BioSyent Releases Fiscal 2011 and Fourth Quarter Financial Results-Strong Growth Continues

March 29 2012 - 8:00AM

Marketwired Canada

BioSyent Inc. ("BioSyent") (TSX VENTURE:RX) today released a summary of its

Fiscal 2011 and Fourth Quarter (Q4) 2011 financial results.

-- 2011 Q4 Sales increased 51% vs Q4 2010

-- 2011 Full Year Sales increased 67% vs 2010

-- 2011 Pharma Sales increased 203% following a 201% increase in 2010

-- Pharma compound quarterly growth rate of 35% over last 8 quarters

-- 2011 Full Year Profit increased 8.6 times over 2010

Total Sales for Q4 2011, hit a new record and were 51% higher at $703,337 in Q4

of 2011, compared to $465,191 in the corresponding prior year period. Sales for

full year 2011 were 67% higher at $2,808,666 compared to $1,681,210 in the prior

year period. The growth was driven by the pharmaceutical business which grew by

203% from $675,918 in 2010 to $2,049,776 in 2011.

The Company earned total comprehensive income of $417,950 for Full Year 2011,

which was 8.6 times the total comprehensive income in 2010 of $48,386. The

Increase in Cash and Cash Equivalents of $586,950 for Fiscal Year 2011, was 14.6

times the corresponding figure of $40,307 in the prior year period. Working

Capital increased by 75% from $642,811 on December 31, 2010 to $1,128,065 at the

end of 2011.

The Financial Statements and Management's Discussion & Analysis will be posted

on sedar.com on March 29, 2011.

BioSyent Inc. also announces the grant of 100,000 incentive stock options to an

employee of the Company. These incentive stock options are exercisable at a

price of $0.57 up to March 28, 2017.

BioSyent Inc. continues to concentrate on its pharmaceutical strategy to source

products that have been successfully developed and proven to be safe and

effective; manage these products through the regulatory process and product

registration (approval); and once approved, market these products in Canada. The

Company is focused on medications that occupy a niche in the market, that are

unique either due to complexity of manufacture or provide novel technological or

therapeutic advantages, or that are backed by strong partners holding

intellectual property rights that are defendable. This strategy allows the

Company to market these medications as brands owned by, or licensed to, it.

BioSyent Inc. is a publicly traded specialty pharmaceutical company whose wholly

owned subsidiary, BioSyent Pharma Inc., sources, acquires or in-licences

pharmaceutical products and markets these products in Canada. Wholly owned

BioSyent subsidiary Hedley Technologies Ltd. operates the company's legacy

business marketing bio and health friendly non-chemical insecticides. BioSyent

common shares are listed for trading on the TSX Venture Exchange (TSXV) under

the symbol RX.

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

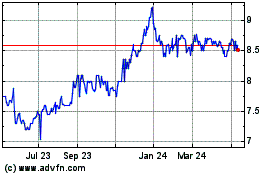

Biosyent (TSXV:RX)

Historical Stock Chart

From Jun 2024 to Jul 2024

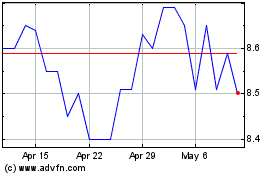

Biosyent (TSXV:RX)

Historical Stock Chart

From Jul 2023 to Jul 2024