YANGAROO Inc. (TSX-V: YOO, OTCBB: YOOIF), the

leading secure digital media management and distribution company,

today announced its results for the second quarter ended June 30,

2018.

Revenue for Q2 was $1,797,924, 11% lower than

the same period in 2017 and 8% lower than Q1 2018, with net loss of

$18,828 and normalized EBITDA of $48,365. Revenue for the first

half of 2018 was $3,747,014, 1% lower than the first half of 2017

with net income of $66,143 and normalized EBITDA of $227,931.

Advertising revenue of $1,025,092 in Q2 has

dropped 16% over the same period in 2017 and dropped 17% over the

previous quarter. The year-to-date revenue for the first 2 quarters

was $2,254,547, which remained flat compared to the same 2 quarters

in 2017. The decrease in Q2 was mainly due to inconsistent timing

of campaign spending by a major client, as evidenced by higher

revenues from the client in the previous quarter.

Entertainment Division’s Q2 revenue was

$772,832, down 4% over 2017 and up 7% over the previous quarter.

The revenue of the first half of 2018 was $1,492,467, 2% lower than

the same period in 2017. The change in revenue recognition

standards in 2018 resulted in lower awards management revenue in

the current quarter compared to last year, but is a timing change

only. However, the increase in volume of music deliveries in the

current quarter brought a positive change compared to previous

quarter. The drop of revenue for the first half of 2018 was mainly

a result of the general decline in the volume of subscription and

music video deliveries.

“The flat revenue year to date, both

consolidated and in the Advertising Division, does not yet reflect

the business development efforts outlined last quarter,” said Gary

Moss, President and CEO of YANGAROO. “YANGAROO continues to develop

its Advertising Division sales force and opportunity

pipeline. The Company recently added ad sales representatives

in the Los Angeles and Miami markets and they are already

contributing to sales opportunities. The Advertising Division

pipeline continues to grow and mature and the first significant new

customers are completing their testing and onboarding

processes. The Company expects new customer business to start

making a contribution to revenue in the latter part of 2018. Until

revenue growth accelerates, the Company will continue to carefully

control costs.”

Total operating expense was $1,846,239 for the

quarter ended June 30, 2018, 3% higher than the previous year and

3% lower than the previous quarter. The year-to-date operating

expenses was $3,747,336, 8% higher than the same period in 2017.

The increases for both the current quarter and the year-to-date

were primarily due to higher value of stock options granted, salary

adjustments and bonus accrual. The decrease over previous quarter

was a result of lower stock option expenses in the current quarter.

The Company has incurred a net loss of $18,828 in the current

quarter, compared to a net income of $171,597 in the same quarter

of last year; and retained a net income of $66,143 in the first

half of 2018, compared to $204,446 in the same period of last year.

Excluding the impact of non-cash and non-operating costs, the

second quarter of 2018 had positive normalized EBITDA of $48,365

and $227,931 for the first half of 2018.

Summary of operating results for the periods

ended June 30th:

|

$CDN |

Six Months |

Second Quarter |

|

|

2018 |

2017 |

2018 |

|

2017 |

|

Revenue |

3,747,014 |

3,766,797 |

1,797,924 |

|

2,026,731 |

|

EBITDA |

156,099 |

292,354 |

25,033 |

|

218,165 |

|

Normalized EBITDA |

227,931 |

422,465 |

48,365 |

|

301,952 |

|

Net income (loss) for the period |

66,143 |

204,446 |

(18,828 |

) |

171,597 |

|

Basic income (loss) per share |

0.001 |

0.003 |

(0.000 |

) |

0.003 |

|

Diluted income (loss) per share |

0.001 |

0.003 |

(0.000 |

) |

0.003 |

Please note that all currency in this press

release is denoted in Canadian dollars.

The full text of the financial statements and

Management Discussion & Analysis is available at

www.yangaroo.com and at www.sedar.com.

About YANGAROO:YANGAROO is a

company dedicated to digital media management. YANGAROO’s patented

Digital Media Distribution System (DMDS) is a leading secure B2B

digital cloud-based solution focused on the music and advertising

industries. The DMDS solution provides more accountable, effective,

and far less costly digital management of broadcast quality media

via the Internet. It replaces the physical, satellite and closed

network distribution and management of audio and video content, for

music, music videos, and advertising to television, radio, media,

retailers, and other authorized recipients. The YANGAROO Awards

platform is now the industry standard and powers most of North

America’s major awards shows.

YANGAROO has offices in Toronto, New York, and

Los Angeles. YANGAROO trades on the TSX Venture Exchange (TSX-V)

under the symbol YOO and in the U.S. under OTCBB: YOOIF. For

further information, please contact Gary Moss at 416-534-0607

ext.111 or visit www.yangaroo.com.

THE TSX VENTURE EXCHANGE HAS NOT

REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Cautionary Note Regarding

Forward-looking Statements

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of applicable Canadian securities laws. All

statements other than statements of present or historical fact are

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

"anticipate", "achieve", "could", "believe", "plan", "intend",

"objective", "continuous", "ongoing", "estimate", "outlook",

"expect", "may", "will", "project", "should" or similar words,

including negatives thereof, suggesting future outcomes.

Forward looking statements are subject to both

known and unknown risks, uncertainties and other factors, many of

which are beyond the control of YANGAROO, that may cause the actual

results, level of activity, performance or achievements of YANGAROO

to be materially different from those expressed or implied by such

forward looking statements, including but not limited to: the use

of proceeds of the offering, receipt of all necessary approvals of

the offering, general business, economic, competitive, political

and social uncertainties; negotiation uncertainties and other risks

of the technology industry. Although YANGAROO has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause YANGAROO’s actual

performance and results to differ materially from any projections

of future performance or results expressed or implied by such

forward-looking statements. Any forward-looking statements are made

as of the date hereof and, except as required by law, neither

YANGAROO assumes no obligation to publicly update or revise such

statements to reflect new information, subsequent or otherwise.

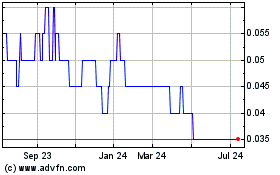

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

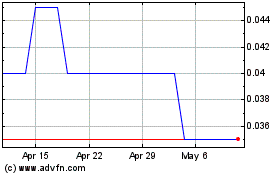

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Jan 2024 to Jan 2025