BioSyent Releases Second Quarter Results; Record Quarterly Sales and Profit: Sales Up 89%, Profit Up 196%

August 22 2012 - 5:21PM

Marketwired Canada

BioSyent Inc. ("BioSyent") (TSX VENTURE:RX) today released a summary of its

Second Quarter (Q2) 2012 financial results.

-- Q2 Sales of $1,216,115 sets an all time quarterly record and represents

growth of 89% over Q2 2011

-- Q2 2012 Pharmaceutical Sales of $ 1,054,026 grew by 127% vs. Q2 2011 and

38% vs. Q1 2012

-- Record Q2 Earnings Before Tax of $337,437 represents growth of 198% over

Q2 2011

-- Total Comprehensive Income for first half 2012 of $611,813 was higher

than that of 2011 by 439%

-- Q2 basic earnings per share of $0.03

-- Cummulative Basic EPS over the last 4 consecutive quarters is $0.07

Total Sales for Q2 2012, hit a new quarter record and were $1,216,115 or 89%

higher compared to $643,177 in the corresponding prior year period and 34%

higher than the immediately preceeding quarter (Q1 2012) which had sales of

$904,488. Pharmaceutical Sales were $1,054,026 in Q2 2012, or 127% higher than

the corresponding prior year period sales which were $465,163.

Earnings Before Tax (EBT - sales and other income less all expenses other than

tax) for the second quarter of 2012 was $337,437 which is 198% higher than

$113,214 in the second quarter of 2011. EBT for the first six months of 2012 was

$610,620 or 431% higher than $115,093 in corresponding prior year period.

The Company earned Total Comprehensive (Net) Income of $ 338,962 in Q2 2012

compared to a Total Comprehensive Income of $ 114,340 in Q2 2011. For the six

months ended June 30, 2012, the Total Comprehensive Income of $611,813 was 439%

higher than $113,454 in the corresponding prior year period.

Working capital has increased by 55% from $ 1,128,065 as at December 31, 2011 to

$1,744,243 as at June 30, 2012. Cash and cash equivalents on June 30, 2012 were

64% of working capital compared to 94% as at December 31, 2011. During the First

Half of 2012 the Company channelled a portion of the incremental cash flow

resulting from Net Income into investments in working capital, primarily

receivables and inventory.

Subsequent to the Quarter end BioSyent Inc. announced that its subsidiary

BioSyent Pharma Inc. has received marketing approval from Health Canada for its

unique new oral iron supplement FeraMAX(R) Powder and that it has signed an

exclusive Licensing and Distribution Agreement with a European partner for two

new products that will be marketed by its' Hospital Products Division.

The Financial Statements and Management's Discussion & Analysis will be posted

on www.sedar.com on August 22, 2012.

As at the date of this press release the Company had 12,806,195 shares issued

and outstanding.

For a direct market quote (15 minutes delay) for the TSX Venture Exchange and

other Company financial information please visit www.tmxmoney.com.

BioSyent Inc. continues to concentrate on its pharmaceutical strategy to source

products that have been successfully developed and proven to be safe and

effective; manage these products through the regulatory process and product

registration (approval); and once approved, market these products in Canada. The

Company is focused on medications that occupy a niche in the market, that are

unique either due to complexity of manufacture or provide novel technological or

therapeutic advantages, or that are backed by strong partners holding

intellectual property rights that are defendable. This strategy allows the

Company to market these medications as brands owned by, or licensed to, it.

BioSyent Inc. is a publicly traded specialty pharmaceutical company whose wholly

owned subsidiary, BioSyent Pharma Inc., sources, acquires or in-licences

pharmaceutical products and markets these products in Canada. Wholly owned

BioSyent subsidiary Hedley Technologies Ltd. operates the company's legacy

business marketing bio and health friendly non-chemical insecticides. BioSyent

common shares are listed for trading on the TSX Venture Exchange (TSXV) under

the symbol RX.

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

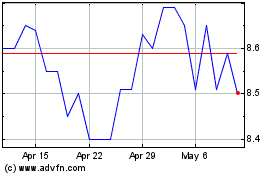

Biosyent (TSXV:RX)

Historical Stock Chart

From Jun 2024 to Jul 2024

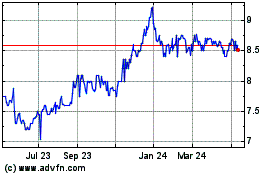

Biosyent (TSXV:RX)

Historical Stock Chart

From Jul 2023 to Jul 2024