Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”) is pleased to provide a review of the Company’s key

accomplishments over the past year delivering value for our owners

and advancing Revival Gold’s portfolio of exciting gold development

projects located in the western United States.

Highlights

-

Revival Gold realized its ambition to grow potential heap

leach gold production and enhance the Company’s path to production

by acquiring Ensign Minerals Inc. (“Ensign”), a private

company and the owner of the Mercur Gold Project (“Mercur”), an

attractive past-producing gold project located in Utah. The

acquisition delivered a complementary 6,300-hectare gold project

with Inferred Mineral Resources of 89.6 million tonnes at 0.57 g/T

containing 1.6 million ounces of gold1.

- In connection with

the purchase of Mercur, Revival Gold completed a C$7.2

million equity financing in May bringing in Sun Valley

Gold LLC and Libra Advisors LLC as well-regarded new institutional

investors in the Company.

- The Company

immediately commenced metallurgical test work on Mercur and, in

September, reported an 84% average recovery from five

column leach composite tests undertaken on representative

samples at Mercur. The columns demonstrated rapid leach kinetics

with 90% of gold leached reporting to solution after only

five days2.

- Work continued at

Mercur with Kappes Cassiday & Associates and RESPEC

Company LLC having been engaged to complete an updated Mineral

Resource estimate and Preliminary Economic Assessment

(“PEA”) by the end of Q1-2025.

-

At the Beartrack-Arnett Gold Project (“Beartrack-Arnett”) located

in Idaho, Revival Gold restructured and extended the

Company’s earn-in agreement (“Agreement”) with Meridian Beartrack

Co. (a subsidiary of Pan American Silver Corp.) and the

owner of the Beartrack property and related infrastructure. Under

the restructuring, the Company converted an obligation to pay the

greater of US$6 per ounce of gold in mineral resource or US$15 per

ounce of gold in mineral reserve on the third anniversary of the

closing of the Agreement, into a 0.3% Net Smelter Return Royalty on

future production. The restructuring also provides for a three-year

extension to the earn-in; thereby deferring the requirement for

Revival Gold to arrange site bonding (US$10.2 million face value)

until October 2027.

-

During the Spring and Summer of 2024, Revival Gold’s exploration

team completed an extensive exploration targeting

exercise to build on the Company’s understanding of the

mineral potential and drill targets south of the Joss deposit and

outboard of the Haidee deposit at Beartrack-Arnett. The program

included 90 line-kilometers of geophysical surveys, geochemical

sampling, field mapping and structural modeling.

-

Meanwhile, permitting preparation for the first phase heap leach

opportunity envisioned for Beartrack-Arnett continued with the

competition of a draft Plan of Operations this

month. An updated permitting schedule and budget will

follow next quarter.

-

During the year, the former President of Eldorado Gold,

Norm Pitcher, joined the Company’s Board of

Directors and Revival Gold’s exploration leadership was

transitioned to the Company’s accomplished Chief Geologist,

Dan Pace.

- Revival Gold

continued to maintain an exemplary safety record with zero

lost-time incidents among Company employees and

contractors.1 See “NI 43-101 Technical Report for the Mercur

Project, Camp Floyd and Ophir Mining Districts, Tooele & Utah

Counties, Utah, USA” prepared by Lions Gate Geological Consulting

Inc., RESPEC Company LLC, and Kappes, Cassidy & Associates,

dated May 24th, 2024.2 See Revival Gold news release dated

September 9th, 2024.

“Revival Gold transformed its business in 2024

with the addition of the Mercur Gold Project, the restructuring of

its underlying agreement to acquire the Beartrack property, and key

personnel moves to build on the strength of our team. Looking

ahead, Revival Gold’s portfolio encompassing two

multi-million-ounce gold systems, some 30,000 acres of highly

prospective claims, and credible development plans for future gold

production in the U.S., offers investors exceptional value and

exposure to gold at a time when quality new gold projects are

becoming increasingly more scarce,” said Hugh Agro, President &

CEO. “Our team is looking forward to 2025 and we are excited about

Revival Gold’s potential,” added Agro.

Qualified Persons

John P. W. Meyer, P.Eng., Vice President,

Engineering & Development, Steven T. Priesmeyer, C.P.G., Vice

President Exploration, and Dan Pace, Regis. Mem. SME, Chief

Geologist, Revival Gold Inc. are the Company’s designated Qualified

Persons for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects and

have reviewed and approved its scientific and technical

content.

About Revival Gold Inc.

Revival Gold is one of the largest, pure gold,

mine developers in the United States. The Company is advancing

engineering and economic studies on the Mercur Gold Project in Utah

and mine permitting preparations and ongoing exploration at the

Beartrack-Arnett Gold Project located in Idaho.

Revival Gold is listed on the TSX Venture

Exchange under the ticker symbol “RVG” and trades on the OTCQX

Market under the ticker symbol “RVLGF”. The Company is

headquartered in Toronto, Canada, with its exploration and

development office located in Salmon, Idaho.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on

SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Hugh Agro, President & CEO, or Lisa Ross, Vice President

& CFOTelephone: (416) 366-4100 or

Email: info@revival-gold.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

“forward-looking information” within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”). Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document

include, but are not limited to, Revival Gold using positive

metallurgical test results to support heap leach recovery rate

assumptions for a PEA, that the PEA will be delivered around the

end of Q1-2025, that a draft Plan of Operations will be completed

this month and an updated permitting schedule and budget will

follow next quarter, the Company’s plan to acquire Meridian

pursuant to the Agreement, the Amendment allowing the Company to

focus on developing Beartrack-Arnett in a responsible, efficient

and expeditious manner without the burden of a large payment

obligation in advance of production, the Company’s objectives,

goals and future plans, and statements of intent, the implications

of exploration results, mineral resource/reserve estimates and

exploration and mine development plans. Factors that could cause

actual results to differ materially from such forward-looking

statements include, but are not limited to failure to identify

mineral resources, failure to convert estimated mineral resources

to reserves, the inability to maintain the modelling and

assumptions upon which the interpretation of results are based

after further testing, the inability to complete a feasibility

study which recommends a production decision, the preliminary

nature of metallurgical test results, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, changes in regulatory requirements, political

and social risks, uncertainties relating to the availability and

costs of financing needed in the future, uncertainties or

challenges related to mineral title in the Company’s projects,

changes in equity markets, inflation, changes in exchange rates,

fluctuations in commodity and in particular gold prices, delays in

the development of projects, capital, operating and reclamation

costs varying significantly from estimates, the continued

availability of capital, accidents and labour disputes, and the

other risks involved in the mineral exploration and development

industry, an inability to raise additional funding, the manner the

Company uses its cash or the proceeds of an offering of the

Company’s securities, an inability to predict and counteract the

effects of COVID-19 on the business of the Company, including but

not limited to the effects of COVID-19 on the price of commodities,

capital market conditions, restriction on labour and international

travel and supply chains, future climatic conditions, the discovery

of new, large, low-cost mineral deposits, the general level of

global economic activity, disasters or environmental or climatic

events which affect the infrastructure on which the project is

dependent, and those risks set out in the Company’s public

documents filed on SEDAR+. Although the Company believes that the

assumptions and factors used in preparing the forward-looking

statements in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all.

Specific reference is made to the most recent Annual Information

Form filed on SEDAR+ for a more detailed discussion of some of the

factors underlying forward-looking statements and the risks that

may affect the Company’s ability to achieve the expectations set

forth in the forward-looking statements contained in this

presentation. The Company disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, other than

as required by law.

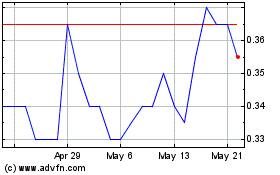

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Jan 2024 to Jan 2025