VVC Exploration Announces Signing of a $4 Million Loan Facility Term Sheet

January 29 2014 - 2:27PM

Marketwired Canada

VVC Exploration Corporation ("VVC" or the "Company") (TSX VENTURE:VVC) is

pleased to announce that as a part of a potential debt financing effort

discussed in a December 30, 2013 press release, it has received and signed a

Termsheet between Aeris Trading Corp. (a Joint Venture Company between Alexander

Capital Equity Group ("ACE") and Alpha Trading LLC.), and Camex Mining

Development Group Inc. ("Camex"), a wholly owned subsidiary of VVC Exploration

Corporation.

This $4 million term sheet, proposes a two part loan facility. First, a $2

million tranche to be available for drawdown by the end of February, and second,

a further $2 million upon the receipt of all mining permits on the Company's 33%

VVC owned Samalayuca Copper Project.

The loan is focused on the startup of production at the Samalayuca Copper

Project which is 33% owned by Camex, and may also be used for the corporate

operations of Camex and VVC.

James A. Culver, President of VVC and Camex, commented: "We are very excited to

receive this term sheet, and expect to begin working on loan documentation with

Aeris this week. We have had numerous discussions with ACE and are pleased to

have an opportunity to work with one of their companies and with their trading

partner, Alpha Trading Inc."

Proposed Loan Terms are as follows:

-- A total loan facility of US$4.0 million, with at least $500,000 to be

advanced at the end of February 2104 and the balance at regular

intervals over 12 months.

-- Repayment will occur from 50% of any cash flow that Camex may receive

from its Samalayuca Copper Project, and, in any case, must be completely

repaid within 5 years from the date of the first disbursement.

-- The loan will be secured by half of Camex's ownership of its Samalayuca

Copper Project in Chihuahua, Mexico.

-- Outstanding principal shall bear an interest rate of 12% per annum.

-- A bonus of 1 million common shares of VVC (priced at $0.05 per share)

and 2 million common share purchase warrants ("Warrant(s)") will be

issued for each $500,000 drawdown of the loan facility, up to a maximum

of 8 million shares and 16 million Warrants, if the full $4 million loan

facility is utilized. Each Warrant entitles the holder to purchase one

additional common share of the Company at $0.08 per share for a period

of 5 years.

Finders fees of 2% of the aggregate amount of the loan may be payable to

persons, at arms' length to the Lender, Camex and VVC, who are instrumental in

arranging the closing of this facility, payable on each draw-down.

The terms of this loan will require the approval of the TSX Venture Exchange

("TSXV"). The Company has filed the details of the offer with the TSXV and will

seek approval of final loan documentation. Investors are cautioned that there

can be no assurance that the Loan will be completed or, if it is completed, that

it will be on the terms as disclosed herein. VVC will announce the status of the

Loan including, if and when definitive loan documentation is entered into, in

further press releases.

About VVC Exploration Corporation

VVC is a Canadian exploration and mining company with projects in Mexico and

Canada, which includes a near production copper prospect in Chihuahua State, and

gold and silver prospects in Sonora and Sinaloa States, Mexico. The Company also

has a grassroots gold/VMS prospect in the Timmins area of northern Ontario. VVC

is aggressively seeking to convert its near production copper project,

Samalayuca, to pilot scale production, then full production.

On behalf of the Board of Directors

Michel J. Lafrance, Secretary-Treasurer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains "forward-looking information" (within the meaning of

applicable Canadian securities laws) and "forward -looking statements" (within

the meaning of the U.S. Private Securities Litigation Reform Act of 1995). Such

statements or information are identified with words such as "anticipate",

"believe", "expect", "plan", "intend", "potential", "estimate", "propose",

"project", "outlook", "foresee" or similar words suggesting future outcomes or

statements regarding an outlook. Such statements include, among others, those

concerning the Company's anticipated plans to secure a loan for the Samalayuca

Copper Project".

Such forward-looking information or statements are based on a number of risks,

uncertainties and assumptions which may cause actual results or other

expectations to differ materially from those anticipated and which may prove to

be incorrect. Assumptions have been made regarding, among other things,

management's expectations regarding future growth, plans for and completion of

projects by Company's third party relationships, availability of capital, and

the necessity to incur capital and other expenditures. Actual results could

differ materially due to a number of factors, including, without limitation,

operational risks in the completion of Company's anticipated projects, delays or

changes in plans with respect to the development of Company's anticipated

projects by Company's third party relationships, risks affecting the ability to

develop projects, risks inherent in operating in foreign jurisdictions, the

ability to attract key personnel, and the inability to raise additional capital.

No assurances can be given that the efforts by Company will be successful.

Additional assumptions and risks are set out in detail in the Company's MD&A,

available on SEDAR at www.sedar.com.

Although the Company believes that the expectations reflected in the

forward-looking information or statements are reasonable, prospective investors

in the Company's securities should not place undue reliance on forward-looking

statements because the Company can provide no assurance that such expectations

will prove to be correct. Forward-looking information and statements contained

in this news release are as of the date of this news release and the Company

assumes no obligation to update or revise this forward-looking information and

statements except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

VVC Exploration Corporation

Serge Cadorette

(514) 361-0749

scadorette@vvcexploration.com

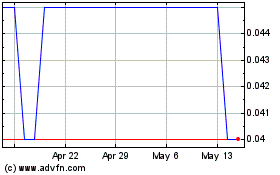

VVC Exploration (TSXV:VVC)

Historical Stock Chart

From May 2024 to Jun 2024

VVC Exploration (TSXV:VVC)

Historical Stock Chart

From Jun 2023 to Jun 2024