NuLegacy Gold Announces C$12.5 Million Private Placement

January 08 2021 - 6:30PM

NuLegacy Gold Corporation announces a non-brokered

private placement of up to 100,000,000 units (the

“

Units”) at a price of C$0.125 per Unit to raise

gross proceeds to the Company of C$12.5 million (the

“

Offering”).

Each Unit will consist of one common share of

the Company (a “Common Share”) and one

transferable Common Share purchase warrant (a

“Warrant”). Each Warrant will entitle the holder

to acquire one Common Share of the Company at an exercise price of

C$0.20 for a period of 36 months following closing of the

Offering.

NuLegacy’s CEO Albert Matter comments that “Our

recent winter 2020 drill program was highly successful; and

subsequent analysis and geological remodeling strongly support our

analysis that the Rift Anticline target bears significant

structural and stratigraphic similarities and connectors to Barrick

Gold’s Goldrush Carlin-style gold systems approximately 8

kilometres to the northwest.I We are utilizing the improved gold

market conditions to strengthen our treasury. This will enable us

to accelerate and expand our Spring/Summer 2021 drilling and

exploration program.”

The net proceeds of the Offering will be used to

carry out an expanded exploration program on the Rift Anticline

beyond the 12 core holes currently planned for the Spring-Summer

2021 drilling program, as well as for general corporate and working

capital purposes.

The Offering is subject to, among other things,

acceptance of the TSX Venture Exchange (the

“TSXV”) with an initial closing scheduled for on

or about January 18, 2021. All securities issued pursuant to the

Offering will be subject to a four month hold period from the date

of closing. The Company may pay finder’s fees in cash,

shares or warrants or any combination thereof to certain finders

and/or advisors in connection with the sale of Units in accordance

with the policies of the TSXV.

On trend: NuLegacy Gold

is focused on confirming high-grade Carlin-style gold deposits

within the ~ 6 sq. km Rift Anticline target in the northwest corner

of its flagship 108 sq. km (42 sq. mile) district scale Red Hill

Property in the Cortez gold trend of Nevada. The Rift Anticline

target is located on trend and adjacentI to the three,

multi-million ounce Carlin-type gold deposits (the Pipeline, Cortez

Hills and Goldrush deposits) which are ranked amongst the world’s

thirty largest, lowest cost and politically safest gold mines and

are three of Nevada Gold Mines’ most profitable mines. II

I The similarity and proximity

of these deposits in the Cortez Trend including Goldrush are not

necessarily indicative of the gold mineralization in NuLegacy’s Red

Hill Property.II As extracted from Barrick’s

Q4-2013 and Q1-2014 reports. As reported by Barrick, the Goldrush

resource contains 8,557,000 indicated ounces of gold within 25.78

million tonnes grading ~10.57 g/t and 1,650,000 inferred ounces

within 5.6 million tonnes grading ~9.0 g/t.

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

ON BEHALF OF THE BOARD OF NULEGACY GOLD

CORPORATION

Albert MatterChief Executive Officer &

DirectorTel: +1 (604) 639 - 3640Email: albert@nuggold.com

For more information about NuLegacy visit:

www.nulegacygold.com or www.sedar.com.

This new release does not constitute an offer to

sell or a solicitation of an offer to buy any of the securities in

the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any state

securities laws and may not be offered or sold within the United

States or to or for the account or benefit of a U.S. person (as

defined in Regulation S under the U.S. Securities Act) unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Cautionary Statement on Forward-Looking

Information: This news release contains forward-looking

information and statements under applicable securities laws, which

information and/or statements relate to future events or future

performance (including, but not limited to, the size of the

Offering, the proposed use of proceeds and the anticipated closing

date thereof; the prospective nature of the Rift Anticline target

and proposed exploration and drilling programs thereon and the

timing and costs thereof) and reflect management’s current

expectations and beliefs based on assumptions made by and

information currently available to the Company. Readers are

cautioned that such forward-looking information and statements are

neither promises nor guarantees, and are subject to risks and

uncertainties that may cause future results to differ materially

from those expected including, but not limited to, actual results

of exploration activities, unanticipated geological, stratigraphic

and structural formations, environmental risks, operating risks,

accidents, labor issues, delays in obtaining governmental approvals

and permits, the availability of financing, market conditions,

future prices for gold, changes in personnel and other risks in the

mining industry. There are no known resources or reserves in the

Red Hill Property, any proposed exploration programs are

exploratory searches for commercial bodies of ore and the presence

of gold resources on properties adjacent or near the Red Hill

Property including Goldrush is not necessarily indicative of the

gold mineralization on the Red Hill Property. There is also

uncertainty about the spread of COVID-19 and the impact it will

have on the Company’s operations, personnel, supply chains, ability

to access properties or procure exploration equipment, contractors

and other personnel on a timely basis or at all and economic

activity in general. All the forward-looking information and

statements made in this news release are qualified by these

cautionary statements and those in our continuous disclosure

filings available on SEDAR at www.sedar.com. The forward-looking

information and statements in this news release are made as of the

date hereof and the Company does not assume any obligation to

update or revise them to reflect new events or circumstances save

as required by applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

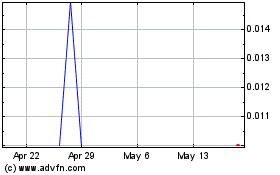

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

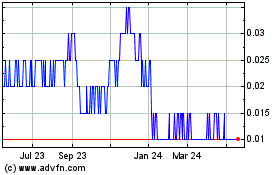

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Nov 2023 to Nov 2024