Wi2Wi Corporation ("Wi2Wi" or the "Company") (TSX-V:YTY)

(Common Shares: 81,544,306) is pleased to announce its

unaudited consolidated interim financial results for the quarter

ended June 30, 2013

Three Months to June 30,

2013

Three Months to June 30,

2012

Six Months to June 30,

2013

Six Months to June 30,

2012

(in thousands of US dollars) Statement

of results Revenue $1,324 $938 $2,577

$1,739 Gross Profit 551 295 1,045 582

Operating expenses Research and Development 262 297 515 570

Selling, general and administrative 958 1,460 2,495 2,155 Share

Listing expenses and interest paid 30 25 3,044

35 Net Loss and Total Comprehensive Loss $(699)

$(1,487) $(5,009) $(2,178) Net loss per share,

basic and diluted $(0.01) $(0.02) $(0.06)

$(0.03)

Wi2Wi designs, manufactures and markets miniaturized embedded

wireless connectivity solutions (incorporating both hardware and

software) for premium industrial/medical, smart-home/smart

building and government markets worldwide. These products and value

added services provide highly integrated, multifunctional wireless

sub systems for mobile applications of all forms for mobile

devises.

The results of the quarter follow the completion of the

amalgamation of Wi2Wi Corporation and International Sovereign

Energy Corp. The additional capital introduced, following the

completion of the RTO transaction, was utilized to discharge

certain liabilities and other obligations, as well as to generate

working capital to allow the Company to satisfy the backlog demand

from customers that had accumulated. The growth in revenue from the

first to the second quarter was 6% and builds on the excellent

sales momentum we are currently experiencing. Gross margins are

sound in the six months ended June 30, 2013 being in excess of 40%.

Expenses for the second quarter are now indicative of the current

levels, excluding the effect of reporting Stock Compensation

expense in the quarter, as this is calculated on when options are

vested.

Dr. Hans Black, Chairman of Wi2Wi, stated, “We are extremely

pleased with our first half results. Our substantial efforts to

better service Wi2Wi’s customer base has translated into a higher

and profitable level of business activity, and has aided our

strategy in engaging new sales leads. The completion of the RTO

transaction has also allowed us to reduce those related expenses

and now enables us to fully focus on solidifying the gains we have

made in the first half of this year. We look forward to further

growth in our revenue base and gross margins for the balance of

2013 and into 2014.”

Dr. Reza Ahy, Chief Executive Officer, stated, “We have been

systematically building up a pipeline of quality customers and

industry leaders. Wi2Wi currently has 55 design wins or design ins

for its third generation WiFi and WiFi Bluetooth and GPS products.

The increase in demand for our third generation GPS products is

exceedingly strong, and the large number of customers that have

advanced to the design wins and design ins bodes well for Wi2Wi’s

future. This gives a clear indication of the high acceptance levels

we have been able to achieve through our high quality products, and

highlights our ability to create solutions for customers through

our value added services. This is augmented by a need we have

identified by offering software development and other technical

advancements that shrink the design and pre-manufacturing cycles

through plug and play type processes, allowing customers to go to

market sooner than is the norm in our industry.”

For further information, please contact:

John Lokker, CA, CFEChief Financial Officer(408) - 416-4221

Forward-Looking Statements: This news release contains certain

forward-looking statements, including management's assessment of

future plans and operations, and the timing thereof, that involve

substantial known and unknown risks and uncertainties, certain of

which are beyond the Company's control. Such risks and

uncertainties include, without limitation, risks associated with

oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of

commodity prices, currency fluctuations, imprecision of reserve

estimates, environmental risks, competition from other producers,

inability to retain drilling rigs and other services, delays

resulting from or inability to obtain required regulatory approvals

and ability to access sufficient capital from internal and external

sources, the impact of general economic conditions in Canada, the

United States and overseas, industry conditions, changes in laws

and regulations (including the adoption of new environmental laws

and regulations) and changes in how they are interpreted and

enforced, increased competition, the lack of availability of

qualified personnel or management, fluctuations in foreign exchange

or interest rates, stock market volatility and market valuations of

companies with respect to announced transactions and the final

valuations thereof, and obtaining required approvals of regulatory

authorities. The Company's actual results, performance or

achievements could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurances can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits, including the amount of proceeds, that

the Company will derive there from. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect the Company’s

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com).

This news release contains “forward-looking statements” within

the meaning of applicable securities laws relating to, among other

things, the Proposed Transaction. Readers are cautioned not to

place undue reliance on forward-looking statements. Actual results

and developments may differ materially from those contemplated by

these statements. Completion of the Proposed Transaction described

herein is dependent on a number of factors and is subject to a

number of risks and uncertainties, and it is not certain that the

Proposed Transaction will be completed. Factors that could cause

actual results to differ materially include, but are not limited

to, changes in the Company`s or Wi2Wi’s business, general business,

economic and competitive uncertainties and delay or failure to

receive board, shareholder or regulatory approvals.

Forward-looking statements are made based on management’s

beliefs, estimates and opinions on the date the statements are made

and the Corporation undertakes no obligation to update

forward-looking statements and if these beliefs, estimates and

opinions or other circumstances should change, except as required

by applicable law. All subsequent forward-looking statements,

whether written or oral, attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these cautionary statements. Furthermore, the forward-looking

statements contained in this news release are made as at the date

of this news release and the Company does not undertake any

obligation to update publicly or to revise any of the included

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Wi2Wi CorporationJohn Lokker, CA, CFE, (408) - 416-4221Chief

Financial Officer

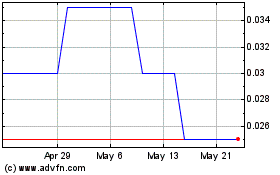

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

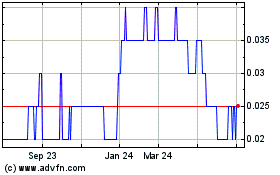

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From Jul 2023 to Jul 2024