Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”) is pleased to announce the expansion of its land

position, the results of recent geophysical and geological work,

and the advance of exploration on a newly defined target area known

as Sharkey on the Company’s Beartrack-Arnett Gold Project

(“Beartrack-Arnett”) located in Idaho, USA.

Highlights

- Fifty-seven lode

claims encompassing 476 hectares have been staked to increase

Revival Gold’s land position on prospective exploration ground at

the south end of Beartrack-Arnett (see Figure 1 for details);

- 18-line

kilometers of IP geophysics along with 16-line kilometers of CSAMT

geophysics collected over multiple campaigns at Beartrack between

1990 and 1996 were reprocessed with present-day algorithms to

produce a consistent set of 2-D inversion products;

- The reprocessed

geophysical data together with results from last season’s soil

geochemistry survey and recent Leapfrog software-based geological

and structural modeling has further clarified Revival Gold’s

understanding of the geology and structure in the Panther

Creek-Coiner Fault System;

- The Panther

Creek-Coiner Fault System extends approximately five kilometers

south of the Joss Zone at Beartrack-Arnett and is now thought to be

an anastomosing (or braided) fault system that is typical of the

structures that host many orogenic gold deposits;

- Potential

targets in braided shear zones include bends, or changes in strike,

and structural intersections of the various structures within the

broader structural system, and multiple strands of the shear zone

may be mineralized; and,

- Chief among the

newly defined targets is Sharkey located within the Panther Creek

Structural Corridor approximately two kilometers south of the

existing underground mineralization in the Joss target area.

“Revival Gold’s recent work analysing and

modeling geophysical and geological data from the south end of

Beartrack-Arnett has sharpened our exploration team’s focus on the

Panther Creek-Coiner Fault braided fault system,” said Hugh Agro,

President & CEO. “The Sharkey target has emerged as a

high-value under-cover target with tonnage and grade potential

equivalent to, and perhaps greater than, what we have at Joss.

Sharkey lies within Revival Gold’s approved Plan of Operations

permit for drilling at Beartrack-Arnett and represents a

high-priority target for follow-up exploration this season,” added

Agro.

Further Details

The Beartrack-Arnett Project consists of two

orogenic gold systems with a Measured & Indicated Mineral

Resource of 86.2 million tonnes at 0.87 g/T gold

containing 2.42 million ounces of gold, and an Inferred

Mineral Resource of 50.7 million tonnes at 1.34 g/T gold

containing 2.19 million ounces of gold (see “Preliminary

Feasibility Study NI 43-101 Technical Report on the

Beartrack-Arnett Heap Leach Project, Lemhi County, Idaho, USA”,

prepared by Kappes, Cassidy & Associates, Independent Mining

Consultants, Inc., KC Harvey Environmental LLC, and WSP USA

Environment & Infrastructure Inc. dated August 2nd, 2023).

Most of the Beartrack-Arnett Mineral Resource is

contained within five deposits at Beartrack distributed over more

than five kilometers of strike of the Panther Creek Shear Zone

(“PCSZ”). Gold has been encountered in all Revival Gold drill holes

intersecting the PCSZ, and the structure has been drill-tested over

a vertical distance of 750 meters. The high-grade, potentially

underground mineable resource at Joss (6.7 million tonnes of

Inferred Mineral Resource at 4.0 g/T gold containing 877,000 ounces

of gold), has been drilled for over 400 meters vertically and

mineralization is open in all directions.

The most favorable host rocks at Beartrack are

Mesoproterozoic siltites and silty quartzites. These units are

mineralized in the South Pit ore body and at Joss, where grades are

generally highest. These units extend to the south and are exposed

along the margins of the Leesburg Basin.

Revival Gold’s IP and reprocessed CSAMT

geophysical lines effectively map contrasting resistivities between

the post-mineralization (Tertiary and Quaternary) Leesburg Basin

fill sequence and the Mesoproterozoic host rocks. In the Joss area,

mineralization occurs immediately east of a post-mineral Basin

bounding fault (Coiner Fault). The structure is effectively mapped

by the CSAMT and can be projected for approximately five kilometers

south of Joss (see Figure 2 for details).

The Coiner Fault, and associated mineralization,

is not exposed south of the South Pit due to extensive

post-mineralization Tertiary sedimentary and volcanic cover in the

Leesburg Basin. The post-mineralization cover obscures geology and

presents an intriguing exploration opportunity as any

mineralization in this area is not exposed.

The intersection of the Coiner Fault and the

Arnett structure is also an exploration target. This is the deepest

portion of the Leesburg Basin but represents a large area of

favorable structural preparation.

In addition to the recently reprocessed

geophysics, Revival Gold conducted a soil survey during the 2023

field season to characterize the soil geochemistry over the Coiner

Fault. 119 soil samples were taken over the approximate trace of

the fault. Overall, the soil survey showed a general trend of

increasing gold, arsenic, and mercury from south to north. A

spatially coherent anomaly over the structure was, however, not

detected.

In 2020 Revival Gold drilled three core holes

approximately 1.2 to 2.2 kilometers south of the southern Joss

drill fence to explore the intersection of the Arnett Creek

structure with the Coiner Fault. Difficult drilling conditions

prevented the holes from testing a significant thickness of the

target stratigraphy. The holes are thought to have encountered the

trough of the Leesburg Basin but were drilled west of the Coiner

Fault based on Revival Gold’s current CSAMT interpretation.

In 2021 Revival Gold continued exploring both

Joss and the southern extension of the Coiner Fault south of Joss.

One core hole was drilled approximately 500 meters south of the

southern Joss drill fence. Based on Revival Gold’s current

understanding of the Joss deposit architecture, this hole is

believed to have passed over the top of the mineralized horizon

intercepting 73 meters of the target Mesoproterozoic stratigraphy

before passing back into the post-mineral basin fill. Anomalous

gold (high of 0.048 ppm) and arsenic (high of 185 ppm) were

intercepted within the target stratigraphy associated with

sericitic alteration and quartz veining.

Revival Gold’s 2020 and 2021 drilling leaves the

southern extension of the Coiner Fault System untested and worthy

of further exploration. An additional program of field mapping,

infill geophysics, and scout drilling, is being prepared to further

evaluate the structural corridor south of Joss.

Figure 1:

Panther Creek-Coiner Fault System Showing

Claim Additions and the Sharkey Target

Figure 2:

Perspective View of Reprocessed CSAMT Resistivity

Showing Key Structures 2023 Mineral Resource Blocks > 2

g/t Au

Qualified Persons

Steven T. Priesmeyer, C.P.G., Vice President

Exploration, and Dan Pace, Regis. Mem. SME, Chief Geologist,

Revival Gold Inc., are the Company’s designated Qualified Person

for this news release within the meaning of National Instrument

43-101 Standards of Disclosure for Mineral Projects and have

reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold is a growth-focused gold

exploration and development company. The Company is advancing the

Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing

gold mine in Idaho. The Project benefits from extensive existing

infrastructure and is the subject of a recent Preliminary

Feasibility Study for the potential restart of open pit heap leach

gold production operations.

Since reassembling the Beartrack-Arnett land

position in 2017, Revival Gold has made one of the largest new

discoveries of gold in the United States in the past decade. The

mineralized trend at Beartrack extends for over five kilometers and

is open on strike and at depth. Mineralization at Arnett is open in

all directions.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on SEDAR+ at

www.sedarplus.ca.

For further information, please contact: Hugh Agro, President

& CEO or Lisa Ross, CFO, telephone: (416) 366-4100 or email:

info@revival-gold.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”). Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document include, but are not

limited to, the Company’s objectives, goals and future plans, and

statements of intent, the implications of exploration results,

mineral resource/reserve estimates and the economic analysis

thereof, exploration and mine development plans, timing of the

commencement of operations, estimates of market conditions, and

statements regarding the results of the pre-feasibility study,

including the anticipated capital and operating costs, sustaining

costs, net present value, internal rate of return, payback period,

process capacity, average annual metal production, average process

recoveries, concession renewal, permitting of the project,

anticipated mining and processing methods, proposed pre-feasibility

study production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, availability of labour, tax rates and

commodity prices that would support development of the Project.

Factors that could cause actual results to differ materially from

such forward-looking statements include, but are not limited to

failure to identify mineral resources, failure to convert estimated

mineral resources to reserves, the inability to maintain the

modelling and assumptions upon which the interpretation of results

are based after further testing, the inability to complete a

feasibility study which recommends a production decision, the

preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, changes in regulatory

requirements, political and social risks, uncertainties relating to

the availability and costs of financing needed in the future,

uncertainties or challenges related to mineral title in the

Company’s projects, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity and in particular gold

prices, delays in the development of projects, capital, operating

and reclamation costs varying significantly from estimates, the

continued availability of capital, accidents and labour disputes,

and the other risks involved in the mineral exploration and

development industry, an inability to raise additional funding, the

manner the Company uses its cash or the proceeds of an offering of

the Company’s securities, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labour and

international travel and supply chains, future climatic conditions,

the discovery of new, large, low-cost mineral deposits, the general

level of global economic activity, disasters or environmental or

climatic events which affect the infrastructure on which the

project is dependent, and those risks set out in the Company’s

public documents filed on SEDAR+. Although the Company believes

that the assumptions and factors used in preparing the

forward-looking statements in this news release are reasonable,

undue reliance should not be placed on such information, which only

applies as of the date of this news release, and no assurance can

be given that such events will occur in the disclosed time frames

or at all. Specific reference is made to the most recent Annual

Information Form filed on SEDAR+ for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this presentation. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

other than as required by law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0d0eb93b-cf83-45ba-aeb7-fbe94c5ce6b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/45e6ec98-a1af-450b-bb87-aaf3c3c44bd6

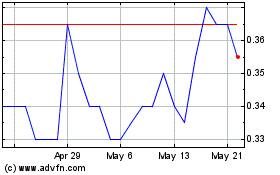

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Dec 2023 to Dec 2024