BioSyent Releases Financial Results-First Quarter 2008 & Re-Filing of Annual Certification-2007

May 30 2008 - 4:00PM

Marketwired Canada

BioSyent Inc. ("BioSyent")(TSX VENTURE:RX) today released a summary of its

financial results for the first quarter 2008. For the three months ending March

31, 2008, sales decreased by 4.9% from $302,840 in quarter one 2007 to $287,997

in quarter one 2008. The company incurred a loss of ($74,067) in quarter one

2008 compared to a loss of ($29,416) in quarter one 2007. This loss is

predominantly due to higher operating expenses leading up to the launch of

Ciprofloxacin Injection which was first shipped in May 2008 and lower sales of

Protect-It(R) in quarter one 2008 as compared to quarter one 2007.

Total working capital has decreased by approximately 9% from $1,097,489 on

December 31, 2007 to $1,002,858 on March 31, 2008. Cash and cash equivalents

account for 83% of working capital as of March 31, 2008.

Full details of 2008 quarter one results and Financial Statements and

Management's Discussion & Analysis will be posted on sedar.com on May 30, 2008.

At the request of the Ontario Securities Commission, BioSyent is also re-filing

the Certificates of the President and Chief Executive Officer and of the Chief

Financial Officer of the Company in respect of its annual filings for the year

ended December 31, 2007, which certificates were previously filed. The refiling

of these Certificates is necessary due to the use of outdated forms in the

previously filed Certificates. The Company is also refiling its annual MD&A to

reflect such revised annual certification and reference to the new certification

is contained in Section 11 of the annual MD&A, which is the only section of the

MD&A that has been changed.

BioSyent Inc. continues to concentrate on its pharmaceutical strategy to source

products that have been successfully developed and proven to be safe and

effective; manage these products through the regulatory process and product

registration (approval); and once approved, market these products in Canada.

These pharmaceuticals will compete in both the branded and generic market

segments and will not require further product development investment other than

regulatory costs.

BioSyent Inc. is a publicly traded specialty pharmaceutical company whose wholly

owned subsidiary, BioSyent Pharma Inc., sources, acquires or in-licences

pharmaceutical products and markets these products in Canada. Wholly owned

BioSyent subsidiary Hedley Technologies Ltd. operates the company's legacy

business marketing bio and health friendly non-chemical insecticides. BioSyent

common shares are listed for trading on the TSX Venture Exchange (TSXV) under

the symbol RX.

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

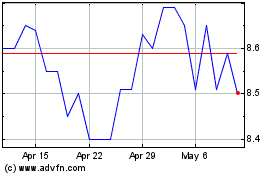

Biosyent (TSXV:RX)

Historical Stock Chart

From Jun 2024 to Jul 2024

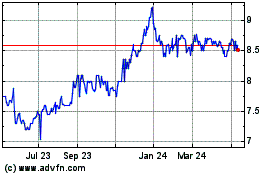

Biosyent (TSXV:RX)

Historical Stock Chart

From Jul 2023 to Jul 2024