Search Minerals Inc.

(TSXV: SMY)

(“

Search” or the “

Company”), is

pleased to announce that InCoR Holdings Limited

(“

InCoR”) has agreed to convert its convertible

debenture of the Company (the “

InCoR Debenture”)

in the principal amount of $1,000,000, as of November 11, 2020.

Additionally, Springhill Investments Ltd.

(“

Springhill”) has agreed to convert its

convertible debenture of the Company (the “

Springhill

Debenture”) in the principal amount of $500,000, as of

November 11, 2020.

Each of the InCor Debenture and Springhill

Debenture (together, the “Debentures”) is

convertible into units of the Company (“Units”),

at a price of $0.05 per Unit. Each Unit consists of one common

share of the Company (a “Share”) and one common

share purchase warrant (a “Warrant”). Each Warrant

is exercisable into one Share at a deemed price of $0.05 per

Warrant, for a period of five years from the date of conversion. As

a result of the conversion of the Debentures, the Company will

issue a total of 20,000,000 Units to InCoR, in accordance with the

terms of the InCor Debenture and a total of 10,000,000 Units to

Springhill, in accordance with the terms of the Springhill

Debenture.

The Company has also agreed to issue 3,800,000

Shares at a price of $0.05 per Share in settlement of outstanding

debt of approximately $190,000 (the “Shares for Debt

Transaction”), owing to certain arm’s length and non-arm’s

length parties (together, the “Creditors”).

Greg Andrews, President/CEO states: “We

appreciate the support that InCoR and Springhill are providing

Search with their early conversion of these debentures. These

conversions strengthen our balance sheet with the elimination of

these liabilities, and interest costs associated with the

debentures. In addition, we thank certain creditors for their

shares for debt transactions, which helps preserve our current cash

position.”

The conversion of the InCor Debenture

constitutes a “related party transaction” within the meaning of

Multilateral Instrument 61-101 Protection of Minority Security

Holders in Special Transactions (“MI 61-101”)

because InCoR is a “Control Person” of the Company. Additionally,

the issuance of Shares to certain Creditors pursuant to the Shares

for Debt Transaction constitutes a “related party transaction”

within the meaning of MI 61-101 as certain Creditors are related

parties of the Company. The Company is relying on the exemptions

from the formal valuation and minority approval requirements in

Sections 5.5.(a) and 5.7(1)(a) of MI 61-101, on the basis that the

fair market value of the transactions does not exceed 25% of the

Company’s market capitalization.

The Company further announces that it has agreed

to extend the maturity date of an unsecured loan of $200,000 (the

“Loan”) with an arm’s length party, which was

originally announced on November 15, 2019. The Loan will be

extended (the “Loan Extension”) for a period of

one year from the original maturity date of the Loan, and will be

repayable at any time without penalty and will bear interest at a

rate of 10% per annum, paid quarterly. In consideration for

agreeing to the Loan Extension, the Company will cancel and reissue

4,000,000 common share purchase warrants (the “Bonus

Warrants”) to the lender as of the date of the Loan

Extension. Each Bonus Warrant will be exercisable into one Share

for a period of one year from the date of issuance at a price of

$0.05 per Bonus Warrant. No finders' fees or commissions were paid

in connection with the Loan Extension.

The Shares for Debt Transaction, the Loan

Extension and the issuance of the Bonus Warrants are subject to TSX

Venture Exchange approval. Additionally, all securities issued

pursuant to the conversion of the Debentures, the Loan and the

Shares for Debt Transaction will be subject to a statutory hold

period of four months from the date of issuance, in accordance with

applicable securities legislation.

About Search Minerals Inc.

Led by a proven management team and board of

directors, Search is focused on finding and developing Critical

Rare Earths Elements (CREE), Zirconium (Zr) and Hafnium (Hf)

resources within the emerging Port Hope Simpson – St. Lewis CREE

District of South East Labrador. The Company controls a belt 63 km

long and 2 km wide and is road accessible, on tidewater, and

located within 3 local communities. Search has completed a

preliminary economic assessment report for

FOXTROT, and a resource estimate for DEEP

FOX. Search is also working on three exploration prospects

along the belt which include: FOX MEADOW,

SILVER FOX and AWESOME FOX.

Search has continued to optimize our patented

Direct Extraction Process technology with the generous support from

the Department of Tourism, Culture, Industry and Innovation,

Government of Newfoundland and Labrador, and from the Atlantic

Canada Opportunity Agency. We have completed two pilot plant

operations and produced highly purified mixed rare earth carbonate

concentrate and mixed REO concentrate for separation and

refining.

For further

information, please contact:

Greg AndrewsPresident and CEOTel:

604-998-3432E-mail: info@searchminerals.ca

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Statements:

This news release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statements”) within the meaning of

applicable Canadian and United States securities legislation

including the United States Private Securities Litigation Reform

Act of 1995. All statements, other than statements of historical

fact, included herein, without limitation, statements relating the

future operating or financial performance of the Company, are

forward-looking statements.

Forward-looking statements are frequently, but

not always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “potential”, “possible”, and

similar expressions, or statements that events, conditions, or

results “will”, “may”, “could”, or “should” occur or be achieved.

Forward-looking statements in this news release relate to, among

other things, completion of the Shares for Debt Transaction or

completion of the Loan Extension and issuance of the Bonus

Warrants. Actual future results may differ materially. There can be

no assurance that such statements will prove to be accurate, and

actual results and future events could differ materially from those

anticipated in such statements. Forward-looking statements reflect

the beliefs, opinions and projections on the date the statements

are made and are based upon a number of assumptions and estimates

that, while considered reasonable by the respective parties, are

inherently subject to significant business, economic, competitive,

political and social uncertainties and contingencies. Many factors,

both known and unknown, could cause actual results, performance or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward-looking statements and the parties have made

assumptions and estimates based on or related to many of these

factors. Such factors include, without limitation, the risk that

the Company does not receive the approval of the TSX Venture

Exchange for the Shares for Debt Transaction, the Loan Extension

and the issuance of the Bonus Warrants.

Readers should not place undue reliance on the

forward-looking statements and information contained in this news

release concerning these times. Except as required by law, the

Company does not assume any obligation to update the

forward-looking statements of beliefs, opinions, projections, or

other factors, should they change.

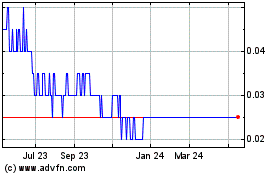

Search Minerals (TSXV:SMY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Search Minerals (TSXV:SMY)

Historical Stock Chart

From Nov 2023 to Nov 2024