REPEAT: Plato Gold Intercepts 5.66 g/t Au Over 8.50 m Including 10.08 g/t Au Over 2.5 m

May 06 2008 - 12:12PM

Marketwired Canada

NOT FOR DISTRIBUTION IN THE UNITED STATES.

Plato Gold Corp. (TSX VENTURE:PGC) ("Plato") an exploration company with a

portfolio of properties in significant gold mining camps in Northern Ontario,

Northern Quebec, and Santa Cruz, Argentina is pleased to release assay results

from the last 3 drill holes completed this year at the Nordeau Project. The

Property is located 50 km east of Val-d'Or, Quebec and has been optioned from

Globex Mining Enterprises Inc. ("Globex"). The recent drill results further

exemplify a widening and an increasing grade in the "Main Zone" at Nordeau West.

Highlights Include:

NW-08-06 8.5m of 5.66 g/t Au - From 553.80m - 562.30m

Including 2.5m of 10.08 g/t Au - From 558.05m - 560.55m

All three holes namely, NW-08-04 to NW-08-06, inclusive, successfully

intersected gold bearing mineralization within the favourably altered mafic

volcanic horizons. Hole NW-08-06 intersected a broad zone of mineralization at a

vertical depth of 525m that graded 5.66 g/t Au over 8.50m and included a

narrower high grade interval of 10.08 g/t Au over 2.5m. Hole NW-08-05 drilled on

the same north-south section intersected the same horizon at a vertical depth of

425m (100m above hole NW-08-06) and graded 1.00 g/t Au over 8.65m including a

narrow interval grading 4.29 g/t Au over 0.65m. Hole NW-08-04 intersected a much

wider lower grade zone within the same mineralized horizon 125m west along

strike of hole NW-08-06 and at the same approximate vertical depth of 525m. The

mineral zone intersection in hole NW-08-04 graded 0.77 g/t Au over 18.65 m.

The six hole NQ diamond drill core program (3,369 meters) conducted by Forage

Val d'Or and completed in 2008 at the Project was designed to target gold zones

indicated by new 3D geological and gold grade models developed within GEMCOM's

GEMS 6.1 software system. The model indicates the Nordeau West claims overlay an

extensive zone of alteration and lower grade gold mineralization throughout the

approximately 1 km strike length of the claims. This broad zone of lower grade

mineralization appears to plunge moderately to steeply northwest. The model

further indicates that within this larger lower grade zone occurs several high

grade shoots that plunge relatively shallow towards the northeast. The present

interpretation suggests that a series of "en echelon" high grade lenses plunge

shallow to the northeast and are "stacked" within the larger lower grade zone

plunging steeply to the northwest.

The successful intersection of the wide lower grade zones in holes NW-08-04 and

NW-08-05 in the central portion of the claims represents significant up-side

potential for developing resources. The successful high grade intersection in

hole NW-08-06 indicates potential to develop high grade shoots along the shallow

northeast plunge from shallower historic high grade intersections near the

western limits of the property. Notably this deeper intersection represents an

area which has received very little attention from previous exploration

campaigns.

The principal gold mineralization on the property is found within sheared and

altered mafic volcanics near a contact with metamorphosed sediments containing

magnetite iron formations proximal to the contact. The gold mineralization is

typically within quartz veins containing disseminated to locally semi-massive

sulphides. Gold is found as free grains within quartz veins or associated with

sulphide mineralization. The associated sulphide mineralization consists of

arsenopyrite, pyrite, pyrhotite, and minor chalcopyrite.

The most significant drill assay intervals from the last three holes are:

----------------------------------------------------------------------------

NW-08-04 FROM TO LENGTH Au

m m m g/t

548.45 567.40 18.95 0.77

INCLUDING 550.60 554.85 4.25 1.01

AND 565.55 567.40 1.85 2.49

----------------------------------------------------------------------------

NW-08-05 FROM TO LENGTH Au

m m m g/t

393.65 402.30 8.65 1.00

INCLUDING 393.65 394.30 0.65 4.29

----------------------------------------------------------------------------

NW-08-06 FROM TO LENGTH Au

M m m g/t

553.80 562.30 8.50 5.66

INCLUDING 558.05 560.55 2.50 10.08

AND 558.05 558.95 0.90 15.25

AND 559.80 560.55 0.75 14.45

AND 561.50 562.30 0.80 4.66

----------------------------------------------------------------------------

The results from the recently completed drill program will be added to the

database and the geological model updated and re-evaluated by A.S. Horvath

Engineering Inc. Recommendations for follow-up exploration drilling are

anticipated.

The program is being managed by Jason Ross and Martin Bourgoin, P.Geo., who are

independent consultants. Martin Bourgoin, P.Geo., is the Project's Qualified

Person under the guidelines of National Instrument 43-101, and he has reviewed

and approved this release.

QA/QC Procedures

The Company has implemented a quality control program to ensure best practices

in sampling and analysis of the core samples. The core is first logged and then

split in half during the sampling process with the remaining half being retained

for verification and reference purposes. Duplicates, standards and blanks are

inserted randomly into the sample stream. The samples are delivered directly in

security bags to ALS-Chemex Laboratories Ltd. in Val-d'Or, Quebec (Certification

ISO 9001) for analysis by fire assay - AA techniques. ALS-Chemex Laboratories

Ltd. of Val-d'Or, Quebec an accredited lab is the primary assay laboratory.

Additionally ALS Chemex has attained ISO 9001:2000 registration which requires

evidence of a quality management system covering all aspects of the assaying

process. To ensure compliance with this system regular internal audits are

undertaken by staff members specially trained in auditing techniques.

About Plato Gold Corp.

Plato Gold Corp. ("Plato") is a Canadian junior gold exploration company listed

on the TSX Venture Exchange. Plato has Canadian exploration projects in Northern

Ontario, Northern Quebec and the Lolita Property in the province of Santa Cruz,

Argentina. The Northern Ontario project includes 5 properties: Guibord, Harker,

Harker-Garrison, Holloway and Marriott in the Harker/Holloway gold camp located

east of Timmins, Ontario. The Northern Quebec project includes 7 properties:

Nordeau Bateman, Vauquelin, Vauquelin Pershing, Vauquelin Horseshoe, Pershing

Denain, Hop O'My Thumb and Once Upon a Time. All 7 properties are located near

Val d'Or, Quebec and Plato is in the early stage of exploring these projects. In

Argentina, the Lolita Property is comprised of 3 contiguous concessions and

initial work has been started on this property. For additional company

information, please visit: www.platogold.com.

For all Plato Gold Corp. investor relations needs, investors are asked to visit

the Plato Gold Corp. IR Hub at http://www.agoracom.com/ir/platogold where they

can post questions and receive answers within the same day, or simply review

questions and answers posted by other investors. Alternatively, investors are

able to e-mail all questions and correspondence to pgc@agoracom.com where they

can also request addition to the investor e-mail list to receive all future

press releases and updates in real time.

Cautionary Statements

This news release contains "forward-looking statements", within the meaning of

the United States Private Securities Litigation Reform Act of 1995 and similar

Canadian legislation, concerning the business, operations and financial

performance and condition of Plato. Forward-looking statements include, but are

not limited to, statements concerning Plato's plans for its mineral properties,

which involve known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of Plato, or industry

results, to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking information..

Generally, these forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such

words and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made, and they are subject to known and

unknown risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of Plato to be

materially different from those expressed or implied by such forward-looking

statements, including but not limited to risks related to: risks related to

exploration; actual resource viability, and other risks of the mining industry.

Although management of Plato has attempted to identify important factors that

could cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking statements. Plato

does not undertake to update any forward-looking statements that are

incorporated by reference herein, except in accordance with applicable

securities laws.

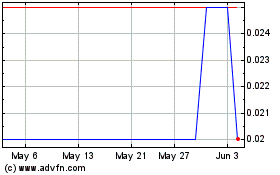

Plato Gold (TSXV:PGC)

Historical Stock Chart

From May 2024 to Jun 2024

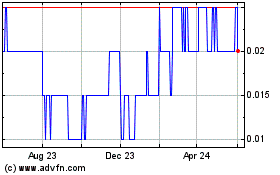

Plato Gold (TSXV:PGC)

Historical Stock Chart

From Jun 2023 to Jun 2024