1st Colonial Bancorp, Inc. (OTCBB:FCOB), the holding company of

1st Colonial National Bank, today reported that its net income for

the nine months ended September 30, 2011 was $573,000 ($0.18 per

share), compared to $664,000 ($0.21 per share) for the nine months

ended September 30, 2010.

Gerry Banmiller, President and Chief Executive Officer,

commented, “Our operating philosophy for the third quarter of 2011

mirrored the initiatives of the second quarter of 2011, which is to

continue to focus on reducing expenses and increasing our fee

income. Because of our focus on core deposits away from

certificates of deposit, our net interest spread continues to

improve.”

Mr. Banmiller added, “To compensate for a lack of commercial

loans, we underwent an initiative to book home equity consumer

loans. A major advertising campaign yielded almost triple the

dollar volume of home equity loans in the third quarter than we had

in the second quarter of 2011. We have used our same conservative

underwriting standards, but our aggressive in branch and newspaper

advertising has yielded many more applications than in the past,

and the volume continues to be exciting. In October we booked the

same dollar amount as the entire second quarter. One of the

requirements for a lower rate of interest is a direct debit to a

new or existing checking account. As a result, new retail checking

business has been significant.”

At September 30, 2011, 1st Colonial also reported $281.4 million

in total assets, $176.8 million in total loans and $245.6 million

in deposits. These amounts are relatively flat when compared to the

$277.4 million in total assets, $177.1 million in total loans and

$243.4 million in deposits from September 30, 2010. The stalling of

the balance sheet is reflective of the continued lack of qualified

commercial loan demand. Investments were $78.6 million compared to

$79.7 million at September 30, 2010.

Net interest income of $6,668,000 for the nine months ended

September 30, 2011 was $391,000, or 6.2%, higher than the net

interest income of $6,277,000 for the nine months ended September

30, 2010. This was due primarily to a 0.30% increase in net

interest spread to 3.27% for the nine months ended September 30,

2011 compared to 2.97% for the nine months ended September 30,

2010.

1st Colonial’s provision for loan losses for the nine months

ended September 30, 2011 was $1,525,000 compared to the $1,310,000

provision for the nine months ended September 30, 2010.

Non-interest income decreased $102,000 or 8.0% from the prior

year. Non-interest income for the nine months ended September 30,

2010 included a gain on sale of investments of $212,000, and there

was no gain or loss from the sale of investments during the nine

months ended September 30, 2011. Fees generated by the origination

and sale of SBA loans increased by $93,000, partially offsetting

the decrease in non-interest income caused by the 2010 investment

sale.

Non-interest expense increased $330,000 or 6.1% from the

comparable period in 2010. Salaries and benefits accounted for

$176,000 of the increase due to additional personnel in the

residential lending department and general salary and benefit

increases. Expenses related to loans in foreclosure and legal

expenses inherent with enforcing loan contracts increased by

$208,000. Advertising expenses decreased $57,000 from the

comparable period in 2010. Included in non-interest expense for the

nine months ended September 30, 2011 were losses on real estate

owned of $51,000, compared to $29,000 for the nine months ended

September 30, 2010.

As a result of lower pre-tax earnings and increased tax exempt

investments, our income tax expense decreased from $215,000 for the

nine months ended September 30, 2010 to $50,000 for the nine months

ended September 30, 2011.

The company also reported that its net income for the three

months ended September 30, 2011 was $228,000, a decrease of $63,000

from the comparable period ended September 30, 2010. Additionally,

diluted earnings per share decreased to $0.07 for the quarter ended

September 30, 2011 from $0.09 for the quarter ended September 30,

2010. Net interest income increased $152,000, but this was more

than offset by a $310,000 increase in the provision for loan

losses. Noninterest income increased by $25,000 due to a $54,000

increase in fees generated by the origination and sale of SBA loans

and our noninterest expense decreased by $5,000. Our lower pre-tax

earnings and increased tax exempt investments for the quarter

caused a decrease in income tax expense of $65,000 compared to the

three months ended September 30, 2010.

Highlights as of September 30, 2011 and September 30, 2010, and

comparing the three and nine months ended September 30, 2011 and

the three and nine months ended September 30, 2010, respectively

(all unaudited), include the following (dollars in thousands,

except per share data):

at at $ increase/

% increase/

September 30,

2011

September 30,

2010

Decrease

decrease

Total assets $281,454 $277,404 $4,050 1.5% Total

loans 176,845 177,160 (315) -0.2% Investments 78,640 79,724

(1,084) -1.4% Total deposits 245,639 243,370 2,269 0.9%

Shareholders' equity 24,124 23,973 151 0.6%

For the nine months ended $ increase/ % increase/

September 30,

2011

September 30,

2010

Decrease

decrease

Net interest income $6,668 $6,277 $391 6.2% Provision

for loan losses 1,525 1,310 215 16.4% Other income 1,180

1,282 (102) -8.0% Non interest expense 5,700 5,370 330 6.1%

Tax expense (benefit) 50 215 (165) -76.7%

Net income

573 664 (91) -13.7% Earnings per share (diluted) $0.18 $0.21

($0.03) -14.3%

For the three months

ended $ increase/

% increase/

September 30,

2011

September 30,

2010

Decrease

decrease

Net interest income $2,287 $2,135 $152 7.1% Provision

for loan losses 625 315 310 98.4% Other income 447 422 25

5.9% Non interest expense 1,854 1,859 (5) -0.3% Tax

expense (benefit) 27 92 (65) -70.7%

Net income

228 291 (63) -21.6% Earnings per share (diluted) $0.07 $0.09

($0.02) -22.2%

1st Colonial National Bank, the subsidiary of 1st Colonial

Bancorp, provides a range of business and consumer financial

services, placing emphasis on customer service and access to

decision makers. Headquartered in Collingswood, New Jersey, the

Bank also has branches in the New Jersey communities of Westville

and Cinnaminson. To learn more, call (856) 858-8402 or visit

www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; varying and unanticipated costs of collection with

respect to nonperforming loans; changes in interest rates, changes

in FDIC assessments, deposit flows, loan demand, and real estate

values; competition; changes in accounting principles, policies or

guidelines; changes in laws or regulations and in the manner in

which the regulators enforce same; new technology and other factors

affecting our operations, pricing, products and services.

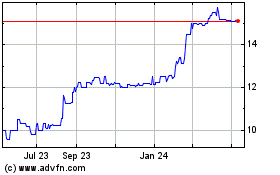

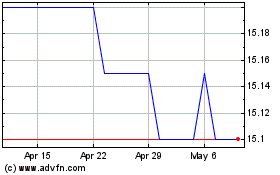

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jun 2024 to Jul 2024

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jul 2023 to Jul 2024