorporated herein by reference.

Item

9. Persons/Assets, Retained, Employed, Compensated or Used.

(a)

Solicitations or Recommendations.

The information set forth in the Offer Letter under “The Offer, Section 13. The

Depositary” and “The Offer, Section 14. Fees and Expenses” is incorporated herein by reference. Except as

described herein, no persons have been directly or indirectly employed, retained or otherwise compensated to make solicitations

or recommendations in connection with the Offer, other than certain employees of the Company, none of whom will receive any special

or additional compensation in connection with the Offer beyond their normal compensation. The Company has engaged Maxim Merchant

Capital, a division of Maxim Group LLC, as its financial advisor for the Offer, as a result of which the Company has agreed to

pay to Maxim Merchant Capital customary financial advisory compensation relating to the dollar amount of securities sold in the

private placement to be conducted by the Company concurrently with the Offer. The compensation to be paid to Maxim Merchant Capital

is described in the Offer Letter under “The Offer, Section 14. Fees and Expenses”. See the information set forth

on page iv of the Offer Letter.

Item

10. Financial Statements.

(a)

Financial Information.

Incorporated herein by reference are the Company’s financial statements that were included

as Part II, Item 8 in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed with the Securities and

Exchange Commission (the “

SEC

”) on April 16, 2019 (the “

Form 10-K

”), and the

Company’s financial statements that were included as Part I, Item 1 in its Quarterly Report on Form 10-Q for the fiscal

quarter ended March 31, 2019, filed with the SEC on May 15, 2019 (the

“Form 10-Q

”). The Form 10-K and

the Form 10-Q are each available for review on the SEC’s website at www.sec.gov. In addition, the information set forth

in the Offer Letter under “The Offer, Section 9. Financial Information Regarding the Company” is incorporated herein

by reference.

(b)

Pro Forma Information.

Not applicable.

Item

11. Additional Information.

The

information set forth in the Offer Letter and the related Letter of Transmittal, copies of which are filed as Exhibits (a)(l)(C)

and (a)(l)(D) hereto, respectively, is incorporated herein by reference.

Item

12. Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer

to Exchange Letter dated May 28, 2019. (#)

|

|

|

|

|

|

(a)(1)(B)

|

|

Letter of Transmittal.

(#)

|

|

|

|

|

|

(a)(1)(C)

|

|

Amended and Restated Offer to Exchange Letter dated June 6, 2019.

|

|

|

|

|

|

(a)(1)(D)

|

|

Amended and Restated Letter of Transmittal.

|

|

|

|

|

|

(a)(5)(A)

|

|

The Company’s Annual Report on Form 10-K for the year ended December 31, 2018 (incorporated herein by reference to the Company’s filing with the SEC on April 16, 2019).

|

|

|

|

|

|

(a)(5)(B)

|

|

The Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 (incorporated herein by reference to the Company’s filing with the SEC on May 15, 2019).

|

|

|

|

|

|

(b)

|

|

Not

applicable.

|

|

|

|

|

|

(d)(1)

|

|

Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K dated July 20, 2005).

|

|

|

|

|

|

(d)(2)

|

|

Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.7 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011).

|

|

|

|

|

|

(d)(3)

|

|

Form of Common Stock Purchase Warrant issued by the Company to the purchasers of its Series E Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K dated April 16, 2018).

|

|

|

|

|

|

(d)(4)

|

|

Form of Common Stock Purchase Warrant issued by the Company to the purchasers of its Series F Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K dated July 11, 2018).

|

|

|

|

|

|

(g)

|

|

Not

applicable.

|

|

|

|

|

|

(h)

|

|

Not

applicable.

|

#

Previously filed.

Item

13. Information Required by Schedule 13E-3.

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Nancy R. Phelan

|

|

|

Name:

|

Nancy

R. Phelan

|

|

|

Title:

|

Chief

Executive Officer

|

|

Date:

June 6, 2019

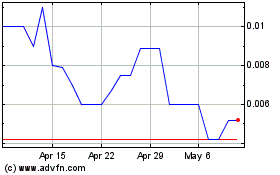

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

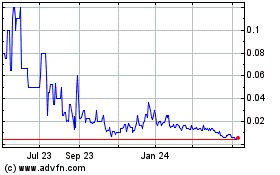

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Dec 2023 to Dec 2024