Rugby Mining Limited: Drilling and Exploration Update

May 24 2012 - 6:30AM

Marketwired Canada

Rugby Mining Limited ("Rugby" or the "Company") (TSX VENTURE:RUG) wishes to

update the market on recent exploration activities at its Philippine, Colombian

and Argentine projects.

Rugby is cognisant of market conditions and plans to maintain a cash reserve

(currently CAN $3.2 million) sufficient to remain active and competitive. The

potentially high grade Mabuhay gold project and the very promising Comita copper

porphyry project remain as priority opportunities for the Company. Drilling is

likely to begin in the near future on the Rio Chico

gold-platinum-palladium-copper project in Argentina. The target is shallow and

can be tested quickly and inexpensively.

Mabuhay Gold Project, Philippines

The Mabuhay project in Surigao Province comprises the Motherlode high grade

epithermal gold target and a gold-copper porphyry target at depth. The Company

is awaiting a routine MPSA application approval, the timing of which is beyond

the Company's control. The expectation is an approval before year end.

The Company remains very enthusiastic about the potential of the project and is

frustrated at the administrative delay. Almost no new titles have been granted

during the past year while the exploration industry awaits a new Executive Order

for the Mining Industry. The Motherlode drilling program is planned to commence

shortly after the MPSA application approval.

Comita Copper Porphyry Project, Colombia

The Comita project covers a copper porphyry system situated in the western

cordillera of Colombia. The Company continues to work through the administrative

process necessary to conduct drilling and is advancing the community

socialisation and baseline environmental programs. Prior to drilling, the

Company is required to conduct a Consulta Previa ("CP") with the community and

obtain a forestry extraction permit. A CP is a government supervised agreement

between a company and the community that forms a basis for exploration and

development work. Certain activities related to the CP and the forestry

extraction permit application have commenced. It is anticipated that exploration

should be able to commence later in 2012.

Rugby recently acquired additional data from historical geological

reconnaissance work. These data show well defined geochemical anomalies that are

co-incident with magnetic "lows" defined in Rugby's 2011 airborne magnetic

survey. This signature is typical for many porphyry projects on a global basis.

There is no record of previous drilling on this prospective target area.

Rio Chico Gold-Platinum-Palladium-Copper Project, Argentina

The Rio Chico project is an undrilled gold-platinum-palladium-copper ("PGM")

target situated in Catamarca Province, Argentina. Drill pad and access road

construction have commenced in preparation for a shallow drilling program to

test a multi-element PGM geochemical anomaly over a 500 metre ("m") strike

length.

Within the anomaly are previously reported rock-chip sample assays as follows:

-- 0.1% copper, 1.3 g/t gold, 9.6 g/t platinum, 4.9 g/t palladium

-- 1.8% copper, 0.3 g/t gold, 0.9 g/t platinum, 1.2 g/t palladium

-- 1.5% copper, 0.2 g/t gold, 1.8 g/t platinum, 2.8 g/t palladium

Once a suitable drill contractor is selected the commencement of the drilling

will be announced on the Company's website.

Interceptor Copper-Gold Project, Argentina

The Interceptor project is a large-scale copper-gold porphyry target situated in

Catamarca Province, Argentina. The Company planned a 2,000 m drilling program to

delineate the nature and extent of the target, but due to difficult drilling

conditions and equipment limitations only 1,033 m of the planned program was

completed.

One of the three drill holes, IND-01, successfully reached the target depth and

intersected a wide zone of porphyry style mineralisation. The porphyry interval

assayed 126 m at 0.24% copper and 116 ppm molybdenum, commencing at a down-hole

depth of 29 m. Significant drill assays are shown on Table 1 below.

Drill holes IND-02 and IND-03, which were designed to test deeper geophysical

anomalies, were abandoned in fault zones before reaching the target depth. Rugby

halted the program and the drill rig was demobilised as it was unable to

satisfactorily test the geophysical targets.

Interceptor will require future drilling to delineate the true potential of the

project. The Company will defer that drilling to conserve cash for its higher

priority projects. All drill-hole details are shown on Table 2 below.

Table 1. Significant Results for the Interceptor Project Drilling

Mineralised Intercepts

------------------------------------------------------------

------------------------------------------------------------

HOLE FROM TO WIDTH Copper Gold Molybdenum

m m m % ppm ppm

------------------------------------------------------------

IND-01 29 155 126 0.24 0.05 116

Includes 35 65 30 0.44 0.05 100

------------------------------------------------------------

------------------------------------------------------------

Table 2. Drill Hole Survey Data

---------------------------------------------------------------------------

---------------------------------------------------------------------------

HOLE EAST NORTH AZIMUTH DOWN DEPTH REMARKS

DIP M

---------------------------------------------------------------------------

Terminated due to

IND-01 569800 6937450 90 -60 337.9 high water flow

Abandoned before

IND-02 569500 6937450 90 -65 414.0 target depth

Abandoned before

IND-03 570025 6937500 90 -50 281.4 target depth

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Datum: WGS84 zone 19S

Quality Control and Assurance

Assay results presented above are preliminary with no cutting of high grades.

All diamond drill core samples are split on regular 2 metre intervals or on

geological contacts and represent sawn half core. Samples were prepared at the

ALS Minerals ("ALS") and assayed at ALS, a registered (or pending registration)

ISO-9001:2008 certified laboratory. ALS is independent of Rugby.

Standard and blank samples are used throughout the sample sequence as checks for

the diamond drilling reported in this release.

Paul Joyce, a "qualified person" ("QP") within the definition of that term in

National Instrument 43-101, Standards of Disclosure for Mineral Projects, has

supervised the preparation of the technical information that forms the basis for

this news release.

About Rugby

Management has a successful record in the identification, acquisition,

exploration and development of international mining projects. The Company

treasury is CAN $3.2 million.

Mabuhay Project, Philippines: The Company holds an option to acquire up to 80%

of the Mabuhay project in Surigao Province. The Company considers the project to

have excellent potential for the discovery of both epithermal gold deposits and

gold-copper porphyry systems.

Comita Project, Colombia: Rugby holds an option to earn up to 60% of Comita, an

undrilled large scale porphyry copper-gold project in the western cordillera of

Colombia. The project was recognised during a joint German-Colombian government

sponsored exploration program over 20 years ago. No systematic exploration has

been conducted since that time.

Interceptor Project, Argentina: The Company holds an option to acquire 100% of

the Interceptor copper-gold project in "mining friendly" Catamarca Province. The

property is near the Maricunga gold belt in Chile, an established mining

district that hosts both producing gold mines and advanced stage porphyry-type

projects.

Hawkwood Project, Australia: Rugby holds an option to acquire 90% of the

Hawkwood project in Queensland. The property, covering 427 km2 is prospective

for gold, copper-gold and iron deposits. In January 2010, the Company entered

into an agreement with Eastern Iron Limited wherein that company can earn an 80%

interest in iron ore targets in the project area. To date Eastern Iron has

conducted several programs, including geophysical surveys and drilling.

For additional information you are invited to visit the Rugby Mining Limited

website at www.rugbymining.com.

RUGBY MINING LIMITED

Paul Joyce, President and CEO

CAUTIONARY STATEMENT

Certain of the statements made and information contained herein is

"forward-looking information" within the meaning of the British Colombia,

Alberta and Ontario Securities Acts. This includes statements concerning the

Company's plans at its projects, which involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance

or achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking information. Forward-looking information is subject to a

variety of risks and uncertainties which could cause actual events or results to

differ from those reflected in the forward-looking information, including,

without limitation, the effect on prices of major mineral commodities such as

copper, gold and iron by factors beyond the control of the Company; events which

cannot be accurately predicted such as political and economic instability,

terrorism, environmental factors and changes in government regulations and

taxes; the shortage of personnel with the requisite knowledge and skills to

design and execute exploration programs; difficulties in arranging contracts for

drilling and other exploration services; the Company's dependency on equity

market financings to fund its exploration programs and maintain its mineral

exploration properties in good standing; political risk that a government will

change, interpret or enforce mineral tenure, environmental regulations, taxes or

mineral royalties in a manner that could have an adverse effect on the Company's

assets or financial condition and impair its ability to advance its mineral

exploration projects or raise further funds for exploration; risks associated

with title to resource properties due to the difficulties of determining the

validity of certain claims as well as the potential for problems arising from

the interpretation of laws regarding ownership of mineral tenures in the

Philippines and in the sometimes ambiguous conveyancing characteristic of many

resource properties, currency risks associated with foreign operations, the

timing for obtaining permits to conduct exploration activities, the ability to

conclude agreements with local communities and other risks and uncertainties,

including those described in each of the Company's management discussion and

analysis including those contained in its year-end financial statements for the

year ended February 28, 2011 filed with the Canadian Securities Administrators

and available at www.sedar.com.

In addition, forward-looking information is based on various assumptions

including, without limitation, assumptions associated with exploration results

and costs and the availability of materials and skilled labour. Should one or

more of these risks and uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those

described in forward-looking statements. Accordingly, readers are advised not to

place undue reliance on forward-looking information. Except as required under

applicable securities legislation, the Company undertakes no obligation to

publicly update or revise forward-looking information, whether as a result of

new information, future events or otherwise.

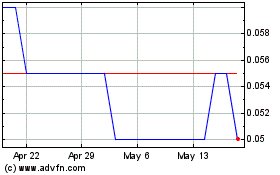

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From May 2024 to Jun 2024

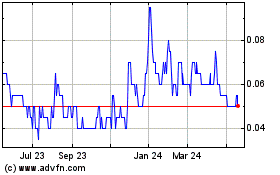

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From Jun 2023 to Jun 2024