Solar Alliance announces closing private placement

July 31 2024 - 7:01PM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector, is

pleased to announced that, further to its news release of May 14,

2024, June 27, 2024 and July 19, 2024, it has closed the third and

final tranche (the “

Third Tranche”) of its

non-brokered private placement of 14,000,000 units of the Company

(the “

Units”) at a price of C$0.05 per Unit for

gross proceeds of C$700,000 (the “

Offering”). An

aggregate of 1,000,000 Units were sold under the Third Tranche for

Third Tranche gross proceeds of C$50,000.

Each Unit is comprised of one (1) common share

of the Company (a “Common Share”) and one (1)

Common Share purchase warrant (a “Warrant”). Each

Warrant entitles the holder thereof to acquire one (1) Common Share

(a “Warrant Share”) at an exercise price of C$0.07

per Warrant Share at any time for a period of thirty-six (36)

months following the closing of the applicable tranche of the

Offering.

The Company intends to use the net proceeds from

the Offering for general corporate and working capital purposes.

The Offering is subject to certain conditions including, but not

limited to, the receipt of all necessary approvals, including the

approval of the TSX Venture Exchange (the “TSXV”)

and applicable securities regulatory authorities.

The Units sold under the Offering were offered

by way of the “listed issuer” financing exemption (the

“Listed Issuer Exemption”) under National

Instrument 45-106 – Prospectus Exemptions (“NI

45-106”) and therefore all securities issued and issuable

under the Offering are not subject to a hold period under

applicable Canadian securities laws.

There is an offering document related to the

Offering that can be accessed under the Company’s profile at

www.sedarplus.ca and on the Company’s website at

www.solaralliance.com. Prospective investors should read this

offering document before making an investment decision.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any state securities laws and may not be offered or

sold within the United States or to or for the account or benefit

of a U.S. person (as defined in Regulation S under the United

States Securities Act) unless registered under the U.S. Securities

Act and applicable state securities laws or an exemption from such

registration is available.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)

Solar Alliance is an energy solutions provider

focused on the commercial, utility and community solar sectors. Our

experienced team of solar professionals reduces or eliminates

customers' vulnerability to rising energy costs, offers an

environmentally friendly source of electricity generation, and

provides affordable, turnkey clean energy solutions. Solar

Alliance’s strategy is to build, own and operate our own solar

assets while also generating stable revenue through the sale and

installation of solar projects to commercial and utility customers.

The Company currently owns two operating solar projects in New York

and actively pursuing opportunities to grow its ownership pipeline.

The technical and operational synergies from this combined business

model supports sustained growth across the solar project value

chain from design, engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

statements, projections and estimates with respect to the Offering,

the use of proceeds of the Offering, the resale restrictions of the

securities issued pursuant to the Offering, the issuance of the

Units pursuant to the Listed Issuer Exemption, uncertainties

related to the ability to raise sufficient capital; changes in

economic conditions or financial markets; litigation, legislative

or other judicial, regulatory, legislative and political

competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the 565-kW

and 872 KW Tennessee solar project; the ability to predict and

counteract the effects of COVID-19 on the business of the Company,

including but not limited to the effects of COVID-19 on the

construction sector, capital market conditions, restriction on

labour and international travel and supply chains; potential

corporate growth opportunities and the ability to execute on the

key objectives in 2024. Consequently, actual results may vary

materially from those described in the forward-looking

statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

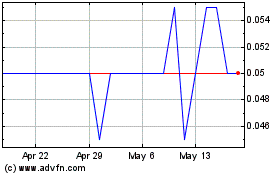

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

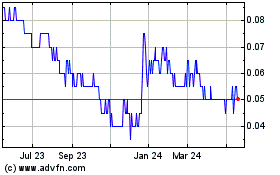

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Dec 2023 to Dec 2024