Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the "Company") is

pleased to release its March 31, 2012 financial and operating results and a

summary of its updated reserve report dated May 1, 2012. This press release

should be read in conjunction with the Company's March 31, 2012 filings on

Sedar.

Financial Summary

Three Months Ended March

31

----------------------------------------------------------------------------

2012 2011 % Change

----------------------------------------------------------------------------

Oil and gas revenue $ 2,855,893 $ 3,122,279 (9)

Cash flow from operations 1,227,765 1,634,148 (25)

Per share - basic and diluted 0.02 0.03 (32)

Net loss (111,382) (1,053,595) (89)

Per share - basic and diluted (0.00) (0.02) (90)

Net debt 12,451,000 12,833,000 (3)

Capital expenditures $ 846,000 $ 3,616,000 (77)

Shares outstanding - end of period 62,239,477 56,261,477 11

----------------------------------------------------------------------------

Total oil and natural gas revenue decreased by 9% to $2,855,893 for the three

month period ended March 31, 2012 compared to $3,122,279 for the same period in

2011. For the three month period ended March 31, 2012, Petro-Reef generated cash

flow from operations of $1,227,765 ($0.02 per basic share), a decrease of 25%

compared to $1,634,148 ($0.03 per basic share) for the three month period ended

March 31, 2011.

Daily Production

Three months ended March 31 2012 2011 % Change

----------------------------------------------------------------------------

Average Average

----------------------------------------------------------------------------

Crude Oil and NGL (bbl/d) 330 296 11

Natural Gas (mcf/d) 2,631 3,064 (14)

Combined (boe/d) 769 807 (5)

----------------------------------------------------------------------------

Daily production volumes decreased by 5% to 769 boe/d in the three months ended

March 31, 2012 as compared to 807 boe/d for the same period in 2011. Oil volumes

increased by 11% to 330 bbl/day quarter while gas production decreased by 14% to

2,631 mcf/day. In Q1 2012 oil and NGL production comprised 43% of total

production as compared to 37% in Q1 2011.

Earnings and Cash Flow Summary

Three months

ended March 2012 2011 % Change 2012 2011 % Change

31

----------------------------------------------------------------------------

CDN $ ($ / boe) ($ / boe)

----------------------------------------------------------------------------

Gross Revenue 2,855,893 3,122,279 (9) 41.29 42.99 (4)

----------------------------------------------------------------------------

Royalties (275,524) (513,058) (46) (3.98) (7.06) (44)

----------------------------------------------------------------------------

Revenue after

royalties 2,580,369 2,609,221 (1) 37.31 35.92 4

----------------------------------------------------------------------------

Operating

expenses 912,445 846,074 8 13.19 11.65 13

----------------------------------------------------------------------------

Operating

netback 1,667,924 1,763,147 (5) 24.11 24.28 -

----------------------------------------------------------------------------

Realized gain

(loss) on

risk (97,938) 175,135 (156) (1.42) 2.41 -

management

contracts

----------------------------------------------------------------------------

General &

administrativ 208,482 204,724 2 3.01 2.82 7

e expenses

----------------------------------------------------------------------------

Interest

expense 133,739 99,410 35 1.93 1.37 41

----------------------------------------------------------------------------

Cash flow from

operations 1,227,765 1,634,148 (25) 17.75 22.50 (21)

(1)

----------------------------------------------------------------------------

Unrealized

gain (loss)

on risk (71,020) (903,673) (92) (1.03) (12.44) -

management

contracts

----------------------------------------------------------------------------

Other income 230,252 250,919 (8) 3.33 3.45 (4)

----------------------------------------------------------------------------

Stock based

compensation 87,371 140,536 (38) 1.26 1.93 (35)

----------------------------------------------------------------------------

Accretion 10,964 16,943 (35) 0.16 0.23 (32)

----------------------------------------------------------------------------

Depletion and

depreciation 1,400,044 1,637,618 (15) 20.24 22.55 (10)

----------------------------------------------------------------------------

Income before

income taxes (111,382) (813,703) - (1.61) (11.20) -

----------------------------------------------------------------------------

Deferred

income tax 0 239,892 (100) 0.00 3.30 (100)

expense

----------------------------------------------------------------------------

Net Income

(loss) (111,382)(1,053,595) (89) (1.61) (14.51) (89)

----------------------------------------------------------------------------

Per Share -

Basic (0.00) (0.02)

----------------------------------------------------------------------------

Per Share -

Diluted (0.00) (0.02)

----------------------------------------------------------------------------

Net Debt to Cash Flow from operations

Three months ended Year ended

March 31, 2012 December 31,2011

----------------------------------------------------------------------------

Total funds flow from operations $ 1,227,765 $ 3,149,636

----------------------------------------------------------------------------

Annualized funds flow from

operations 4,911,060 3,149,636

----------------------------------------------------------------------------

Total net debt $ 12,450,960 $ 12,832,532

----------------------------------------------------------------------------

Net debt to annualized funds flow

from operations 2.53 4.07

The net debt as a multiple of annualized cash flow decreased from 4.07 at

December 31, 2011 to 2.53 at March 31, 2012.

Netbacks

Three months ended March 31 2012 2011 % Change

----------------------------------------------------------------------------

($ / boe) ($ / boe)

----------------------------------------------------------------------------

Operating netback ($/boe)

----------------------------------------------------------------------------

Revenue 41.29 42.99 (4)

----------------------------------------------------------------------------

Royalties (3.98) (7.06) (44)

----------------------------------------------------------------------------

Operating expenses (13.19) (11.65) 13

----------------------------------------------------------------------------

Operating netback per boe 24.11 24.28 (1)

----------------------------------------------------------------------------

Realized gain (loss) on risk management

contracts (1.42) 2.41 (159)

----------------------------------------------------------------------------

General and administrative expenses (3.01) (2.82) 7

----------------------------------------------------------------------------

Interest expense (1.93) (1.37) 41

----------------------------------------------------------------------------

Cash flow from operations per boe 17.75 22.50 (21)

----------------------------------------------------------------------------

Petro-Reef realized a combined price per boe for the three month period ended

March 31, 2012 of $41.29 representing a 4% decrease compared to the realized

price per unit of production of $42.99 for the same period in 2011. The price of

oil increased by 3% and the price of natural gas decreased by 42% over the same

period last year.

Realized losses on risk management contracts on a per unit of production basis

were $1.42 for the three month period ended March 31, 2012 compared to a gain of

$2.41 for the same period in 2011.

Royalties on a per unit of production basis decreased 44% to $3.98 for the three

month period ended March 31, 2012 compared to $7.06 for the same period in 2011.

The effective royalty rate decreased to 9.6% of gross revenue for the three

month period ended March 31, 2012 from 16.4% for the same period in 2011.

Production and operating expenses on a per unit of production basis increased

13% to $13.19 for the three months ended March 31, 2012 compared to $11.65 for

the same period in 2011.

Operating netbacks were $24.11/boe in Q1 2012 versus $24.28 in Q1 2011.

On a per unit of production basis general and administrative expenses increased

by 7% to $3.01 and interest expense increased by 41% to $1.93 year over year.

For the three months ended March 31, 2012 cash flow netbacks per boe decreased

by 21% over the same period in 2011.

Financial

At March 31, 2012 the Corporation had two operating facilities with a Canadian

Chartered Bank. Facility A is a revolving operating demand loan with a maximum

limit of $13,000,000. Facility B is a non-revolving acquisition/development

demand loan that provides an additional $6,000,000 of financing. Interest is at

prime plus 1.0% per annum for Facility A and prime plus 1.5% per annum for

Facility B. Petro-Reef has the ability to borrow by way of Bankers Acceptances.

At March 31, 2012 the balance owing on Facility A was $12,064,000 (December 31,

2011 - $12,511,000) and the amount owing on Facility B was nil (December 31,

2011 - nil).

The facilities are secured by a combined $60,000,000 floating charge debenture

over all the Corporation's assets with a negative pledge and undertaking to

provide fixed charges on the Corporation's major producing properties at the

request of the bank. The facilities are repayable on demand. The facilities have

a working capital covenant whereby the total current assets (including undrawn

amounts under facility A) must be greater than 1.0x total current liabilities

(excluding financial instruments and certain debt instruments). Petro-Reef's

working capital ratio as calculated using its Canadian Chartered Bank formula as

at March 31, 2012 was 1.36 (1.86 as at December 31, 2011). Petro-Reef is in

compliance with its working capital covenant.

Reserves

A new independent reserves evaluation effective May 1, 2012 has increased the

Company's proven plus probable reserve base by 10.6 percent, and the value

(discounted at 10 percent) by 23.5 percent. The main reason for the material

increase was the inclusion of the results of the 11-12 well drilled in Q1 2012.

The Company believes that further successful development drilling will continue

to significantly improve our reserve base.

The independent evaluation of gross proved plus probable reserves dated May 1,

2012 based on April 1, 2012 forecast prices and costs indicated a net increase

to 1,851,800 BOE from 1,674,900 BOE at December 31, 2011 after extensions,

technical revisions, discoveries, acquisitions, economic factors, and

production. After considering the production for the period January 1 to March

31, 2012 of 69,200 BOE, the 2012 reserve additions totalled 246,100 BOE which

represents an increase of 14.7% over the 2011 year end reserves.

Using a 10% net present value ("NPV"), the value of proved plus probable

reserves at forecast prices and costs (before income taxes) was $40,496,000 as

compared with proved plus probable reserves of $32,792,300 as at December 31,

2011 an increase of $7,703,700.

Petro-Reef's gross proved, probable plus possible reserves at May 1, 2012

totaled 2,527,300 BOE. Using a 10% NPV, the value of proved, probable plus

possible reserves at forecast prices and costs (before income taxes) totaled

$55,993,100.

Proved plus probable reserves were comprised of 61% crude oil and natural gas

liquids and 39% natural gas (December 31, 2011 - 53% crude oil and natural gas

liquids and 47% natural gas).

Of the total proved plus probable reserves reported (using forecast prices)

Petro-Reef's reserves are 57% proved and 43% probable.

Based on proved plus probable reserves and 2012 average production volume,

Petro-Reef's reserve life index was 5.3 years (38.7 years remaining life) on a

proved plus probable basis at May 1, 2012 compared with 5.1 years (38.7 years

remaining life) at the end of 2011. Petro-Reef's reserve life index (RLI) is an

indication of the number of years it would take to deplete the Company's

reserves.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

Reference is made to barrels of oil equivalent (BOE). Barrels of oil equivalent

may be misleading, particularly if used in isolation. In accordance with

National Instrument 51-101, a BOE conversion ratio for natural gas of 6 Mcf: 1

bbl has been used, which is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

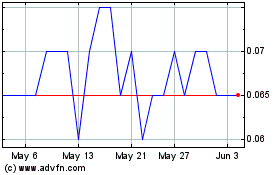

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Oct 2024 to Nov 2024

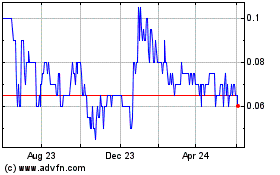

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Nov 2023 to Nov 2024