PyroGenesis Canada Inc.

(“

PyroGenesis”

or the “

Company”) (TSXV:PYR) (OTCQB:PYRNF)

(FRA:8PY) is pleased to announce that is has entered into an

agreement with Mackie Research Capital Corporation (as the sole

underwriter and sole bookrunner, the

“

Underwriter”), pursuant to which the Underwriter

have agreed to purchase, on a bought-deal basis, 1,600,000 units of

the Company (the “

Units”) for gross proceeds to

the Company of $5,760,000 (the "

Offering") at a

price of $3.60 per Unit.

Each Unit shall be comprised of one common share

of the Company (a "Common Share") and one-half of

one Common Share purchase warrant of the Company (each whole

warrant, a "Warrant"). Each Warrant shall entitle

the holder thereof to purchase one additional Common Share at an

exercise price of $4.50 at any time up to 24 months from Closing

(as defined herein).

Provided that if, at any time prior to the

expiry date of the Warrants, the volume weighted average trading

price of the Common Shares on the TSX Venture Exchange (the

“Exchange”), or other principal exchange on which

the Common Shares are listed, is greater than $6.75 for 20

consecutive trading days, the Company may, within 15 days of the

occurrence of such event, deliver a notice to the holders of

Warrants accelerating the expiry date of the Warrants to the date

that is 30 days following the date of such notice (the

“Accelerated Exercise Period”). Any unexercised

Warrants shall automatically expire at the end of the Accelerated

Exercise Period.

The Company has granted the Underwriter an

option (the

“Underwriter’s

Option”) to increase the size of the Offering by up to an

additional number of Units, and/or the components thereof, that in

aggregate would be equal to 15% of the total number of Units to be

issued under the Offering, at any time up to 30 days following the

closing of the Offering.

The net proceeds from the Offering will be used

for working capital and general corporate purposes.

The Units will be offered by way of a short form

prospectus to be filed in those provinces of Canada as the

Underwriter may designate pursuant to National Instrument 44-101 –

Short Form Prospectus Distributions and may be offered in the

United States on a private placement basis pursuant to an

appropriate exemption from the registration requirements under

applicable U.S. law.

The Closing of the Offering is expected to occur

on or about October 30, 2020 (the (“Closing”) and

is subject to the Company receiving all necessary regulatory

approvals, including the approval of the Exchange.

About

PyroGenesis Canada Inc.

PyroGenesis Canada Inc., a high-tech company, is

the world leader in the design, development, manufacture and

commercialization of advanced plasma processes and products. We

provide engineering and manufacturing expertise, as well as turnkey

process equipment packages to the defense, metallurgical, mining,

advanced materials (including 3D printing), oil & gas, and

environmental industries. With a team of experienced engineers,

scientists and technicians working out of our Montreal office and

our 3,800 m2 manufacturing facility, PyroGenesis maintains its

competitive advantage by remaining at the forefront of technology

development and commercialization. Our core competencies allow

PyroGenesis to lead the way in providing innovative plasma torches,

plasma waste processes, high-temperature metallurgical processes,

and engineering services to the global marketplace. Our operations

are ISO 9001:2015 and AS9100D certified, and have been since 1997.

PyroGenesis is a publicly-traded Canadian Corporation on the TSX

Venture Exchange (Ticker Symbol: PYR) and on the OTCQB Marketplace.

For more information, please visit www.pyrogenesis.com.

For Further Information, Please

Contact:

Rodayna Kafal, Vice President Investors

Relations and Strategic Business Development,

Phone: (514) 937-0002, E-mail:

ir@pyrogenesis.com

RELATED LINK: http://www.pyrogenesis.com/

Cautionary Note Regarding Forward

Looking Information:

This press release contains certain

forward-looking statements, including, without limitation,

statements containing the words "may", "plan", "will", "estimate",

"continue", "anticipate", "intend", "expect", "in the process" and

other similar expressions which constitute "forward- looking

information" within the meaning of applicable securities laws.

Forward-looking statements reflect the Corporation's current

expectation and assumptions and are subject to a number of risks

and uncertainties that could cause actual results to differ

materially from those anticipated. These forward-looking statements

involve risks and uncertainties including, but not limited to, our

expectations regarding the acceptance of our products by the

market, our strategy to develop new products and enhance the

capabilities of existing products, our strategy with respect to

research and development, the impact of competitive products and

pricing, new product development, and uncertainties related to the

regulatory approval process. Such statements reflect the current

views of the Corporation with respect to future events and are

subject to certain risks and uncertainties and other risks detailed

from time-to-time in the Corporation's ongoing filings with the

securities regulatory authorities, which filings can be found at

www.sedar.com, or at www.otcmarkets.com. Actual results, events,

and performance may differ materially. Readers are cautioned not to

place undue reliance on these forward-looking statements. The

Corporation undertakes no obligation to publicly update or revise

any forward- looking statements either as a result of new

information, future events or otherwise, except as required by

applicable securities laws. Neither the TSX Venture Exchange, its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) nor the OTCQB accepts

responsibility for the adequacy or accuracy of this press

release.

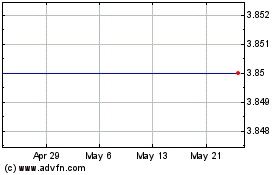

PyroGenesis Canada (TSXV:PYR)

Historical Stock Chart

From Oct 2024 to Nov 2024

PyroGenesis Canada (TSXV:PYR)

Historical Stock Chart

From Nov 2023 to Nov 2024