UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 12)*

Abcam plc

(Name of Issuer)

Ordinary Shares

(Title of Class of Securities)

000380204

(CUSIP Number)

Jonathan Milner

Honey Hill House, 20 Honey Hill

Cambridge CB3 0BG

With copies to:

|

Richard M. Brand

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000 |

Michael Newell

Cadwalader, Wickersham & Taft LLP

100 Bishopsgate

London EC2N 4AG

44 (0) 20 7170 8540 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 28, 2023

(Date of Event Which Requires Filing of This

Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. x

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1 |

|

NAME OF REPORTING PERSON

Dr. Jonathan Milner |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

PF (See Item 3)

|

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e) ¨

|

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7 |

|

SOLE VOTING POWER

11,745,4001

|

| |

8 |

|

SHARED VOTING POWER

2,410,8022 |

| |

9 |

|

SOLE DISPOSITIVE POWER

11,745,4001

|

| |

10 |

|

SHARED DISPOSITIVE POWER

2,410,8022

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,156,2021, 2

|

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.15%*

|

| 14 |

|

TYPE OF REPORTING PERSON

IN

|

| |

|

|

|

|

|

|

* All percentage calculations set forth herein are based upon the

aggregate of 230,148,147 Ordinary Shares as of August 31, 2023, as disclosed in Form SH01 filed at the Companies House of the United

Kingdom on September 21, 2023.

1 Includes 11,700,200 Ordinary Shares directly held by

the Reporting Person and 45,200 shares directly held by the Reporting Person through American Depository Shares representing, each, one

Ordinary Share (“ADS”).

2 Includes 399,382 ADSs held by the Reporting Person’s

spouse, 1,977,967 ADSs held by three limited companies over which the Reporting Person exercises investment discretion and 33,453 ADSs

held by a charitable trust to which the Reporting Person is a trustee and signatory. The Reporting Person disclaims beneficial ownership

over the shares beneficially owned by his spouse, except to the extent of his pecuniary interest therein.

This Amendment No. 12 to Schedule

13D (this “Amendment No. 12”) amends and supplements the Schedule 13D filed on May 1, 2023, as amended and supplemented on

May 18, 2023, May 30, 2023, June 5, 2023, June 6, 2023, June 12, 2023, June 20, 2023, June 21, 2023, June 23, 2023, June 27, 2023, August

16, 2023 and September 14, 2023 (the “Original 13D,” and as amended and supplemented by this Amendment No. 12, the “Schedule

13D”) by the Reporting Person, relating to the Ordinary Shares of the Issuer. Except as specifically provided herein, this Amendment

No. 12 does not modify any of the information previously reported in the Schedule 13D. Capitalized terms not defined in this Amendment

No. 12 shall have the meaning ascribed to them in the Original 13D.

The purpose of this Amendment No. 12 is to update

the disclosure in Items 4, 5 and 7 of the Schedule 13D as hereinafter set forth.

| ITEM 1. |

SECURITY AND ISSUER |

This statement on Schedule

13D relates to the Ordinary Shares of the Issuer. The principal executive offices of the Issuer are located at Discovery Drive, Cambridge

Biomedical Campus, Cambridge, CB2 0AX, United Kingdom.

| ITEM 2. |

IDENTITY AND BACKGROUND |

(a), (f) This statement is being filed by

Dr. Jonathan Milner, a citizen of the United Kingdom.

(b) The address of the Reporting Person is

Honey Hill House, 20 Honey Hill, Cambridge, CB3 0BG.

(c) The Reporting Person’s

principal occupation is as an investor and executive in life sciences companies.

(d), (e) During the last

five years, the Reporting Person (i) has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

and (ii) was not a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such

proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violations with respect to such laws.

| ITEM 4. |

PURPOSE OF TRANSACTION |

Item 4 is hereby amended to add the following:

On September 28, 2023, the Reporting Person published

his Proxy Statement, for the forthcoming court meeting, as set forth more fully in Exhibit 99.18 hereto.

On September 28, 2023, the Reporting Person published

a press release regarding the Issuer, as set forth more fully in Exhibit 99.19 hereto.

| ITEM 5. |

PURPOSE OF TRANSACTION |

Item 5 of the Schedule 13D is hereby amended and

restated as follows:

(a) The Reporting Person is the holder of 11,700,200

Ordinary Shares and 45,200 ADSs. In addition, the Reporting Person may be deemed to share beneficial ownership over (a) 1,977,967 ADSs

beneficially owned by three limited companies over which the Reporting Person exercises investment discretion, (b) 399,382 ADSs beneficially

owned by the Reporting Person’s spouse and (c) 33,453 ADSs held by a charitable trust to which the Reporting Person is a trustee

and signatory. The Reporting Person disclaims beneficial ownership over the shares beneficially owned by his spouse, except to the extent

of his pecuniary interest therein. The shares described in this Item 5 represent approximately 6.15% of the outstanding Ordinary

Shares

(b)

| |

(i) |

Sole power to vote or to direct the vote: 11,745,400 |

| |

(ii) |

Shared power to vote or direct the vote: 2,410,802 |

| |

(iii) |

Sole power to dispose or to direct the disposition of: 11,745,400 |

| |

(iv) |

Shared power to dispose or to direct the disposition of: 2,410,802 |

(c) See Schedule IV, which is incorporated herein

by reference, describes the transactions by the Reporting Person in the Common Stock during the past sixty days.

(d) N/A

(e) N/A

| ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS |

Item 7 is hereby amended to add the following

exhibits:

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: September 28, 2023

| |

By: |

/s/ Jonathan Milner |

| |

|

Name: Jonathan Milner |

Schedule IV

TRADING DATA

The following table sets forth all transactions in the Ordinary Shares

of the Issuer effected by the Reporting Person in the past 60 days. Except as otherwise noted below, all such transactions were purchases

or sales of Ordinary Shares effected in the open market and the table excludes commissions paid in per share prices.

| Reporting Person |

Trade Date |

Buy/Sell |

No. of

Shares/

Quantity |

Unit Cost/

Proceeds |

Security |

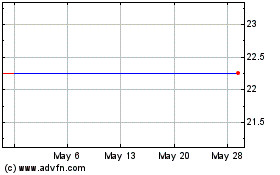

| Jonathan Milner |

9/11/2023 |

Buy |

4,500 |

$22.8599 |

ADS |

| Jonathan Milner |

9/12/2023 |

Buy |

4,500 |

$22.7899 |

ADS |

| Jonathan Milner |

9/13/2023 |

Buy |

4,500 |

$22.8389 |

ADS |

| Jonathan Milner |

9/14/2023 |

Buy |

4,500 |

$22.8172 |

ADS |

| Jonathan Milner |

9/15/2023 |

Buy |

4,500 |

$22.8200 |

ADS |

| Jonathan Milner |

9/18/2023 |

Buy |

4,500 |

$22.7244 |

ADS |

| Jonathan Milner |

9/19/2023 |

Buy |

4,500 |

$22.6700 |

ADS |

| Jonathan Milner |

9/20/2023 |

Buy |

4,500 |

$22.6500 |

ADS |

| Jonathan Milner |

9/21/2023 |

Buy |

4,500 |

$22.6800 |

ADS |

| Jonathan Milner |

9/22/2023 |

Buy |

4,500 |

$22.6000 |

ADS |

Exhibit 99.18

MEETING OF SHAREHOLDERS

OF

Abcam plc

Discovery Drive

Cambridge Biomedical Campus

Cambridge CB2 0AX

United Kingdom (Registered in England & Wales

under Company No. 03509322)

PROXY STATEMENT

DATED September 28, 2023

OF

Jonathan Milner

To Fellow Abcam Shareholders:

This Proxy Statement and

the accompanying WHITE Proxy Card are being furnished to shareholders (“Shareholders”) of Abcam plc (“Abcam”

or the “Company”) in connection with the solicitation of proxies by Dr. Jonathan Milner (“Dr. Milner”)

to oppose the proposed acquisition by Danaher Corporation (NYSE: DHR) or one of its affiliates of all of the outstanding shares of Abcam

(the “Shares”) for $24.00 per Share to be effected by means of a court-approved scheme of arrangement pursuant to the

United Kingdom Companies Act 2006 (the “Companies Act”) (the “Proposed Transaction”) at meeting(s)

of the Shareholders convened with the permission of the relevant courts in England and Wales under the Companies Act in connection with

the Proposed Transaction, to be held at the Company’s offices at Discovery Drive, Cambridge Medical Campus, Cambridge, CB2 0AX,

United Kingdom or another location to be announced by the Company, including any adjournments, postponements or continuations thereof

(the “Court Meeting”).

Further details of the Court

Meeting, and other details relating to the Proposed Transaction, will be included in a circular issued by Abcam to Shareholders in due

course (the “Scheme Circular”). Dr. Milner encourages you to read the contents of the Scheme Circular when it is available

as it will contain detailed information about the Proposed Transaction and the Court Meeting.

As more fully detailed in

an open letter from Dr. Milner to you dated on or around the date hereof, Dr. Milner believes that the Proposed Transaction is poorly

conceived, ill-advised and not in the best interests of Abcam or its Shareholders.

Proposal

As set forth more fully in this Proxy Statement,

we are soliciting proxies from the Shareholders (including from the holders (“ADS Holders”) of American Depositary

Shares (“ADSs”)) in respect of the following proposal to be considered at the Court Meeting:

THAT the scheme of arrangement to effect the acquisition

by Danaher Corporation (or one of its affiliates) of shares in the Company at a price equal to $24.00 per share, such scheme of arrangement

as more particularly described in a circular published or to be published by the Company (such scheme of arrangement in its original form

or with or subject to any modification, addition or condition made thereto in accordance with applicable law) (the “Scheme”)

and approved or imposed by a court of competent jurisdiction in England and Wales, be approved and the directors of the Company (or a

duly authorised committee thereof) be authorised to take all such actions as they may consider necessary or appropriate for carrying the

Scheme into effect.

Other Matters

Dr. Milner knows of no other business to be presented

at the Court Meeting. If any other business should properly come before the Court Meeting, it is intended that the holder of the WHITE

Proxy Card will vote that proxy on such other business in accordance with that holder’s judgment.

DR. MILNER URGES SHAREHOLDERS (INCLUDING ADS HOLDERS)

TO VOTE THE WHITE PROXY CARD AGAINST THE PROPOSAL.

PLEASE NOTE THAT, IF YOUR SHARES ARE REPRESENTED

BY AMERICAN DEPOSITARY SHARES AND HELD ON DEPOSIT BY CITIBANK, N.A. AS DEPOSITARY (THE “DEPOSITARY”), OR IF YOUR SHARES

ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO HAVE YOUR VOTES CAST AT THE MEETING, YOU MUST OBTAIN, COMPLETE AND

TIMELY RETURN A PROXY CARD ISSUED IN YOUR NAME OR COMPLY WITH OTHER VOTING INSTRUCTIONS PROVIDED BY THAT INTERMEDIARY.

BACKGROUND TO THE SOLICITATION

| · | Dr. Milner founded Abcam in 1998 and became its Chief Executive Officer and a Director on the Board of

Directors of Abcam (the “Board”). |

| · | Under Dr. Milner’s leadership the Company enjoyed positive share performance and great scientific

success, becoming the world’s leading supplier of antibodies. |

| · | In 2005, Dr. Milner led the Company to listing on the London Stock Exchange. |

| · | In 2014, Dr. Milner stepped down as Chief Executive Officer to facilitate an orderly succession of management

leadership. By this time initial investors in the Company had experienced an extraordinary ~20x appreciation. |

| · | Upon the occurrence of Dr. Milner’s stepping down, Mr. Alan Hirzel, previously the Chief Marketing

Officer of the Company, was promoted to Chief Executive Officer. Dr. Milner continued as Deputy Chairman of the Board and undertook a

role mentoring the new Chief Executive Officer. |

| · | By 2019, the Company had grown to a market capitalization of ~$5 billion. |

| · | In June 2020, Dr. Milner announced that he would not stand for reelection to the Board later that year,

after what he believed to be a sufficient period of transition to new leadership. |

| · | On October 21, 2020, the Company’s registration of ADSs to be traded through the Nasdaq exchange

was declared effective by the U.S. Securities and Exchange Commission (“SEC”). |

| · | Effective October 26, 2020, the Company executed a Deposit Agreement with Citibank, N.A. as Depositary

to create a facility to hold Shares represented by ADSs. The Deposit Agreement empowers the Depositary to vote Shares it holds pursuant

to instructions received from ADS holders. The Deposit Agreement contains a provision facilitating conversion of ADSs to ordinary shares

upon payment of a $5 per 100 share conversion fee. |

| · | On October 17, 2022 the Company announced that it would delist from the London Stock Exchange. |

| · | On December 13, 2022, the Company’s voluntary delisting from the London Stock Exchange became effective

and trading of ordinary shares through that exchange ceased. |

| · | Subsequently, over 90% of the Company’s Shares have come to be held through ADS arrangements and

traded via Nasdaq rather than held directly by investors as ordinary shares. |

| · | From October 2020 through early 2023 the Company experienced sustained financial underperformance and

value destruction for Shareholders following the Nasdaq listing. |

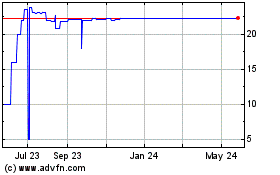

| · | During that time the public trading price of the Company’s stock fell from ~$19 per Share to a low

of ~$13 per Share – a loss of about one-third of its market value in just over two years. This erosion of share value is out of

step with the performance of peer companies, which enjoyed an average ~one-third increase in value during that same time, in a range of

~10% gain to a high of ~70% gain. |

| · | During that time Abcam’s Return on Invested Capital (“ROIC”) dropped as well.

Prior to Dr. Milner’s resignation, Abcam’s ROIC typically exceeded its Weighted Average Cost of Capital. |

| · | On March 10, 2023 Dr. Milner filed an SEC Form 13G disclosing his direct beneficial ownership of 11,993,853

shares. |

| · | On April 28, 2023, Dr. Milner met with Peter Allen, the Chairman of the Board, and Alan Hirzel, the Chief

Executive Officer, to discuss the Company’s poor performance and the possibility that the Board would appoint him as a Director

so he could help return the Company to strong performance. |

| · | On May 1, 2023 Dr. Milner filed a Schedule 13D declaring “that he intends to become more actively

involved in the affairs of the Issuer and to engage with the Issuer regarding its governance, performance and direction.” |

| · | Given the Board’s disappointing response to his proposed return to the Board, and the Board’s

discretion to call an extraordinary general meeting, and his 6.4% ownership of the Company, Dr. Milner reached out to the Depositary,

through which he could vote the ordinary shares represented by his ADSs, to inquire about proper paths by which he could call an extraordinary

general meeting regarding his proposed appointment to the Board that would not require that he first convert his ADSs into ordinary shares. |

| · | On May 9, 2023, the Depositary, by its legal counsel, wrote to Dr. Milner’s legal counsel acknowledging

the substantial fee required for conversion of ADSs to Ordinary Shares, and proposing a process which the Depositary thought was an alternative

to call a general meeting without conversion of ADSs that should be fully acceptable to Abcam. |

| · | On May 11, 2023, Dr. Milner addressed the Company through a letter from his legal counsel to ask that

the Board exercise its discretion to call an extraordinary general meeting of the Shareholders if he should request such a meeting, or

at a minimum, that the Company would permit him to direct the calling of such a meeting himself without having first to convert his ADS

holdings into ordinary shares of the Company, following the procedures recommended by the Company’s own Depositary. |

| · | On May 15, 2023, the Company responded through its legal counsel that the Board would not call an extraordinary

general meeting at Dr. Milner’s request, claiming “we think it’s highly premature to explore the mechanics of requisitioning

an Extraordinary General Meeting of the company’s shareholders.” |

| · | On May 16, 2023, Dr. Milner replied through a letter by his legal counsel stating that the Company “is

playing games and is not considering in good faith Dr. Milner’s candidacy for the Board” and it posed a question: “[w]e

ask again – will the Company call an EGM if asked by Dr. Milner if that request is accompanied by evidence of his ownership of ADRs?” |

| · | On May 17, 2023, a representative of the Company contacted Dr. Milner to advise him that the Board could

agree to appoint him as a non-executive director if he would agree to certain restrictions on his rights as a shareholder and director,

including standstill and non-disparagement agreements. |

| · | The foregoing exchange of correspondence and other dealings with the Company convinced Dr. Milner that

the Board would not work with him in good faith to join as a full member or to have an effective say in Company management thereafter,

so he would instead need to obtain the authority needed to make required changes at the Company by action of its Shareholders instead.

Factors leading to that conclusion included the Board’s use of ADRs to stifle shareholder franchise rights. |

| · | On May 19, 2023, Dr. Milner initiated the conversion of 11.7 million ADSs to ordinary shares, and he paid

the conversion fee of nearly $600,000 which was required by the conversion according to the Deposit Agreement. |

| · | On May 30, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his delivery of a demand

for a general meeting of the Company to be held to effect changes to the Board and a press release regarding that action. |

| · | On May 30, 2023, Dr. Milner received word that the conversion of his ADSs to ordinary shares was completed. |

| · | On June 5, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his publication of

a Proxy Statement of Jonathan Milner dated June 5, 2023 in connection with his demand for the aforementioned general meeting. |

| · | On June 6, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his publication of

a slide-deck presentation regarding the Company entitled “Abcam in Focus.” |

| · | On June 12, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his publication of

a slide-deck presentation regarding the Company entitled “Abcam in Focus” and an open letter to Shareholders. |

| · | On June 20, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his delivery of the

June 19, 2023 letters to the Company and its legal counsel in connection with the aforementioned general meeting demand. |

| · | On June 23, 2023, the Company announced that it had decided to initiate a process to explore strategic

alternatives for the Company to maximize shareholder value, including a potential sale of the Company. |

| · | On June 26, 2023, Dr. Milner announced the suspension of his solicitation to allow the Board to focus

on pursuing its strategic review and thereby create maximum shareholder value. |

| · | On August 16, 2023, Dr. Milner filed an amendment to his Schedule 13D which disclosed his publication

of an open letter to the Board, publicly requesting an update by the Company with regard to its exploration of strategic alternatives

for the maximization of value for shareholders. |

| · | On August 28, 2023, the Company announced that it had entered into a definitive agreement pursuant to

which Danaher would acquire all of the outstanding shares of Abcam for $24.00 per share in cash and that such transaction had been unanimously

approved and recommended by the Board. |

| · | On September 14, 2023, Dr. Milner announced his decision to oppose the Proposed Transaction on the basis

that the $24.00 per share price substantially undervalues the Company and filed an amendment to his Schedule 13D in connection therewith. |

| · | On September 18, 2023, Dr. Milner, through his legal counsel, sent a letter to Abcam (marked for the attention

of Marc Perkins, Abcam’s Secretary and General Counsel) containing a request of shareholder records. That letter requested, among

other things: |

| o | Depository Trust Company list; |

| o | All information in, or which comes into, the possession of the Company, its transfer agent, its proxy

solicitor, or any other of the Company’s agents or representatives, or which reasonably can be obtained from nominees of any central

certificate depositary system as of the Determination Dates, concerning the number and identity of actual beneficial owners of the Company’s

ordinary shares, including, without limitation: (i) a breakdown of any such holdings in the name of The Depository Trust Company - Cede

& Co. (“Cede & Co.”) and any other similar securities depository or nominees; (ii) all omnibus proxies and all "Weekly

Security Position Listing Daily Closing Balances" reports issued by Cede & Co, in or which comes into the possession of the Company,

its transfer agent, its proxy solicitor, or any other of the Company’s agents or representatives, and if such information is not

in the Company’s possession, custody or control, such information should be requested, obtained and provided to us; |

| o | Registered American Depositary Receipts list: A complete record or list of the holders of the Company’s

American Depository Shares, certified by the Company or its transfer agent, showing the name, address and number of shares registered

in the name of each such holder; |

| o | Non-Objecting Beneficial Owners list: All information as of the Determination Dates in or which comes

into the possession of the Company, its transfer agent, its proxy solicitor, or any other of the Company’s agents or representatives,

or which can reasonably be obtained from brokers, dealers, banks, clearing agencies or voting trustees relating to the names of the non-objecting

beneficial owners (“NOBOs”) and consenting beneficial owners of the

ordinary shares, including the name, address and the number of shares held by each NOBO. Such information is readily available to the

Company under Rule 14b-1(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), from Broadridge Financial

Solutions, Mediant Communications LLC, Say Technologies and other such entities and custodian banks; |

| o | Respondent Bank Lists and Omnibus Proxies: All omnibus proxies and related respondent bank lists and

omnibus proxies for such lists pursuant to Rule 14b-2 under the Exchange Act, as of the Determination Dates, in or which comes into the

possession of the Company, its transfer agent, its proxy solicitor, or any other of the Company’s agents or representatives, issued

by Broadridge Financial Solutions, Inc., Mediant Communications LLC, Say Technologies, and other such entities; |

| o | Electronic Mail Addresses: To the extent the Company, or any person or entity acting at its behest,

or on its behalf, maintains or begins to maintain electronic mail addresses or other electronic contact information concerning shareholders

for the purpose of communicating with such shareholders, all such information as of the Determination Dates; and |

| o | Material Request Lists: Any material request lists as of the Determination Dates in or which comes

into the possession of the Company, its transfer agent, its proxy solicitor, or any other of the Company’s agents or representatives,

provided by Broadridge Financial Solutions, Inc., Mediant Communications LLC, Say Technologies, and other such entities. |

| · | On September 25, 2023, Abcam sent a letter to Dr. Milner’s legal counsel indicating Abcam’s

refusal to provide the records noted above. That letter stated, in part: |

We note that your Request asks the

Company to provide copies of certain other records relating to the legal and beneficial ownership of American depositary shares, in addition

to the Registers. As you may be aware, sections 116 and 811 of the Companies Act 2006 only require the Company to provide, on receipt

of a valid request, copies of specific statutory registers. The Company will not therefore be providing you with copies of the broader

records listed in your Request, which are beyond the scope of these provisions of the Companies Act 2006.

REASONS FOR THE SOLICITATION

| · | Dr. Milner believes that the Proposed Transaction grossly undervalues Abcam. |

| · | Dr. Milner believes that the $24 per share price fails to provide any meaningful bid premium to the owners

of an outstanding UK life sciences asset. |

| · | The Board’s acceptance of the terms of the Proposed Transaction within such a short period of time

(approximately two months) after announcing a review of strategic alternatives, including a potential sale, appears to indicate a rushed

process. |

| · | Dr. Milner understands that the Company has put in place excessively favourable arrangements for management

in connection with a sale of the Company, which creates a perverse incentive for the Board to recommend the Proposed Transaction. |

| · | Following Dr. Milner initiating a campaign to be appointed as Executive Chairman of the Board on or around

May 2023, the Company’s share price experienced a notable increase, surging from approximately $15 to approximately $22 per share,

a 47% increase in value. Dr. Milner believes that the shares in the Company should be trading at these levels if the Company were under

the stewardship of a competent and disciplined management and Board with a clear strategy to further drive shareholder value going forwards. |

| · | If the requisite shareholder approvals (as described in more detail later in this Proxy Statement) are

not forthcoming in respect of the Proposed Transaction, Dr. Milner intends to requisition a general meeting of the Company with the object

of reshaping the Board, including the removal of the current CEO, CFO and Chairman from office. |

| · | Further details of Dr. Milner’s reasons for the solicitation and his strategic proposals for the

Company are set forth in his open letter to the Shareholders dated the date of this Proxy Statement and on the website www.abcamfocus.com. |

Dr. Milner

Dr. Milner is pursuing this

solicitation of proxies from Shareholders (including ADS Holders). His principal business address is Honey Hill House, 20 Honey Hill,

Cambridge, CB3 0BG, United Kingdom.

Annex A sets forth all transactions

in securities of Abcam he has effected during the past two years and his total beneficial ownership of securities of Abcam.

Dr. Milner intends to vote

all Shares under his beneficial ownership AGAINST the Proposed Transaction. As set forth more fully under Annex A, Dr. Milner

may be deemed to beneficially own, within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), 14,156,202 Shares, representing approximately 6.15% of outstanding Shares, based upon the 230,148,147 Shares outstanding

as of August 31, 2023, as disclosed in the Form SH01 filed at the Companies House of the United Kingdom on September 21, 2023. Dr. Milner

is a trustee and signatory over shares held by a charitable trust, exercises investment discretion over and has authority to vote Shares

beneficially owned by three certain limited liability companies. Dr. Milner disclaims beneficial ownership of Shares owned by his spouse

except to the extent of his pecuniary interest in those Shares.

Dr. Milner is independent from

the Company under the independence standards applicable to the Company under paragraph (a)(1) of Item 407 of Regulation S-K.

Except as set forth herein,

(a) Dr. Milner is not, and was not within the past year, a party to any contract, arrangement or understanding with any person with respect

to any securities of Abcam, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against

loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (b) Dr. Milner, and no associate

of Dr. Milner, to his knowledge, has any arrangement or understanding with any person with respect to (x) any future employment by Abcam

or its affiliates or (y) any future transactions to which Abcam or any of its affiliates will or may be a party; (c) Dr. Milner, and no

associate of Dr. Milner, owns beneficially, directly or indirectly, any securities of Abcam or any subsidiary of Abcam; and (d) Dr. Milner,

and no associate of Dr. Milner, to his knowledge, was a party to a transaction that is required to be described under Item 404(a) of Regulation

S-K.

Except as set forth herein,

(a) neither Dr. Milner, nor any associate of him, is a party adverse to Abcam or any of its subsidiaries or has a material interest adverse

to Abcam or any of its subsidiaries in any material proceeding; (b) there is no event that occurred during the past 10 years with respect

to him that is required to be described under Item 401(f) of Regulation S-K; and (c) there is no arrangement or understanding between

him and any other person pursuant to which they are to be selected as a nominee hereunder.

Scheme Circular

Dr. Milner makes no representation,

warranty, assurance or undertaking (express or implied) with respect to the content of the Scheme Circular and accepts no responsibility

for the content thereof. All and any such responsibility and liability is expressly disclaimed to the fullest extent permitted by applicable

law.

Forward-Looking Statements

This Proxy Statement

contains forward-looking statements. All statements contained herein that are not clearly historical in nature or that necessarily

depend on future events are forward-looking, and the words “anticipate,” “believe,” “expect,”

“potential,” “could,” “opportunity,” “estimate,” “plan,” and similar

expressions are generally intended to identify forward-looking statements. The statements contained herein that are not historical

facts are based on current expectations, speak only as of the date of this Proxy Statement and involve risks, uncertainties and

other factors that may cause actual results, performance or achievements to be materially different from any future results,

performances or achievements expressed or implied by such statements. Assumptions relating to the foregoing involve judgments with

respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are

difficult or impossible to predict accurately and many of which are beyond the control of Dr. Milner. Although Dr. Milner believes

that the assumptions underlying the forward-looking statements are reasonable as of the date of this Proxy Statement, any of the

assumptions could be inaccurate and therefore, there can be no assurance that the forward-looking statements included herein will

prove to be accurate and therefore actual results could differ materially from those set forth in, contemplated by, or underlying

those forward-looking statements. In light of the significant uncertainties inherent in the forward-looking statements included

herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and

strategic initiatives expressed or implied by such forward-looking statements will be achieved. Except to the extent required by

applicable law, Dr. Milner will not undertake and specifically declines any obligation to disclose the results of any revisions that

may be made to any forward-looking statements herein to reflect events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

HOW TO VOTE

Generally

According to applicable law,

the relevant courts in England and Wales may approve the Proposed Transaction if a majority in number representing 75% in value of the

eligible members or class of members, present and voting either in person or by proxy at the Court Meeting, approve the Proposed Transaction.

Further details in respect of the threshold requirements are set forth below. Abstentions and broker non-votes will have no effect on

the vote outcome. As a result, your vote is extremely important. We urge Shareholders (including ADS Holders) to vote AGAINST

the Proposed Transaction on the WHITE proxy card.

If you attend the Court Meeting

in person and you beneficially own Shares but are not the record owner, including if your Shares are represented by ADSs, your mere attendance

at the Court Meeting WILL NOT be sufficient to vote your Shares or to cancel your prior given proxy card.

YOUR FAILURE TO ACT

ACCORDING TO PROPER VOTING PROCEDURE COULD NEGATE YOUR INTENDED VOTE. IF YOU HAVE ANY QUESTIONS ABOUT THE VOTING PROCESS OR REQUIRE

ANY OTHER ASSISTANCE WITH EXECUTING YOUR PROXY AND VOTING, PLEASE CONTACT:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, New Jersey 07003

Shareholders in North America call: 877-777-8211

Shareholders outside North America call: 0800-102-

6998

By Email: focusabcam@allianceadvisors.com

This Proxy Statement,

as well as other proxy materials distributed by or for Dr. Milner regarding the Court Meeting, will be available free of charge online

at www.abcamfocus.com.

Only holders of record of Shares

as of the close of business on a record date and time to be announced by the Company (the “Company Record Date”) will

be entitled to notice of, and to attend and to vote at, the Court Meeting and any adjournments, postponements or continuations thereof.

We expect the Company will disclose the number of Shares issued and outstanding as of the Company Record Date at or about the time it

announces the Company Record Date and the Court Meeting date.

Once the Company has fixed

the Company Record Date, the Depositary shall, pursuant to the Depositary Agreement1,

fix a record date for the determination of the ADS Holders who shall be entitled to give instructions for the exercise of voting rights

at the Court Meeting (the “ADS Record Date”). The Depositary must make reasonable efforts to establish the ADS Record

Date as closely as practicable to the Company Record Date. Only holders of record of ADSs as of close of business in New York on the ADS

Record Date shall be entitled to give instructions to the Depositary to vote their underlying Scheme Shares (as defined below) at the

Court Meeting.

The Company Record Date and

the ADS Record Date will be posted online at www.abcamfocus.com promptly after the Company or the Depositary (as applicable) announces

it. You are encouraged to check www.abcamfocus.com frequently for updates.

1

§§4.9 and 4.10 of the Deposit Agreement

Quorum; Voting Procedures

Abcam is registered in England

& Wales and is therefore subject to the Companies Act, which, together with the articles of association of Abcam (the “Articles”),

governs the processes for shareholder voting at Shareholder meetings. There are a number of differences between English and U.S. law in

relation to voting. Given the shareholder approval requirements under the Companies Act in connection with the Proposed Transaction, as

further detailed below, the resolution put to the vote of the Court Meeting will be by way of a poll.

Only holders of record of the

Shares at the close of business on the Company Record Date, shall be entitled to notice of, and to attend and to vote at, the Court Meeting.

A large percentage of the Company’s Shares are and on the Company Record Date will be held in the name of the Depositary which issues

Company-sponsored ADSs which, in turn, each represent one Share.

Persons who own Shares indirectly

on the ADS Record Date through a brokerage firm, bank or other financial institution, including persons who own Shares in the form of

ADSs through the Depositary, must return a voting instruction form to have their Shares or the Shares underlying their ADSs, as the case

may be, voted on their behalf.

Under U.S. national securities

exchange rules, if such person does not provide voting instructions, their brokerage firm, bank or other financial institution is only

allowed to vote their securities on routine matters and cannot vote their securities on any non-routine matter. A “broker non-vote”

occurs when a brokerage firm, bank, or other financial institution holding the securities for a beneficial owner votes on one proposal

but does not vote on another proposal because, with respect to such other proposal, the brokerage firm, bank or financial institution

does not have discretionary voting power and has not received instructions from the beneficial owner as to how to vote such securities.

We are not aware of any routine matters being presented at the Court Meeting. For non-routine matters, brokers, or other nominees, do

not have authority, discretionary or otherwise, to vote the securities of a beneficial owner unless they receive proper instructions to

do so from the beneficial owner in a timely manner.

We encourage you to provide

voting instructions to your brokerage firm, bank or other financial institution by giving your proxy to them as promptly as possible to

ensure that your Shares will be voted at the Court Meeting according to your instructions. You should receive directions from your brokerage

firm, bank or other financial institution about how to submit your proxy to them at the time you receive this Proxy Statement. Instructions

regarding how to vote and how to submit your vote will be provided on each proxy card and voting instruction form you will receive, and

you are encouraged to follow those instructions carefully and submit your vote in a timely manner. If you have any questions about completion

or submission of the form, contact Alliance Advisors utilizing the contact information provided in this Proxy Statement.

At the Court Meeting, broker

non-votes will not be counted for the purpose of determining the number of votes cast on a given proposal. The required vote for each

of the proposals expected to be acted upon at the Court Meeting is described below.

Vote Required for Approval

According to applicable law,

the relevant courts in England and Wales may approve the Proposed Transaction if a majority in number of the shareholders who are on the

register of members of the Company on the Company Record Date and who are present and vote, whether in person or by proxy, at the Court

Meeting and who represent not less than 75% in value of the Scheme Shares voted by those shareholders, approve the Proposed Transaction.

“Scheme

Shares” are ordinary shares of the Company (a) in issue as at the date of the Scheme Circular, (b) issued after the date

of the Scheme Circular but before the Company Record Date, and (c) issued after the Company Record Date but before the

“Scheme Record Date” (being the date and time to be specified in the Scheme Circular by reference to which the

shares transferring to Danaher under the Proposed Transaction shall be determined) in respect of which the original or any

subsequent holder thereof is bound by the scheme of arrangement relating to the Proposed Transaction. Scheme Shares do not include

ordinary shares held by Danaher or its nominees or held by the Company in treasury.

Both the Company Record Date

and the Scheme Record Date should be specified in the Scheme Circular and will be posted online at www.abcamfocus.com promptly

after the Company announces them. You are encouraged to check www.abcamfocus.com frequently for updates.

HOW TO VOTE

ADS Holders

There are two ways ADS Holders

as of the ADS Record Date may vote. Such Persons may:

| 1. |

Mark, sign, date and lodge the enclosed WHITE Proxy Card (together with a duly signed and dated power of attorney or other authority (if any) under which it is executed (or a notarized copy of such power of attorney or other authority)), by returning the Proxy Card to the Depositary or your relevant bank, broker or other nominee (as applicable), in each case, in accordance with their instructions, so as to be received by a date and time to be announced by the Depositary, which date is expected to be approximately a week before the Court Meeting (the “ADS Instruction Date”) – each proxy properly tendered will, unless otherwise directed by the ADS Holder, be voted AGAINST the Proposed Transaction at the Court Meeting; or |

| 2. |

ADS Holders are entitled to vote their ADSs (and underlying Shares) in accordance with any separate instructions that the Depositary or their relevant bank, broker or other nominee (as applicable) may send. However, Dr. Milner encourages all ADS Holders to vote AGAINST the Proposed Transaction on the WHITE proxy card so that an accurate assessment of votes can be made. |

You are urged to complete

the enclosed WHITE Proxy Card and lodge it return it to the Depositary or your relevant bank, broker or other nominee (as applicable)

in accordance with their instructions so as to be received by no later than the ADS Instruction Date. If you specify a choice with

respect to the proposal by marking the appropriate box on the proxy, the ADSs will be voted in accordance with that specification. IF

NO SPECIFICATION IS MADE IN RESPECT OF THE PROPOSED TRANSACTION, ALL ADSS REPRESENTED BY THE PROXY WILL BE VOTED AGAINST

THE PROPOSED TRANSACTION.

ADS holders are not entitled

to vote directly at the Court Meeting, but a Deposit Agreement dated as of October 26, 2020 (the “Deposit Agreement”),

exists among the Company, the Depositary and all holders and beneficial owners of ADSs issued thereunder pursuant to which registered

holders of ADSs as of the ADS Record Date are entitled to instruct the Depositary as to the exercise of voting rights pertaining to the

Shares so represented. The Depositary has agreed that it will endeavor, insofar as practicable, to vote (in person (if permitted) or by

delivery to the Company of a proxy) the Shares registered in the name of the Depositary, in accordance with the instructions of the ADS

holders. In the event that the Depositary timely receives voting instructions from an ADS holder which fail to specify the manner in which

the Depositary is to vote the Shares represented by such holder’s ADSs, the Depositary will deem such ADS holder (unless otherwise

specified in the notice distributed to ADS holders) to have instructed the Depositary to vote in favor of the items set forth in such

voting instructions. Instructions from ADS holders must be sent to the Depositary so that the instructions are received by a date and

time to be announced by the Depositary, which date is expected to be approximately a week before the Court Meeting. Shares represented

by the ADSs for which ADS holders have not timely submitted valid voting instructions to the Depositary shall not be voted unless exceptions

apply pursuant to §4.10 of the Deposit Agreement.

Persons who own Shares indirectly

on the ADS Record Date through a bank, broker or other nominee, must return a voting instruction form to such bank, broker or other nominee

to have their Shares voted on their behalf. We encourage you to provide voting instructions to your bank, broker or other nominee by giving

your proxy to them as promptly as possible to ensure that your Shares will be voted at the Court Meeting according to your instructions.

You should receive a WHITE

voting instruction form from your bank, broker or other nominee about how to submit your voting instructions to them at the time you receive

this Proxy Statement.

Direct Shareholders

There are three ways persons

who hold Shares registered in their own name on the Company Record Date may vote. Such Persons may:

| 1. |

Mark, sign, date and lodge the enclosed WHITE Proxy Card (together with a duly signed and dated power of attorney or other authority (if any) under which it is executed (or a notarized copy of such power of attorney or other authority)), by delivering the proxy either by hand or by post, at the offices of Alliance Advisors, 205a High Street, West Wickham, Kent, United Kingdom, BR4 0PH, so as to be received by a date and time to be announced by the Company, which date is expected to be approximately two days before the Court Meeting (the “Ordinary Share Instruction Date”) – each proxy properly tendered will, unless otherwise directed by the Shareholder, be voted AGAINST the Proposed Transaction at the Court Meeting; |

| 2. |

Vote in person by submitting a written ballot in person at the Court Meeting; or |

| 3. |

Shareholders are entitled to execute and return a proxy card the Company may send. However, Dr. Milner encourages all Shareholders to vote in favor of the proposals on the WHITE proxy card so that so that an accurate assessment of votes can be made. |

The Articles provide that Persons

who own Shares who desire to attend a general meeting must have their names entered on the Register at a time specified in the notice

of meeting, but which is not more than 48 hours before the time fixed for the meeting.2

Regardless of whether you

are able to attend the Court Meeting, you are urged to complete the enclosed WHITE Proxy Card and lodge it at the office of Alliance noted

above so as to be received by no later than the Ordinary Share Instruction Date. All valid proxies received prior to the meeting will

be voted. If you specify a choice with respect to the proposal by marking the appropriate box on the proxy, the Shares will be voted

in accordance with that specification. IF NO SPECIFICATION IS MADE, ALL SHARES REPRESENTED BY THE PROXY WILL BE VOTED AGAINST

THE PROPOSED TRANSACTION.

Proxy Procedures

IN ORDER FOR SHAREHOLDERS (INCLUDING ADS HOLDERS)

TO VOTE AS RECOMMENDED IN THIS PROXY STATEMENT, PLEASE MARK, SIGN AND DATE THE ENCLOSED WHITE PROXY CARD AND RETURN IT IN ACCORDANCE

WITH THE INSTRUCTIONS NOTED ABOVE.

IF YOU ARE UNCLEAR ABOUT THE SUBMISSION DEADLINE

OR THE SUBMISSION PROCEDURE OR ANY OTHER ASPECT OF THE VOTING PROCESS, PLEASE CONTACT ALLIANCE ADVISERS FOR ASSISTANCE UTILIZING THE CONTACT

INFORMATION PROVIDED ABOVE.

Only ADS Holders as of

the ADS Record Date, and Shareholders as of the Company Record Date, will be entitled to vote. If you were an ADS Holder on the ADS

Record Date or a Shareholder on the Company Record Date, you will retain your voting rights even if you sell such ADSs after the ADS

Record Date or you sell such Shares after the Company Record Date (as applicable). Accordingly, it is important that you vote the

ADSs held by you on the ADS Record Date and you vote the Shares held by you on the Company Record Date, or grant a proxy to vote

such ADSs or Shares, even if you sell such ADSs after the ADS Record Date or you sell such Shares after the Company Record Date (as

applicable).

2

Articles Section 58.3

Revocation of Proxies

Indirect shareholders,

including ADS Holders

ADS Holders who have voted

using the enclosed WHITE proxy card may revoke or change their proxy instructions up to 48 hours prior to the vote at the Court Meeting

by submitting to the Depositary or your relevant bank, broker or nominee (as applicable) a properly executed, subsequently dated, and

lodged proxy card that will revoke all prior voting instructions or proxy cards, including any proxy cards that you may have submitted

to Abcam, the Depositary, or your relevant bank, broker or nominee (as applicable).

Although such a revocation is effective if delivered

in accordance with the above instructions, Dr. Milner requests that either the original or a copy of any revocation be mailed to him c/o

Alliance Advisors, 205a High Street, West Wickham, Kent, United Kingdom, BR4 0PH, United Kingdom so that he will be aware of all revocations.

Persons who hold Shares represented

by ADSs or held by a bank, broker or other nominee and who otherwise wish to change or revoke their voting instructions should also contact

such intermediary for information on how to do so. ADS Holders are strongly encouraged to submit their voting instructions as soon

as possible. Keep in mind that only your last-dated instructions will be considered in the vote tabulations.

Direct Shareholders

Persons who hold Shares directly

may revoke or change their proxy instructions up to 48 hours prior to the vote at the Court Meeting by:

| · | submitting a properly executed, subsequently dated, and lodged proxy card that will revoke all prior voting

instructions or proxy cards, including any proxy cards that you may have submitted to Abcam; or |

| · | attending the Court Meeting and withdrawing your proxy by voting in person (although attendance at the

Court Meeting will not in and of itself constitute revocation of a proxy). |

Although such a revocation

is effective if delivered in accordance with the above instructions, Dr. Milner requests that either the original or a copy of any revocation

be mailed to him c/o Alliance Advisors, 205a High Street, West Wickham, Kent, United Kingdom, BR4 0PH, United Kingdom so that he will

be aware of all revocations.

Delivery of Proxy Materials

Some banks, brokers and other

nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means

that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate

copy of the document to you if you call or write to Alliance Advisors LLC, at the address set forth above on the back cover of this Proxy

Statement.

Cost and Method of Solicitation

Dr. Milner has retained Alliance

Advisors to conduct solicitation on his behalf, for which Alliance Advisors is to receive a fee of up to $150,000. Dr. Milner has agreed

to indemnify Alliance Advisors against certain liabilities and expenses. Proxies may be solicited by mail, courier services, Internet,

advertising, telephone, telecopier, or in person. It is anticipated that Alliance Advisors will employ up to 25 persons to solicit proxies

from ADS Holders for the Court Meeting. The total expenditures in furtherance of, or in connection with, the solicitation of proxies is

approximately $1,000,000 to date, and is estimated to be approximately $2,500,000 in total. Dr. Milner will bear all costs associated

with this solicitation as necessary.

Additional Information

Certain information relating

to Abcam is not included in this Proxy Statement. Such information includes interests of certain persons in matters to be acted upon at

the Court Meeting, the securities of Abcam held by Abcam’s directors, executive officers and 5% shareholders, information regarding

the directors and management of Abcam, and the date by which proposals of security holders intended to be presented at the next annual

general meeting of Shareholders must be received by Abcam. We expect such information will be provided by or otherwise made available

by the Company, and Dr. Milner takes no responsibility for the accuracy or completeness of any information contained in or taken from

Abcam’s public filings or otherwise provided by Abcam.

Date: September 28, 2023

| |

/s/ Jonathan Milner |

| |

Jonathan Milner |

ANNEX A

Dr. Milner’s Beneficial Ownership of Company

Securities

As of the date of publication

of this Proxy Statement, Dr. Milner may be deemed to beneficially own, within the meaning of Rule 13d-3 under the Exchange Act, 14,156,202

Shares, representing approximately 6.15% of outstanding Shares. Percentages of outstanding Shares stated here are based upon the 230,148,147

Shares outstanding as of August 31, 2023, as disclosed in the Form SH01 filed at the Companies House of the United Kingdom on September

21, 2023. Dr. Milner personally holds 11,700,200 Ordinary Shares and 45,200 ADSs. Dr. Milner is a trustee and signatory over 33,453 ADSs

held by a charitable trust, exercises investment discretion over and has authority to vote the 1,977,967 ADSs beneficially owned by three

certain limited liability companies. Dr. Milner disclaims beneficial ownership over the 339,382 ADSs owned by his spouse except to the

extent of his pecuniary interest in those Shares.

Summary Table

The following table indicates

the date of each purchase and sale of securities of the Company of Dr. Milner within the past two years and the number of securities in

each such transaction. No part of the purchase price or market value of the securities listed below is represented by funds borrowed or

otherwise obtained for the purpose of acquiring or holding such securities.

| Name |

Date |

Purchased/(Sold) |

| Dr. Jonathan Milner |

5-Nov-21 |

(112,210) |

| Dr. Jonathan Milner |

9-Dec-21 |

(133,178) |

| Dr. Jonathan Milner |

24-Dec-21 |

(16) |

| Dr. Jonathan Milner |

29-Dec-21 |

(9,372) |

| Dr. Jonathan Milner |

30-Dec-21 |

(170,000) |

| Dr. Jonathan Milner |

30-Dec-21 |

(146,451) |

| Dr. Jonathan Milner |

11-Jan-22 |

(1) |

| Dr. Jonathan Milner |

23-Sep-22 |

(94,769) |

| Dr. Jonathan Milner |

14-Oct-22 |

(9,333)* |

| Dr. Jonathan Milner |

14-Oct-22 |

(9,333)* |

| Dr. Jonathan Milner |

14-Oct-22 |

(9,333)* |

| Dr. Jonathan Milner |

14-Oct-22 |

(12,000)* |

| Dr. Jonathan Milner |

17-Oct-22 |

(14,000)* |

| Dr. Jonathan Milner |

17-Oct-22 |

(1)* |

| Dr. Jonathan Milner |

28-Oct-22 |

(14,000)* |

| Dr. Jonathan Milner |

28-Oct-22 |

(14,000)* |

| Dr. Jonathan Milner |

28-Oct-22 |

(12,000)* |

| Dr. Jonathan Milner |

4-Nov-22 |

(11,000)* |

| Dr. Jonathan Milner |

5-Dec-22 |

(14,000)* |

| Dr. Jonathan Milner |

26-Jan-23 |

(9,901) |

| Dr. Jonathan Milner |

26-Jan-23 |

(15,099) |

| Dr. Jonathan Milner |

17-Apr-23 |

(65,000) |

| Dr. Jonathan Milner |

19-Apr-23 |

(54,996) |

| Dr. Jonathan Milner |

19-Apr-23 |

(10,004) |

| Dr. Jonathan Milner |

20-Apr-23 |

(65,000) |

| Dr. Jonathan Milner |

25-Apr-23 |

(65,000) |

| Dr. Jonathan Milner |

29-June-2023 |

(33,453)** |

| Dr. Jonathan Milner |

11-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

12-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

13-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

14-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

15-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

18-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

19-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

20-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

21-Sept-2023 |

4,500 |

| Dr. Jonathan Milner |

22-Sept-2023 |

4,500 |

* Denotes a gift

** Denotes transfer to charitable

trust

IMPORTANT

Your vote is important, no matter how many Shares

or ADSs you own.

We urge you to vote AGAINST

the Proposed Transaction.

1. If your Shares are represented by ADSs, please mark, sign and date the enclosed WHITE Proxy Card and return it in accordance with the instructions you receive from the Depositary or your relevant bank, broker or nominee (as applicable) so as to be received by no later than the ADS Instruction Date.

2. If your Shares are registered in your own name, please mark, sign and date the enclosed WHITE Proxy Card and lodge it at Alliance Advisors, 205a High Street, West Wickham, Kent, United Kingdom, BR4 0PH so as to be received by no later than the Ordinary Share Instruction Date.

If you have any questions or require any assistance

in executing or delivering your proxy, please call:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, New Jersey 07003

Shareholders in North America call: 877-777-8211

Shareholders outside North America call: 0800-102-

6998

By Email: focusabcam@allianceadvisors.com

**DR. MILNER RECOMMENDS THAT YOU TO VOTE AGAINST

THE PROPOSED TRANSACTION**

WHITE PROXY CARD

ABCAM PLC

THIS PROXY IS SOLICITED ON BEHALF OF DR. JONATHAN

MILNER

I/We:

(Enter name(s) in full block capital letters, please)

Of:

being (a) member of Abcam plc (the “Company”)

hereby appoint each of Dr. Jonathan Milner, Richard Brand, Esq., Michael Newell, Esq. and Carlo Pia, Esq. to attend, speak, and vote for

me/us and on my/our behalf as identified by an “X” in the appropriate box below at, and in their discretion on other matters

that may properly come before, the meeting(s) of Shareholders convened with the permission of a court of competent jurisdiction in England

and Wales under the United Kingdom Companies Act 2006 in connection with the proposed acquisition by Danaher Corporation (NYSE: DHR) or

one of its affiliates of all of the outstanding shares of the Company for $24.00 per share to be effected by means of a court-approved

scheme of arrangement pursuant to the United Kingdom Companies Act 2006, which is to be held at the Company’s offices at Discovery

Drive, Cambridge Medical Campus, Cambridge, CB2 0AX, United Kingdom or another location to be announced by the Company, including any

adjournments, postponements or continuations thereof.

I/We instruct my/our proxy to vote as follows:

|

Resolution |

|

For |

|

Against |

|

Abstain

(see n.2) |

|

| THAT the scheme of arrangement to effect the acquisition by Danaher Corporation (or one of its affiliates) of shares in the Company at a price equal to $24.00 per share, such scheme of arrangement as more particularly described in a circular published or to be published by the Company (such scheme of arrangement in its original form or with or subject to any modification, addition or condition made thereto in accordance with applicable law) (the “Scheme”) and approved or imposed by a court of competent jurisdiction in England and Wales, be approved and the directors of the Company (or a duly authorised committee thereof) be authorised to take all such actions as they may consider necessary or appropriate for carrying the Scheme into effect. |

|

|

|

|

|

|

|

Dated:

This proxy, when properly executed, will be

voted in the manner directed therein. If no such direction is made, this proxy will be voted AGAINST the resolution.

Notes:

| 1. |

Please indicate with an “X” in the appropriate box how you wish the proxy to vote. In the absence of any indication, this proxy will be voted AGAINST the resolution. |

| 2. |

If you mark the box “abstain”, it will mean that your proxy will abstain from voting and, accordingly, your vote will not be counted either for or against the resolution. |

| 3. |

The form of proxy should be signed and dated by the member or his attorney duly authorized in writing. If the appointer is a corporation this proxy should be under seal or under the hand of an officer or attorney duly authorized. Any alteration made to the form of proxy should be initialed. |

| 4. |

To be valid, this form of proxy, together with a duly signed and dated power of attorney or any other authority (if any) under which it is executed (or a notarized copy of such power of attorney or other authority) must be signed and dated and (i) if your Shares are represented by ADSs, returned to the Depositary or your relevant bank, broker or nominee (as applicable) in accordance with their instructions, so as to be received by a date and time to be announced by Citibank, N.A. as Depositary, which date is expected to be approximately one week before the Court Meeting; and (ii) if you hold your Shares directly, by delivering the proxy either by hand or by post to Alliance Advisors, 205a High Street, West Wickham, Kent, United Kingdom, BR4 0PH, so as to be received by them by a date and time to be announced by the Company, which date is expected to be approximately two days before the Court Meeting. |

| |

|

| 5. |

In the case of joint holders of Shares, signature of any one holder will be sufficient, but the names of all the joint holders should be stated. The vote of the senior holder (according to the order in which the names stand in the register of members in respect of the holding) who tenders a vote in person or by proxy will be accepted to the exclusion of the vote(s) of the other joint holder(s). |

| |

|

| 6. |

Completion and return of a form of proxy will not preclude a direct holder of Shares from attending, speaking and voting at the meeting or any adjournment thereof in person. If a proxy is appointed and the direct holder of Shares attends the meeting in person, the proxy appointment will automatically be terminated. |

Exhibit 99.19

Jonathan Milner issues Open Letter to shareholders

of Abcam plc

Urges shareholders to Vote AGAINST the

proposed acquisition of Abcam by Danaher Corporation

CAMBRIDGE, England, 28 September 2023

– Dr. Jonathan Milner, the founder and one of the largest investors in Abcam plc (“Abcam” or the

“Company”) (NYSE: ABCM) with ownership of 6.15%, today issued an open letter to the Company’s shareholders

announcing his “Vote AGAINST” campaign and providing them with the opportunity to send a clear message to the Board that

they are dissatisfied with the proposed acquisition of Abcam by Danaher Corporation (NYSE: DHR) or its affiliates

(“Danaher”) and Abcam’s governance, execution and cost control.

Find out more and read the full text of the letter

at the Focus Abcam website.

The full text of the letter follows:

“Dear Fellow Abcam Shareholders,

Time for change, calling for focus

In late 2022 and early 2023, my concerns as a

shareholder in our company grew significantly regarding Abcam’s performance following my departure from the Board in October 2020.

Subsequently, I initiated a series of consultations with other owners of the business. By April of this year, my efforts revealed what

I believe to be a distressing series of issues, including inadequate governance, lacklustre investor relations, deficient cost controls,

and subpar execution.

In light of these well-documented failures, which

I have extensively detailed on my website, I found it imperative to take action. I sought to rejoin the Board with the intention

of leveraging my experience and expertise to help steer Abcam back to its previous fortunes. Regrettably, my request to rejoin the Board

was beset with restrictions that would have limited my ability to contribute meaningfully and would have impeded my fiduciary responsibilities.

Consequently, I felt compelled to convene an Extraordinary General Meeting (EGM) where I advocated for the selective replacement of the

CFO, Chairman, and Chair of the Remuneration Committee, all of whom I identified as the principal contributors to the Company’s

misfortunes. My aim was to rejoin the Company, with the intent of collaborating effectively with the current CEO, Alan Hirzel, as I had

done previously.

June – Review of strategic alternatives

In June 2023, the Board made a significant announcement,

stating that the Company had initiated a process to explore strategic alternatives for the Company by evaluating a broad range of

options to maximise shareholder value, including ‘a potential sale.’ I agreed at the time that the Board should be given

the opportunity to conduct this process I hoped that such a process would have started by addressing some of the actions I had spelt

out in my June letter to shareholders, but I have also always openly supported a sale of the Company at a full and fair

price. Therefore, reluctantly, I decided to withdraw my EGM resolutions to provide the Company with the necessary time and space to

conduct the review and identify the best path forward for all shareholders. However, given the historical disregard and lack of

consideration for shareholders displayed by the Executive Directors and the Board, I held reservations about the outcome of this

review. I made it clear at the time in a public statement that I would review progress in the Autumn and that if it seemed

that a full and fair process had not been run, I would reinstate my call for an EGM and hold the Board accountable. I also offered

to rejoin the Board in any capacity (subject to a customary non-executive director contract but with no discriminatory restrictions

that would prevent me from performing my duties) to bring my experience, expertise, and shareholder perspective to help with the

strategic review process. This offer was not acted upon.

August – $24: the wrong price at the

wrong time

My concerns were validated on August 28th when

the Company disclosed that it had received what I, and other shareholders, consider to be an inadequately low offer of $24 per

share from Danaher. I believe that this offer grossly undervalues Abcam, confirming my doubts about the Board’s commitment to securing

the best deal for shareholders. This derisory offer highlights the gulf that has developed between the Board and shareholders. I believe

the Company’s review of strategic alternatives had only one outcome in mind, namely, a sale of the business to deflect attention

away from my call for focus on key metrics, governance and Executive Directors’ performance. I believe the proposals I have outlined

for Abcam would provide a far better outcome for shareholders, returning the Company to the position it previously held as a premium-rated

life sciences company with a long track record of impeccable execution and an absolute focus on shareholder value.

When I initiated my campaign earlier this year,

my focus on fixing Abcam resonated with institutional investors and the share price experienced a notable increase, surging from approximately

$15 to around $22, a 47% increase in value. Whilst some of this increase in value can be attributed to the mere action of initiating a

review of strategic alternatives, it is my belief that the stock should be trading at these levels if the Company were under the stewardship

of competent and disciplined executives and a Board with a clear strategy to further drive shareholder value going forwards.

The Executive Directors have argued that I should

have waited for the shareholder circular to be published to understand the details of the negotiation process. I believe a detailed explanation

of the negotiation process misses the point and will only serve to incur more costs and waste more time. With the strategic review being

launched at a time when the Company’s performance was not optimal and sector multiples depressed, I believe it was highly unlikely

to deliver full value for shareholders against that backdrop. Couple this with the swift acceptance of what I believe to be a subpar bid

(within a mere two-month timeframe) and excessively favourable financial arrangements for Executive Directors (which I believe presents

a significant conflict of interest), all at the expense of shareholders, and you reach what I maintain is the derisory offer of $24 per

share that the Board wishes to recommend to you. Put simply, I believe $24 per share is the wrong price at the wrong time for a company

that is a globally recognised brand in the life sciences sector.

Next steps – Vote AGAINST and consider

my alternative plan for value creation at a forthcoming EGM

I believe that $24 per share is the wrong price

at the wrong time for all of the reasons stated above. It seems nonsensical to be rushed into accepting $24 per share now when the deal

is not expected to close until June 2024 at the earliest and there is a real opportunity to restore Abcam to a high performing and highly

valued business that is recognised for its quality the world over. Like all shareholders, I believe there is a full and fair price to

acquire control of Abcam and I shall not stand in the way of such an offer. However, I also maintain that without a strategic premium

being paid now is not the right time to sell the business and, under my stewardship, we can turn around Abcam's fortunes.

Vote AGAINST to take the first step in

seeing real shareholder value creation. Upon the successful conclusion of the “Vote AGAINST” campaign and the subsequent

withdrawal of the proposed deal, my immediate course of action will involve calling for an EGM with the objective of reshaping the

Company's Board, including the removal of the current CEO, CFO, and Chairman. I have created a shadow Board for Abcam, composed of

highly qualified and independent nominees who share my vision. These individuals bring substantial sector expertise and adhere to

top-tier governance practices and would be led by an experienced, industry-proven Chair to provide oversight and ensure

accountability for the entire Board, myself included. I would assume the role of full-time CEO and one of my first tasks would be to

reach out to the highly talented and dedicated staff at Abcam and provide leadership, focus and empathy with what will have been a

long period of uncertainty.

Having served Abcam as CEO from 1999 to 2014 and

later as Deputy Chairman from 2015 to 2020, I would bring a depth of insight into the Company and my tenure has consistently demonstrated

excellent investor relations and a commitment to delivering shareholder value. Building on this legacy, earlier this year, I rolled out

a six-month plan, aimed at elevating Abcam's market position by refocusing on the Group’s core leadership position in antibodies,

improving operating and EBITDA margins, boosting free cash flow, and resuming dividend payments. This will include continuing the strategy

that I initiated when I was CEO and supported as Deputy Chairman of increasing in-house manufacturing of Abcam’s own high-quality,

high-margin products and decreasing reliance on third-party reagents.

Looking ahead, my strategy includes maintaining

Abcam's listing on NASDAQ and listing the Company on the Main Market of the London Stock Exchange. To support me with this process, I

am pleased to announce that I have appointed Peel Hunt, a leading UK investment bank, as part of my advisory team. With the benefit of

hindsight, I believe that leaving the LSE last year was misguided and led to a number of long-term UK shareholders becoming sellers over

time. Abcam also benefitted from a scarcity value when listed in London with a broad and deep following of long-standing institutional

shareholders. This dual listing approach aims to better cater to UK institutions and would take advantage of recently announced regulatory

reforms in the UK, while also prioritising the maintenance of the important NASDAQ listing in the US.

Shareholder value creation will be at the heart of my strategy and

I strongly believe in transparency and equality for all shareholders. I encourage shareholders to visit my website for further details

of my campaign and to see updates on my plan for Abcam.

I URGE ALL SHAREHOLDERS TO VOTE AGAINST THIS

PROPOSED TRANSACTION ON THE PROXY FORM. THIS IS AN OPPORTUNITY FOR SHAREHOLDERS TO SEND A CLEAR MESSAGE TO THE BOARD THAT THEY ARE DISSATISFIED

WITH THE PROPOSED ACQUISITION AS WELL AS WITH THE COMPANY’S GOVERNANCE, EXECUTION AND COST CONTROL.

Yours sincerely,

Jonathan Milner”

Jonathan Milner

https://abcamfocus.com/

Investor contact

Alliance Advisors

Alliance Advisors LLC

T: +44 7733 265 198 / focusabcam@allianceadvisors.com

Michael Roper

Peel Hunt LLP

T: +44 (0) 20 7418 8900

Christopher Golden / James Steel

Sohail Akbar / Jock Maxwell Macdonald

International PR advisers

ICR Consilium (Europe)

T: +44 (0)20 3709 5700 / E: focusabcam@consilium-comms.com

Mary-Jane Elliott / Matthew Neal / Davide Salvi

ICR (US)

T: +1 646 677 1811 / E: FocusAbcam@icrinc.com

Dan McDermott

IMPORTANT ADDITIONAL INFORMATION

THIS DOCUMENT HAS BEEN ISSUED BY DR. JONATHAN

MILNER ("DR. MILNER").

DR. MILNER IS PUBLISHING A PROXY STATEMENT AND

ACCOMPANYING [WHITE] PROXY CARD TO BE USED TO SOLICIT VOTES AGAINST THE PROPOSED ACQUISITION OF ABCAM PLC (THE "COMPANY") BY

DANAHER CORPORATION OR ONE OF ITS AFFILIATES AT $24 PER SHARE AT A MEETING OF THE SHAREHOLDERS CONVENED PURSUANT TO THE COMPANIES ACT

2006 (THE “COURT MEETING”).

DR. MILNER STRONGLY ADVISES ALL SHAREHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.