Razor Energy Corp. (“Razor” or the “Company”) (TSXV: RZE)

(www.razor-energy.com) is pleased to announce its fourth quarter

and year end 2019 financial and operating results. Selected

financial, operational and reserves information is outlined below

and should be read in conjunction with Razor’s audited consolidated

financial statements, management’s discussion and analysis

and annual information form ("AIF") for the year ended

December 31, 2019, which are available on SEDAR at

www.sedar.com and the Company’s website.

2019 HIGHLIGHTS

Operating

- Production during the year averaged 4,387 boe/d, representing a

decrease of 10% in comparison to 2018 when production averaged

4,888 boe/d. The decrease was due to the Company's reduced

reactivation program in 2019, reduced workover activity, issues

with third party fuel gas supply and composition, as well as

non-operated pipeline outages, partially offset by production from

the properties of Little Rock Resources Ltd. ("Little Rock")

properties acquired during Q3 2019 (the "Little Rock

Acquisition");

- Achieved 2019 operating netback of $6.92/boe, down 39% from

2018;

- Achieved adjusted funds flow of $8.0 million in 2019 a 58%

decrease from 2018, mainly driven by a 18% decrease in total

revenues from 2018.

Capital

- Invested a total of $13.6 million in 2019, comprised mainly of

the continuation of the well reactivation program and the South

Swan Hills co-produced geothermal power generation project;

and

- Reactivated 24 gross (23.3 net) wells during 2019, resulting in

422 boe/d of additional initial production.

Acquisitions

- Completed the Little Rock Acquisition, providing Razor with a

second core region in southern Alberta, comprised of the Jumpbush,

Majorville, Badger, Enchant and Chin Coulee areas. The acquisition

added approximately 800 boe/d of production.

2020 OUTLOOK

Production in Q1 2020 is anticipated to average

4,200 boe/d due to impacts from the significant decrease in

realized oil prices, leading to a reduction of reactivation and

workover spending in Q1 2020. These wells will be brought back

online when economics justify, with spending being focused on the

highest capital efficiency projects. As well, Q1 production has

been adversely affected by non-operated pipeline outages.

These outages were rectified by the end of Q1 2020.

In response to the aforementioned decrease

in oil prices, the Company has shut in all

of its operated heavy oil production, along

with certain light oil wells which are sub-economic

at current prices. As of the date of this announcement, the

Company is forecasting Q2 2020 production to be approximately 3,600

boe/d. The Company actively monitors the economics for all of its

operated production and may shut in additional wells. The timing to

restart shut in oil wells is dependent on improvements

in both WTI prices and local price differentials. The

Company currently forecasts WTI pricing and local price

differentials will improve starting in Q3 2020. However, the timing

of an improvement depends on successful

progress with the COVID-19 virus and an increase

in the global demand for oil.

The preparation of financial forecasts is

challenging at this time; however, the

Company anticipates negative cash flow from

operations during Q2 2020 and into the second half of

2020 if oil prices remain depressed. The Company is working to

mitigate losses by limiting field spending and applying for

government assistance programs where available, including the

Canada Emergency Wage Subsidy.

SELECT QUARTERLY AND ANNUAL

HIGHLIGHTS

The following tables summarize key financial and

operating highlights associated with the Company’s financial

performance.

|

|

Three Months Ended December 31, |

Twelve months ended December 31, |

|

($000's, except for per share amounts and volumes) |

2019 |

2018 |

2019 |

2018 |

| Production

volumes2 |

|

|

|

|

|

Oil (bbl/d) |

2,839 |

|

2,995 |

|

2,712 |

|

3,143 |

|

| Gas (mcf/d)1 |

4,962 |

|

3,225 |

|

4,635 |

|

3,770 |

|

| NGL (bbl/d) |

1,011 |

|

1,374 |

|

903 |

|

1,117 |

|

|

Total (boe/d) |

4,677 |

|

4,907 |

|

4,387 |

|

4,888 |

|

| Sales volumes

3 |

|

|

|

|

| Oil (bbl/d) |

2,862 |

|

2,611 |

|

2,783 |

|

3,046 |

|

| Gas (mcf/d)1 |

4,962 |

|

3,225 |

|

4,635 |

|

3,770 |

|

| NGL (bbl/d) |

1,011 |

|

1,374 |

|

903 |

|

1,117 |

|

|

Total (boe/d) |

4,700 |

|

4,523 |

|

4,458 |

|

4,792 |

|

|

Oil inventory volumes (bbls) |

9,251 |

|

35,267 |

|

9,251 |

|

35,267 |

|

| Oil and natural gas

revenue |

|

|

|

|

| Oil and NGLs sales |

20,013 |

|

14,712 |

|

78,365 |

|

91,901 |

|

| Natural gas sales |

774 |

|

565 |

|

2,438 |

|

2,481 |

|

| Sales of commodities purchased

from third parties 7 |

(25 |

) |

4,352 |

|

8,551 |

|

15,639 |

|

| Blending and processing |

1,874 |

|

1,912 |

|

8,842 |

|

10,472 |

|

| Other revenues |

119 |

|

342 |

|

1,976 |

|

2,406 |

|

|

Total revenue |

22,755 |

|

21,883 |

|

100,172 |

|

122,899 |

|

| Cash flows from operating

activities |

3,922 |

|

6,696 |

|

16,238 |

|

22,360 |

|

|

Per share -basic and diluted |

0.19 |

|

0.06 |

|

0.96 |

|

1.10 |

|

| Funds flow 4 |

37 |

|

903 |

|

7,719 |

|

17,200 |

|

|

Per share -basic and diluted |

— |

|

0.06 |

|

0.46 |

|

1.10 |

|

| Adjusted funds flow 4 |

305 |

|

1,974 |

|

7,959 |

|

20,435 |

|

|

Per share -basic and diluted |

0.01 |

|

0.13 |

|

0.47 |

|

1.31 |

|

| Net income (loss) |

(11,853 |

) |

3,773 |

|

(29,573 |

) |

4,239 |

|

|

Per share - basic and diluted |

(0.56 |

) |

0.25 |

|

(1.75 |

) |

0.27 |

|

| Dividends paid |

790 |

|

3,126 |

|

2,564 |

|

3,126 |

|

| Dividends paid per share |

0.04 |

|

0.20 |

|

0.15 |

|

0.20 |

|

| Weighted average number of

shares outstanding (basic and diluted) |

21,056,770 |

|

15,360,729 |

|

16,926,491 |

|

15,622,374 |

|

|

Capital expenditures |

2,378 |

|

3,315 |

|

13,590 |

|

33,758 |

|

| Net

assets acquired 5 |

— |

|

43 |

|

256 |

|

3,921 |

|

| Netback

($/boe) |

|

|

|

|

|

Oil and gas sales 6 |

48.07 |

|

36.71 |

|

49.66 |

|

53.97 |

|

|

Royalty |

(10.80 |

) |

(9.34 |

) |

(8.72 |

) |

(11.18 |

) |

|

Operating expenses |

(29.90 |

) |

(24.53 |

) |

(31.80 |

) |

(29.26 |

) |

|

Transportation and treating |

(2.37 |

) |

(2.17 |

) |

(2.22 |

) |

(2.17 |

) |

|

Operating netback 4 |

5.00 |

|

0.67 |

|

6.92 |

|

11.36 |

|

|

Gain/(Loss) on sale of commodities purchased from third parties

7 |

(0.06 |

) |

1.07 |

|

(0.01 |

) |

0.47 |

|

|

Net blending and processing income 4 |

2.74 |

|

1.74 |

|

3.34 |

|

3.01 |

|

|

Realized gain/(loss) on commodity contracts settlement 6 |

0.46 |

|

2.38 |

|

(1.61 |

) |

(1.51 |

) |

|

Other revenues |

0.28 |

|

0.82 |

|

1.21 |

|

1.38 |

|

|

General and administrative |

(4.52 |

) |

(2.91 |

) |

(3.89 |

) |

(3.24 |

) |

|

Other expenses |

(3.13 |

) |

— |

|

(0.83 |

) |

— |

|

|

Impairment |

(9.25 |

) |

— |

|

(2.46 |

) |

— |

|

|

Acquisition and transaction costs |

— |

|

— |

|

(0.13 |

) |

(0.01 |

) |

|

Interest |

(2.87 |

) |

(2.87 |

) |

(3.02 |

) |

(2.62 |

) |

|

Corporate netback 4 |

(11.35 |

) |

0.90 |

|

(0.48 |

) |

8.84 |

|

1) Gas production and sales volumes

include internally consumed gas used in power generation.2)

Production volumes for the twelve months ended December 31, 2019

includes Little Rock's daily average production from September 11

to December 31, 2019.3) Sales volumes for the twelve months

ended December 31, 2019 includes Little Rock's daily average sales

from September 11 to December 31, 2019. Sales volumes include

change in inventory volumes.4) Refer to "Non-IFRS

measures".5) Net acquisitions exclude non-cash items and is

net of post-closing adjustments.6) Excludes the effects of

financial risk management contracts but includes the effects of

fixed price physical delivery contracts.7) Since 2018, Razor

started to purchase commodity products from third parties to

fulfill sales commitments, and subsequently sell these products to

its customers.

|

|

December 31, |

| ($000's

unless otherwise stated) |

2019 |

2018 |

|

Total assets |

189,158 |

|

157,937 |

|

| Cash |

1,905 |

|

2,239 |

|

| Long-term debt

(principal) |

45,876 |

|

46,155 |

|

| Net

debt 1 |

66,911 |

|

54,244 |

|

| Number

of shares outstanding |

21,064,466 |

|

15,188,834 |

|

1) Refer to "Non-IFRS measures".

2019 YEAR-END RESERVES

In October 2019, the Calgary Chapter of the

Society of Petroleum Evaluation Engineers ( SPEE ) and associated

industry professionals updated the Canadian Oil and Gas Evaluation

Handbook ("COGEH"). These updates clarify and streamline

previous guideline recommendations initiated in 2018 and offer

additional guidance regarding Canadian reserves evaluations.

For the second year in a row, Razor continues to

be an industry leader, alongside Sproule Associates Limited

("Sproule"), by incorporating industry best practice by including

all abandonment, decommissioning and reclamations costs (ADR) and

inactive well costs (“IWC”) into the Company's 2019 year-end

reserves report.

For 2019, the net present value of before tax

cash flows discounted at 10% ("NPV10") for each reserve category

disclosed below includes all abandonment, decommissioning and

reclamation costs, and inactive well costs totaling $61.3

million.

|

|

December 31, |

|

Reserves Summary1 |

|

|

| ($000's

unless otherwise stated) |

2019 |

2018 |

|

Proved developed producing (Mboe) |

11,144 |

|

12,194 |

|

|

Total Proved (Mboe) |

16,258 |

|

15,397 |

|

|

Total Proved plus probable (Mboe) |

20,750 |

|

20,223 |

|

|

Proved developed producing - NPV102 |

116,832 |

|

148,671 |

|

|

Total Proved - NPV102 |

189,257 |

|

197,733 |

|

|

Total Proved plus probable - NPV102 |

242,719 |

|

209,047 |

|

1) The table summarizes the data contained

in an independent report of Razor's gross reserves, as evaluated by

Sproule, qualified reserves evaluators, dated February 24, 2020.

The figures have been prepared in accordance with the standards

contained in the COGEH and the reserve definitions contained in

National Instrument 51-101 - Standards of Disclosure for Oil and

Gas Activities. Gross reserves means the total working interest

(operating and non-operating) share of remaining recoverable

reserves owned by Razor before deductions of royalties payable to

others and without including any royalty interests owned by Razor.

Additional reserve information is included in the AIF.2) NPV

10 is net present value of before tax cash flows discounted at

10%.

OPERATIONAL UPDATE

In 2019, Razor's average production decreased

10% to 4,387 boe/d, from 4,888 boe/d average production in 2018, of

which approximately 82% was light oil and NGLs.

As at December 31, 2019, Razor had 9,251 bbls of

light oil inventory (2018 - 35,267 bbls). MSW differentials and WTI

pricing improved significantly during 2019 and the Company sold a

portion of its light oil inventory throughout the year. The Company

continues to improve the effectiveness of sales and production

management through more advanced inventory, blending and

transportation processes and controls.

In Q4 2019, production of 4,677 boe/d was down

4% from the same quarter of 2018 due to the decrease in general

reactivation and optimization activities, as well as due to

non-operated pipeline outages in effect for Q4 2019.

However, Q4 2019 production was up 7% from Q3

2019 due to a strategic acquisition of a second core region in

southern Alberta, comprised of the Jumpbush, Majorville, Badger,

Enchant and Chin Coulee areas. This strategic acquisition provided

additional average daily production of 716 boe/d during Q4

2019.

During the fourth quarter of 2019, the Company

realized an average operating netback of $5.00/boe, up 857% as

compared to Q4 2018, primarily attributable to the sharp decrease

in MSW differentials to WTI in the fourth quarter of 2018.

For the year ended December 31, 2019, the average operating

netback of $6.92/boe was a 39% decrease from the same period in

2018, due to lower realized oil and gas sales and higher operating

expenses during 2019.

Royalty rates averaged 22% in the fourth quarter

of 2019, up from 18% in the third quarter of 2019, and down from

25% in the same quarter of 2018, primarily due to the timing of

realized oil prices as compared to the reference oil price used by

the Government of Alberta as the basis for calculating royalties.

As the index price is set a month in advance, periods of sharp

price decreases will result in higher than expected royalty rates,

conversely in periods of price increases, due to the pricing lag,

realized royalties will be lower than expected.

In the fourth quarter of 2019, operating

expenses increased by 22% as compared to Q4 2018 and stayed on par

as compared to Q3 2019 due to decreased production, as well as

non-operated pipeline expenditures, and the incremental operating

costs associated with the Little Rock Acquisition during Q3

2019.

The top five cost drivers are fuel and

electricity, labour, taxes and licenses, facility and pipeline

repairs which accounted for 76% of total operating expenses in 2019

(2018 - 80%). Facility and pipeline repairs, and workovers

accounted for 28% (2018 - 33%) of operating expenses while fuel and

electricity followed closely at 26% (2018 - 29%) of operating

expenses.

Management is focused on continuous improvement

of operational efficiencies to drive down key cost drivers.

CAPITAL PROGRAM

In 2019, Razor invested $13.6 million (before

$6.1 million of government grants) through its capital program,

comprised mainly of the continuation of the well reactivation

program and on its South Swan Hills co-produced geothermal power

generation project.

The Company reactivated 24 gross (23.3 net)

wells during 2019, resulting in 422 boe/d of additional initial

production.

During 2019, Razor invested $4.5 million on its

South Swan Hills co-produced geothermal power generation project.

The Company expects the capital cost of the project to be $35

million, generating 21 MW of grid connected power, of which 6MW

will be from renewable and sustainable geothermal power generation.

Natural Resources Canada's Clean Growth Program ("NRCAN") will

contribute $5.0 million toward the project, and Alberta Innovates

has committed $2 million. The Company received $4.3 million of

grants related to the project in 2019.

Razor, through its wholly-owned subsidiary Blade

Energy Services Corp., has been building up its field equipment

fleet since Q4 2018 in order to internalize certain field services

such as road maintenance and trucking.

Corporate capital expenditures related to an

upgrade of the corporate information technology infrastructure and

the purchase of corporate vehicles.

ABANDONMENT, RECLAMATION, AND REMEDIATION

EXPENDITURES

Razor inherited decommissioning liabilities

included in its Swan Hills, Kaybob and Little Rock

acquisitions. In Q4 2019, the Company spent $0.3 million on

abandonment, reclamation, and remediation expenditures (Q4 2018 -

$1.1 million).

The Company voluntarily opted in to the Alberta

Energy Regulator’s (AER) Area Based Closure (ABC) program.

Accordingly, Razor has committed to an annual spend target

dedicated to asset retirement which includes decommissioning,

abandonment and reclamation of inactive wells and facilities.

Through this commitment, low-risk wells included in the Inactive

Well Compliance Program (IWCP) are now exempt from requiring

suspension allowing for greater focus on end of life

activities.

ABOUT RAZOR

Razor is a publicly-traded junior oil and gas

development and production company headquartered in Calgary,

Alberta, concentrated on acquiring, and subsequently enhancing,

producing oil and gas properties primarily in Alberta. The Company

is led by experienced management and a strong, committed Board of

Directors, with a long-term vision of growth, focused on efficiency

and cost control in all areas of the business. Razor currently

trades on TSX Venture Exchange under the ticker “RZE”.

For additional information please

contact:

| Doug

BaileyPresident and Chief Executive Officer |

OR |

|

Kevin

BraunChief Financial Officer |

| |

|

|

|

| Razor Energy

Corp.800, 500-5th Ave SWCalgary, Alberta T2P 3L5Telephone: (403)

262-0242www.razor-energy.com |

|

|

|

READER ADVISORIES

FORWARD-LOOKING STATEMENTS:

This press release may contain certain statements that may be

deemed to be forward-looking statements. Such statements relate to

possible future events, including, but not limited to, the

Company’s objectives, including near and medium term objectives,

the Company’s capital program, applications for government

assistance programs, reactivation, workover, stimulation, shut-ins,

water and other activities, future rates of production, capital

investments and sources of funding relating to the installation of

natural gas power generation, and the capacity thereof, geothermal

waste heat recovery, the partnership with NRCAN and Alberta

Innovates, oil blending and service integration, anticipated

abandonment, reclamation and remediation costs for 2020,

commitments under the ABC program and other environmental, social

and governance initiatives, production guidance and shareholder

returns. Statements relating to “reserves” are also deemed to

be forward-looking statements, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves described exist in the quantities predicted or estimated

and that the reserves can be profitably produced in the future. All

statements other than statements of historical fact may be

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

“anticipate”, “believe”, "expect", “plan”, “estimate”, “potential”,

“will”, “should”, “continue”, “may”, “objective” and similar

expressions. The forward-looking statements are based on certain

key expectations and assumptions made by the Company, including but

not limited to expectations and assumptions concerning the

availability of capital, current legislation, receipt of required

regulatory approvals, the timely performance by third-parties of

contractual obligations, the success of future drilling and

development activities, the performance of existing wells, the

performance of new wells, the Company’s growth strategy, general

economic conditions, availability of required equipment and

services, prevailing commodity prices, price volatility, price

differentials and the actual prices received for the Company's

products. Although the Company believes that the expectations and

assumptions on which the forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because the Company can give no

assurance that they will prove to be correct. Since forward-

looking statements address future events and conditions, by their

very nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry and

geothermal electricity projects in general (e.g., operational risks

in development, exploration and production; delays or changes in

plans with respect to exploration or development projects or

capital expenditures; variability in geothermal resources; as the

uncertainty of reserve estimates; the uncertainty of estimates and

projections relating to production, costs and expenses, and health,

safety and environmental risks), electricity and commodity price

and exchange rate fluctuations, changes in legislation affecting

the oil and gas and geothermal industries and uncertainties

resulting from potential delays or changes in plans with respect to

exploration or development projects or capital expenditures. In

addition, the Company cautions that current global uncertainty with

respect to the spread of the COVID-19 virus and its effect on the

broader global economy may have a significant negative effect on

the Company. While the precise impact of the COVID-19 virus on the

Company remains unknown, rapid spread of the COVID-19 virus may

continue to have a material adverse effect on global economic

activity, and may continue to result in volatility and disruption

to global supply chains, operations, mobility of people and the

financial markets, which could affect interest rates, credit

ratings, credit risk, inflation, business, financial conditions,

results of operations and other factors relevant to the Company.

Please refer to the risk factors identified in the most recent AIF

and management's discussion and analysis of the Company which are

available on SEDAR at www.sedar.com. The forward-looking statements

contained in this press release are made as of the date hereof and

the Company undertakes no obligation to update publicly or revise

any forward-looking statements or information, whether as a result

of new information, future events or otherwise, unless so required

by applicable securities laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Razor's prospective results of

operations, sales volumes, production and production efficiency,

balance sheet, capital spending, investment infrastructure and

components thereof, all of which are subject to the same

assumptions, risk factors, limitations, and qualifications as set

forth in the above paragraph. FOFI contained in this document was

approved by management as of the date of this document and was

provided for the purpose of providing further information about

Razor's future business operations. Razor disclaims any intention

or obligation to update or revise any FOFI contained in this

document, whether as a result of new information, future events or

otherwise, unless required pursuant to applicable law. Readers are

cautioned that the FOFI contained in this document should not be

used for purposes other than for which it is disclosed herein.

NON-IFRS MEASURES: This press

release contains the terms "funds flow", "adjusted funds flow",

"net blending and processing income", "net debt", "income (loss) on

sale of commodities purchased from third parties", "operating

netback" and "corporate netback", which do not have standardized

meanings prescribed by International Financial Reporting Standards

("IFRS") and therefore may not be comparable with the calculation

of similar measures by other companies. Funds flow represents cash

generated from operating activities before changes in noncash

working capital. Adjusted funds flow represents cash flow from

operating activities before changes in non-cash working capital and

decommissioning obligation expenditures incurred. Management uses

funds flow and adjusted funds flow to analyze operating performance

and leverage, and considers funds flow and adjusted funds flow from

operating activities to be key measures as it demonstrates the

Company's ability to generate cash necessary to fund future capital

investments and repay debt. Net blending and processing income is

calculated by adding blending and processing income and deducting

blending and processing expense. Net debt is calculated as the sum

of the long-term debt and lease obligations, less working capital

(or plus working capital deficiency), with working capital

excluding mark-to-market risk management contracts. Razor believes

that net debt is a useful supplemental measure of the total amount

of current and long-term debt of the Company. Operating netback

equals total petroleum and natural gas sales less royalties and

operating costs calculated on a boe basis. Income on sale of

commodities purchased from third parties is calculated by adding

sales of commodities purchased from third parties and deducting

commodities purchased from third parties. Income on sale of

commodities purchased from third parties may not be comparable to

similar measures used by other companies. Razor considers operating

netback as an important measure to evaluate its operational

performance as it demonstrates its field level profitability

relative to current commodity prices. Corporate netback is

calculated by deducting general & administration, acquisition

and transaction costs, and interest from operating netback.

Razor considers corporate netback as an important measure to

evaluate its overall corporate performance.

ADVISORY PRODUCTION

INFORMATION: Unless otherwise indicated herein, all

production information presented herein is presented on a gross

basis, which is the Company's working interest prior to deduction

of royalties and without including any royalty interests.

BARRELS OF OIL EQUIVALENT: The

term "boe" or barrels of oil equivalent may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil equivalent

(6 Mcf: 1 bbl) is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Additionally, given that the

value ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

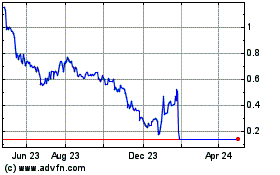

Razor Energy (TSXV:RZE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Razor Energy (TSXV:RZE)

Historical Stock Chart

From Jul 2023 to Jul 2024