Vancouver, British Columbia - August 22, 2013. Nortec

Minerals Corp. ("Nortec" or the

"Issuer") (TSX-V: NVT) is pleased to announce the following:

Stock Option

Plan

At the Company's annual and special

meeting of shareholders held on May 28, 2013 ("AGSM"), shareholders

approved the amended and restated stock option plan (the "Plan"),

amending the former "fixed" plan to a "rolling" plan which reserves

a maximum of 10% of the total outstanding common shares of the

Company at the time of grant. TSX Venture Exchange ("TSXV")

approval of the Plan was received in June, 2013.

Extension of Share

Purchase Warrants

An application was filed with the

TSXV for a two (2) year extension of certain share purchase

warrants.

Share purchase warrants issued

pursuant to the 8,941,500 unit non-brokered private placement at a

price of $0.12 per unit announced on July 4, 2010. Each unit

consisted of one share and one share purchase warrant which is

exercisable to acquire one share of the Company at an exercise

price of $0.20 per share. The private placement was accepted for

filing by the TSXV on July 7, 2010. A total of 2,025,000 warrants

have previously been exercised. The share purchase warrants expiry

date has previously been extended for one year with an expiry date

of July 7, 2013.

TSXV approval was received on June

14, 2013 and the new expiry date of the warrants will be July 7,

2015.

Share purchase warrants issued

pursuant to the 735,000 unit non-brokered private placement at a

price of $0.12 per unit announced on July 26, 2010. Each unit

consisted of one share and one share purchase warrant which is

exercisable to acquire one share of the Company at an exercise

price of $0.20 per share. The private placement was accepted for

filing by the TSXV on August 5, 2010. A total of 100,000 warrants

have previously been exercised. The share purchase warrants expiry

date has previously been extended for one year with an expiry date

of August 4, 2013.

TSXV approval was received on June

14, 2013 and the new expiry date of the warrants will be August 4,

2015.

Change

of Address

As previously announced,

as of September 1, 2013, Nortec's new office address will be Suite

2300, 1066 West Hastings Street, Vancouver, British Columbia, V6E

3X4.

Other News

At the Company's AGSM the

shareholders elected the following individuals to the Company's

board of directors, Mohan Vulimiri, Peter Tegart, Balraj Mann,

Grant Crooker, Etienne Walter and Harvey Stark. Prior board member

Ernest Peters did not stand for re-election.

"On behalf of the board of directors, I thank Ernest Peters for

his valuable contributions to the Company during his tenure." said

Mohan Vulimiri, Chief Executive Officer of the Company.

About

Nortec Minerals Corp.

Nortec is

a mineral exploration and development company based in Vancouver,

British Columbia. The Company has

a 100% interest

in the Tammela

Gold & Lithium

Project in South-West

Finland; an option

to earn from

Akkerman Exploration B.V., a

100% interest in

the Seinajoki Gold Property

and Kaatiala Beryllium-Rare Earth Property in

Western Finland.

Nortec signed an

option agreement to transfer 100% ownership

of its wholly-owned Finnish subsidiary, Nortec Minerals Oy (NMOy),

to Finore Mining Inc. ("Finore"). NMOy holds 100% interest in

the Lantinen Koillismaa ("LK")

Palladium-Platinum-Gold-Copper-Nickel Project in

north-central Finland. Nortec currently holds

84,144,915 Shares (or 60%, on an undiluted basis) of

Finore.

The LK project comprises of the

following target areas (exploration claims and exploration claim

applications): Kaukua, Haukiaho, Haukiaho East, Lipeavaara and

Murtolampi targets.

Diamond core

drilling to date carried out by Finore defined areas for higher

grade potential resources amenable for Open-pit development at both

Haukiaho and Kaukua targets.

The previous NI 43-101 Mineral

Resource

estimate

of the Kaukua

and Haukiaho deposits was prepared by Watts Giffis

and Mcquat Ltd., a well known international geological and mining

consulting firm, in November

and December

2011 and filed on SEDAR on January 24,

2012.

Inferred

Mineral

Resource:

19.6

Million Tonnes @ 0.26g/t Pd;

0.09g/t Pt;

0.10g/t Au; 0.24%

Cu; 0.15%

Ni (Haukiaho).

8.5

Million

Tonnes @ 0.76g/t Pd;

0.27g/t Pt;

0.08g/t

Au; 0.16%

Cu ; 0.11% Ni (Kaukua).

A combined total of 28.1

Million

Tonnes

for 586,080 ounces

PGE+Gold (370,998 ounces

Pd; 130,311 ounces Pt; 84,770 ounces Au); 60,567 tonnes

of Cu

and 38,703 tonnes of Ni.

Indicated

Mineral

Resource (Kaukua):

2.6

Million Tonnes @ 0.67g/t Pd;

0.22g/t Pt; 0.07g/t Au; 0.17% Cu;

0.12%

Ni. for

80,399 ounces PGE+Gold (56,112 ounces Pd; 18,425 ounces Pt; 5,862 ounces Au), 4,429

tonnes of Cu and 3,126 tonnes of Ni.

The Company recently

sold its 51% interest,

subject to net smelter royalties, in

the TL Nickel-Copper-Cobalt Property

in Northern

Labrador, Canada to Vulcan

Minerals Inc.; Information

on the Company's

projects can

be referred

to on www.nortecminerals.com.

On behalf of the Board of

Directors,

NORTEC

MINERALS CORP.

"Mohan

R. Vulimiri"

Mohan R. Vulimiri, CEO

and Chairman

The TSX Venture Exchange has not reviewed and does not accept the

responsibility for the adequacy or accuracy of this news

release.

This press

release contains certain forward looking statements which involve

known and unknown risks, delays and uncertainties not under the

Company's control which may cause actual results, performances or

achievements of the Company to be materially different from the

results, performances or expectations implied by these forward

looking statements. This news

release does not constitute an offer to sell or a solicitation of

an offer to buy any of the securities in the United

States.

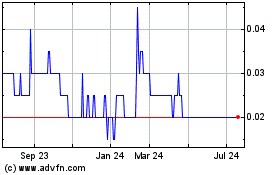

Nortec Minerals (TSXV:NVT)

Historical Stock Chart

From Dec 2024 to Jan 2025

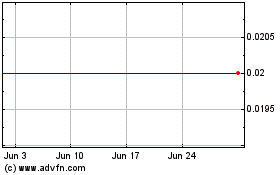

Nortec Minerals (TSXV:NVT)

Historical Stock Chart

From Jan 2024 to Jan 2025